India Ultrasonic Skincare Devices Market Size, Share, Trends and Forecast by Product, End Use, and Region, 2026-2034

India Ultrasonic Skincare Devices Market Summary:

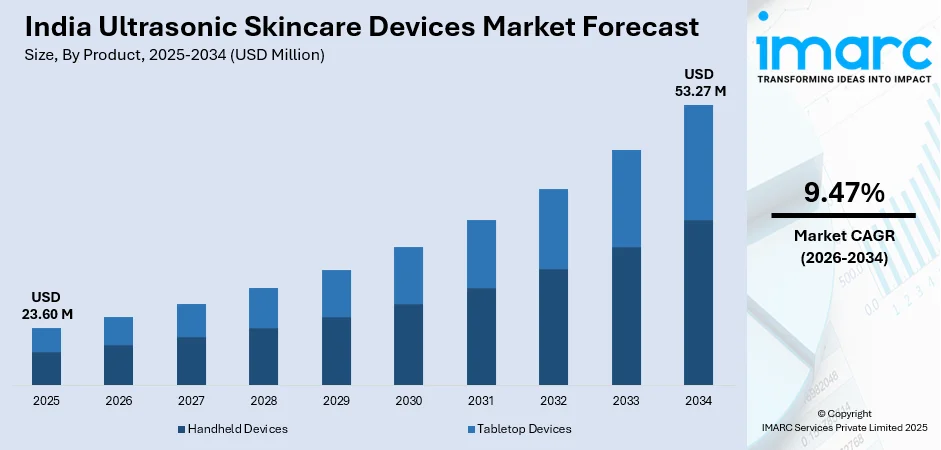

The India ultrasonic skincare devices market size was valued at USD 23.60 Million in 2025 and is projected to reach USD 53.27 Million by 2034, growing at a compound annual growth rate of 9.47% from 2026-2034.

The India ultrasonic skincare devices market is experiencing robust growth, driven by increasing consumer awareness about advanced skincare solutions and the rising preferences for non-invasive beauty treatments. The expanding middle-class population with higher disposable incomes is fueling the demand for professional-grade at-home skincare tools. Furthermore, the growing influence of social media beauty trends and recommendations from dermatologists are accelerating adoption. The proliferation of e-commerce platforms has enhanced product accessibility, enabling consumers to explore a wide range of ultrasonic devices.

Key Takeaways and Insights:

-

By Product: Handheld devices dominate the market with a share of 81% in 2025, owing to their portability, affordability, and ease of use for daily skincare routines. The rise in do-it-yourself (DIY) beauty treatments and the convenience of at-home usage have cemented their popularity among Indian consumers seeking professional-grade results.

-

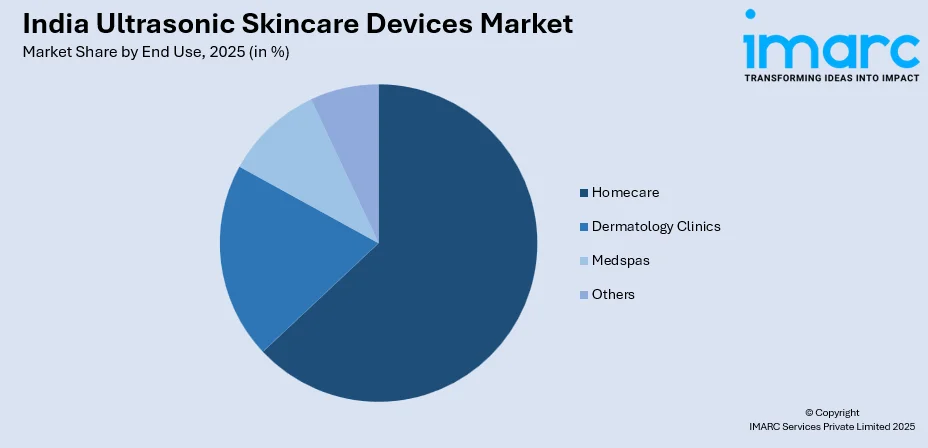

By End Use: Homecare leads the market with a share of 63% in 2025. This dominance is driven by the growing preferences for convenient, cost-effective skincare solutions that deliver spa-like results at home. The expansion of e-commerce platforms and increasing product awareness through digital marketing have significantly boosted homecare adoption.

-

By Region: North India represents the largest region with 30% share in 2025, driven by the concentration of urban population in Delhi-NCR, high purchasing power, and strong presence of specialty retailers and dermatology clinics. The region's beauty-conscious consumers actively follow skincare trends, reinforcing market expansion.

-

Key Players: Key players drive the India ultrasonic skincare devices market by introducing innovative products, expanding distribution networks, and partnering with e-commerce platforms. Their investments in marketing campaigns, influencer collaborations, and dermatologist endorsements boost consumer awareness and accelerate adoption across diverse consumer segments.

To get more information on this market Request Sample

The India ultrasonic skincare devices market is witnessing transformative growth, as consumers increasingly seek advanced, non-invasive skincare solutions. Ultrasonic technology utilizes high-frequency sound waves to deeply cleanse the skin, enhance product absorption, and stimulate collagen production, making it highly appealing for addressing concerns, such as acne, pigmentation, and aging. The market is benefiting from the rising penetration of e-commerce platforms, with beauty e-commerce and quick commerce sales in India recording 39% growth from June to November 2024, compared to 2023, demonstrating the expanding digital accessibility of skincare devices. The growing number of dermatology clinics reflects the increasing emphasis on professional skincare services that complement at-home device usage. Furthermore, the influence of K-beauty trends and social media skincare routines has heightened consumer interest in ultrasonic facial tools. The convergence of technological innovations, rising disposable incomes, and heightened beauty consciousness positions the market for sustained expansion throughout the forecast period.

India Ultrasonic Skincare Devices Market Trends:

Integration of Artificial Intelligence (AI) and Smart Technologies in Skincare Devices

The integration of AI and smart technologies represents a transformative trend in the India ultrasonic skincare devices market. Manufacturers are increasingly incorporating AI-powered skin analyzers, app connectivity, and real-time skin diagnostics into ultrasonic devices. In September 2024, Kaya Clinic launched India's first AI-powered dermatology app offering personalized skin diagnosis, reflecting the convergence of technology and skincare. These innovations enable users to customize treatments based on individual skin profiles, enhancing efficacy and user engagement through data-driven personalization.

Growing Preferences for Multi-functional Beauty Devices

Indian consumers are increasingly gravitating towards multi-functional ultrasonic devices that combine multiple technologies in a single unit. Devices integrating ultrasonic waves with light-emitting diode (LED) light therapy, microcurrent stimulation, and galvanic ion therapies are gaining significant traction. This trend aligns with the consumer desire for convenience and value, enabling users to address multiple skincare concerns, including cleansing, anti-aging, and skin tightening, with one device. The demand for compact, rechargeable devices with dual or triple-mode functionalities reflects the evolving expectations of beauty-conscious consumers.

Rise of At-Home Professional Skincare Treatments

The trend of professional-grade skincare treatments at home continues to accelerate in India. Consumers are seeking devices that deliver salon-quality results without clinic visits, driven by convenience, privacy, and cost considerations. The proliferation of handheld ultrasonic devices offering deep pore cleansing, exfoliation, and serum infusion capabilities has democratized access to advanced skincare. The broadening of e-commerce platforms has expanded the availability and accessibility of these devices. As per IMARC Group, the India e-commerce market is set to attain USD 651.10 Billion by 2034, growing at a compound annual growth rate of 19.63% from 2026-2034.

Market Outlook 2026-2034:

The India ultrasonic skincare devices market demonstrates promising growth prospects, driven by technological advancements, expanding e-commerce penetration, and rising consumer awareness about non-invasive skincare solutions. The convergence of beauty technology with personalized skincare is expected to redefine consumer expectations, with AI-integrated devices enabling customized treatment protocols. The market generated a revenue of USD 23.60 Million in 2025 and is projected to reach a revenue of USD 53.27 Million by 2034, growing at a compound annual growth rate of 9.47% from 2026-2034. The expanding network of dermatology clinics and medspas, coupled with increasing disposable incomes among India's urban and semi-urban population, will continue to fuel adoption. The growing influence of K-beauty trends and social media skincare routines will further boost demand for ultrasonic devices offering enhanced product absorption and skin rejuvenation capabilities.

India Ultrasonic Skincare Devices Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Handheld Devices | 81% |

| End Use | Homecare | 63% |

| Region | North India | 30% |

Product Insights:

- Handheld Devices

- Tabletop Devices

Handheld devices dominate with a market share of 81% of the total India ultrasonic skincare devices market in 2025.

Handheld ultrasonic skincare devices have emerged as the preferred choice among Indian consumers, due to their portability, user-friendly design, and affordability. These compact devices enable consumers to perform deep cleansing, exfoliation, and product infusion treatments conveniently at home, aligning with the growing DIY beauty culture. The rise in self-care awareness and the influence of social media platforms have cemented the popularity of handheld ultrasonic tools. As per DataReportal, in January 2024, India had 462.0 Million social media users, representing 32.2% of its overall population.

The segment's dominance is further reinforced by the wide availability of handheld devices across e-commerce platforms and retail stores, making them accessible to consumers across metropolitan and tier-2 cities. These devices typically feature rechargeable batteries, ergonomic designs, and multi-functional capabilities, including LED therapy and galvanic ion modes. The integration of smart sensors and app connectivity in newer models is attracting tech-savvy consumers seeking personalized skincare experiences. Manufacturers continue to introduce compact, affordable variants to capture price-sensitive consumers while premium offerings target the aspirational segment.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Dermatology Clinics

- Medspas

- Homecare

- Others

Homecare leads with a share of 63% of the total India ultrasonic skincare devices market in 2025.

The homecare segment dominates the market, driven by the increasing consumer preferences for convenient, cost-effective skincare solutions that deliver professional-quality results at home. The expansion of e-commerce platforms has significantly enhanced product accessibility, enabling consumers across urban and semi-urban regions to explore diverse ultrasonic device options. The growing influence of beauty influencers and social media tutorials has educated consumers about at-home skincare routines, accelerating homecare adoption.

The homecare segment's growth is further supported by the increasing working population seeking time-efficient skincare solutions and the rising preference for privacy in personal grooming. As per the Economic Survey 2024, India's working force was around 56.5 crore, with over 45% engaged in agriculture, 11.4% in manufacturing, and 28.9% in services. Consumers are investing in devices that offer deep pore cleansing, enhanced product absorption, and anti-aging benefits without requiring salon visits. The availability of affordable handheld devices with multiple functionalities has democratized access to advanced skincare treatments.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 30% share of the total India ultrasonic skincare devices market in 2025.

North India leads the ultrasonic skincare devices market, propelled by high urbanization rates, strong purchasing power, and heightened beauty consciousness in Delhi-NCR, Chandigarh, Jaipur, and Lucknow. The region benefits from a well-established retail infrastructure with specialty beauty retailers, dermatology clinics, and the presence of international brand outlets. Consumers in North India actively follow dermatologist-recommended skincare trends and K-beauty routines, reinforcing demand for advanced ultrasonic devices. In November 2024, KorinMi, a Korean skincare clinic brand, launched its first Indian outlet in Delhi, reflecting the region's receptiveness to innovative skincare solutions.

The concentration of affluent, beauty-conscious consumers in metropolitan areas drives premium device adoption, while the expanding middle class in tier-2 cities contributes to volume growth. North India's strong influencer culture and social media engagement further amplify product awareness and consumer interest in ultrasonic skincare technology. The region's established healthcare infrastructure, with numerous dermatology clinics and aesthetic centers, creates opportunities for professional device adoption. The opening of flagship stores by international beauty brands in Delhi-NCR underscores the region's position as India's premium beauty market hub.

Market Dynamics:

Growth Drivers:

Why is the India Ultrasonic Skincare Devices Market Growing?

Rising Consumer Awareness and Demand for Non-Invasive Skincare Solutions

The rising awareness about the benefits of skincare and the need for non-surgical beauty treatments are major factors propelling the ultrasonic skincare devices market in India. As a result of the recommendations from dermatologists, bloggers, and the influence of the online community, consumers are becoming more aware about the importance of skincare. The use of ultrasonic devices has increased due to the need for therapies that provide noticeable effects without requiring surgery or long recovery times. They deliver professional results at home through the usage of sound waves at a high frequency. The large youth population of the country considers shiny and youthful-looking skin as a status symbol, resulting in the increased demand for efficient products. Ultrasonic devices are becoming indispensable components of contemporary skincare regimens in urban and semi-urban India due to the convergence of technology innovations and rising beauty consciousness.

Expansion of E-Commerce and Digital Retail Channels

The rapid expansion of e-commerce platforms has significantly transformed the distribution landscape for ultrasonic skincare devices in India. In FY25, the India e-commerce industry reached a GMV of around INR 1.19 Lakh Crore (USD 14 Billion), indicating a 12% year-over-year increase. E-commerce platforms have democratized the market for high-end beauty technology, allowing customers in tier-2 and tier-3 cities to purchase products that only the urban population had access to. The e-commerce platforms provide customers with a wide range of products, competitive pricing, customer reviews, and easy delivery options, thereby overcoming the hurdles hindering purchase decisions. The implementation of digital marketing approaches and customer influencer programs has raised the awareness level of the product. The e-commerce platforms have ensured comprehensive product details, video demonstrations, and recommendations through AI, thereby enabling knowledgeable purchase decisions for the customers. The increased penetration of smartphones and digital payment options in the Indian market has further aided the easy purchase of ultrasonic skincare devices online.

Growing Network of Dermatology Clinics and Aesthetic Centers

The expanding network of dermatology clinics and aesthetic centers across India is creating substantial opportunities for professional-grade ultrasonic device adoption. As of January 2025, Sakhiya Skin Clinic ran 35 clinics throughout India. The figure is anticipated to increase to 40 by the end of 2025. It seeks to establish 100 clinics nationwide by 2027, as part of its bold expansion plan to enhance its status as a frontrunner in skincare and haircare. These facilities employ sophisticated ultrasonic devices for procedures, such as deep purifying facials, skin renewal, and product infusion, establishing the efficacy of the devices for potential new users of the technology in the home environment. Dermatologists and aesthetic professionals play a critical role in educating people on the benefits of ultrasonic technology, thereby contributing to professional and personal device market sales. Moreover, the increased investments by clinic chains in advanced technology and the emergence of the medspa segment of the business continue to fuel future market growth.

Market Restraints:

What Challenges the India Ultrasonic Skincare Devices Market is Facing?

High Product Costs Limiting Mass Market Penetration

In India's cost-conscious market, the high price of ultrasonic skincare products is a major obstacle to their widespread acceptance. Complex parts, cutting-edge technology integration, and manufacturing costs related to high-frequency sound wave creation are the main causes of premium pricing. This cost restriction constrains the possibility for volume expansion in semi-urban and rural sectors by limiting market penetration to wealthy urban consumers.

Limited Consumer Awareness in Non-Metropolitan Areas

Outside of large cities, consumer knowledge about ultrasonic skincare technology is still low, which is impeding market growth. Smaller cities and rural communities have not yet received consumer education due to the technical nature of ultrasonic technology and its skincare uses. The addressable market is constrained by this awareness deficit and the lack of demonstration possibilities in non-metropolitan locations.

Concerns Regarding Device Safety and Efficacy

Consumer concerns about device safety and efficacy pose challenges to market adoption. Some potential users express hesitancy regarding the use of high-frequency sound waves on skin, fearing potential side effects or skin barrier damage. The absence of stringent regulatory oversight for at-home beauty devices and the proliferation of low-quality products in the market amplify these concerns. Reports of skin sensitivity, microtears, or irritation from improper device usage further discourage potential adopters.

Competitive Landscape:

The India ultrasonic skincare devices market features a competitive landscape comprising international beauty technology brands, domestic players, and emerging startups. Global players leverage established brand equity, technological expertise, and extensive distribution networks to capture market share, while domestic manufacturers focus on affordability and localized product development. Competition intensifies through product innovations, multi-functional device offerings, and strategic partnerships with e-commerce platforms and dermatology clinics. Companies invest significantly in digital marketing, influencer collaborations, and dermatologist endorsements to build consumer trust and brand awareness. The market is witnessing continuous product launches, featuring AI integration, smart sensors, and app connectivity, to differentiate offerings. Strategic collaborations between beauty brands and technology firms drive innovations, while acquisitions enable portfolio expansion and market consolidation.

India Ultrasonic Skincare Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Handheld Devices, Tabletop Devices |

| End Uses Covered | Dermatology Clinics, Medspas, Homecare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India ultrasonic skincare devices market size was valued at USD 23.60 Million in 2025.

The India ultrasonic skincare devices market is expected to grow at a compound annual growth rate of 9.47% from 2026-2034 to reach USD 53.27 Million by 2034.

Handheld devices dominated the market with a share of 81%, owing to their portability, affordability, ease of use, and suitability for at-home professional-grade skincare treatments across diverse consumer demographics.

Key factors driving the India ultrasonic skincare devices market include rising consumer awareness about non-invasive skincare, e-commerce expansion, growing dermatology clinic networks, and increasing disposable incomes among beauty-conscious consumers.

Major challenges include high product costs limiting mass market penetration, limited consumer awareness in non-metropolitan areas, concerns regarding device safety and efficacy, and the presence of low-quality products affecting consumer trust.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)