India Transplantation Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

India Transplantation Market Overview:

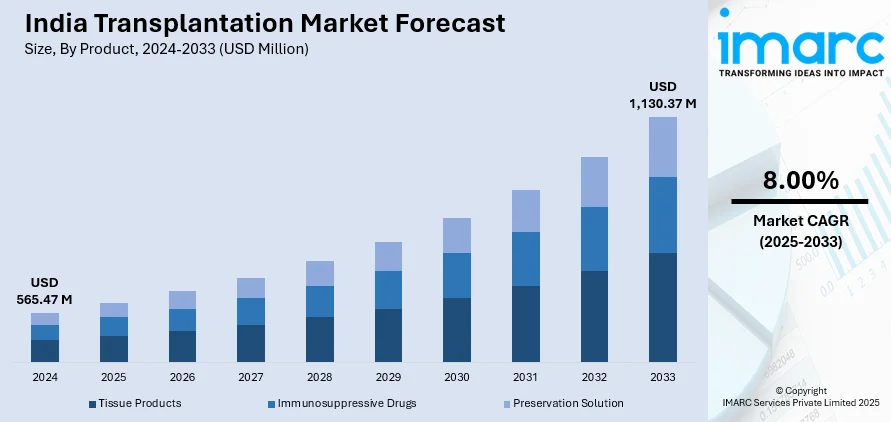

The India transplantation market size reached USD 565.47 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,130.37 Million by 2033, exhibiting a growth rate (CAGR) of 8.00% during 2025-2033. The increasing instances of organ failure cases, advancements in transplant technologies, rising awareness about organ donation, and the growing adoption of immunosuppressive drugs are among the primary factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 565.47 Million |

| Market Forecast in 2033 | USD 1,130.37 Million |

| Market Growth Rate 2025-2033 | 8.00% |

India Transplantation Market Trends:

Rising Prevalence of Chronic Diseases Necessitating Organ Transplants

The rising prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and chronic kidney disease (CKD), in India has significantly increased the demand for organ transplantation. CKD, in particular, has emerged as a major health concern, with a growing number of patients being diagnosed at advanced stages. According to the Chronic Kidney Disease Registry’s March 2024 report, the incidence of CKD among Indians is escalating rapidly, with many cases identified at stages 4 and 5. This surge in chronic illnesses has directly impacted organ transplantation rates. In 2023, India recorded approximately 18,378 organ transplants, with kidney transplants constituting a substantial share. Additionally, the country has become a hub for medical tourism, as 10% of these procedures were performed for foreign nationals seeking advanced transplant services. The increasing burden of chronic diseases highlights the critical need for organ transplantation, driving the expansion of India’s transplantation market and reinforcing its role as a key player in global healthcare.

To get more information on this market, Request Sample

Government Initiatives Enhancing Organ Donation and Transplantation Infrastructure

The government has launched several initiatives to enhance organ donation and transplantation infrastructure, driving significant market growth. The establishment of the National Organ and Tissue Transplant Organization (NOTTO) in New Delhi, along with five Regional Organ and Tissue Transplant Organizations (ROTTOs) and 16 State Organ and Tissue Transplant Organizations (SOTTOs), has enhanced the coordination of organ donation and transplantation nationwide. Additionally, financial assistance programs have been introduced to support transplant patients. In February 2024, the Assam government unveiled the Sushrusha Scheme, providing INR 1 lakh (approximately USD 1,195.86) in financial aid to kidney transplant recipients. Public awareness campaigns, such as "Angdaan Mahotsav" and "Organ Donation Month," launched in July 2023, have played a crucial role in educating citizens about the significance of organ donation, leading to a surge in donor registrations. These efforts have resulted in a substantial increase in deceased-donor transplants, rising from 837 a decade ago to 2,935 in 2023, underscoring the growing acceptance of organ donation in India.

India Transplantation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, application, and end user.

Product Insights:

- Tissue Products

- Immunosuppressive Drugs

- Preservation Solution

The report has provided a detailed breakup and analysis of the market based on the product. This includes tissue products, immunosuppressive drugs, and preservation solution.

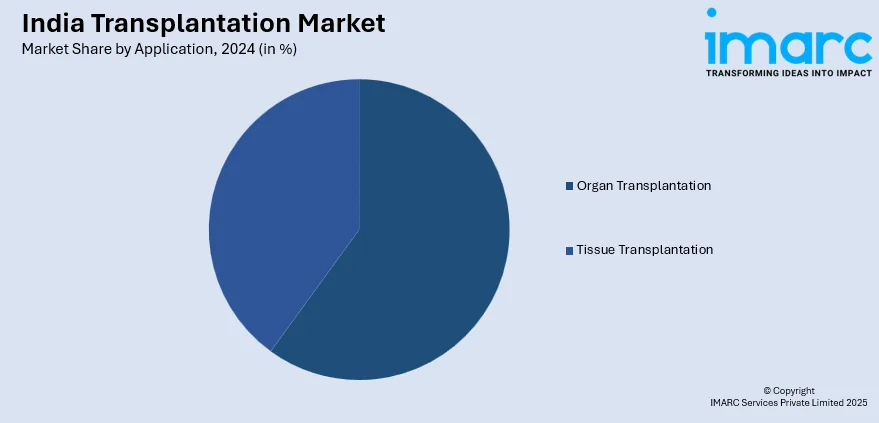

Application Insights:

- Organ Transplantation

- Tissue Transplantation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes organ transplantation and tissue transplantation.

End User Insights:

- Hospitals

- Transplantation Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, transplantation centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Transplantation Market News:

- January 2025: Tamil Nadu announced that over the past year, it recorded 268 deceased organ donations, up from 178 in 2023, leading to 1,500 transplants - the highest since 2008. This surge is attributed to the 'State Honor' initiative, introduced in September 2023, which accords state honors at donors' funerals. Since its inception, 326 donors received such honors, inspiring 11,547 new registrations in 2024 alone, bringing the total to 19,097 over two years.

- September 2024: India established its first registry for patients needing hand transplants, managed by the National Organ and Tissue Transplant Organization (NOTTO), to ensure transparent and priority-based allocation of donated hands.

- May 2024: Manipal Hospitals announced the acquisition of all three AMRI centers in Kolkata, as well as its plans to begin liver transplants. The hospital, which spent INR 2,200 crore to acquire the divisions, would align service quality with Manipal Hospitals' standards. The initiative will allow eastern patients to receive treatment closer to home rather than going to distant locations such as Bengaluru.

India Transplantation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Tissue Products, Immunosuppressive Drugs, Preservation Solution |

| Applications Covered | Organ Transplantation, Tissue Transplantation |

| End Users Covered | Hospitals, Transplantation Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India transplantation market performed so far and how will it perform in the coming years?

- What is the breakup of the India transplantation market on the basis of product?

- What is the breakup of the India transplantation market on the basis of application?

- What is the breakup of the India transplantation market on the basis of end user?

- What are the various stages in the value chain of the India transplantation market?

- What are the key driving factors and challenges in the India transplantation market?

- What is the structure of the India transplantation market and who are the key players?

- What is the degree of competition in the India transplantation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India transplantation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India transplantation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India transplantation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)