India Two-Wheeler Leasing Market Size, Share, Trends and Forecast by Vehicle Type, Leasing Type, End-User, Distribution Channel, and Region, 2025-2033

India Two-Wheeler Leasing Market Overview:

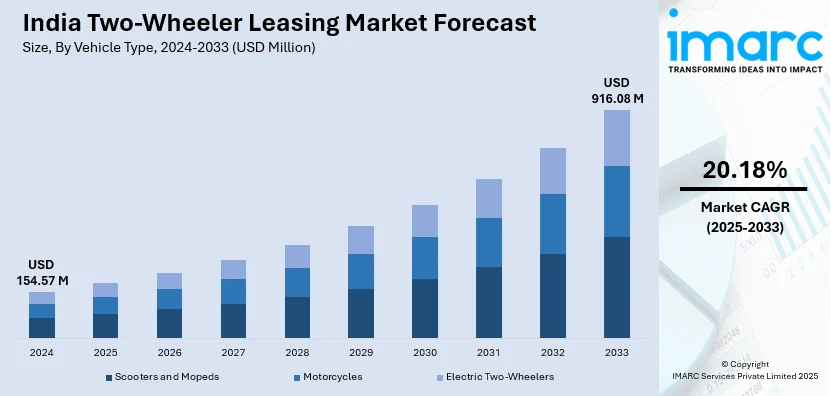

The India two-wheeler leasing market size reached USD 154.57 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 916.08 Million by 2033, exhibiting a growth rate (CAGR) of 20.18% during 2025-2033. The market is expanding due to the increasing adoption of electric vehicles, driven by sustainability goals and cost-efficiency. Fleet operators prefer Robust Utility Vehicles (RUVs) for reliable operations, while partnerships and flexible financing boost leasing accessibility, supporting last-mile connectivity and gig economy growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 154.57 Million |

| Market Forecast in 2033 | USD 916.08 Million |

| Market Growth Rate 2025-2033 | 20.18% |

India Two-Wheeler Leasing Market Trends:

Increasing Demand for Robust Utility Vehicles

India's two-wheeler leasing market has seen a growing preference for Robust Utility Vehicles (RUVs), particularly from fleet operators and logistics companies. Known for their durability and advanced safety features, RUVs provide reliable performance in urban and semi-urban environments. This demand has surged as companies seek cost-effective electric solutions for last-mile deliveries and mobility services. In June 2024, BGauss launched the RUV350, marking India's first Robust Utility Vehicle. This development introduced a sturdy, efficient vehicle designed to minimize operational downtime. Offering features like an extended battery range and low maintenance costs, the RUV350 quickly gained traction among large fleet operators. BGauss also implemented flexible leasing packages, further reducing upfront expenses for companies. These initiatives played a crucial role in increasing the adoption of electric RUVs. With governments supporting electric mobility through incentives and infrastructure development, leasing companies are expanding their offerings to meet the rising demand. The adoption of RUVs is set to continue growing, driven by the operational advantages they provide to commercial fleets. As more operators prioritize cost efficiency and sustainability, the robust two-wheeler leasing market in India is expected to strengthen further.

To get more information on this market, Request Sample

Expansion of Electric Two-Wheeler Leasing Networks

The Indian two-wheeler leasing market has also expanded rapidly, supported by the increasing availability of electric vehicles. Leasing companies are actively working to meet the rising demand for sustainable and accessible mobility solutions. This trend has been particularly beneficial for gig workers and last-mile delivery operators in both metro and non-metro areas. A major development in this sector occurred in August 2024 when BLive announced the expansion of its electric two-wheeler leasing operations. The company aimed to add 10,000 vehicles to its fleet by March 2025. By forming strategic partnerships with leading e-commerce aggregators, BLive ensured a consistent supply of electric two-wheelers for delivery services. Additionally, it introduced affordable leasing models with low upfront costs, making electric mobility accessible to gig workers. These efforts significantly boosted fleet availability and encouraged broader EV adoption. The expansion of charging infrastructure and the introduction of battery-swapping stations further supported operational efficiency. With leasing companies continuing to invest in fleet growth and sustainable mobility, the adoption of electric two-wheelers is expected to accelerate, contributing to a greener transportation landscape in India.

India Two-Wheeler Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, leasing type, end-user, and distribution channel.

Vehicle Type Insights:

- Scooters and Mopeds

- Motorcycles

- Electric Two-Wheelers

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes scooters and mopeds, motorcycles, and electric two-wheelers.

Leasing Type Insights:

- Operational Leasing

- Financial Leasing

The report has provided a detailed breakup and analysis of the market based on the leasing type. This includes operational leasing and financial leasing.

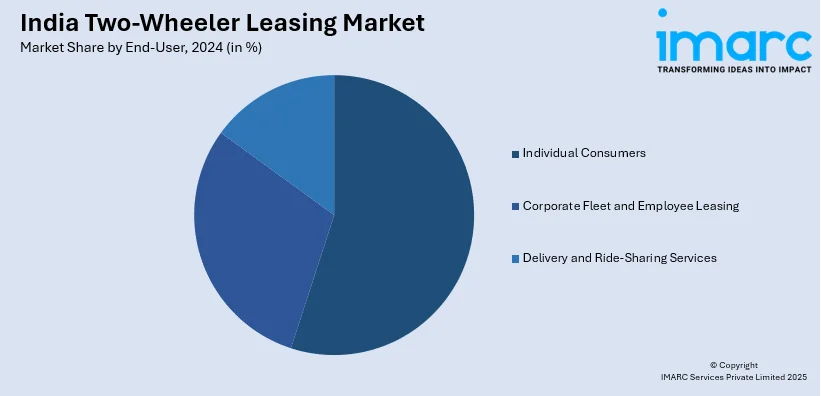

End-User Insights:

- Individual Consumers

- Corporate Fleet and Employee Leasing

- Delivery and Ride-Sharing Services

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes individual consumers, corporate fleet and employee leasing, and delivery and ride-sharing services.

Distribution Channel Insights:

- Online

- Leasing Platforms

- E-Commerce

- Offline

- Dealerships

- Rental Agencies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online (leasing platforms and e-commerce) and offline (dealerships and rental agencies).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Two-Wheeler Leasing Market News:

- December 2024: Lectrix EV introduced the NDuro electric two-wheeler at INR 59,999, offering a Battery-as-a-Service (BaaS) model. This reduced upfront costs by 40%, enhancing affordability and promoting wider EV adoption. The initiative boosted the two-wheeler leasing sector by increasing accessibility and financial flexibility.

- June 2024: eBikeGo announced plans to expand its electric two-wheeler fleet to 1 Lakh units by FY26. This initiative enhanced the two-wheeler leasing sector, supporting last-mile delivery growth, increasing EV adoption, and improving accessibility in Tier I, II, and III cities across India.

India Two-Wheeler Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Scooters and Mopeds, Motorcycles, Electric Two-Wheelers |

| Leasing Types Covered | Operational Leasing, Financial Leasing |

| End-Users Covered | Individual Consumers, Corporate Fleet and Employee Leasing, Delivery and Ride-Sharing Services |

| Distribution Channels Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India two-wheeler leasing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India two-wheeler leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India two-wheeler leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The two-wheeler leasing market in India was valued at USD 154.57 Million in 2024.

The India two-wheeler leasing market is projected to exhibit a CAGR of 20.18% during 2025-2033, reaching a value of USD 916.08 Million by 2033.

The India two-wheeler leasing market is driven by rising demand for affordable mobility solutions, especially among urban youth and working professionals. Increasing fuel efficiency, flexible leasing options, and lower upfront costs compared to ownership are also boosting adoption. Growth in app-based delivery services further accelerates demand for leased two-wheelers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)