India Ultra-Secure Smartphone Market Size, Share, Trends and Forecast by Operating System, End User, and Region, 2025-2033

India Ultra-Secure Smartphone Market Overview:

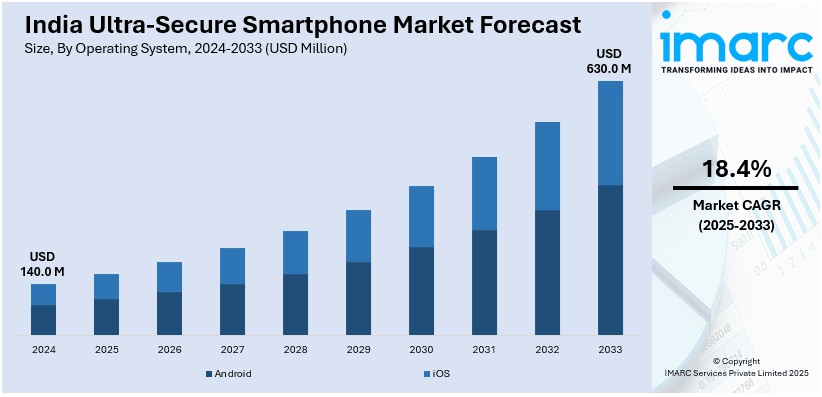

The India ultra-secure smartphone market size reached USD 140.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 630.0 Million by 2033, exhibiting a growth rate (CAGR) of 18.4% during 2025-2033. The market is witnessing significant growth, driven by an increasing demand for biometric security features and the widespread adoption of AI-driven threat detection systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 140.0 Million |

| Market Forecast in 2033 | USD 630.0 Million |

| Market Growth Rate 2025-2033 | 18.4% |

India Ultra-Secure Smartphone Market Trends:

Increasing Demand for Biometric Security Features

In India, the demand for ultra-secure smartphone has seen a notable rise, driven largely by the increasing importance of personal data protection and privacy. Consumers, particularly in sectors such as finance, healthcare, and government services, are gravitating towards devices that offer enhanced biometric security features. For instance, in January 2025, Infinix introduced the Smart 9 HD in India, accompanied by Android 14 Go Edition, dual-SIM support, a side-mounted fingerprint sensor, stereo speakers, IP54 rating, and a 3.5mm headphone jack. Advanced fingerprint scanners, facial recognition, and iris scan systems provide higher security than conventional passwords or PINs. The Indian market now shows a preference for devices that not only consider security but also comply with international standards concerning data encryption and privacy regulations. Security professionals whose job involves handling sensitive information, industries where mobile security is paramount, form an important component of this demand. The push by the government for a digital economy and the growing awareness of cyber threats has led the consumer and enterprise market to demand smartphones with strong biometric features. Smartphone manufacturers are, therefore, integrating advanced biometric technologies and secure hardware features to present these devices as a frontline against cybercrime. Indicative of the wider acceptance of security as a basic feature of mobile technology, this development shows how fast India is adapting to international security standards.

To get more information on this market, Request Sample

Adoption of AI-driven Threat Detection Systems

The growing concerns about cyber threats in India have led to the rapid adoption of artificial intelligence (AI)-driven threat detection systems in ultra-secure smartphones. As cyberattacks become more sophisticated, smartphone manufacturers are integrating AI technologies to proactively monitor and identify security breaches in real time. These AI-based systems can detect irregular patterns of behavior, malicious applications, or unauthorized access attempts, providing a level of security that surpasses traditional methods. For instance, in October 2024, Samsung announced the launch of the Enterprise Edition Galaxy S24 Ultra (12GB RAM, 256GB storage) and Galaxy S24 (8GB RAM, 256GB storage) in India, offering AI tools, security, and reliable patch management for corporate users. Indian consumers, particularly in urban areas, are becoming more aware of the threats posed by malware, phishing attacks, and data theft. As a result, smartphones equipped with AI-driven security systems that can continuously analyze potential vulnerabilities are gaining traction. This is especially significant in industries where intellectual property protection and data security are paramount, such as technology, finance, and e-commerce. In addition, the integration of AI allows for a more personalized security experience, where the system learns the user's behavior and adapts to detect anomalies that may signal potential threats. This trend is contributing to the evolution of smartphones in India, transforming them from merely communication devices into highly secure tools for managing sensitive data. The enhanced security features powered by AI are positioning the Indian market as one of the fastest-growing segments for ultra-secure smartphone globally.

India Ultra-Secure Smartphone Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on operating system and end user.

Operating System Insights:

- Android

- iOS

The report has provided a detailed breakup and analysis of the market based on the operating system. This includes android and iOS.

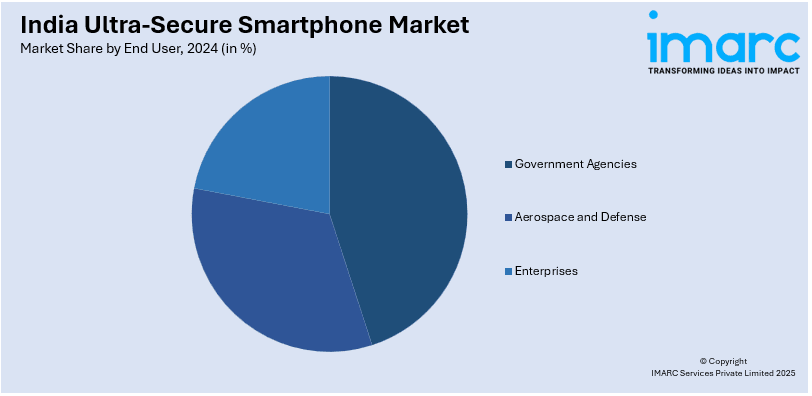

End User Insights:

- Government Agencies

- Aerospace and Defense

- Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes Government Agencies, Aerospace and Defense, and Enterprises.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ultra-Secure Smartphone Market News:

- In January 2025, The Indian Army declared the utilization of SAMBHAV (Secure Army Mobile Bharat Version) smartphones for secure communication at the China border. With apps like M-Sigma for messaging, document sharing, and media exchange, these devices, compatible with Airtel and Jio, aim to prevent information leaks that occurred with previous apps like WhatsApp.

India Ultra-Secure Smartphone Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Operating Systems Covered | Android, iOS |

| End Users Covered | Government Agencies, Aerospace and Defense, Enterprises |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ultra-secure smartphone market performed so far and how will it perform in the coming years?

- What is the breakup of the India ultra-secure smartphone market on the basis of operating system?

- What is the breakup of the India ultra-secure smartphone market on the basis of end user?

- What is the breakup of the India ultra-secure smartphone market on the basis of region?

- What are the various stages in the value chain of the India ultra-secure smartphone market?

- What are the key driving factors and challenges in the India ultra-secure smartphone?

- What is the structure of the India ultra-secure smartphone market and who are the key players?

- What is the degree of competition in the India ultra-secure smartphone market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ultra-secure smartphone market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ultra-secure smartphone market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ultra-secure smartphone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)