India Ultrafiltration Market Size, Share, Trends and Forecast by Type, Module, Application, and Region, 2025-2033

India Ultrafiltration Market Overview:

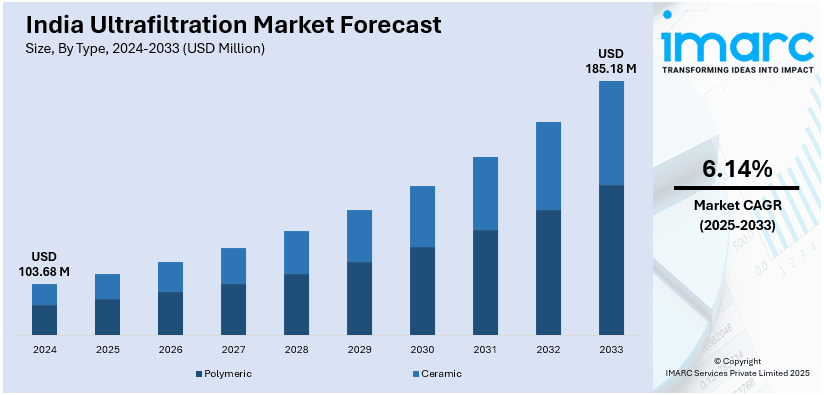

The India ultrafiltration market size reached USD 103.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 185.18 Million by 2033, exhibiting a growth rate (CAGR) of 6.14% during 2025-2033. Rising water pollution, rapid urbanization, escalating demand for safe drinking water, stringent government regulations on wastewater treatment, and the expanding industrial and food processing sectors are key factors driving the India ultrafiltration market, which is also supported by technological advancements and the surge in the adoption of membrane-based filtration systems across both urban and rural regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 103.68 Million |

| Market Forecast in 2033 | USD 185.18 Million |

| Market Growth Rate 2025-2033 | 6.14% |

India Ultrafiltration Market Trends:

Increasing Water Pollution and Scarcity

One of the key drivers for the India ultrafiltration market is the increasing rate of water pollution combined with extreme water scarcity. India is witnessing an acute crisis of water, with almost 35 million Indians lacking accessibility to safe drinkable water. Rapid urbanization, industrial effluents, and indiscriminate sewage disposal are significant contributors to water quality deterioration. Major rivers such as the Ganga, Yamuna, and Godavari are seriously polluted with biological wastes, chemicals, and heavy metals, rendering water unsuitable for direct usage or industrial purposes. Ultrafiltration technology, employing semi-permeable membranes to filter out suspended solids, bacteria, viruses, and macromolecules, presents a viable option in treating contaminated surface and groundwater. Unlike traditional filtration technologies, UF presents a chemical-free, energy-saving, and space-saving technology that is especially suited for rural and decentralized environments where water treatment infrastructure is not well established.

To get more information on this market, Request Sample

Expanding Food & Beverage Processing Sector

The expanding food and beverage (F&B) processing sector is another key driver. The India food processing market is expected to reach INR 65,244.8 Billion by 2033, exhibiting a growth rate (CAGR) of 8.38% during 2025-2033. India is a major food producer and consumer, and its processed food market is going through a consistent upwards trend because of growing urban incomes, shifting eating patterns, and growth in organized retail. Ultrafiltration is an important factor in maintaining product consistency, enhancing shelf life, and achieving high hygiene standards in this sector. In dairy processing, for example, UF membranes are utilized in large volumes for lactose removal, protein standardization, and whey protein concentration, which allows manufacturers to produce value-added products such as Greek yogurt, protein-enriched milk, and infant formula. In the same manner, in juice clarification and beverage preparation, UF removes pulp, bacteria, and spoilage organisms without the necessity for heat or preservatives, and hence the final product's nutritional and sensory character is preserved.

India Ultrafiltration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, module, and application.

Type Insights:

- Polymeric

- Ceramic

The report has provided a detailed breakup and analysis of the market based on the type. This includes polymeric and ceramic.

Module Insights:

- Hollow Fiber

- Plate and Frame

- Tubular

A detailed breakup and analysis of the market based on the module have also been provided in the report. This includes hollow fiber, plate and frame, and tubular.

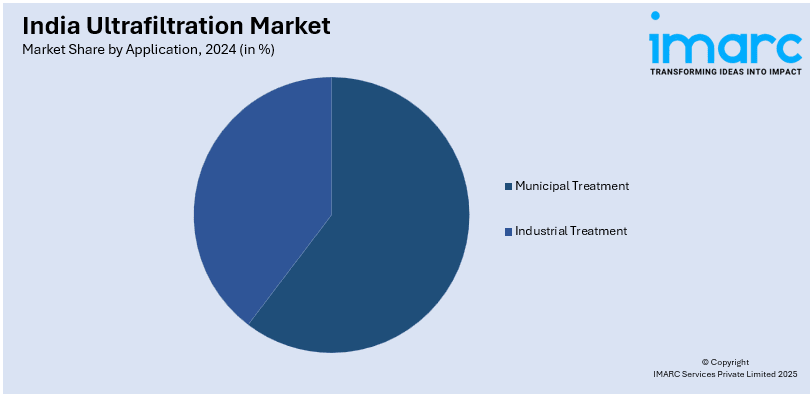

Application Insights:

- Municipal Treatment

- Industrial Treatment

- Food and Beverage

- Pharmaceutical Processing

- Chemical and Petrochemical Processing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes municipal treatment and industrial treatment (food and beverage, pharmaceutical processing, chemical and petrochemical processing, and others).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ultrafiltration Market News:

- March 2025: Memsift Innovations and Murugappa Group launched the GOSEP™ ultrafiltration membrane and opened a manufacturing facility with a capacity of 1.2 million square meters annually. This initiative enhances India's production capabilities in advanced membrane technologies, catering to industries like microelectronics, textiles, chemicals, and pharmaceuticals.

- October 2024: Kent RO Systems Ltd. has partnered with BLACK+DECKER to introduce advanced water purifiers in India, notably the BLACK+DECKER Crest RO Purifier. This purifier employs a seven-stage purification system, incorporating ultrafiltration (UF) technology to effectively remove fine particles, bacteria, and viruses, thereby enhancing water quality.

India Ultrafiltration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polymeric, Ceramic |

| Modules Covered | Hollow Fiber, Plate and Frame, Tubular |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India ultrafiltration market performed so far and how will it perform in the coming years?

- What is the breakup of the India ultrafiltration market on the basis of type?

- What is the breakup of the India ultrafiltration market on the basis of module?

- What is the breakup of the India ultrafiltration market on the basis of application?

- What are the various stages in the value chain of the India ultrafiltration market?

- What are the key driving factors and challenges in the India ultrafiltration?

- What is the structure of the India ultrafiltration market and who are the key players?

- What is the degree of competition in the India ultrafiltration market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ultrafiltration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ultrafiltration market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ultrafiltration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)