India Unsaturated Polyester Resins Market Size, Share, Trends, and Forecast by Type, End-Use, Form, and Region, 2025-2033

India Unsaturated Polyester Resins Market Overview:

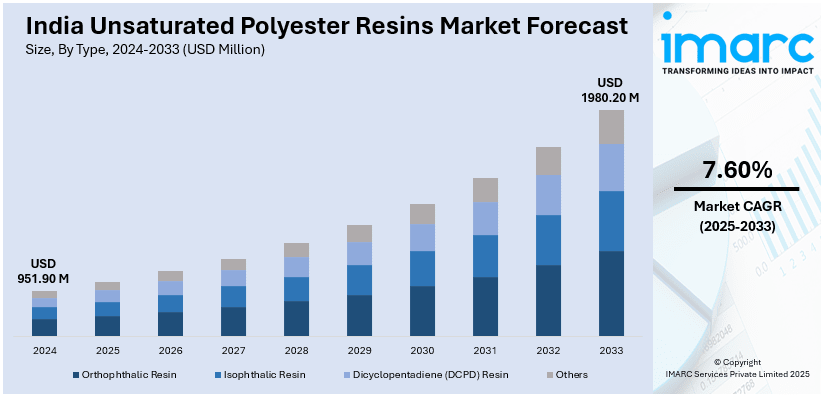

The India unsaturated polyester resins market size reached USD 951.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,980.20 Million by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025-2033. The market is expanding due to the rising demand in construction, automotive, and marine industries. Growth is further driven by increased infrastructure projects, lightweight composite materials, and advancements in resin formulations enhancing durability, corrosion resistance, and cost-effectiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 951.90 Million |

| Market Forecast in 2033 | USD 1,980.20 Million |

| Market Growth Rate 2025-2033 | 7.60% |

India Unsaturated Polyester Resins Market Trends:

Growing Demand for Unsaturated Polyester Resins in Infrastructure and Construction

The increasing use of unsaturated polyester resins (UPR) in India's construction sector is a key market trend, driven by rapid urbanization and infrastructure expansion. For instance, as per industry reports, India is witnessing accelerated urbanization, with projections indicating that the nation's cities and towns will be home to 490% of its total population, i.e., 600 Million individuals, by the year 2036. UPR-based composites are widely utilized in building materials such as fiber-reinforced plastic (FRP) panels, roofing sheets, and pipes due to their high strength, corrosion resistance, and lightweight properties. Government-led infrastructure projects, including Smart Cities Mission and large-scale transportation networks, are fueling demand for durable and cost-effective composite materials. Additionally, UPR’s superior weather resistance makes it ideal for outdoor applications, further supporting its adoption. The shift toward sustainable and energy-efficient construction materials has also boosted interest in UPR, as manufacturers develop formulations with reduced styrene emissions. The widespread adoption of prefabricated construction elements using UPR-based composites is enhancing construction efficiency while reducing maintenance costs. These factors position UPR as a preferred material in India’s evolving infrastructure landscape.

To get more information on this market, Request Sample

Expanding Applications in the Automotive and Transportation Industry

The automotive and transportation industry is increasingly incorporating unsaturated polyester resins to develop lightweight, high-performance components. The push for fuel efficiency and lower emissions is prompting automakers to replace conventional metal parts with composite materials that offer strength while reducing vehicle weight. UPR-based composites are widely used in automotive body panels, bumpers, and interior components due to their impact resistance and design flexibility. The expansion of India’s electric vehicle (EV) market is further driving the product demand, as lightweight composites enhance battery efficiency and overall vehicle performance. For instance, as per industry reports, India is set to emerge as the largest EV market by the year 2030. In line with this, the market is anticipated to grow to USD 27.70 Billion by 2028. Additionally, railway and public transport projects are adopting UPR for interior fittings and exterior panels to improve durability and reduce operational costs. Innovations in resin formulations, including fire-resistant and low-VOC (volatile organic compound) variants, are further strengthening the adoption of UPR in transportation applications. The growing focus on sustainable and high-performance materials is expected to accelerate UPR usage in this sector.

India Unsaturated Polyester Resins Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, end-use, and form.

Type Insights:

- Orthophthalic Resin

- Isophthalic Resin

- Dicyclopentadiene (DCPD) Resin

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes orthophthalic resin, isophthalic resin, dicyclopentadiene (DCPD) resin, and others.

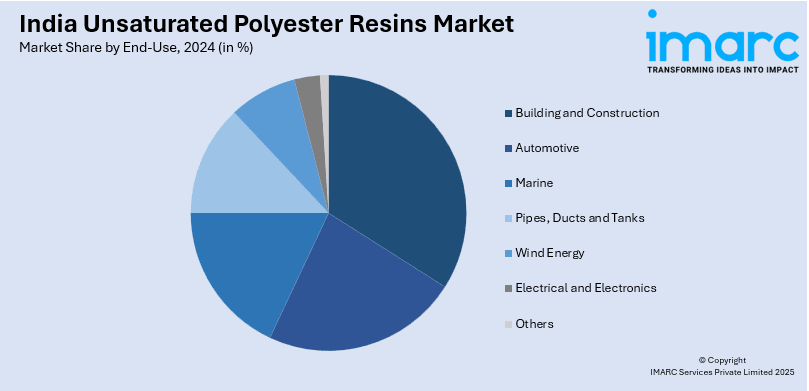

End-Use Insights:

- Building and Construction

- Automotive

- Marine

- Pipes, Ducts and Tanks

- Wind Energy

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes building and construction, automotive, marine, pipes, ducts and tanks, wind energy, electrical and electronics, and others.

Form Insights:

- Liquid Form

- Powder Form

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid form and powder form.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Unsaturated Polyester Resins Market News:

- In December 2024, INEOS Enterprises announced its agreement to sell INEOS Composites, a leading producer of unsaturated polyester resins with robust presence in India, to KPS Capital Partners for approximatelyUSD 1.791 Billion. The deal, subject to regulatory approvals, may impact market consolidation, investment, and supply dynamics in the global unsaturated polyester resins industry, influencing key end-use sectors.

India Unsaturated Polyester Resins Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Orthophthalic Resin, Isophthalic Resin, Dicyclopentadiene (DCPD) Resin, Others |

| End-Uses Covered | Building and Construction, Automotive, Marine, Pipes, Ducts and Tanks, Wind Energy, Electrical and Electronics, Others |

| Forms Covered | Liquid Form, Powder Form |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India unsaturated polyester resins market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India unsaturated polyester resins market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India unsaturated polyester resins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The unsaturated polyester resins market in India was valued at USD 951.90 Million in 2024.

The India unsaturated polyester resins market is projected to exhibit a (CAGR) of 7.60% during 2025-2033, reaching a value of USD 1,980.20 Million by 2033.

India unsaturated polyester resins market is driven by the increasing demand from the end-use sectors such as construction, automotive, and electrical. Growing infrastructure development, choice for light-weight and corrosion-resistant products, and increasing composite applications drive market growth. Increased investments in manufacturing and the use of advanced resin formulations drive the growth of the industry further.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)