India UPS Market Size, Share, Trends and Forecast by Type, Capacity, Application, and Region, 2025-2033

India UPS Market Overview:

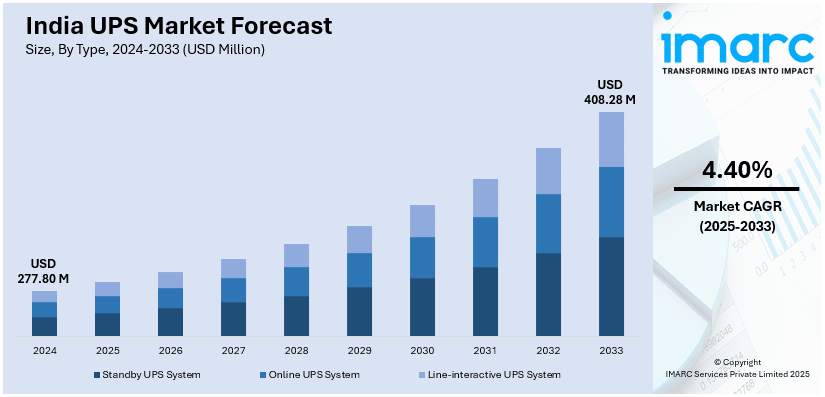

The India UPS market size reached USD 277.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 408.28 Million by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The market is driven by rising power outages in Tier II and Tier III cities, increased demand from IT and telecom sectors, expanding industrialization, and growing reliance on data centers and digital infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 277.80 Million |

| Market Forecast in 2033 | USD 408.28 Million |

| Market Growth Rate 2025-2033 | 4.40% |

India UPS Market Trends:

Surge in Demand from Data Centers and Cloud Infrastructure

The rapid expansion of India's data center ecosystem is significantly boosting the demand for UPS systems. For instance, as per industry reports, India's data centre operational capacity is projected to nearly double from approximately 1,150 MW in December 2024 to between 2,000 and 2,100 MW by March 2027. This expansion is expected to involve investments of ₹40,000-45,000 crore during FY2026-FY2027. With digital services rising sharply, data centers are increasing their capacities and requiring reliable power backup solutions to ensure continuous operation. Government initiatives like the Data Centre Policy and growing investments from global players are reinforcing this trend. UPS systems with high efficiency, modularity, and scalability are gaining preference, especially in metro and edge data centers. Moreover, the increasing adoption of cloud computing across sectors necessitates uninterrupted power for server uptime, further fueling market growth.

To get more information on this market, Request Sample

Increasing Adoption in Healthcare and Diagnostics

The healthcare sector in India is witnessing a significant increase in the adoption of UPS systems across hospitals, diagnostic laboratories, and medical research facilities. The rising need for uninterrupted power supply is being driven by the criticality of life-saving equipment such as MRI machines, ventilators, surgical tools, and automated diagnostic systems, which must operate continuously without risk of data loss or patient safety compromise. Any power fluctuation or outage could lead to service disruptions, operational delays, or even endanger lives. As healthcare infrastructure expands beyond metropolitan areas, demand for compact, energy-efficient, and easy-to-maintain UPS models tailored for small clinics and rural healthcare centers is growing. This trend is further supported by government programs aimed at strengthening medical services in underserved regions and ensuring healthcare system reliability. For instance, in March 2025, the Government of India unveiled a mobile, plug-and-play hydrogen fuel cell system to power telecom towers, aiming for uninterrupted service and reduced emissions. Developed by ARCI, the PEMFC technology offers a clean alternative to diesel generators, crucial for remote areas. This initiative aligns with India's renewable energy goals, promising reliable, eco-friendly telecom operations.

India UPS Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, capacity, and application.

Type Insights:

- Standby UPS System

- Online UPS System

- Line-interactive UPS System

The report has provided a detailed breakup and analysis of the market based on the type. This includes standby UPS system, online UPS system, and line-interactive UPS system.

Capacity Insights:

- Less than 10 kVA

- 10-100 kVA

- Above 100 kVA

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes less than 10 kVA, 10-100 kVA, and above 100 kVA.

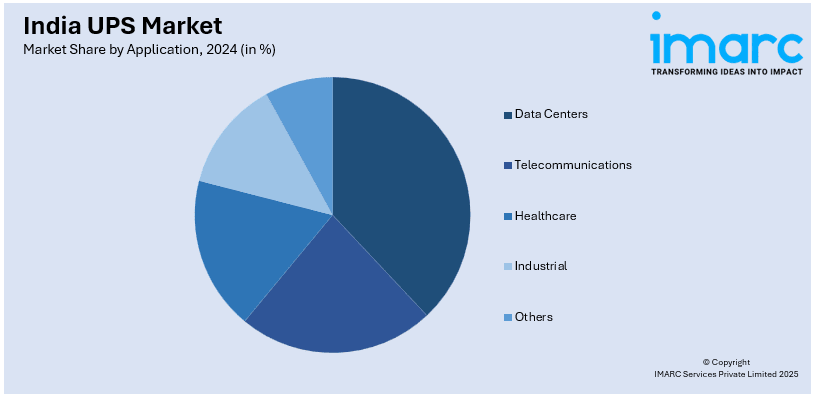

Application Insights:

- Data Centers

- Telecommunications

- Healthcare

- Hospitals

- Clinics

- Industrial

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes data centers, telecommunications, healthcare (hospitals and clinics), industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India UPS Market News:

- In January 2025, Microtek unveiled a new line of Solar Tall Tubular Batteries, targeting consumers seeking robust, uninterrupted power systems. These batteries are engineered for extended backup, ensuring critical appliances remain operational during power outages, effectively functioning as a solar-powered UPS solution. Highlighting fast recharge and minimal maintenance, Microtek emphasizes reliability and continuous power flow. By storing solar energy, these batteries offer energy independence, mitigating grid reliance, and providing a sustainable, consistent power source. This launch addresses the growing demand for reliable, uninterrupted power supply, especially in regions prone to power disruptions, offering a greener, cost-effective alternative.

- In October 2024, JSW MG Motor India, in collaboration with Vision Mechatronics, launched India’s first high-voltage second-life battery under ‘Project Revive’. Unveiled at The Battery Show 2024, the battery features an indigenous battery management system and will be deployed as an industrial UPS in Pune. The innovation supports circular economy goals by repurposing EV batteries for energy storage.

India UPS Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Standby UPS System, Online UPS System, Line-Interactive UPS System |

| Capacities Covered | Less than 10 kVA, 10-100 kVA, Above 100 kVA |

| Applications Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India UPS market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India UPS market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India UPS industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UPS market in India was valued at USD 277.80 Million in 2024.

The India UPS market is projected to exhibit a CAGR of 4.40% during 2025-2033, reaching a value of USD 408.28 Million by 2033.

Key factors driving the India UPS market include the increasing demand for reliable power backup solutions due to frequent power outages, growth in industrial innovations and IT infrastructure, rising adoption of renewable energy sources, and growing awareness about the importance of uninterrupted power supply in various sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)