India Urology Devices Market Size, Share, Trends and Forecast by Product Type, Application, End User, and Region, 2025-2033

India Urology Devices Market Overview:

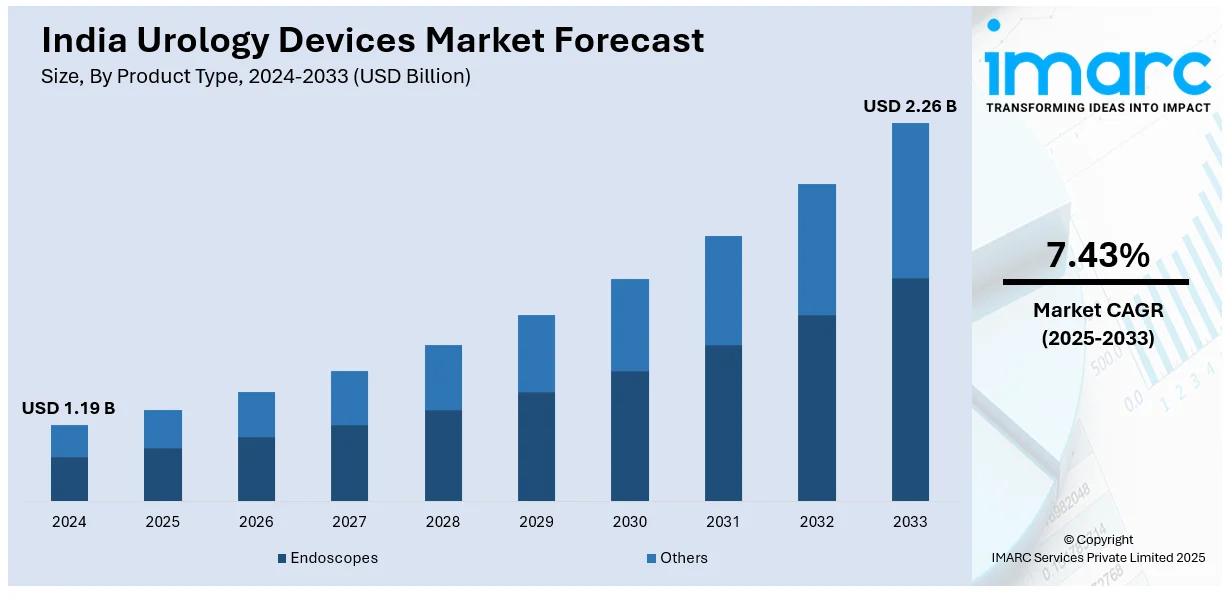

The India urology devices market size reached USD 1.19 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.26 Billion by 2033, exhibiting a growth rate (CAGR) of 7.43% during 2025-2033. The market is driven by the increase in prevalence of urological conditions, growing elderly population, and rising awareness regarding early detection and treatment. Development of innovative technology in minimally invasive interventions, robotic interventions, and artificial intelligence-based diagnostic systems are also boosting demand for advanced urology devices among healthcare professionals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.19 Billion |

| Market Forecast in 2033 | USD 2.26 Billion |

| Market Growth Rate 2025-2033 | 7.43% |

India Urology Devices Market Trends:

Growing Demand for Minimally Invasive Urology Devices

India urology devices market is seeing a strong movement toward minimally invasive treatments with the growing demand for treatments that help minimize patient recovery times, pushing technology up. Equipment like laser-based devices, robotic surgical equipment, and endoscopes are in increasing demand because they can carry out accurate, less invasive surgery. Minimally invasive procedures, including laparoscopic and endoscopic surgery, present many advantages such as decreased hospital stay, faster recovery, lessened complications, and smaller cuts. This is especially true in the management of diseases such as prostate hypertrophy, kidney stones, and bladder cancer, where conventional surgery could have traditionally been the case. Due to rising awareness of the advantages of minimally invasive therapy, and in addition, increased demand for faster recovery and improved patient results, the utilization of minimally invasive urology devices is increasingly growing throughout Indian healthcare centers.

To get more information on this market, Request Sample

Rising Prevalence of Urological Disorders and Aging Population

Growing incidences of urological conditions, including kidney stones, prostate disease, incontinence, and bladder cancer, are fueling the demand for urology devices in India. With a growing population and aging population, there is an increasing number of urological conditions that need to be treated by specialized devices. Specifically, the elderly are more prone to urological diseases, including benign prostatic hyperplasia (BPH) and urinary tract infections, resulting in increased demand for diagnostic and therapeutic urology equipment. Further, lifestyle changes like improper diet, sedentary lifestyle, and excessive stress are also causing an upsurge in kidney conditions like stones and infections. The growing consciousness and early detection of these diseases have further fueled demand for sophisticated urology devices, as patients and physicians seek efficient, effective therapies. This will continue to have a major impact on the urology devices market in India.

Technological Advancements and Innovation in Urology Devices

Technological innovations and advancements are playing a vital role in transforming the India urology devices market. Advances in robotic surgery, 3D imaging, and artificial intelligence (AI) are reshaping the domain of urology and enhancing the accuracy and effectiveness of surgical procedures. For instance, robotic surgery has gained immense popularity for the conduct of complex urological procedures like prostatectomies and kidney procedures since it is more precise, causes less trauma, and is followed by faster recovery. The use of AI and machine learning in diagnostic devices has also enhanced the early detection of urological diseases, including kidney stones and bladder cancer, to enable more targeted treatment plans. The creation of affordable and portable urology devices, including home-use monitoring devices for urinary incontinence and kidney function, is also becoming increasingly popular. Recently, in April 2024, Breach Candy Hospital, renowned for its healthcare quality, enhanced its infrastructure by inaugurating a new tower on its grounds in Mumbai, featuring state-of-the-art amenities. ZEE's role has been crucial in the creation of the state-of-the-art Kidney Centre in this new building. The Centre is crafted with careful consideration for medical regulations and aligns with applicable standards. It includes 11 beds designed to offer top-notch dialysis services to patients, capable of accommodating around 12,000 patients each year. With these technological developments continuing to grow, they are likely to spur growth in the urology devices market further, improving patient outcomes and healthcare efficiency in India.

India Urology Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, application, and end user.

Product Type Insights:

- Endoscopes

- Cystoscopes

- Disposable

- Reusable

- Ureteroscopes

- Disposable

- Reusable

- Cystoscopes

- Others

- Laser and Lithotripsy Devices

- Dialysis Devices

- Accessories

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes endoscopes [cystoscopes (disposable, reusable), ureteroscopes (disposable, reusable), and others], laser and lithotripsy devices, dialysis devices, accessories, and others.

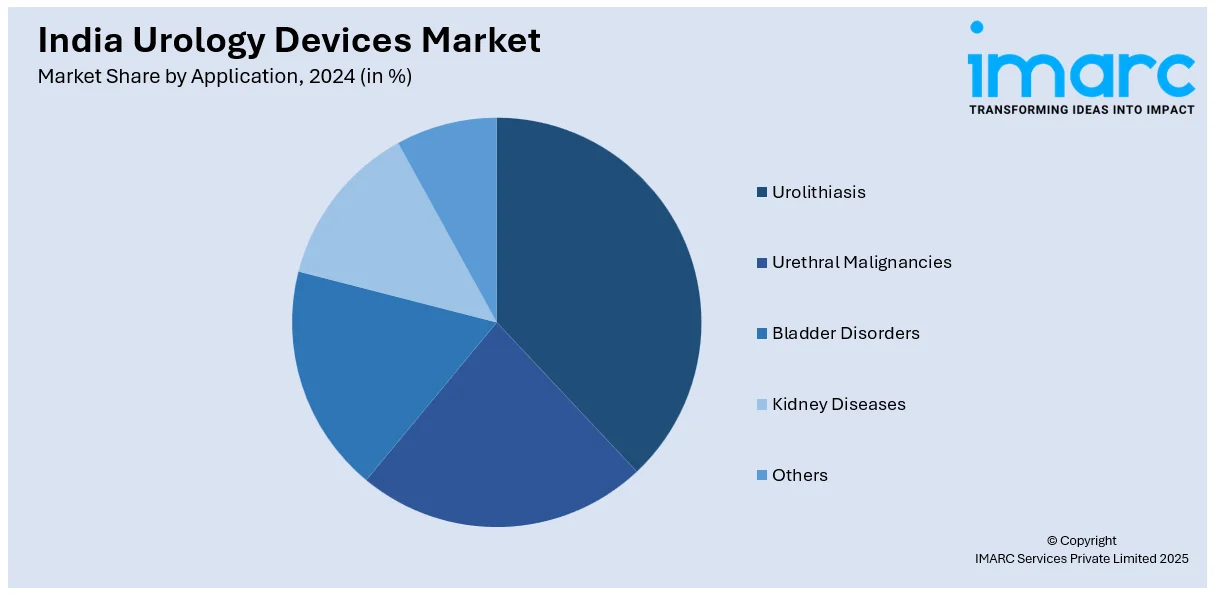

Application Insights:

- Urolithiasis

- Urethral Malignancies

- Bladder Disorders

- Kidney Diseases

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes urolithiasis, urethral malignancies, bladder disorders, kidney diseases, and others.

End User Insights:

- Hospitals and Ambulatory Surgical Centers

- Dialysis Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and ambulatory surgical centers, dialysis centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Urology Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Urolithiasis, Urethral Malignancies, Bladder Disorders, Kidney Diseases, Others |

| End Users Covered | Hospitals and Ambulatory Surgical Centers, Dialysis Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India urology devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India urology devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India urology devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The urology devices market in India was valued at USD 1.19 Billion in 2024.

The India urology devices market is projected to exhibit a CAGR of 7.43% during 2025-2033, reaching a value of USD 2.26 Billion by 2033.

A rising prevalence of urological disorders, such as kidney stones and urinary incontinence, is driving demand for advanced diagnostic and treatment devices. Improvements in healthcare infrastructure and insurance coverage are enhancing access. Additionally, technological innovation like minimally invasive instruments and advanced imaging systems and increasing health awareness are further fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)