India Used Truck Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, End User, and Region, 2026-2034

India Used Truck Market Summary:

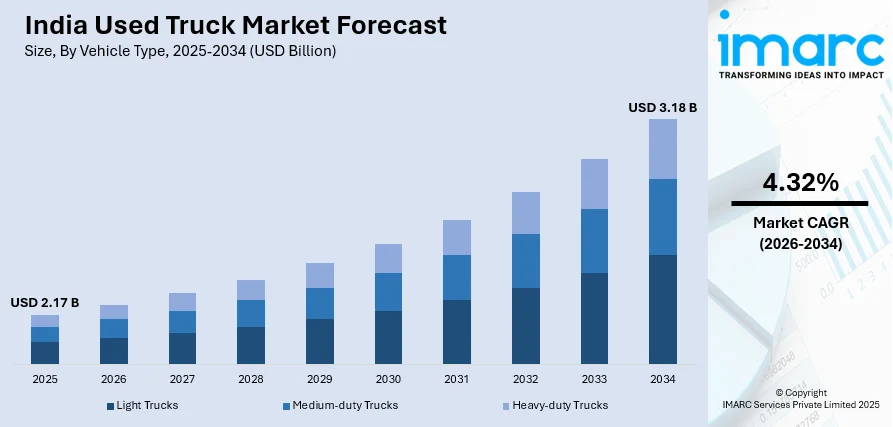

The India used truck market size was valued at USD 2.17 Billion in 2025 and is projected to reach USD 3.18 Billion by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034.

The market is driven by the expanding logistics and transportation sectors, rising construction activity, and the shift toward cost-effective commercial vehicle options. Small and mid-sized businesses, along with fleet operators, are increasingly opting for pre-owned trucks to meet their delivery and cargo needs. Growth in e-commerce and last-mile delivery services is creating consistent demand, while digital marketplaces are streamlining transactions by offering financing, documentation support, and vehicle inspection services, propelling India used truck market share.

Key Takeaways and Insights:

- By Vehicle Type: Medium-duty trucks dominate the market with a share of 44% in 2025, driven by its flexibility in accommodating various freight demands in urban and inter-city logistics operations.

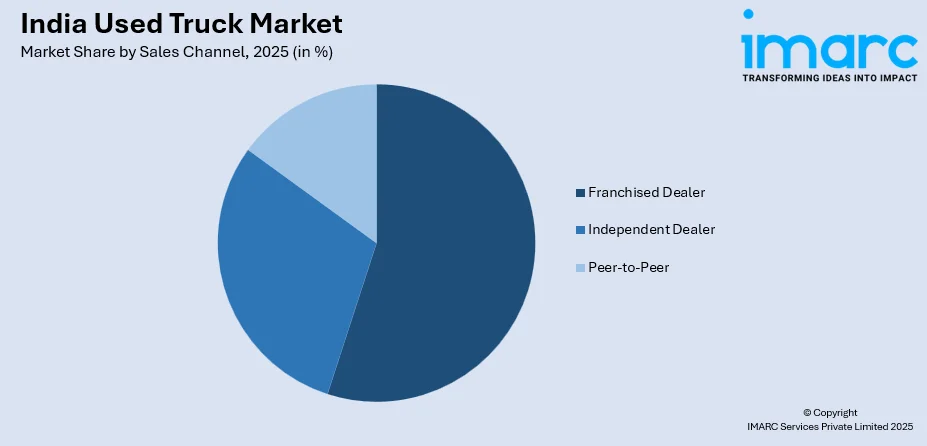

- By Sales Channel: Franchised dealer leads the market with a share of 56% in 2025, owing to increased buyer confidence because of certified pre-owned vehicles, car inspection services, and financial programs.

- By End User: Construction represents the largest segment with a market share of 45% in 2025, driven by ongoing infrastructure development initiatives, highway construction projects, and real estate expansion requiring reliable heavy-duty transportation solutions.

- By Region: North India leads the market with a share of 32% in 2025, owing to strong industrial and agricultural activity, expanding logistics networks, and proximity to major manufacturing and warehousing hubs.

- Key Players: The India used truck market exhibits a moderately fragmented competitive structure, with organized resale platforms competing alongside independent dealers and peer-to-peer channels. Major players are focusing on digital transformation, certified pre-owned programs, vehicle refurbishment services, and integrated financing solutions to capture market share.

To get more information on this market Request Sample

The India used truck market is experiencing sustained momentum, propelled by the country's rapid urbanization and industrialization trajectory. As businesses and fleet operators seek cost-effective transportation solutions, the demand for pre-owned commercial vehicles continues to rise significantly. The thriving e-commerce sector has catalyzed logistics requirements, necessitating large fleets for efficient supply chain management and last-mile delivery services. Digital platforms and online marketplaces have revolutionized the buying and selling process, offering transparency, verified listings, and streamlined documentation that enhance buyer confidence. In March 2025, Gurugram-based TrucksUp launched TrucksHub, a digital marketplace organizing India’s fragmented used-truck market, offering verified listings, inspection reports, and financing options, enhancing transparency and trust. Furthermore, government initiatives aimed at infrastructure development, including road connectivity improvements in rural and semi-urban regions, are further fueling demand. The accessibility and affordability of spare parts, coupled with improved refurbishment services, have reduced operational downtime and maintenance costs, encouraging the adoption of pre-owned trucks across diverse industry verticals.

India Used Truck Market Trends:

Digital Transformation of Used Truck Trading

The used truck market in India is witnessing a significant shift toward digital platforms and online marketplaces that facilitate transparent and efficient transactions. These platforms offer comprehensive services including verified vehicle listings, detailed inspection reports, documentation support, and integrated financing options. Furthermore, advanced features such as AI-driven pricing tools and vehicle history verification are enhancing buyer confidence. The digital revolution enables buyers to access wider inventory options and make informed decisions without geographical constraints. Additionally, real-time bidding capabilities and seamless documentation processes are streamlining the purchase journey, fundamentally transforming traditional trading practices across the commercial vehicle sector.

Rising Demand for Certified Pre-Owned Programs

The market is experiencing growing preference for certified pre-owned truck programs that offer quality assurance and buyer protection. These programs typically include comprehensive multi-point inspections, professional refurbishment services, warranty coverage, and extended after-sales support. According to reports, Daimler India Commercial Vehicles launched BharatBenz Certified, a structured pre‑owned truck program featuring rigorous 125‑point inspections and exclusive warranties to boost buyer trust in used commercial vehicles. Furthermore, major industry players are establishing structured certified pre-owned divisions that undergo rigorous evaluation processes to meet manufacturer standards. This trend is particularly prominent among small and medium enterprises seeking reliable vehicles with reduced acquisition risk.

Integration of Fleet Management Technologies

Used trucks are increasingly being equipped with advanced telematics and fleet management systems that enhance operational efficiency and vehicle monitoring capabilities. Fleet operators are prioritizing pre-owned vehicles that come with GPS tracking, remote diagnostics, and predictive maintenance features. In January 2024, Tata Motors announced that its Fleet Edge connected vehicle platform had digitally connected over, 5 Lakh commercial vehicles, providing real‑time insights on vehicle health, location, and driver behaviour that help optimise operations and reduce downtime. Moreover, these technological integrations enable real-time performance monitoring, route optimization, and fuel efficiency management. The adoption of connected vehicle technologies makes technologically equipped pre-owned trucks more attractive to commercial buyers.

Market Outlook 2026-2034:

The India used truck market revenue is projected to witness steady expansion throughout the forecast period, driven by the continued growth of logistics and transportation sectors, infrastructure development initiatives, and the expanding e-commerce ecosystem. The market is expected to benefit from increasing adoption of digital trading platforms, improved vehicle refurbishment services, and easier access to financing options. Government infrastructure programs, rural road connectivity improvements, and the National Logistics Policy are anticipated to create sustained demand for cost-effective transportation solutions among enterprises across the country. The market generated a revenue of USD 2.17 Billion in 2025 and is projected to reach a revenue of USD 3.18 Billion by 2034, growing at a compound annual growth rate of 4.32% from 2026-2034.

India Used Truck Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

Medium-duty Trucks |

44% |

|

Sales Channel |

Franchised Dealer |

56% |

|

End User |

Construction |

45% |

|

Region |

North India |

32% |

Vehicle Type Insights:

- Light Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

Medium-duty trucks dominate with a market share of 44% of the total India used truck market in 2025.

Medium-duty trucks have emerged as the dominant vehicle category in the India used truck market, commanding the market share. This segment's leadership position is attributed to the versatile nature of medium-duty trucks that effectively balance payload capacity with operational flexibility, making them ideal for diverse logistics applications ranging from intra-city distribution to regional freight transportation. According to sources, in 2025, VE Commercial Vehicles (VECV) achieved its highest‑ever annual sales of 90,161 light and medium‑duty trucks, underscoring strong demand and acceptance of medium‑duty models in India’s commercial vehicle landscape. Moreover, fleet operators particularly favor this category for its cost-effective acquisition and maintenance profile compared to heavy-duty alternatives.

The growing demand for medium-duty trucks is further propelled by the expansion of organized retail, FMCG distribution networks, and agricultural produce transportation across India. Small and medium enterprises find medium-duty trucks optimal for their operational requirements, as these vehicles offer sufficient cargo capacity without the complexities associated with larger commercial vehicles. The availability of refurbished models through organized resale channels and competitive financing options has made medium-duty trucks increasingly accessible to first-time fleet owners and independent operators seeking reliable transportation assets.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Franchised Dealer

- Independent Dealer

- Peer-to-Peer

Franchised dealer leads with a share of 56% of the total India used truck market in 2025.

Franchised dealer represents the leading sales channel in the India used truck market. This channel's dominance stems from the comprehensive value proposition offered by authorized dealerships, including certified pre-owned programs, manufacturer-backed warranties, professional vehicle inspections, and structured financing arrangements. As per sources, Ashok Leyland launched Re‑AL, an e-marketplace for used commercial vehicles, offering verified listings, structured exchanges, and upgrade options through franchised dealers across India, enhancing transparency and buyer confidence. Moreover, buyers increasingly prefer franchised dealers for the assurance of quality, authentic documentation, and reliable after-sales service that mitigates risks associated with pre-owned vehicle purchases.

The franchised dealer benefits from established brand credibility, extensive service infrastructure, and access to manufacturer-supported refurbishment facilities. These dealers leverage digital platforms to enhance customer reach while maintaining the trust associated with organized retail. The ability to offer trade-in options, vehicle exchange programs, and customized financing solutions positions franchised dealers as the preferred choice for businesses seeking hassle-free acquisition of pre-owned trucks with assured quality standards and transparent transaction processes.

End User Insights:

- Construction

- Oil and Gas

- Others

Construction exhibits a clear dominance with a 45% share of the total India used truck market in 2025.

The construction represents the largest end-user segment in the India used truck market. This dominance is driven by India's ambitious infrastructure development agenda, including highway construction, bridge projects, urban development initiatives, and real estate expansion. According to reports, in FY 2025–26, the National Highways Authority of India (NHAI) invited bids for 52 highway projects covering 2,188 km with an estimated ₹1.15 Lakh Crore capital expenditure, reinforcing strong infrastructure activity that supports heavy used‑truck demand. Moreover, construction companies rely heavily on used trucks for transporting building materials, heavy equipment, and construction supplies across project sites, finding pre-owned vehicles a cost-effective alternative to new purchases for their operational needs.

The construction preference for used trucks is reinforced by the project-based nature of operations where vehicle requirements fluctuate based on contract cycles. Contractors benefit from lower capital investment, faster procurement timelines, and the ability to scale their fleet according to project demands. Government infrastructure initiatives, smart city development programs, and industrial corridor projects continue to create sustained demand for reliable transportation assets. The flexibility of pre-owned vehicle acquisition aligns with the dynamic operational needs of construction businesses across the country.

Regional Insights:

- South India

- North India

- West & Central India

- East India

North India dominates with a market share of 32% of the total India used truck market in 2025.

North India leads the regional market with, driven by the concentration of industrial and agricultural activities in states like Punjab, Haryana, Uttar Pradesh, and Delhi-NCR. The region's strategic location as a major manufacturing and warehousing hub, coupled with extensive freight networks connecting to ports and border trade routes, creating a substantial demand for the commercial transportation. Agricultural produce movement and industrial goods distribution remain key demand drivers in this region.

North India market benefits from well-developed road infrastructure, high density of logistics operators, and the presence of organized used truck trading platforms. Small and medium fleet operators in this region actively participate in the pre-owned truck market to service growing freight requirements without significant capital expenditure. The proximity to major consumption centers, expanding warehousing facilities, and the region's role in supplying goods to neighbouring markets further strengthen demand for reliable and affordable used trucks among commercial operators.

Market Dynamics:

Growth Drivers:

Why is the India Used Truck Market Growing?

Expanding E-commerce and Logistics Infrastructure

The exponential growth of e-commerce in India has created unprecedented demand for efficient logistics and transportation solutions, directly benefiting the used truck market. Online retail platforms require extensive delivery networks to fulfill customer orders across urban, semi-urban, and rural areas, necessitating large fleets of commercial vehicles for first-mile pickup and last-mile delivery operations. In October 2025, Delhivery processed over 107 Million e‑commerce and freight shipments, including 7.2 Million parcels in a single day, reflecting surging logistics volumes that increase demand for scalable pre-owned trucking capacity. Furthermore, small and medium logistics operators servicing e-commerce fulfillment prefer pre-owned trucks to quickly scale their fleet capacity without substantial capital investment.

Cost-Effective Fleet Acquisition for Small Businesses

Small and medium enterprises across India increasingly recognize pre-owned trucks as viable alternatives to new vehicle purchases, driven by significant cost advantages and favorable return on investment. In April 2025, TrucksUp partnered with Sundaram Finance to offer tailored financing solutions for used trucks, easing access to credit and reducing capital barriers for small fleet owners and logistics SMEs across India. Moreover, the lower upfront acquisition cost of used trucks enables businesses to allocate financial resources toward other operational requirements while maintaining adequate transportation capacity. Fleet operators benefit from reduced depreciation impact, as used vehicles have already undergone the steepest value decline during initial ownership years.

Government Infrastructure Development Initiatives

Massive government investments in infrastructure development projects across India are creating sustained demand for commercial vehicles, including the used truck segment. Highway construction, freight corridor development, rural road connectivity programs, and urban infrastructure projects require reliable transportation for materials, equipment, and workforce movement. As per sources, in 2025, the Uttar Pradesh government approved an ₹8,000 Crore Integrated Industrial Township and Logistics Hub at Bodaki, Greater Noida, under the National Logistics Policy, enhancing multimodal connectivity and freight efficiency across the Delhi‑Mumbai Industrial Corridor. Furthermore, the National Logistics Policy aims to enhance logistics efficiency and reduce transportation costs, creating favorable conditions for fleet expansion and vehicle utilization.

Market Restraints:

What Challenges the India Used Truck Market is Facing?

Quality Uncertainty and Vehicle Condition Concerns

Potential buyers often face challenges in accurately assessing the true condition and remaining useful life of pre-owned trucks, particularly when purchasing through unorganized channels. The lack of comprehensive vehicle history documentation, undisclosed accident records, and inconsistent maintenance practices create uncertainty that deters risk-averse buyers from entering the market. Certified pre-owned programs have limited availability outside major urban centers.

Regulatory Compliance and Emission Norms

Evolving emission regulations and stricter environmental compliance requirements pose challenges for the used truck market, as older vehicles may not meet current regulatory standards. Buyers must consider the costs of retrofitting or upgrading vehicles to comply with applicable emission norms, which can reduce the cost advantage of pre-owned truck purchases. Regional variations in enforcement add uncertainty.

Limited Financing Options in Unorganized Segment

Access to affordable financing remains challenging for used truck purchases, particularly through independent dealers and peer-to-peer channels where institutional lending support is limited. Banks and financial institutions often impose stringent eligibility criteria, higher interest rates, and shorter loan tenures for pre-owned commercial vehicles. Small fleet operators in semi-urban and rural areas face difficulties.

Competitive Landscape:

The India used truck market exhibits a moderately fragmented competitive structure characterized by the coexistence of organized resale platforms, franchised dealerships, independent dealers, and peer-to-peer transaction channels. Market participants are increasingly focusing on digital transformation to enhance customer reach and streamline transaction processes. Organized players are differentiating through certified pre-owned programs that offer quality assurance, warranty coverage, and after-sales support to build buyer confidence. The integration of financing solutions, vehicle inspection services, and documentation assistance has become a key competitive strategy. Industry participants are investing in refurbishment facilities and expanding their geographical presence to capture demand.

Recent Developments:

- In March 2025, Gurugram-based TrucksUp partnered with HDFC Bank to offer easy financing for new and used trucks across India. The collaboration enables streamlined loans, flexible EMIs, and faster disbursal, supporting small fleet operators and truck owners while enhancing financial inclusion and efficiency in the country’s used truck market.

India Used Truck Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Light Trucks, Medium-duty Trucks, Heavy-duty Trucks |

| Sales Channles Covered | Franchised Dealer, Independent Dealer, Peer-To-Peer |

| End Users Covered | Construction, Oil and Gas, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India used truck market size was valued at USD 2.17 Billion in 2025.

The India used truck market is expected to grow at a compound annual growth rate of 4.32% from 2026-2034 to reach USD 3.18 Billion by 2034.

Medium-duty trucks held the largest market share driven by their versatility in handling diverse freight requirements, optimal payload capacity for mid-range transportation, and widespread adoption among small and medium fleet operators.

Key factors driving the India used truck market include expanding e-commerce and logistics sectors, cost-effective fleet acquisition for small businesses, government infrastructure development initiatives, growing digital trading platforms, and improved vehicle refurbishment services.

Major challenges include quality uncertainty and vehicle condition concerns in unorganized channels, regulatory compliance with evolving emission norms, limited financing options for pre-owned vehicle purchases, fragmented market structure, and inconsistent documentation practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)