India Used Cooking Oil Market Size, Share, Trends and Forecast by Source, Application, and Region, 2026-2034

India Used Cooking Oil Market Summary:

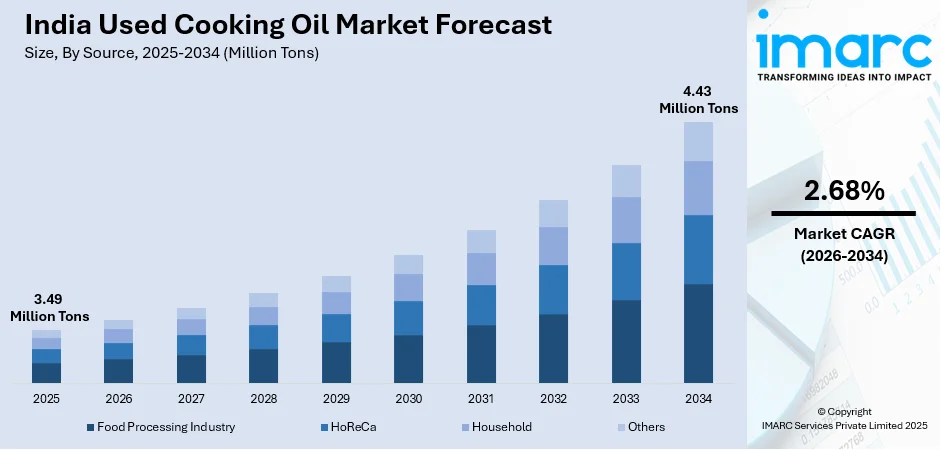

The India used cooking oil market size reached 3.49 Million Tons in 2025 and is projected to reach 4.43 Million Tons by 2034, growing at a compound annual growth rate of 2.68% from 2026-2034.

The India used cooking oil market is experiencing steady expansion, driven by the rapid growth of the food service industry and increasing awareness about the health hazards of repeatedly reused cooking oil. Rising urbanization and changing dietary preferences are fueling the demand for used cooking oil across commercial establishments. Government initiatives aimed at promoting sustainable waste management and biodiesel production are creating new avenues for used cooking oil collection and conversion. The broadening network of restaurants, hotels, and quick service establishments is producing significant quantity of used cooking oil, enhancing the market presence.

Key Takeaways and Insights:

-

By Source: HoReCa dominates the market with a share of 40% in 2025, owing to the high concentration of hotels, restaurants, and catering establishments generating substantial volumes of used cooking oil through commercial food preparation operations. Expansion of food delivery services is further augmenting this segment.

-

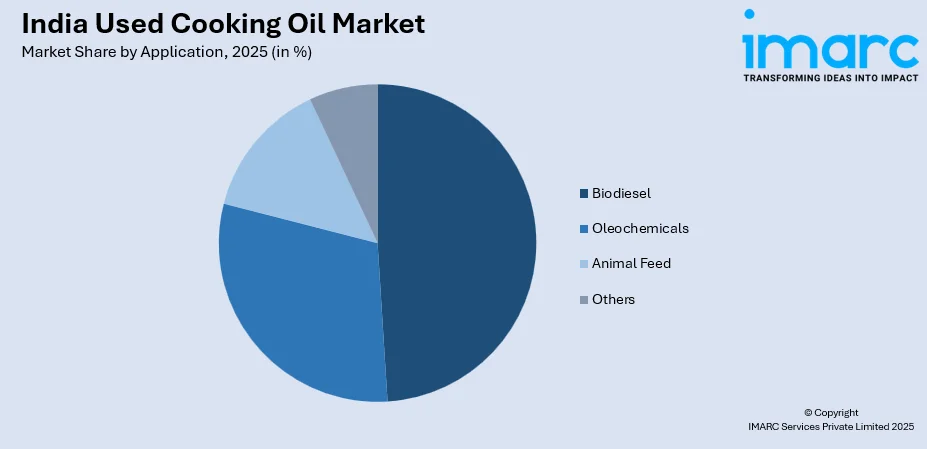

By Application: Biodiesel leads with a market share of 49% in 2025. This dominance is driven by government policies promoting biofuel blending, Food Safety and Standards Authority of India’s (FSSAI) initiatives encouraging collection networks, and increasing investments in biodiesel processing infrastructure across the country.

-

By Region: South India represents the largest region with 36% share in 2025, propelled by the presence of major urban centers like Bengaluru, Chennai, and Hyderabad with thriving food service industries and well-established used cooking oil collection networks supporting biodiesel manufacturing.

-

Key Players: Key players drive the India used cooking oil market by expanding collection networks, investing in biodiesel processing technologies, and strengthening partnerships with food business operators. Their investments in logistics infrastructure, regulatory compliance systems, and awareness campaigns accelerate market penetration and ensure consistent feedstock availability across diverse geographic regions. Some of the key players operating in the market include Aris Bioenergy Private Limited, Biod Energy (India) Private Limited, Bluestone Energy, Eco Green Fuels, Gogreen Bioenergy India Pvt Ltd, K Nandini Refineries, Muenzer Bharat Pvt. Ltd., Northern Biofuels Private Limited, Veolia Environment, and Zomato.

To get more information on this market Request Sample

The India used cooking oil market is propelled by multiple growth factors converging to create a favorable ecosystem. The expanding food service industry, characterized by rapid proliferation of restaurants, cloud kitchens, and quick service establishments, is generating unprecedented volumes of used cooking oil requiring proper disposal. As per IMARC Group, the India cloud kitchen market size was valued at USD 1,097.5 Million in 2024. Government regulatory frameworks mandating safe disposal practices and limiting oil reuse are encouraging food business operators to adopt structured collection systems. The growing awareness about cardiovascular health risks associated with consuming food prepared in repeatedly heated oil is driving behavioral changes among consumers and food establishments. Additionally, rising crude oil import costs are incentivizing investments in alternative fuel sources, positioning used cooking oil as a strategic feedstock for India's energy security objectives.

India Used Cooking Oil Market Trends:

Integration of Digital Platforms in Collection Networks

The market is witnessing increasing adoption of technology-enabled platforms that streamline used cooking oil collection logistics, supported by enhanced internet connectivity. As per DataReportal, at the beginning of 2024, India had 751.5 Million internet users, and internet penetration reached 52.4%. Digital solutions are enabling aggregators to optimize pickup routes, track collection volumes in real-time, and maintain quality documentation for regulatory compliance. Mobile applications are facilitating seamless coordination between food business operators and collection agencies, reducing operational inefficiencies. These technological interventions are enhancing transparency in the supply chain and enabling better traceability from collection points to processing facilities.

Expansion of Organized Collection Infrastructure

The market is experiencing systematic development of organized collection infrastructure spanning multiple cities. Aggregators are establishing comprehensive networks encompassing designated collection points, specialized storage containers, and scheduled pickup services for food establishments. This infrastructure development is reducing the prevalence of informal channels where used cooking oil previously re-entered the food chain. The expanding organized sector is enabling consistent feedstock supply for biodiesel manufacturing while simultaneously addressing public health concerns related to adulterated edible oil.

Growing Emphasis on Circular Economy Principles

The market is increasingly aligning with circular economy frameworks that prioritize waste valorization and resource efficiency. Used cooking oil is being repositioned from a waste product requiring disposal to a valuable resource supporting renewable energy production. This paradigm shift is attracting investments from sustainability-focused enterprises and encouraging food businesses to view used oil disposal as a revenue opportunity rather than a cost burden. The circular approach is fostering collaborative ecosystems connecting waste generators, aggregators, and biofuel producers.

Market Outlook 2026-2034:

The India used cooking oil market demonstrates promising growth prospects, supported by favorable policy frameworks and expanding end use applications. The biodiesel sector continues to drive demand as oil marketing companies increase procurement to meet blending mandates. The market size was estimated at 3.49 Million Tons in 2025 and is expected to reach 4.43 Million Tons by 2034, reflecting a compound annual growth rate of 2.68% over the forecast period 2026-2034. Infrastructure investments in collection networks and processing facilities are expected to strengthen supply chain efficiency. The expanding hotel and restaurant industry will continue to generate substantial volumes while regulatory enforcement will progressively formalize collection mechanisms across tier-two and tier-three cities.

India Used Cooking Oil Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Source | HoReCa | 40% |

| Application | Biodiesel | 49% |

| Region | South India | 36% |

Source Insights:

- Food Processing Industry

- HoReCa

- Household

- Others

HoReCa dominates with a market share of 40% of the total India used cooking oil market in 2025.

The HoReCa segment encompasses hotels, restaurants, and catering establishments that collectively generate substantial volumes of used cooking oil through commercial food preparation operations. These establishments maintain standardized cooking processes with predictable oil turnover patterns, making collection logistics more efficient and cost-effective. The segment benefits from FSSAI regulations mandating proper disposal for food business operators consuming significant quantities of cooking oil daily, driving compliance-oriented collection practices.

The expanding quick service restaurant (QSR) sector and cloud kitchen operations are augmenting used cooking oil generation from this segment. Karnataka reported collecting over 32 lakh Liters of used cooking oil during financial years 2024-25 and 2025-26 under the ‘Repurpose Used Cooking Oil (RUCO)’ initiative, with significant contributions from commercial food establishments. The organized nature of hotel and restaurant operations facilitates systematic collection scheduling, enabling aggregators to maintain consistent supply chains for downstream processing facilities.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

Biodiesel leads with a share of 49% of the total India used cooking oil market in 2025.

Biodiesel leads the India used cooking oil market due to its strong alignment with the country’s energy security and sustainability objectives. Used cooking oil serves as a cost-effective and readily available feedstock for biodiesel production, helping reduce dependence on imported fossil fuels. Converting waste oil into biodiesel also addresses environmental concerns related to improper disposal, making it an attractive option for regulators and fuel producers. These advantages support large-scale offtake from collection networks.

Additionally, biodiesel production from used cooking oil benefits from established blending mandates and growing demand for cleaner transport fuels. Fuel producers prefer used cooking oil–based biodiesel because it offers stable feedstock pricing compared to virgin oils. The ability to integrate biodiesel into existing fuel distribution infrastructure further accelerates adoption, reinforcing biodiesel’s dominant position in the India used cooking oil market.

Regional Insights:

- North India

- West and Central India

- South India

- East India

South India exhibits a clear dominance with a 36% share of the total India used cooking oil market in 2025.

South India leads the market owing to the presence of major metropolitan centers, including Bengaluru, Chennai, Hyderabad, and Kochi that host thriving hospitality and food service industries. The region benefits from well-developed biodiesel manufacturing infrastructure, with Karnataka and Tamil Nadu emerging as key hubs for used cooking oil processing. State-level initiatives promoting collection networks and food safety compliance are driving formalization of used cooking oil management practices across the region.

The region's dominance is reinforced by proactive implementation of FSSAI's RUCO initiative and presence of established biodiesel manufacturers. In August 2024, Karnataka's largest biodiesel plant commenced operations in Padubidri, Udupi district, specifically designed to convert used cooking oil into biodiesel. The concentration of food processing industries and expanding QSR restaurant chains in southern cities continues to strengthen the region's position as the primary contributor to the India used cooking oil market.

Market Dynamics:

Growth Drivers:

Why is the India Used Cooking Oil Market Growing?

Rising Demand for Biodiesel and Alternative Fuels

Rising demand for biodiesel is propelling the market expansion in India. Used cooking oil has emerged as a preferred feedstock for biodiesel production due to its lower cost compared to virgin vegetable oils. Growing emphasis on reducing fossil fuel dependence and improving energy security is encouraging fuel producers to secure sustainable raw materials. Used cooking oil–based biodiesel helps lower greenhouse gas emissions while addressing waste management challenges. Increasing blending of biodiesel with conventional diesel supports steady offtake from aggregators and recyclers. The scalability of biodiesel production using waste oil further strengthens demand. As transportation fuel consumption grows, biodiesel producers increasingly rely on used cooking oil to ensure consistent supply. This strong linkage between waste oil collection and clean fuel production continues to drive market growth across India.

Environmental Regulations and Waste Management Concerns

Environmental regulations and rising concerns over improper waste disposal strongly drive the India used cooking oil market. Unregulated dumping of used cooking oil into drains or reuse in food preparation poses serious environmental and health risks. Authorities are encouraging systematic collection and recycling to prevent pollution and improve sanitation. Used cooking oil recycling supports circular economy principles by converting waste into valuable end products. Municipal bodies and private players are promoting organized collection networks from restaurants, hotels, and food processors. Growing awareness about sustainable waste management practices among businesses further boosts compliance. Recycling used cooking oil reduces landfill burden and water contamination. As environmental accountability increases across industries, demand for structured used cooking oil recovery and recycling solutions continues to rise, supporting market expansion nationwide.

Growth of Foodservice and Hospitality Sectors

The expansion of the foodservice and hospitality sectors is a key driver of the India used cooking oil market. Rapid growth of restaurants, QSRs, hotels, catering services, and cloud kitchens is generating large volumes of used cooking oil. As per IMARC Group, the India QSR market size reached USD 8.7 Billion in 2024. Rising urbanization, changing lifestyles, and increased spending on dining out are accelerating oil consumption in commercial kitchens. Organized foodservice chains prefer authorized collectors to manage waste oil responsibly and maintain brand reputation. Bulk availability of used cooking oil from commercial establishments ensures consistent feedstock supply for recyclers. As the hospitality sector continues to expand across cities and tourist hubs, used cooking oil generation increases proportionally. This steady growth in supply strengthens collection efficiency and supports downstream applications, driving overall market expansion.

Market Restraints:

What Challenges the India Used Cooking Oil Market is Facing?

Fragmented Collection Infrastructure

The market faces challenges from underdeveloped and fragmented collection networks, particularly in tier-two and tier-three cities. Limited aggregator presence in smaller urban centers creates logistical inefficiencies and increases transportation costs. The absence of comprehensive collection infrastructure allows informal channels to persist, where used cooking oil may re-enter food supply chains or be disposed improperly, undermining market formalization efforts.

Limited Awareness Among Small Food Establishments

Small-scale food vendors and street food operators often lack awareness about regulatory requirements for used cooking oil disposal and the availability of authorized collection services. These establishments frequently operate outside formal regulatory frameworks, limiting compliance enforcement. The predominantly unorganized nature of this segment creates challenges for aggregators seeking to expand collection coverage and maintain consistent feedstock quality.

Price Volatility of Alternative Feedstocks

Biodiesel manufacturers face competition from alternative feedstocks, including palm oil derivatives and animal fats, creating price sensitivity in used cooking oil procurement. Fluctuations in international vegetable oil prices influence the relative attractiveness of used cooking oil as feedstock. Economic viability of collection operations depends on maintaining procurement prices that adequately compensate aggregators while remaining competitive against alternative feedstock options.

Competitive Landscape:

The India used cooking oil market exhibits a moderately concentrated structure with several established players operating collection networks and biodiesel manufacturing facilities. Market participants include specialized aggregators focusing on used cooking oil collection, integrated biodiesel manufacturers operating collection-to-processing value chains, and food technology platforms leveraging their restaurant partner networks for oil procurement. Competition centers on geographic network expansion, collection efficiency optimization, and securing long-term supply agreements with food business operators. Players are differentiating through service quality, pickup reliability, regulatory compliance documentation, and pricing competitiveness. Strategic partnerships between collection aggregators and biodiesel manufacturers are strengthening supply chain integration. Investment in technology platforms for logistics optimization and quality monitoring is emerging as a competitive differentiator.

Some of the key players include:

- Aris Bioenergy Private Limited

- Biod Energy (India) Private Limited

- Bluestone Energy

- Eco Green Fuels

- Gogreen Bioenergy India Pvt Ltd

- K Nandini Refineries Muenzer Bharat Pvt. Ltd.

- Northern Biofuels Private Limited

- Veolia Environment

- Zomato

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Source Covered | Food Processing Industry, HoReCa, Household, Others |

| Application Covered | Biodiesel, Oleochemicals, Animal Feed, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Aris Bioenergy Private Limited, Biod Energy (India) Private Limited, Bluestone Energy, Eco Green Fuels, Gogreen Bioenergy India Pvt Ltd, K Nandini Refineries, Muenzer Bharat Pvt. Ltd., Northern Biofuels Private Limited, Veolia Environment and Zomato |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India used cooking oil market reached a volume of 3.49 Million Tons in 2025.

The India used cooking oil market is expected to grow at a compound annual growth rate of 2.68% from 2026-2034 to reach 4.43 Million Tons by 2034.

HoReCa dominated the market with a share of 40%, owing to the concentration of hotels, restaurants, and catering establishments generating substantial volumes through commercial food preparation operations and compliance with FSSAI disposal regulations.

Key factors driving the India used cooking oil market include expanding food service industry and urbanization, government policies promoting biodiesel adoption through blending mandates and RUCO initiatives, and the growing health awareness regarding hazards of consuming food prepared in repeatedly heated cooking oil.

Major challenges include fragmented collection infrastructure, particularly in smaller cities, limited awareness among small food establishments about disposal regulations, persistence of informal channels, price volatility of alternative feedstocks, and inadequate enforcement of regulatory compliance across the unorganized food service sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)