India Tyre Market Size, Share, Trends and Forecast by Vehicle Type, OEM and Replacement Segment, Domestic Production and Imports, Radial and Bias Tyres, Tube and Tubeless Tyres, Tyre Size, Price Segment, and Region, 2026-2034

India Tyre Market Summary:

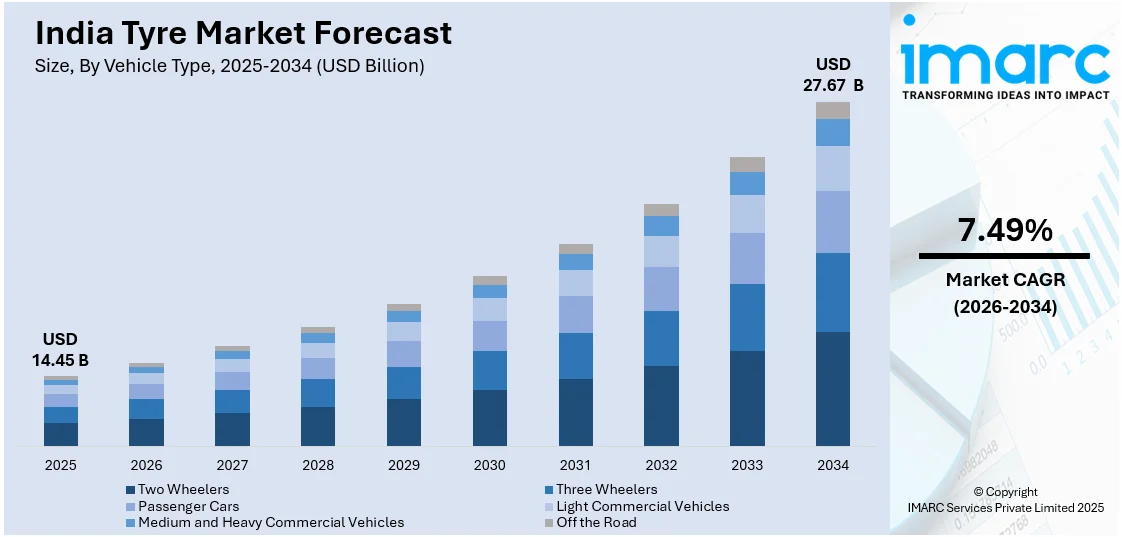

The India tyre market size was valued at USD 14.45 Billion in 2025 and is projected to reach USD 27.67 Billion by 2034, growing at a compound annual growth rate of 7.49% from 2026-2034.

The tyre market in India is gaining strong momentum, as rapid urbanization, rising vehicle ownership, and expanding road infrastructure continue to accelerate demand across segments. Supportive government policies, increasing adoption of radial and tubeless technologies, and growing replacement tyre requirements are reinforcing growth. Advancements in tyre engineering, the emergence of electric vehicle (EV)-specific tyre designs, and strengthening domestic manufacturing capabilities are bolstering the market share.

Key Takeaways and Insights:

- By Vehicle Type: Passenger cars dominate the market with a share of 32% in 2025, owing to rising car ownership among middle-income households, growing demand for premium hatchbacks and sedans, and increasing urbanization driving personal mobility needs across the country.

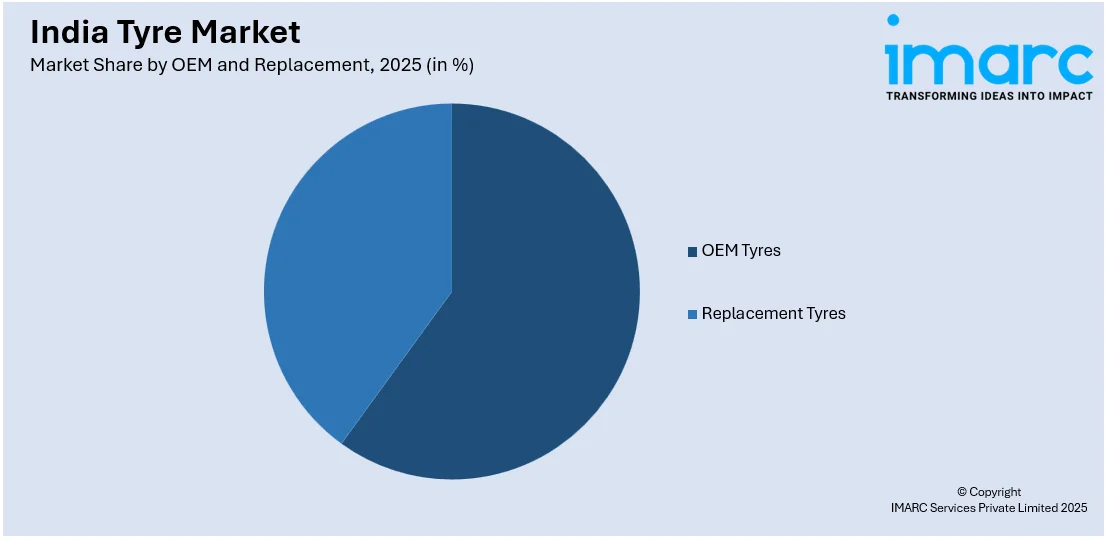

- By OEM and Replacement Segment: Replacement tyres lead the market with a share of 58% in 2025, driven by the expanding installed vehicle base, increasing consumer awareness about tyre maintenance, and improved access to organized retail chains and online tyre sales platforms

. - By Domestic Production and Imports: Domestic production prevails the market with a share of 70% in 2025, reflecting strong government support through manufacturing incentives, a well-established supplier ecosystem, and the presence of major production facilities across multiple states.

- By Radial and Bias Tyres: Radial tyres exhibit a clear dominance with a market share of 64% in 2025, supported by regulatory mandates phasing out bias tyres in new commercial vehicles, superior fuel efficiency characteristics, and growing consumer preference for longer tread life.

- By Tube and Tubeless Tyres: Tubeless tyres comprise the largest segment with a share of 79% in 2025, owing to their enhanced safety features, reduced puncture risks, improved fuel efficiency, and widespread adoption across passenger cars and two-wheelers.

- By Tyre Size: Medium holds a leading position with a share of 50% in 2025, driven by strong adoption in mid-duty commercial vehicles, expanding logistics networks, and the growing preferences for mid-size passenger vehicles and sport utility vehicles (SUVs).

- By Price Segment: Medium commands market leadership with a share of 55% in 2025, reflecting the value-conscious purchasing behavior of the majority consumer base that prioritizes a balance between quality, durability, and affordability.

- By Region: West and Central India represents the largest region with 33% share in 2025, driven by the concentration of major automobile and tyre manufacturing plants in Maharashtra and Gujarat, extensive highway networks, and robust industrial corridors fueling commercial vehicle tyre demand.

- Key Players: Key players drive the India tyre market by expanding production capacities, investing in advanced tyre technologies, strengthening nationwide distribution networks, and forming strategic partnerships to enhance brand visibility, improve product quality, and capture growing demand across passenger, commercial, and EV segments. Some of the key players operating in the market include Apollo Tyres Ltd, Bridgestone India Private Limited, CEAT Ltd, Continental Tyres, JK Tyre & Industries Ltd., MRF Tyres, The Goodyear Tire & Rubber Company, and Yokohama India Pvt Ltd.

To get more information on this market Request Sample

The tyre market in India is advancing as manufacturers, government bodies, and consumers collectively drive demand for high-performance, fuel-efficient, and technologically advanced tyre solutions across diverse vehicle categories. The sector benefits from a rapidly growing automobile industry, with passenger vehicle sales reaching 4.3 Million units in FY 2024-25 in India, as per SIAM Report, reflecting sustained consumer demand for personal mobility. Government initiatives are incentivizing domestic manufacturing capacity expansion and attracting significant foreign direct investment. The transition towards electric mobility is creating new product development opportunities, driving demand for specialized low-rolling-resistance tyres. The replacement segment continues to expand as the installed vehicle base matures and consumers increasingly prioritize timely maintenance and safety-driven tyre upgrades. Rising infrastructure spending, expanding logistics networks, and growing replacement tyre requirements further reinforce the trajectory of the market growth across all segments and regions.

India Tyre Market Trends:

Growing Demand for EV-Specific Tyres

The rising adoption of electric two-wheelers and fleet-integrated electric buses is compelling tyre manufacturers to develop low-resistance, high-durability tyres tailored to EV-specific torque and load dynamics. In 2025, Ola Electric experienced a 7.4% rise in 2-wheeler sales in India, increasing from 8,400 to 9,020 units. Battery-EV fitments represent the fastest-growing propulsion segment, expanding significantly as automakers plan to introduce new EV models, including premium options with extended range and quicker charging capabilities. This shift is driving substantial investments in specialized tyre engineering and formulation.

Expansion of Tyre-as-a-Service Business Models

In India, business-to-business clients are increasingly demanding integrated tyre packages encompassing installation, tracking, maintenance, and warranty coverage. Fleet operators, logistics companies, and public transport providers are shifting towards subscription-based models to optimize operating costs and improve vehicle uptime. These service-oriented offerings enable real-time tyre performance monitoring, predictive maintenance, and streamlined replacement cycles. Original equipment manufacturers (OEMs) and tyre manufacturers are partnering with digital platform providers to deliver data-driven insights, enhance lifecycle management, and strengthen long-term customer relationships through recurring service contracts.

Adoption of Synthetic Rubber Alternatives in Manufacturing

The volatility in natural rubber prices and import restrictions from ASEAN countries are pushing manufacturers to explore synthetic alternatives, driving innovations in compound development. In April 2024, Apollo Tyres, based in India, was awarded a patent for a cross-linkable rubber composition, incorporating natural rubber, filler, and a resin composed of ethylene, acrylic ester, and maleic anhydride. This innovation supports improved durability, heat resistance, and performance consistency across varying operating conditions. Such advancements help manufacturers reduce dependency on raw material imports while stabilizing production costs.

Market Outlook 2026-2034:

The Indian tyre market is poised for robust expansion over the forecast period, underpinned by rising vehicle production, accelerating infrastructure development, and growing consumer preference for advanced tyre technologies. The market generated a revenue of USD 14.45 Billion in 2025 and is projected to reach a revenue of USD 27.67 Billion by 2034, growing at a compound annual growth rate of 7.49% from 2026-2034. The ongoing transition towards radial and tubeless technologies, coupled with increasing demand for EV-compatible tyres, is expected to create significant product innovation opportunities. Government policies, including manufacturing incentives, anti-dumping measures on imported tyres, and the Bureau of Indian Standards star-labelling framework, are reinforcing the competitive positioning of domestic manufacturers.

India Tyre Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

Passenger Cars |

32% |

|

OEM and Replacement Segment |

Replacement Tyres |

58% |

|

Domestic Production and Imports |

Domestic Production |

70% |

|

Radial and Bias Tyres |

Radial Tyres |

64% |

|

Tube and Tubeless Tyres |

Tubeless Tyres |

79% |

|

Tyre Size |

Medium |

50% |

|

Price Segment |

Medium |

55% |

|

Region |

West and Central India |

33% |

Vehicle Type Insights:

- Two Wheelers

- Three Wheelers

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Off the Road

Passenger cars dominate with a market share of 32% of the total India tyre industry in 2025.

Passenger cars maintain leadership position in the market, driven by sustained urban growth, rising middle-class incomes, and increasing preference for personal mobility solutions. As per IMARC Group, the India passenger car market size was valued at USD 63.01 Billion in 2025. Tyre manufacturers are focusing on noise-reduction and performance-oriented tread patterns, especially for premium hatchbacks and sedans, with brands developing product ranges tailored to high-speed urban roads, meeting evolving consumer expectations for ride comfort and handling precision.

The growing premiumization trend in India's passenger vehicle market is reshaping tyre specifications and driving demand for larger-diameter, high-performance products. This shift is speeding up the use of radial tyres with improved rolling resistance, wet-grip qualities, and sophisticated rubber formulations. In order to comply with safety regulations, manufacturers are also including durability improvements and smart labeling. The design specifications for tyres are also influenced by the growing number of electric passenger cars, which place an emphasis on reduced noise, increased load capacity, and longer tread life for urban driving situations.

OEM and Replacement Segment Insights:

Access the comprehensive market breakdown Request Sample

- OEM Tyres

- Replacement Tyres

Replacement tyres lead with a share of 58% of the total Indian tyre market in 2025.

The replacement tyres segment commands a majority share, owing to the large and aging installed vehicle base across India, where regular tyre replacement cycles drive sustained aftermarket demand. The addressable market is growing because of better access to multi-brand dealerships, online tyre platforms, and consumer financing choices. This allows manufacturers to reach price-conscious consumers across the country while improving convenience and service quality in urban and semi-urban settings.

Increasing consumer knowledge of vehicle safety and maintenance requirements, which promotes prompt tyre replacements rather than prolonged usage cycles, further strengthens the segment. Tyre wear is also accelerated by tougher road conditions, increased average vehicle utilization, and more stringent vehicle inspection procedures, which contribute to a steady demand for replacements. Long-term aftermarket growth is maintained by providing consumers with additional incentives to switch to higher-quality tyres, such as promotional offers, bundled services, and warranty-backed products. Seasonal demand surges associated with long-distance travel and monsoon readiness also support the segment's expansion.

Domestic Production and Imports Insights:

- Domestic Production

- Imports

Domestic production comprises the leading segment with a 70% share of the total Indian tyre market in 2025.

The domestic production segment continues to attract significant capital investment from both established players and international entrants seeking to establish manufacturing footprints in India. Indian tyre exports recorded a turnover exceeding INR 23,073 crore in FY 2024, highlighting the sector's growing international competitiveness and diversified market reach. Anti-dumping duties on imported tyres, combined with the Bureau of Indian Standards quality certification requirements, are reinforcing the value proposition of locally manufactured products, while the Production Linked Incentive scheme provides direct financial incentives for scaling domestic output and enhancing value addition.

In India, the segment benefits from a strong policy push, expanding automotive demand, and increasing export orientation. Manufacturers are investing in capacity expansions, automation, and advanced manufacturing technologies to improve productivity and cost efficiency. Proximity to key raw materials, improving port infrastructure, and better logistics connectivity support competitive production economics. Additionally, rising demand from passenger vehicles, commercial fleets, and agricultural machinery provides a stable domestic consumption base.

Radial and Bias Tyres Insights:

- Bias Tyres

- Radial Tyres

Radial tyres hold a leading position with a share of 64% of the total India tyre industry in 2025.

Radial tyres have established clear dominance across the market in India, driven by superior fuel efficiency, longer tread life, and reduced heat generation compared to conventional bias-ply alternatives. Policy-led transitions in vehicle standards and evolving industry preferences have accelerated the movement away from bias tyres, particularly in commercial vehicle categories. These tyres offer better handling, enhanced safety, and lower operating costs, making them well suited for India’s expanding highway network and long-haul transportation needs. Growing awareness about lifecycle cost benefits further supports widespread adoption across vehicle segments.

The expansion of radial tyre manufacturing capacity in India is being actively driven by investments from both domestic and global players. Leading manufacturers are upgrading facilities, adding dedicated radial production lines, and integrating advanced manufacturing technologies to meet rising demand. Focus areas include passenger car, truck, and bus radial tyres, reflecting diversification across end use segments. Sustainability considerations, improved material efficiency, and localization of advanced designs are also shaping capacity expansion strategies, positioning India as a key production hub for radial tyres serving both domestic and export markets.

Tube and Tubeless Tyres Insights:

- Tube Tyres

- Tubeless Tyres

Tubeless tyres exhibit a clear dominance with a 79% share of the total Indian tyre industry in 2025.

Tubeless tyres dominate the India trye market, owing to significant advantages in safety, fuel efficiency, and overall maintenance convenience over traditional tube-type alternatives. The widespread adoption across passenger cars and modern two-wheelers reflects growing consumer preference for products that offer reduced puncture risks, improved heat dissipation, and superior handling characteristics at higher speeds. Easy repairability and lower downtime during puncture incidents further enhance their appeal among daily commuters.

The tubeless segment is further strengthened by ongoing regulatory developments and manufacturer emphasis on safety-enhanced tyre designs that align with global automotive standards. Lightweight construction characteristics enable improved fuel efficiency and extended mileage, making tubeless tyres the preferred specification for both economy and premium vehicle categories. OEMs are increasingly standardizing tubeless tyres across new vehicle models to meet evolving safety expectations. Additionally, advancements in rubber compounds and tread technology continue to improve durability and ride comfort, supporting sustained segment growth.

Tyre Size Insights:

- Small

- Medium

- Large

Medium prevails the market with a 50% share of the total Indian tyre market in 2025.

Medium leads the market, driven by strong demand from passenger cars and light commercial vehicles operating in urban and semi-urban areas. The expansion of logistics networks, combined with the surge in rural and urban goods movement, is sustaining demand for this category across fleet and retail channels. The segment benefits from the convergence of multiple demand drivers, including the growing popularity of compact SUVs, mid-size sedans, and light commercial vehicles that predominantly utilize specifications within this diameter range.

Additionally, the segment develops momentum due to its adaptability to a variety of driving situations and road characteristics that are typical in India. These tyres are ideal for both short-haul commercial operations and regular commuting because they provide the best possible balance between load-bearing capability and riding comfort. In order to improve mileage and longevity, manufacturers are actively broadening their product offerings in this field by providing better tread designs and rubber compositions. Consistent adoption across price-sensitive and value-focused consumer groups is further supported by strong availability through structured dealerships and aftermarket channels.

Price Segment Insights:

- Low

- Medium

- High

Medium maintains market leadership with a 55% share of the total India tyre industry in 2025.

The medium segment captures the largest share of the tyre market in India, reflecting the value-conscious purchasing patterns of the country's broad consumer base that seeks an optimal balance between affordability, quality, and performance. This segment caters to the majority of passenger car and two-wheeler owners, as well as small and medium fleet operators, who prioritize durable and reliable tyre products without the premium pricing associated with high-end alternatives.

The strength of the medium segment is reinforced by the competitive strategies of leading domestic manufacturers who have positioned their core product lines to target this high-volume market tier. Various vehicle manufacturers have developed extensive product portfolios within this price bracket, offering products that balance technological advancement with mass-market accessibility. Wide availability through organized dealerships and aftermarket channels ensures strong penetration across urban and rural markets. Additionally, frequent replacement cycles in this segment help sustain steady demand and long-term volume growth for manufacturers.

Regional Insights:

- North India

- West and Central India

- South India

- East India

West and Central India represents the largest region with a share of 33% of the total Indian tyre industry in 2025.

West and Central India commands the largest regional share in the tyre market in India, driven by the concentration of major automobile and tyre manufacturing plants across Maharashtra and Gujarat. These states host critical automotive production hubs that generate substantial original equipment and replacement tyre demand. In October 2024, Maruti Suzuki announced plans to produce its first EV for Toyota at its Gujarat plant from the spring of 2025, marking a significant step in EV manufacturing that will further stimulate regional tyre demand. The extensive highway network and industrial corridors connecting these states drive robust commercial vehicle tyre consumption.

The region's leadership position is reinforced by the rapid expansion of urban centers, growing logistics and transportation sectors, and increasing preference for personal vehicles among the region's large consumer base. Government initiatives, including smart city projects, the Delhi-Mumbai Industrial Corridor, and ongoing infrastructure development across Maharashtra, Gujarat, Madhya Pradesh, and Rajasthan, are propelling commercial and passenger vehicle adoption. The presence of Bridgestone India's Pune and Indore manufacturing plants ensures proximity to production centers that strengthens the supply chain ecosystem.

Market Dynamics:

Growth Drivers:

Why is the Indian Tyre Market Growing?

Government Manufacturing Incentives and Infrastructure Investment

The Indian government's proactive industrial policy framework is creating a highly favorable environment for tyre manufacturers to expand domestic production capabilities and attract foreign investment. The Production Linked Incentive scheme for the automotive sector directly incentivizes manufacturers to enhance local production capacity, adopt advanced manufacturing technologies, and increase value addition. These incentives are complemented by broader infrastructure investment programs that generate sustained demand for commercial vehicle tyres. The national highway network has expanded substantially, growing 60% from 91,287 kilometers in 2014 to over 146,195 kilometers in 2024, creating vast new surfaces that require consistent tyre replacement cycles. In parallel, state-level policies offering land subsidies, tax concessions, and faster regulatory clearances are further improving the ease of setting up tyre manufacturing facilities across key industrial corridors.

Rising Vehicle Production and Expanding Automobile Ownership

India's robust automobile production growth across all vehicle categories is generating substantial original equipment tyre demand while simultaneously building the installed vehicle base that drives future replacement requirements. The broad-based automotive sector expansion creates multi-layered demand for tyre manufacturers serving diverse segments, ranging from economy two-wheelers to premium SUVs. In September 2024, Tata Motors commenced construction on a new greenfield vehicle manufacturing plant in Panapakkam, Ranipet district, Tamil Nadu, designed to manufacture next-generation cars and SUVs for Tata Motors and Jaguar Land Rover. The growing premiumization trend is shifting the product mix towards higher-value, larger-diameter tyres that generate improved revenue per unit. The commercial vehicle segment benefits from expanding logistics, e-commerce fulfilment, and construction activity, while the rising popularity of electric two-wheelers is opening entirely new product development avenues for manufacturers.

Strengthening Domestic Manufacturing Ecosystem and Export Competitiveness

Strengthening domestic manufacturing capabilities is playing a key role in driving the Indian tyre sector by improving cost efficiency, supply reliability, and product quality. Investments in modern production facilities, automation, and advanced compound technologies are enabling manufacturers to scale output while meeting global performance standards. Manufacturing FDI rose 18% year-on-year in FY 2024-25, reaching USD 19.04 Billion compared to USD 16.12 Billion in FY 2023–24, reflecting heightened investor confidence in India's manufacturing sector. These structural advantages enable domestic manufacturers to invest in technology upgrades, capacity expansion, and research capabilities that strengthen their competitive positioning in both domestic and international markets. The surging export competitiveness allows Indian tyre manufacturers to access international markets, diversify revenue streams, and achieve economies of scale that support sustained domestic market growth.

Market Restraints:

What Challenges the Indian Tyre Market is Facing?

Volatile Raw Material Prices Creating Margin Pressure

The tyre manufacturing industry faces significant challenges from the volatility in natural rubber and petroleum-derived raw material prices. Fluctuating input costs make long-term pricing strategies difficult, compress profit margins, and increase financial uncertainty for manufacturers. Sudden cost spikes are often hard to pass on to end consumers due to intense market competition, impacting overall profitability and investment planning across the value chain.

Import Competition from Low-Cost Manufacturing Markets

Despite the implementation of anti-dumping duties and quality certification requirements, competition from low-cost tyre imports continues to exert downward pressure on domestic pricing, particularly in economy and mid-range segments. Manufacturers from neighboring Asian countries can offer products at competitive price points due to lower labor costs and raw material advantages. This competitive dynamic limits the pricing flexibility of domestic manufacturers, particularly in the replacement segment where price sensitivity remains elevated among individual consumers and small fleet operators.

Escalating Research and Development (R&D) Investment Requirements

The rapid evolution of tyre technology, driven by the transition to EVs, smart tyre integration, and sustainability mandates, is necessitating substantial R&D expenditure that strains profit margins. Developing specialized low-rolling-resistance tyres for EVs, integrating sensor-based monitoring systems, and formulating eco-friendly compound alternatives require sustained capital commitment. Smaller manufacturers face particular challenges in matching the innovation pace set by larger players, potentially widening the competitive gap and limiting their ability to capture emerging market segments.

Top Companies, Brands, Manufacturers in the Indian Tyre Industry:

The tyre market in India is characterized by a mix of established domestic manufacturers and international players competing across diverse vehicle and price segments. Domestic companies leverage strong brand recognition, extensive distribution networks, and proximity to manufacturing bases to maintain leadership in the replacement and original equipment segments. International manufacturers focus on premium positioning and technology differentiation to capture higher-value market tiers. The competitive landscape is intensifying as manufacturers invest in capacity expansion, advanced manufacturing technologies, and product innovation to address evolving consumer preferences and regulatory requirements, while digital transformation initiatives, including online sales platforms and predictive maintenance solutions, are reshaping customer engagement strategies.

Some of the key players include:

- Apollo Tyres Ltd

- Bridgestone India Private Limited

- CEAT Ltd

- Continental Tyres

- JK Tyre & Industries Ltd.

- MRF Tyres

- The Goodyear Tire & Rubber Company

- Yokohama India Pvt Ltd

Recent Developments:

- In December 2025, India's top tyre producer, JK Tyre & Industries Ltd., revealed the introduction of four new Off-the-Road (OTR) tyres during the 13th edition of South Asia’s largest construction equipment trade fair, CII EXCON 2025, taking place at the Bangalore International Exhibition Centre (BIEC), Bangalore. The products enhanced JK Tyre’s OTR range and strengthened the brand’s dedication to driving innovation in the construction and mining sectors.

India Tyre Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Two Wheelers, Three Wheelers, Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Off the Road |

| OEM and Replacement Segments Covered | OEM Tyres, Replacement Tyres |

| Domestic Productions and Imports Covered | Domestic Production, Imports |

| Radial and Bias Tyres Covered | Bias Tyres, Radial Tyres |

| Tube and Tubeless Tyres | Tube Tyres, Tubeless Tyres |

| Tyres Size Covered | Small, Medium, Large |

| Price Segments Covered | Low, Medium, High |

| Regions Covered | North India, East India, West and Central India, South India |

| Companies Covered | Apollo Tyres Ltd, Bridgestone India Private Limited, CEAT Ltd, Continental Tyres, JK Tyre & Industries Ltd., MRF Tyres, The Goodyear Tire & Rubber Company, Yokohama India Pvt Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India tyre market size was valued at USD 14.45 Billion in 2025.

The India tyre market is expected to grow at a compound annual growth rate of 7.49% from 2026-2034 to reach USD 27.67 Billion by 2034.

Passenger cars dominated the market with a share of 32%, driven by rising car ownership among middle-income households, growing demand for premium vehicles, increasing urbanization, and expanding personal mobility requirements across urban and semi-urban areas.

Key factors driving the India tyre market include supportive government manufacturing incentives, expanding road infrastructure, rising vehicle production across all categories, increasing adoption of radial and tubeless technologies, and growing replacement tyre demand.

Major challenges include volatile raw material prices, particularly for natural rubber, competition from low-cost tyre imports, escalating R&D costs for EV and smart tyre technologies, and margin pressure from input cost inflation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)