India Tungsten Market Size, Share, Trends and Forecast by Type, Product, End-User Industry, and Region, 2025-2033

India Tungsten Market Size and Share:

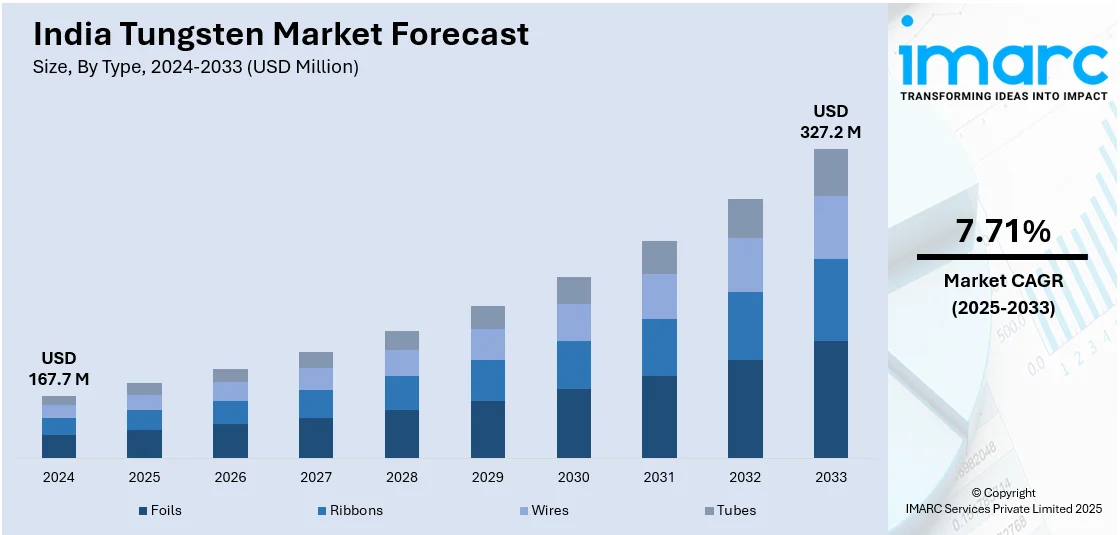

The India tungsten market size reached USD 167.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 327.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.71% during 2025-2033. The market is expanding due to the rising use in medical applications, government policies promoting domestic production, and initiatives aimed at reducing import dependency, which collectively supports key industries such as healthcare, defense, aerospace, and renewable energy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 167.7 Million |

| Market Forecast in 2033 | USD 327.2 Million |

| Market Growth Rate (2025-2033) | 7.71% |

India Tungsten Market Trends:

Increasing Use in Medical and Healthcare Applications

The medical and healthcare sectors are emerging as key contributors to the growth of the India tungsten market. Tungsten is being utilized in medical equipment, particularly in radiation shielding for imaging systems such as X-rays, computed tomography (CT) scans, and radiation therapy devices. The high density and shielding properties of tungsten make it an excellent choice for reducing exposure to harmful radiation, thus ensuring the safety of both patients and healthcare workers. Furthermore, tungsten is employed in surgical instruments that demand accuracy, including needles, blades, and various specialized tools. As the demand for sophisticated healthcare services and medical technologies increases in India, especially with improvements in healthcare infrastructure, the requirement for tungsten-based components is also on a rise. As healthcare facilities modernize and expand, the demand for high-performance materials like tungsten will continue to grow, supporting the overall growth of the market in the country. In 2024, the Board of Radiation and Isotope Technology (BRIT) introduced the local ROTEX-I Industrial Radiography Device in Navi Mumbai. The device employed tungsten heavy alloy for shielding, providing a lighter and safer option compared to imported radiography tools.

To get more information on this market, Request Sample

Government Initiatives and Policies

Government policies and initiatives are essential in fostering the growth of the India tungsten market. India's industrial advancement is backed by several programs, particularly the "Atmanirbhar Bharat" initiative, which motivates local manufacturing of crucial resources such as tungsten. This initiative seeks to lessen the reliance of the nation on imports while promoting the growth of domestic industries. In addition, regulations aimed at the mining and extraction of essential minerals are fostering a more favorable atmosphere for companies engaged in the tungsten supply chain. The Government is proactively offering incentives, subsidies, and beneficial regulations for firms investing in advanced manufacturing technologies, thereby driving the demand for tungsten in high-tech industries such as aerospace, automotive, and electronics. Trade policies aimed at decreasing import reliance, coupled with initiatives to promote sustainable mining practices, are boosting the overall stability of the tungsten market. These strategic actions not only assist in reducing supply chain risks but also promote both foreign and local investments in the tungsten sector. In 2024, India’s Cabinet approved new royalty rates for the mining of 12 critical minerals, including Vanadium, Tungsten, and Cobalt. This move aimed to boost domestic mining and reduce dependency on imports, supporting sectors like renewable energy, defense, and electric vehicle (EV) development. The decision also facilitated the auctioning of mining blocks for these minerals.

India Tungsten Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, product, and end-user industry.

Type Insights:

- Foils

- Ribbons

- Wires

- Tubes

The report has provided a detailed breakup and analysis of the market based on the type. This includes foils, ribbons, wires, and tubes.

Product Insights:

- Carbides

- Tungsten Alloys

- Tungsten Mill Products

- Tungsten Chemicals

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes carbides, tungsten alloys, tungsten mill products, and tungsten chemicals.

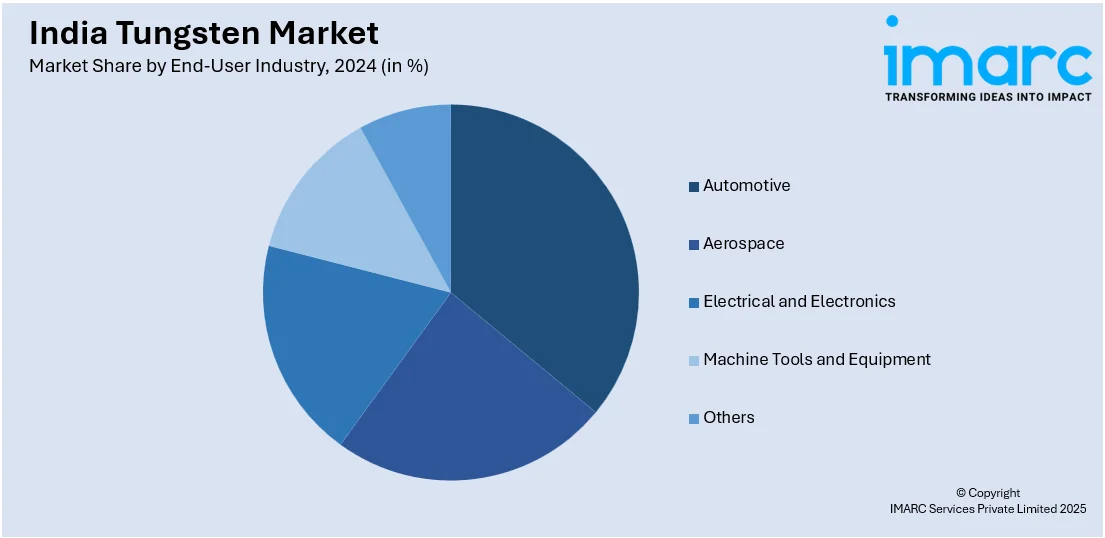

End-User Industry Insights:

- Automotive

- Aerospace

- Electrical and Electronics

- Machine Tools and Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes automotive, aerospace, electrical and electronics, machine tools and equipment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Tungsten Market News:

- In February 2025, India’s Finance Minister announced the removal of customs duties on waste and scrap from critical minerals, including antimony, cobalt, tungsten, and copper. This move is aimed at securing raw material supply for industries such as electronics and EVs.

- In June 2024, India successfully auctioned its first-ever tungsten and cobalt mineral blocks. Hindustan Zinc Limited, a subsidiary of the Vedanta Group, had won the bidding, securing rights for two tungsten blocks in Tamil Nadu and Andhra Pradesh. This marked a significant step in India’s efforts toward mineral independence.

India Tungsten Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Foils, Ribbons, Wires, Tubes |

| Products Covered | Carbides, Tungsten Alloys, Tungsten Mill Products, Tungsten Chemicals |

| End-User Industries Covered | Automotive, Aerospace, Electrical and Electronics, Machine Tools and Equipment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India tungsten market performed so far and how will it perform in the coming years?

- What is the breakup of the India tungsten market on the basis of type?

- What is the breakup of the India tungsten market on the basis of product?

- What is the breakup of the India tungsten market on the basis of end-user industry?

- What is the breakup of the India tungsten market on the basis of region?

- What are the various stages in the value chain of the India tungsten market?

- What are the key driving factors and challenges in the India tungsten market?

- What is the structure of the India tungsten market and who are the key players?

- What is the degree of competition in the India tungsten market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India tungsten market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India tungsten market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India tungsten industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)