India Upholstery Market Size, Share, Trends and Forecast by Material Type, Application, Distribution Channel, and Region, 2025-2033

India Upholstery Market Overview:

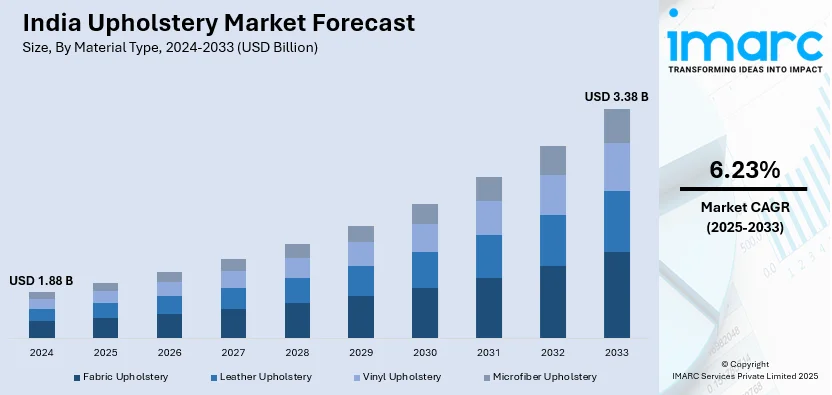

The India upholstery market size reached USD 1.88 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.38 Billion by 2033, exhibiting a growth rate (CAGR) of 6.23% during 2025-2033. Rising urbanization, increasing disposable incomes, and growing preferences for aesthetically appealing interiors are some of the factors propelling the growth of the market. Expanding real estate, evolving consumer lifestyles, and the influence of social media trends further boost demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.88 Billion |

| Market Forecast in 2033 | USD 3.38 Billion |

| Market Growth Rate (2025-2033) | 6.23% |

India Upholstery Market Trends:

Culturally Inspired Luxury in Home Upholstery

Culturally infused home décor is becoming increasingly popular, with designs reflecting regional heritage and traditional artistry. Upholstery with elaborate designs, rich color palettes, and expensive materials is increasingly fashionable. Floral designs, vivid prints, and locally-inspired workmanship appeal to buyers who want to personalize their rooms. This need for high-end, culturally reflecting objects is influencing the luxury home furnishings sector, where authenticity and artistic expression are critical drivers. Furthermore, customers are increasingly drawn to designs that honor legacy while keeping a modern look, resulting in a distinct combination of tradition and current style. This approach reflects a rising interest in handcrafted skills and indigenous motifs in interior design. For example, in November 2024, RR Décor unveiled the Fabric Fantasia collection, drawing inspiration from India's vibrant festivals. This luxurious upholstery line showcases intricate floral motifs and bold patterns, reflecting the country's rich cultural heritage. The collection's vibrant color palette and meticulous craftsmanship cater to the growing demand for premium, culturally infused home décor in India.

To get more information on this market, Request Sample

Growing Demand for Premium Aviation Upholstery

The aviation sector in India is witnessing increased demand for premium upholstery materials as airlines prioritize cabin refurbishment and passenger comfort. Enhanced seating, luxurious fabrics, and modern interior designs are becoming key focus areas. Airlines are investing in high-quality materials that offer durability, aesthetic appeal, and ergonomic comfort. This shift reflects a broader commitment to improving passenger experience and aligning with global standards in aircraft interiors. Upholstery manufacturers and suppliers are responding by offering customizable and innovative solutions, including sustainable and lightweight materials. As the aviation industry expands, partnerships with upholstery providers are expected to grow, further driving innovation and setting new benchmarks in cabin design and in-flight luxury. For instance, in September 2024, Air India initiated a USD 400 Million refurbishment program to upgrade 67 aircraft, including 27 Airbus A320neo and 40 Boeing wide-body planes. This initiative involves installing new seats and interiors, enhancing the demand for premium upholstery materials in India's aviation sector.

India Upholstery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material type, application, and distribution channel.

Material Type Insights:

- Fabric Upholstery

- Cotton

- Linen

- Velvet

- Polyester

- Leather Upholstery

- Genuine Leather

- Synthetic/PU Leather

- Vinyl Upholstery

- Microfiber Upholstery

The report has provided a detailed breakup and analysis of the market based on the material type. This includes fabric upholstery (cotton, linen, velvet, and polyester), leather upholstery (genuine leather and synthetic/PU leather), vinyl upholstery, and microfiber upholstery.

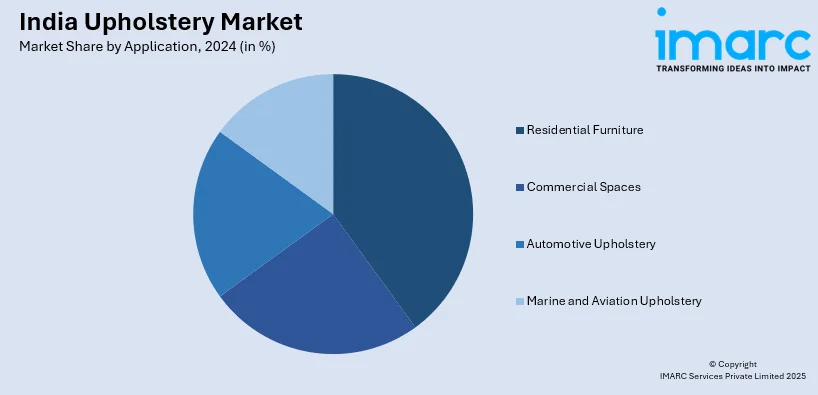

Application Insights:

- Residential Furniture

- Commercial Spaces

- Automotive Upholstery

- Marine and Aviation Upholstery

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential furniture, commercial spaces, automotive upholstery, and marine and aviation upholstery.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Upholstery Market News:

- In March 2025, Citroën announced the upcoming Basalt Dark Edition in India, featuring an all-black interior with dark upholstery. This reflects the growing demand for premium, stylish car interiors, driving the Indian upholstery market as consumers increasingly seek luxurious and personalized in-car experiences.

- In January 2025, the Japan-spec 5-door Suzuki Jimny Nomade, produced in India, introduced a dual-tone fabric seat upholstery in gray and black, differing from the all-black seats in the India-spec model. This variation reflects the growing trend in the Indian upholstery market toward diverse and personalized automotive interior options, highlighting the industry's adaptability to evolving consumer preferences.

India Upholstery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered |

|

| Applications Covered | Residential Furniture, Commercial Spaces, Automotive Upholstery, Marine and Aviation Upholstery |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India upholstery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India upholstery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India upholstery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The upholstery market in India was valued at USD 1.88 Billion in 2024.

The India upholstery market is projected to exhibit a CAGR of 6.23% during 2025-2033, reaching a value of USD 3.38 Billion by 2033.

The India upholstery market is driven by rising disposable incomes, a growing real estate sector, and rapid urbanization. The increasing consumer preference for comfortable, stylish, and customized home furnishings, coupled with the expansion of e-commerce platforms and growing awareness about interior design trends, further fuels its growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)