India Urea Market Size, Share, Trends and Forecast by Grade, Application, End Use Industry, and Region, 2025-2033

India Urea Market:

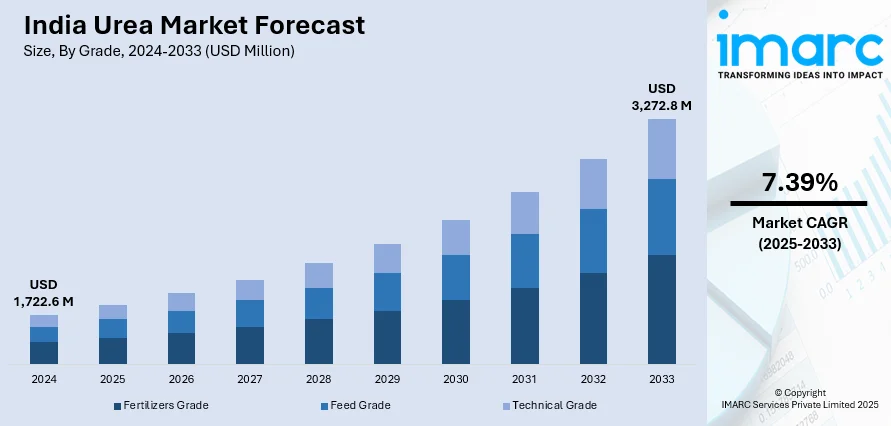

India urea market size reached USD 1,722.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,272.8 Million by 2033, exhibiting a growth rate (CAGR) of 7.39% during 2025-2033. The rising need for food production is escalating the adoption of fertilizers, which is driving the market across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,722.6 Million |

| Market Forecast in 2033 | USD 3,272.8 Million |

| Market Growth Rate (2025-2033) | 7.39% |

India Urea Market Analysis:

- Major Market Drivers: The growing demand for agricultural products and the expanding bioenergy sector are bolstering the market across the country.

- Key Market Trends: The increasing farmlands in India contribute to the steady rise in urea consumption as farmers seek cost-effective solutions for soil fertility management, thereby accelerating the market growth.

- Competitive Landscape: The report has provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

- Geographical Trends: North India's intensive agriculture drives urea demand, while West and Central India's diverse crops maintain steady use. In addition, South India's varied farming patterns boost consumption, and Northeast India experience growing demand due to rice cultivation and enhanced agricultural development initiatives.

- Challenges and Opportunities: The over-reliance on government subsidies is hindering the market. However, promoting balanced fertilizer use and encouraging alternative nutrients to improve soil health and sustainability will continue to bolster the market over the forecasted period.

To get more information of this market, Request Sample

India Urea Market Trends:

Introduction of Innovative and Sustainable Fertilizers

Adopting innovative and sustainable fertilizers improves nutrient efficiency and reduces environmental impact. These advancements support sustainable farming practices, enhance crop yields, and optimize fertilizer usage, thereby promoting long-term soil health and productivity. For example, in April 2024, IFFCO announced the start of Nano Urea Plus production, featuring 16% nitrogen content, to meet crop nitrogen needs. This innovation supports India's urea market by enhancing crop yield and promoting climate-smart farming.

Increasing Domestic Production Capacity and Infrastructure

Enhancing production capacity and developing infrastructure are crucial for reducing dependency on imports and meeting the rising India urea market demand. Expanding production facilities strengthens self-reliance, improves supply chain efficiency, and supports agricultural growth by ensuring a steady supply of urea. For instance, in March 2024, the Prime Minister of India dedicated the HURL Sindri Fertilizer Plant in Jharkhand, enhancing country's urea production by approximately 12.7 lakh metric tons annually. This development supports India's goal of becoming self-reliant in urea and boosts local employment and infrastructure.

Government Initiatives Supporting Fertilizer Diversification

Government policies encourage the diversification of fertilizer types, which helps to address specific nutrient deficiencies in the soil, reduce import reliance, and promote balanced fertilization. These initiatives foster innovation, improve agricultural productivity, and ensure the availability of various fertilizers tailored to different crop needs. For example, in January 2024, the Cabinet Committee on Economic Affairs in India approved the launch of urea gold, sulfur-coated urea, to be sold at the same price as neem-coated urea. This aims to improve soil health, reduce costs, and increase productivity for Indian farmers.

India Urea Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the India urea market forecast at the country and regional levels for 2025-2033. Our report has categorized the market based on the grade, application, and end use industry.

Breakup by Grade:

- Fertilizers Grade

- Feed Grade

- Technical Grade

The report has provided a detailed breakup and analysis of the market based on the grade. This includes fertilizers grade, feed grade, and technical grade.

Urea is available in fertilizer, feed, and technical grades. Fertilizer-grade urea is designed for agriculture to enhance crop yields. In contrast, feed-grade urea is used as a protein substitute in animal feed. Technical grade urea serves various industrial applications, including chemical production.

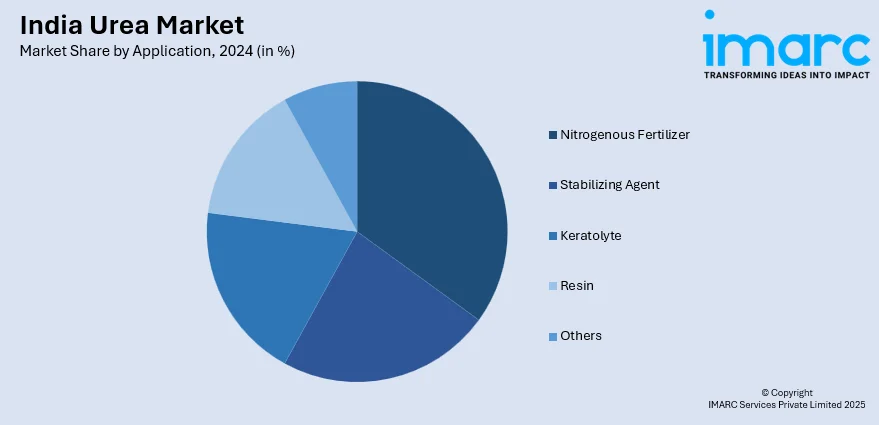

Breakup by Application:

- Nitrogenous Fertilizer

- Stabilizing Agent

- Keratolyte

- Resin

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes nitrogenous fertilizer, stabilizing agent, keratolyte, resin, and others.

Urea is a versatile nitrogenous fertilizer widely used in agriculture to boost plant growth. It also serves as a stabilizing agent in chemicals, a keratolytic in skincare, a resin in industrial applications, and has other specialized uses across industries. It plays a significant role in the India urea market share.

Breakup by End Use Industry:

- Agriculture

- Chemical

- Automotive

- Medical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes agriculture, chemical, automotive, medical, and others.

Urea is vital in agriculture as a fertilizer, enhancing crop growth. In the chemical industry, it serves as a feedstock for resins and plastics. The automotive sector uses it in emissions control, while the medical field utilizes it in diagnostics and treatments. According to the India urea market analysis report, this is augmenting the growth of this segment.

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

According to the India urea market outlook, product usage in the country varies due to diverse agricultural practices. North India sees high demand because of intensive wheat and rice cultivation. In contrast, West and Central India use urea for a variety of crops, while South India's diverse farming also drives moderate demand. Moreover, East and Northeast India are increasing urea use, mainly for rice cultivation, supported by government initiatives. Overall, each region's unique agro-climatic conditions and crop patterns shape urea consumption, thereby reflecting its critical role in India's agriculture.

Competitive Landscape:

The India urea market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Urea Market Recent Developments:

- April 2024: IFFCO announced the start of Nano Urea Plus production, featuring 16% nitrogen content, to meet crop nitrogen needs. This innovation supports India's urea market by enhancing crop yield and promoting climate-smart farming.

- March 2024: The Prime Minister of India dedicated the HURL Sindri Fertilizer Plant in Jharkhand, enhancing country's urea production by approximately 12.7 lakh metric tons annually.

- January 2024: The Cabinet Committee on Economic Affairs in India approved the launch of urea gold, sulfur-coated urea, to be sold at the same price as neem-coated urea.

India Urea Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Grades Covered | Fertilizers Grade, Feed Grade, Technical Grade |

| Applications Covered | Nitrogenous Fertilizer, Stabilizing Agent, Keratolyte, Resin, Others |

| End Use Industries Covered | Agriculture, Chemical, Automotive, Medical, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India urea market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India urea market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India urea industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India urea market was valued at USD 1,722.6 Million in 2024.

The India urea market is projected to exhibit a CAGR of 7.39% during 2025-2033, reaching a value of USD 3,272.8 Million by 2033.

The India urea market is driven by high demand for nitrogen-based fertilizers, government subsidies, and the need to enhance agricultural productivity. Population growth, limited arable land, and food security concerns also boost usage. Expansion of irrigation facilities and support for domestic production further propel market growth across rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)