India Utility Billing Software Market Size, Share, Trends and Forecast by Deployment Mode, Type, End User, and Region, 2025-2033

India Utility Billing Software Market Overview:

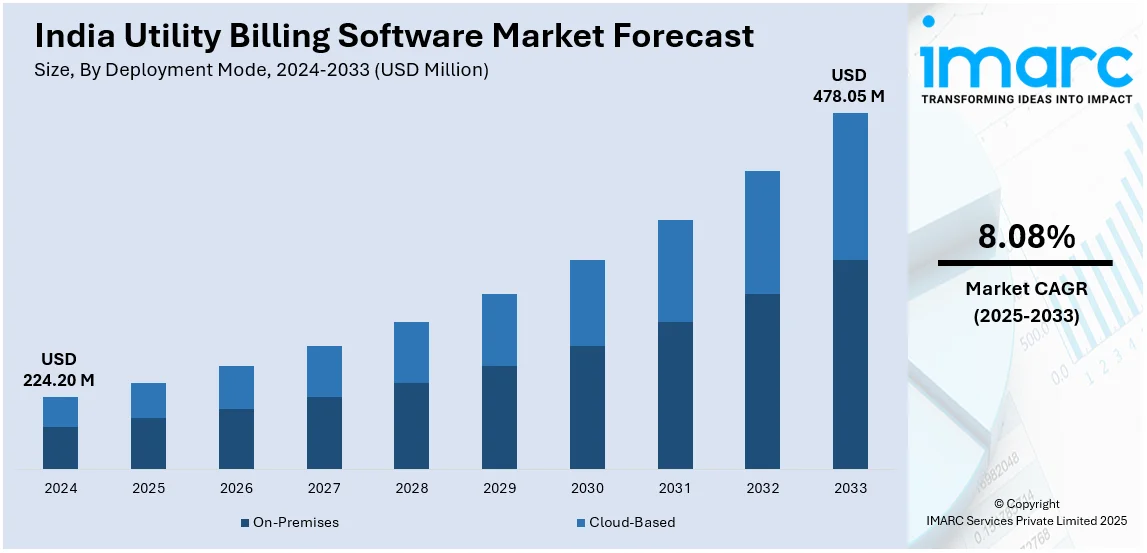

The India utility billing software market size reached USD 224.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 478.05 Million by 2033, exhibiting a growth rate (CAGR) of 8.08% during 2025-2033. The increasing digitalization of utility services, rising demand for efficient billing and payment systems, and government initiatives promoting smart grid infrastructure. Additionally, the need for accurate consumption tracking and seamless customer service solutions across electricity, water, and gas distribution sectors are supporting the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 224.20 Million |

| Market Forecast in 2033 | USD 478.05 Million |

| Market Growth Rate (2025-2033) | 8.08% |

India Utility Billing Software Market Trends:

Integration of Smart Metering and IoT Technologies

India’s utility billing software market is rapidly integrating smart metering and Intent of Things (IoT) technologies. With 11.5 crore (115 million) smart consumer meters, 45 lakh (4.5 million) distribution transformer meters, and 1.7 lakh (170,000) feeder meters awarded and under installation as of January 2025, utilities are shifting towards real-time consumption data and automated billing. Smart meters reduce billing errors, enhance transparency, and minimize manual intervention. Advanced billing software now supports automated meter readings, remote monitoring, and data-driven processes, improving operational efficiency. Customers are helped through bundled dashboards for monitoring consumption habits, promoting mindful consumption. Government initiatives like the Smart Cities Mission and UDAY are accelerating the adoption of billing solutions that support advanced metering infrastructure, aligning with India's broader push for digitalization in the power sector.

To get more information on this market, Request Sample

Cloud-Based Utility Billing Solutions Gaining Traction

The transition to cloud-based utility billing systems is a developing trend in the Indian market, fueled by the demand for scalability, affordability, and increased data accessibility. Cloud platforms enable utility companies to operate billing remotely, with better data security and disaster recovery functions. The systems enable flexible deployment models, where utilities can rapidly respond to changing regulatory or customer requirements. Further, cloud-based software provides bundled features such as customer relationship management (CRM), analytics, and mobile availability, enhancing overall customer interaction. With increasing utility service needs in rural and urban regions, cloud deployment facilitates quicker rollout and smoother updates than on-premise conventional systems. This movement is in the direction of India's overall digital transformation ambitions and aids utilities in attaining greater operational flexibility.

Adoption of AI and Data Analytics for Billing Optimization

Artificial Intelligence (AI) and data analytics are increasingly becoming part of utility billing software in India. Utilities are leveraging AI algorithms to identify anomalies in consumption patterns, forecast demand, and identify revenue leakage. Machine learning (ML) models assist in streamlining billing processes, projecting energy consumption, and making better decisions. Predictive analytics also enables proactive customer service by identifying potential billing conflicts or usage anomalies prior to escalation. In addition, analytics solutions allow customer segmentation according to usage behavior, thus facilitating tailored tariff plans and service offerings. This smart billing system allows utilities to better optimize operational efficiency, minimize errors, and increase customer satisfaction. With India's utility industry becoming more data-driven, the use of AI and analytics within billing systems continues to transform industry practices.

India Utility Billing Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on deployment mode, type and end user.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises, and cloud-based.

Type Insights:

- Platform as a Service

- Infrastructure as a Service

- Software as a Service

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes platform as a service, infrastructure as a service, and software as a service.

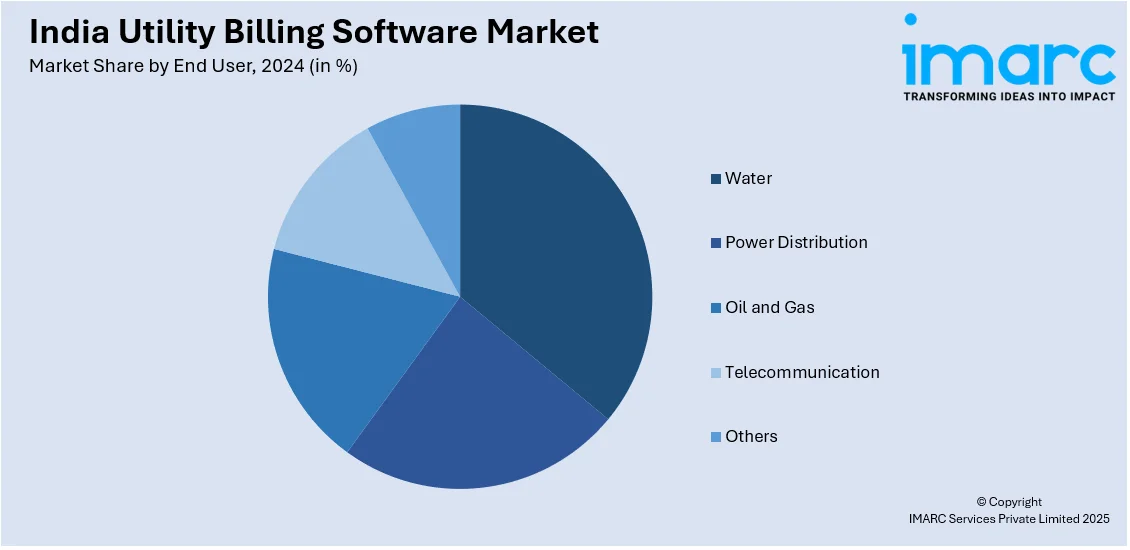

End User Insights:

- Water

- Power Distribution

- Oil and Gas

- Telecommunication

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes water, power distribution, oil and gas, telecommunication, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Utility Billing Software Market News:

- In February 2025, InvoiceCloud partnered with POWERCONNECT.AI to offer integrated AI and digital payment solutions for the utility sector, enhancing customer and agent experiences. The collaboration supports Oracle, SAP, and other CIS platforms, enabling features like AI digital assistants, multilingual self-service, and GenAI-powered training tools. This partnership aims to streamline operations, improve engagement, and simplify bill payments. InvoiceCloud currently serves over 3,200 clients across utilities, government, and insurance sectors.

- In October 2024, KPDCL is transitioning all consumers in Kashmir to a cloud-based billing system under the Revamped Distribution Sector Scheme. Powered by Oracle Cloud Infrastructure, the new Unified Billing System will enhance bill visibility and smart meter access. A new mobile app, “Bill Sahuliyat Plus,” will offer real-time data and an improved interface. The system supports dynamic tariffs, pre-paid billing, and integrates with advanced metering infrastructure and property management features.

- In May 2024, Tide India launched a Bill Payments feature for MSMEs, in partnership with Setu via NPCI’s Bharat BillPay system. The service enables seamless utility bill payments through the Tide app, offering secure, convenient options for electricity, gas, insurance, and more. It helps small businesses track expenses, gain financial insights, and improve cash flow visibility, ensuring 24/7 access, transparency, and real-time payment confirmations for better financial management.

India Utility Billing Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Types Covered | Platform as a Service, Infrastructure as a Service, Software as a Service |

| End Users Covered | Water, Power Distribution, Oil and Gas, Telecommunication, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India utility billing software market performed so far and how will it perform in the coming years?

- What is the breakup of the India utility billing software market on the basis of deployment mode?

- What is the breakup of the India utility billing software market on the basis of type?

- What is the breakup of the India utility billing software market on the basis of end user?

- What is the breakup of the India utility billing software market on the basis of region?

- What are the various stages in the value chain of the India utility billing software market?

- What are the key driving factors and challenges in the India utility billing software market?

- What is the structure of the India utility billing software market and who are the key players?

- What is the degree of competition in the India utility billing software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India utility billing software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India utility billing software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India utility billing software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)