India Two-Wheeler Aftermarket Component Market Size, Share, Trends and Forecast by Component Type, Vehicle Type, Material Type, Distribution Channel, and Region, 2025-2033

India Two-Wheeler Aftermarket Component Market Overview:

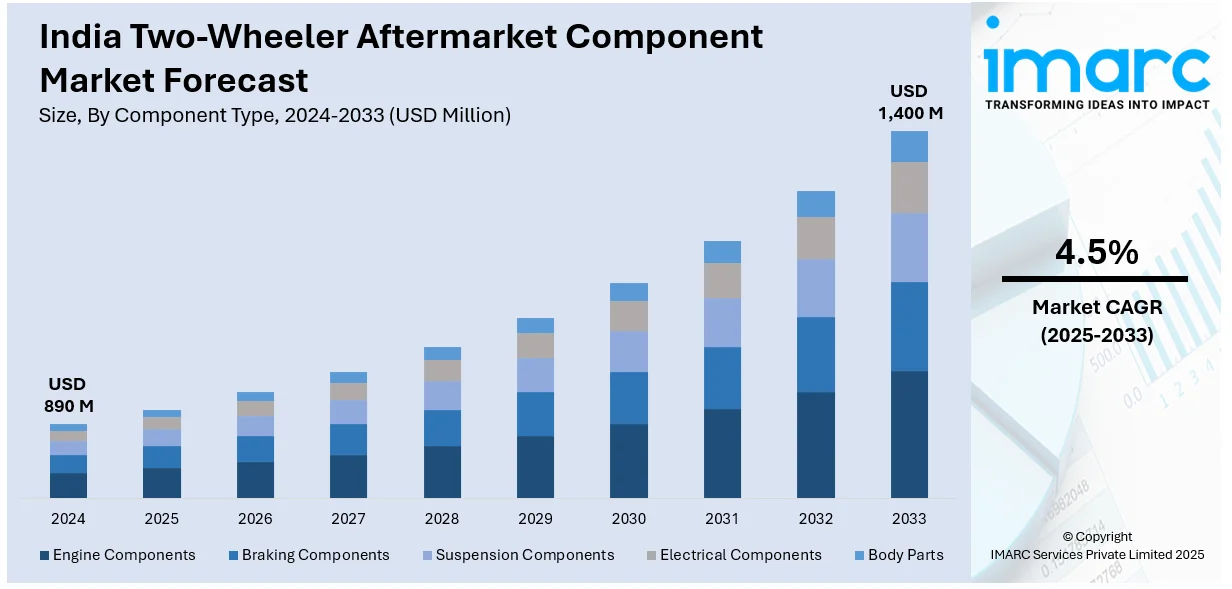

The India two-wheeler aftermarket component market size reached USD 890 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,400 Million by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033. India’s market is growing due to rising vehicle ownership, mechanic training programs, demand for genuine parts, and expansion of professional workshops offering advanced diagnostics, technical support, and standardized servicing across urban and semi-urban regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 890 Million |

| Market Forecast in 2033 | USD 1,400 Million |

| Market Growth Rate 2025-2033 | 4.5% |

India Two-Wheeler Aftermarket Component Market Trends:

Rising Demand for Mechanic Training Initiatives

India’s two-wheeler aftermarket component market is undergoing a shift toward enhancing service reliability and curbing the use of counterfeit parts. With a massive two-wheeler population and frequent demand for maintenance, local mechanics often serve as the first point of contact for consumers. However, lack of formal training and limited awareness about genuine components continue to impact repair quality. To tackle this, aftermarket players are investing in grassroots training to promote the use of original bearings, seals, and maintenance kits. These steps are helping to formalize a large segment of the otherwise unorganized service network. In January 2025, SKF India rolled out a mobile van campaign across 100 cities with the aim of training over 8,000 two-wheeler mechanics. The campaign provided hands-on learning and demonstrations, focusing on identifying genuine products and understanding their benefits in terms of performance and safety. This initiative played a key role in raising awareness about counterfeit risks and strengthening trust in branded components. The effort is not only improving mechanical capability but also encouraging a shift in consumer demand toward verified parts. As a result, it is driving sustained demand for high-quality aftermarket products and supporting the evolution of India’s two-wheeler servicing landscape.

To get more information on this market, Request Sample

Expansion of Professional Aftermarket Workshops

India’s growing two-wheeler aftermarket is gradually moving toward structured servicing formats to match rising consumer expectations for better reliability and service quality. With newer models featuring complex technology and safety components, traditional roadside repairs are no longer sufficient. There is a growing need for workshops equipped with advanced tools, skilled technicians, and access to original spare parts. This demand is prompting companies to establish well-equipped service centers that offer consistent servicing standards, diagnostic expertise, and technical support to independent mechanics. In February 2025, ZF Aftermarket launched India’s first ZF [pro]Tech Plus workshop in New Delhi. The workshop is designed to serve as a center for training, diagnostics, and authorized repairs, focusing on improving the quality of two-wheeler servicing. It offers technical support and product guidance to mechanics while expanding consumer access to genuine ZF parts. This development marks a significant step toward formalizing the aftermarket ecosystem by offering services aligned with OEM standards. It is also helping reduce dependency on unauthorized repair methods and unreliable spare parts. Such initiatives are transforming the way two-wheelers are maintained across the country, improving both service delivery and customer satisfaction in the aftermarket segment.

India Two-Wheeler Aftermarket Component Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component type, vehicle type, material type, and distribution channel.

Component Type Insights:

- Engine Components

- Braking Components

- Suspension Components

- Electrical Components

- Body Parts

The report has provided a detailed breakup and analysis of the market based on the component type. This includes engine components, braking components, suspension components, electrical components, and body parts.

Vehicle Type Insights:

- Motorcycles

- Scooters

- Mopeds

- Electric Two-Wheelers

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes motorcycles, scooters, mopeds, and electric two-wheelers.

Material Type Insights:

- Metals

- Plastics

- Composites

- Rubber

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes metals, plastics, composites, and rubber.

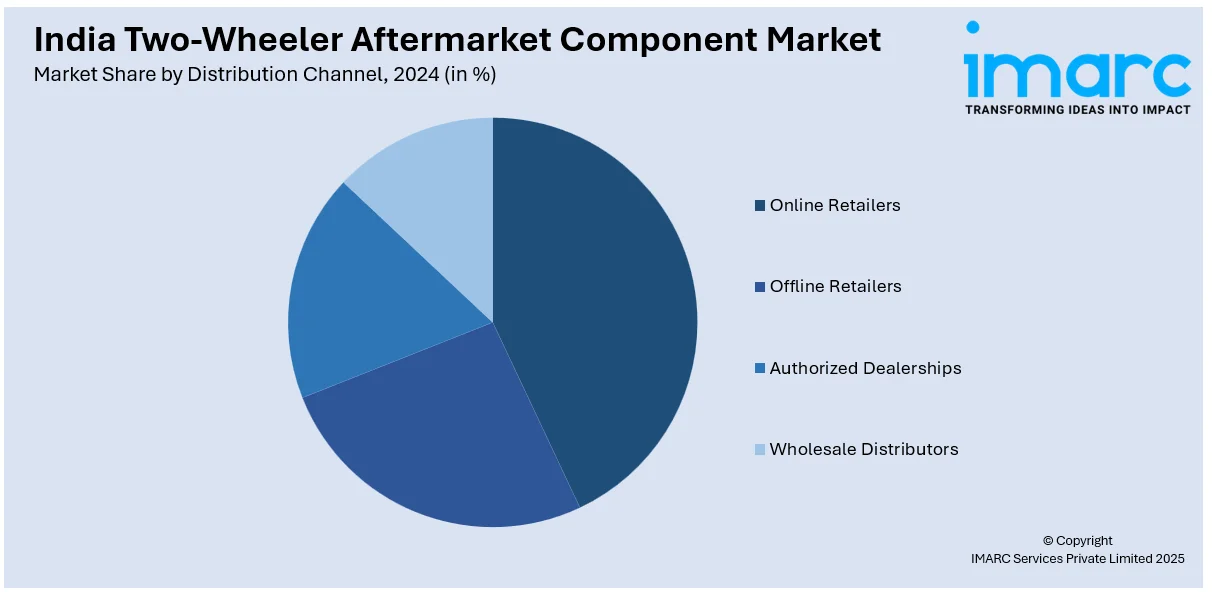

Distribution Channel Insights:

- Online Retailers

- Offline Retailers

- Authorized Dealerships

- Wholesale Distributors

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retailers, offline retailers, authorized dealerships, and wholesale distributors.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Two-Wheeler Aftermarket Component Market News:

- February 2025: Ultraviolette Automotive announced entry into new two-wheeler segments, boosting demand for customized components. This expansion diversified the Indian two-wheeler aftermarket, increasing opportunities for performance parts, battery accessories, and smart mobility components aligned with Ultraviolette’s design and technology-driven electric motorcycles.

- January 2025: BMW Motorrad India launched the new S 1000 RR with advanced components like M winglets, carbon wheels, and electronic chassis. This spurred demand in India’s two-wheeler aftermarket for high-performance parts, custom accessories, and precision electronics, accelerating premium segment component upgrades.

India Two-Wheeler Aftermarket Component Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Engine Components, Braking Components, Suspension Components, Electrical Components, Body Parts |

| Vehicle Types Covered | Motorcycles, Scooters, Mopeds, Electric Two-Wheelers |

| Material Types Covered | Metals, Plastics, Composites, Rubber |

| Distribution Channels Covered | Online Retailers, Offline Retailers, Authorized Dealerships, Wholesale Distributors |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India two-wheeler aftermarket component market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India two-wheeler aftermarket component market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India two-wheeler aftermarket component industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The two-wheeler aftermarket component market in India was valued at USD 890 Million in 2024.

The India two-wheeler aftermarket component market is projected to exhibit a CAGR of 4.5% during 2025-2033, reaching a value of USD 1,400 Million by 2033.

Rapid increase in two-wheeler ownership, rising vehicle age, and affordability of maintenance support aftermarket demand. Additionally, expanding rural reach, growth of independent service centers, and consumer preference for customized accessories and performance upgrades are fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)