India Ultrasound System Market Size, Share, Trends and Forecast by Technology, Display Type, Mobility, Equipment Type, Application, End User, and Region, 2025-2033

India Ultrasound System Market Overview:

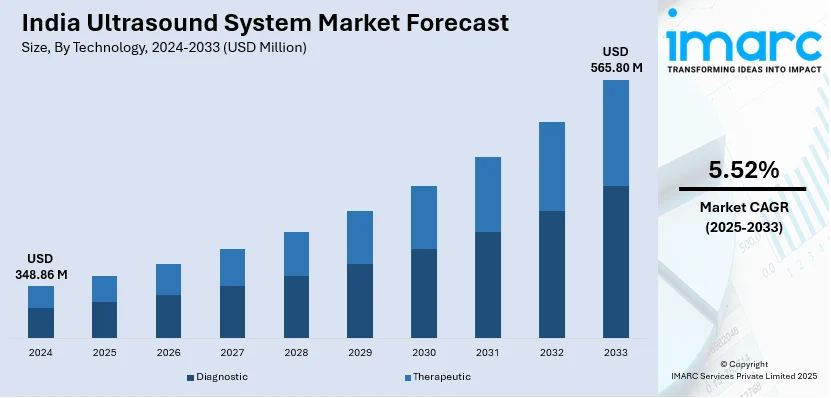

The India ultrasound system market size reached USD 348.86 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 565.80 Million by 2033, exhibiting a growth rate (CAGR) of 5.52% during 2025-2033. The rising healthcare infrastructure investments, increasing prevalence of chronic diseases, continuous advancements in imaging, growing demand for point-of-care (POC) diagnostics, and government initiatives promoting prenatal health are fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 348.86 Million |

| Market Forecast in 2033 | USD 565.80 Million |

| Market Growth Rate 2025-2033 | 5.52% |

India Ultrasound System Market Trends:

Rising Adoption of AI-Powered Ultrasound Imaging

Artificial intelligence (AI) is driving the ultrasound system market in India by boosting diagnostic accuracy, automating workflows, and increasing efficiency. AI-powered ultrasound imaging aids in the real-time interpretation of data, decreasing human error and enabling faster decision making. AI-powered technologies can help radiologists spot abnormalities in prenatal, cardiac, and abdominal images with up to 92% accuracy, boosting early detection rates. A 2024 report by Frost & Sullivan indicates that more than 60% of private healthcare facilities in tier-1 cities are planning to adopt AI-assisted imaging solutions by 2025, which is creating a positive outlook for market expansion. In addition to this, government initiatives such as the Digital India Health Mission are pushing for AI-driven medical solutions, fostering rapid adoption. Additionally, to meet India's rising demand, leading ultrasound producers like GE Healthcare and Philips are investing in AI-powered ultrasound technology, which is propelling the market forward.

To get more information on this market, Request Sample

Surge in Demand for Portable and Handheld Ultrasound Devices

Portable and handheld ultrasound equipment are becoming increasingly popular in India, especially in rural and semi-urban regions where access to cutting-edge medical imaging is scarce. These gadgets are small, reasonably priced, and perfect for point-of-care testing. According to a 2024 industry report, over 75% of newly established diagnostic centers in tier-2 and tier-3 cities are opting for portable ultrasound devices due to affordability and mobility. A survey conducted by the Indian Radiological and Imaging Association (IRIA) revealed that 68% of healthcare practitioners chose portable ultrasound equipment for emergency and bedside applications. Aside from that, government programs like the Ayushman Bharat Scheme seek to enhance rural healthcare access, which increases demand for these devices. Furthermore, firms such as Butterfly Network and Siemens Healthineers are launching innovative, AI-integrated portable ultrasound devices to meet India's diversified medical demands, ultimately contributing to market growth.

India Ultrasound System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on technology, display type, mobility, equipment type, application, and end user.

Technology Insights:

- Diagnostic

- Therapeutic

The report has provided a detailed breakup and analysis of the market based on the technology. This includes diagnostic and therapeutic.

Display Type Insights:

- Black and White

- Colored

A detailed breakup and analysis of the market based on the display type have also been provided in the report. This includes black and white and colored.

Mobility Insights:

- Fixed

- Mobile

The report has provided a detailed breakup and analysis of the market based on the mobility. This includes fixed and mobile.

Equipment Type Insights:

- Refurbished

- New

A detailed breakup and analysis of the market based on the equipment type have also been provided in the report. This includes refurbished and new.

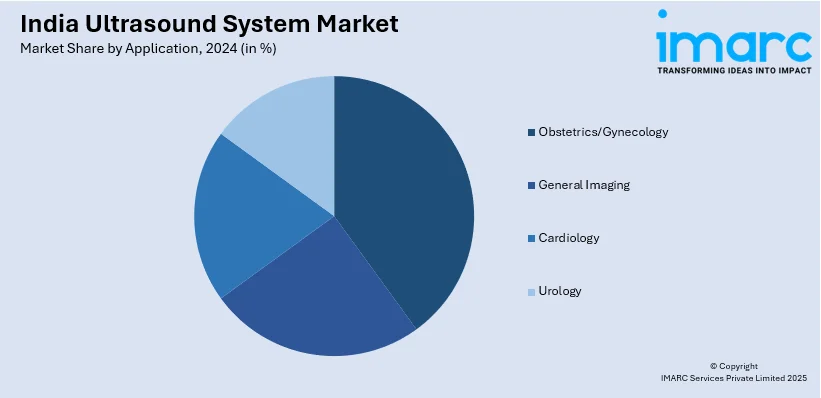

Application Insights:

- Obstetrics/Gynecology

- General Imaging

- Cardiology

- Urology

The report has provided a detailed breakup and analysis of the market based on the application. This includes obstetrics/gynecology, general imaging, cardiology, and urology.

End User Insights:

- Hospitals and Clinics

- Diagnostic Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, diagnostic centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ultrasound System Market News:

- December 2024: Esaote inaugurated a cutting-edge manufacturing facility in New Delhi, India, focused on producing MyLab A and MyLab E Series ultrasound systems, along with portable solutions tailored for the Indian market.

- September 2024: Researchers at the Indian Institute of Technology Madras (IIT Madras) created an AI-powered portable Point-of-Care Ultrasound (POCUS) scanner for diagnosing and managing sports injuries. Designed to be cost-effective and efficient, the device aims to provide real-time injury assessments.

- February 2024: FUJIFILM India launched an endoscopic ultrasound system, the ALOKA ARIETTA 850, with its first installation at Fortis Hospital in Bengaluru, Karnataka. This launch shows FUJIFILM’s dedication to bringing advanced medical imaging technology to India, improving diagnostic accuracy and patient care.

India Ultrasound System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Diagnostic, Therapeutic |

| Display Types Covered | Black and White, Colored |

| Mobilities Covered | Fixed, Mobile |

| Equipment Types Covered | Refurbished, New |

| Applications Covered | Obstetrics/Gynecology, General Imaging, Cardiology, Urology |

| End Users Covered | Hospitals and Clinics, Diagnostic Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ultrasound system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ultrasound system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ultrasound system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India ultrasound system market was valued at USD 348.86 Million in 2024.

The ultrasound system market in India is projected to exhibit a CAGR of 5.52% during 2025-2033, reaching a value of USD 565.80 Million by 2033.

The ultrasound system market in India is driven by investments in healthcare infrastructure, rising chronic and prenatal cases, and preventive care awareness. Technological advances AI-powered, portable, handheld, 3D/4D systems boost diagnostic accuracy. Government health schemes and increased healthcare spending further accelerate adoption, especially in rural and point-of-care settings.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)