India Upholstered Furniture Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2025-2033

India Upholstered Furniture Market Overview:

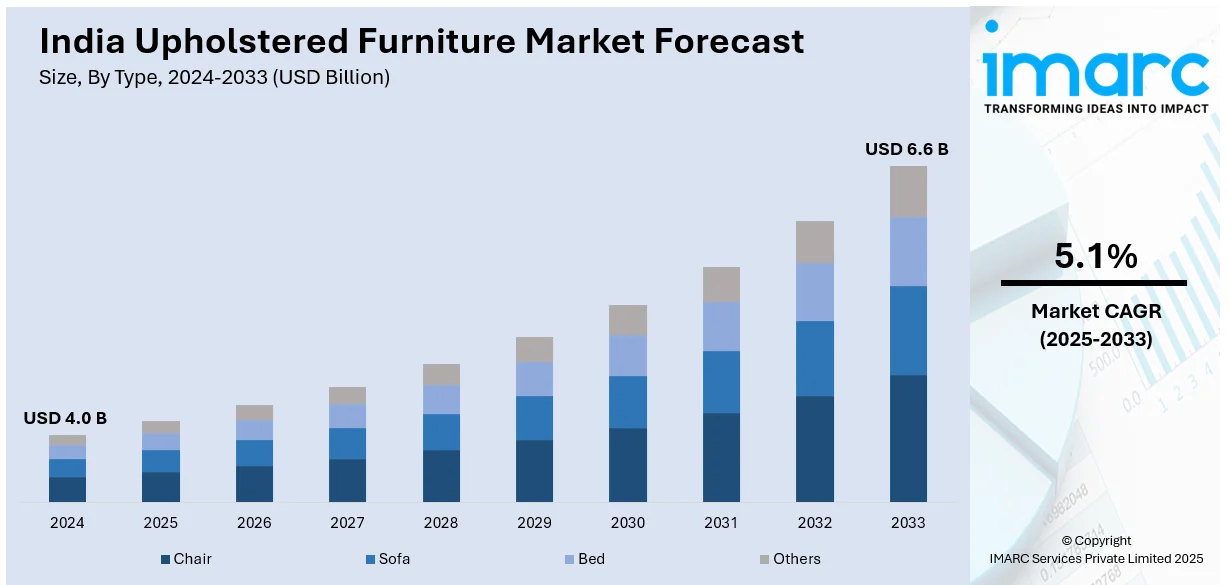

The India upholstered furniture market size reached USD 4.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.1% during 2025-2033. The rising urbanization, increasing disposable incomes, changing consumer lifestyles, growing real estate and hospitality sectors, and demand for stylish, comfortable home décor are some of the factors propelling the growth of the market. E-commerce expansion and exposure to global interior design trends also significantly contribute to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.0 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Market Growth Rate 2025-2033 | 5.1% |

India Upholstered Furniture Market Trends:

Luxury Expansion in Upholstered Furniture Segment

The upholstered furniture market in India is experiencing a shift toward premium offerings, driven by rising disposable incomes, urban lifestyle upgrades, and growing interest in heritage-inspired interior design. Consumers in metropolitan areas are increasingly seeking high-quality, aesthetically distinctive pieces that combine comfort with a refined visual appeal. This demand is opening space for luxury brands to establish a presence, especially those offering exclusive designs and superior craftsmanship. The market is also benefiting from expanding residential development, rising awareness of global design trends, and a preference for cohesive home décor solutions. With an evolving customer base that values both function and form, upholstered furniture is becoming a statement of personal style and status, encouraging more international and upscale players to explore India’s expanding interior décor segment. For example, in August 2024, the UK-based Laura Ashley announced its plans to enter the Indian market, offering premium upholstered furniture and home décor products. The brand’s entry targets urban consumers seeking luxury and heritage-inspired designs.

To get more information on this market, Request Sample

Rising Demand for Fire-Safe Commercial Furnishings

A growing emphasis on fire safety in public interiors is shaping the future of commercial furniture design. New regulations require the use of fire-resistant upholstery in non-domestic settings such as hotels, offices, and entertainment venues. This move is driving manufacturers to shift toward safer, certified materials, elevating the importance of compliance and quality in product development. While this may lead to higher production costs, it also encourages innovation and improved safety standards across the sector. Businesses furnishing public spaces are now prioritizing fire-resistant features, marking a shift toward more responsible and resilient design choices. The focus on safety is becoming a key factor in material selection and procurement across commercial environments. For instance, in September 2024, the Indian government mandated the use of fire-resistant upholstery fabrics in non-domestic upholstered furniture. This regulation aims to enhance fire safety in public spaces like hotels, offices, and cinemas. The rule is expected to impact India’s upholstered furniture market by pushing manufacturers to adopt safer, compliant materials, potentially increasing costs but improving overall safety standards in the commercial furniture segment.

India Upholstered Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, and distribution channel.

Type Insights:

- Chair

- Sofa

- Bed

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes chair, sofa, bed, and others.

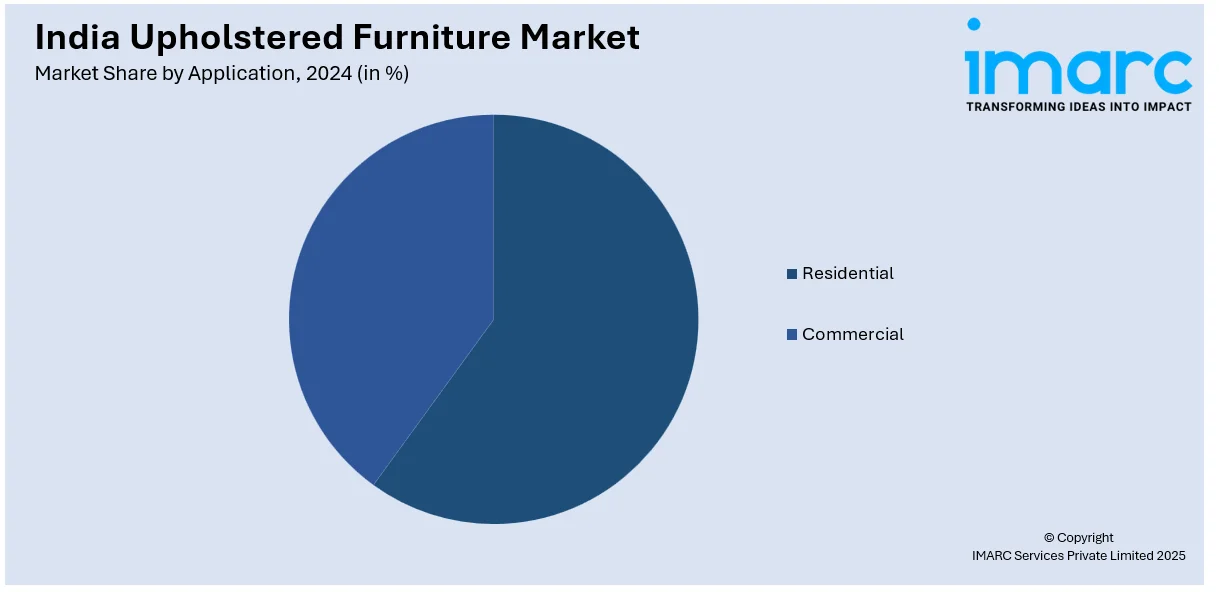

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- E-commerce

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, e-commerce, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Upholstered Furniture Market News:

- In January 2025, Godrej Interio introduced its UPMODS furniture range, emphasizing customization for modern Indian homes. The collection allows modular personalization of upholstered furniture, catering to evolving lifestyle needs and aesthetic preferences. By offering flexible designs and comfort-focused solutions, the brand is addressing rising consumer demand for personalized, space-efficient furniture.

- In October 2024, Nilkamal expanded its retail footprint by launching 60 Nilkamal Homes stores across India, aiming to capture the rising demand for quality upholstered furniture. The new stores focus on curated home solutions, targeting urban and semi-urban consumers. This strategic move is set to boost branded furniture adoption and strengthen Nilkamal’s position in the growing market through enhanced accessibility and an organized retail presence.

India Upholstered Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chair, Sofa, Bed, and Others |

| Applications Covered | Residential and Commercial |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, E-commerce, and Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India upholstered furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India upholstered furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India upholstered furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The upholstered furniture market in India was valued at USD 4.0 Billion in 2024.

The India upholstered furniture market is projected to exhibit a CAGR of 5.1% during 2025-2033, reaching a value of USD 6.6 Billion by 2033.

The India upholstered furniture market is driven by rising urbanization, increasing disposable incomes, growing preference for stylish and comfortable home interiors, expanding e-commerce penetration, and rising awareness of ergonomics. Additionally, demand from residential and hospitality sectors, coupled with customizable and sustainable furniture trends, fuels market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)