India Vacuum Cleaner Market Size, Share, Trends and Forecast by Product, Power Source, Application, Distribution Channel, and Region, 2026-2034

India Vacuum Cleaner Market Summary:

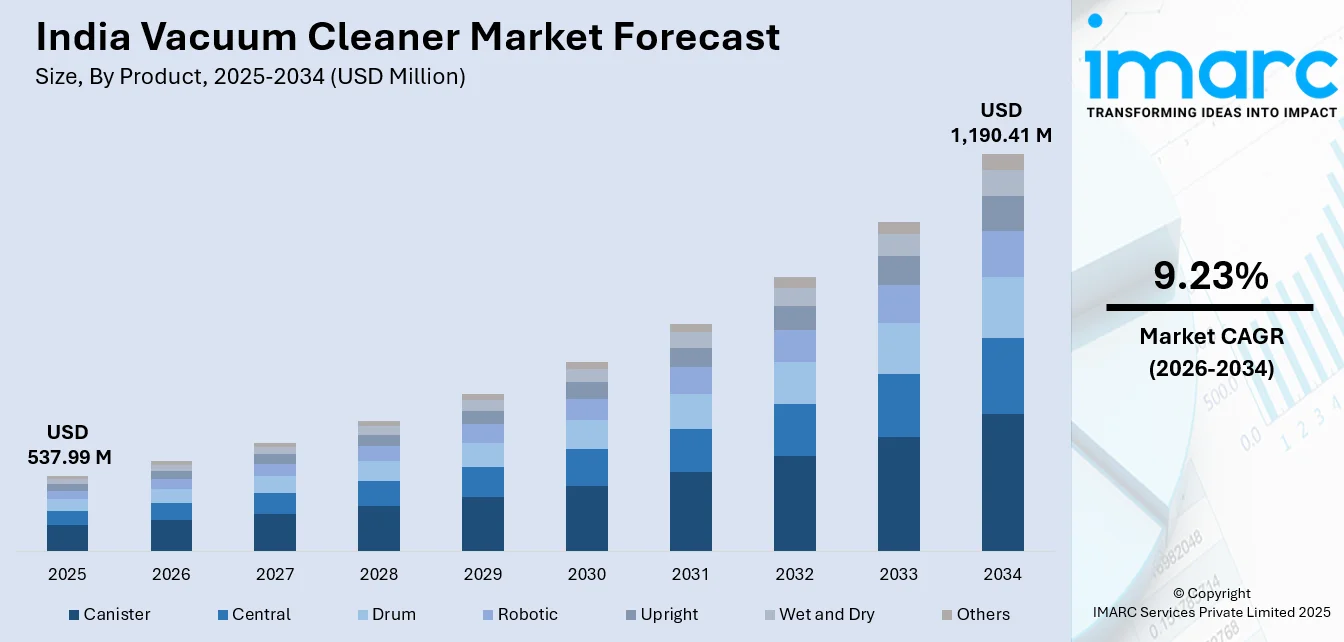

The India vacuum cleaner market size was valued at USD 537.99 Million in 2025 and is projected to reach USD 1,190.41 Million by 2034, growing at a compound annual growth rate of 9.23% from 2026-2034.

The India vacuum cleaner market is witnessing robust expansion driven by rapid urbanization, rising hygiene awareness, and growing demand for advanced cleaning solutions across residential and commercial sectors. Technological innovations in smart and robotic vacuum cleaners are reshaping consumer preferences. Increasing disposable incomes, evolving lifestyles, and the expansion of e-commerce platforms are facilitating widespread product adoption, positioning India as a high-growth market for cleaning appliances.

Key Takeaways and Insights:

- By Product: Canister dominate the market with a share of 26% in 2025, driven by their versatility in cleaning multiple surfaces, compact portable design, and effectiveness in reaching hard-to-access areas such as stairs, corners, and underneath furniture.

- By Power Source: Corded lead the market with a share of 59% in 2025, owing to their consistent suction power, unlimited runtime capability, cost-effectiveness compared to cordless alternatives, and reliability for extended cleaning sessions in both residential and commercial settings.

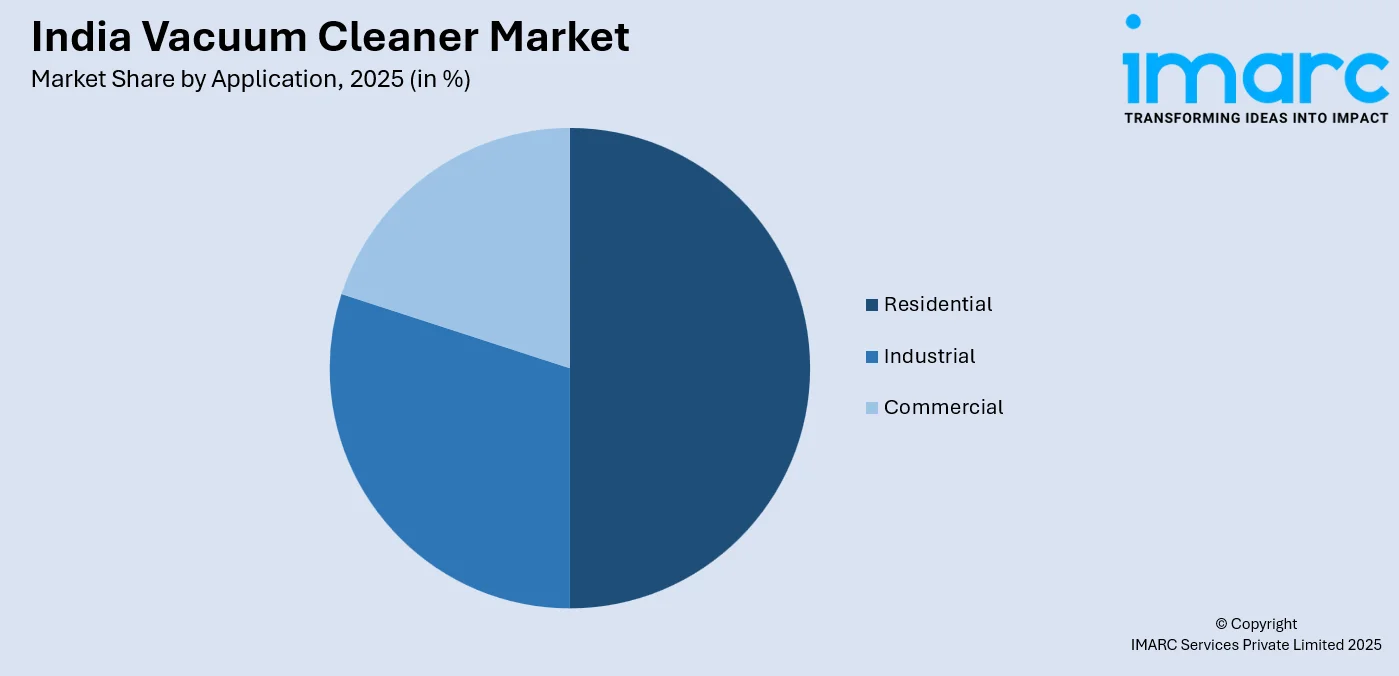

- By Application: Residential represents the largest segment with a market share of 50% in 2025, attributable to growing household adoption driven by busy urban lifestyles, increasing health consciousness, rising nuclear family structures, and the need for efficient home cleaning solutions.

- By Distribution Channel: Offline dominate with a share of 67% in 2025, driven by consumer preference for physical product demonstration, hands-on experience before purchase, established retail networks, and the presence of electronics specialty stores across urban and semi-urban markets.

- By Region: North India lead the market with a share of 31% in 2025, supported by high urbanization rates, concentration of metropolitan areas, strong retail infrastructure, and elevated consumer awareness regarding hygiene and cleanliness standards.

- Key Players: The India vacuum cleaner market exhibits a competitive landscape with established multinational brands and domestic players competing across product segments. Market participants are focusing on technological innovation, smart home integration, and expanding distribution networks to capture growing consumer demand.

To get more information on this market Request Sample

The India vacuum cleaner market is experiencing transformative growth propelled by shifting consumer lifestyles and heightened emphasis on indoor hygiene. Rapid urbanization is driving demand for efficient cleaning solutions as urban households increasingly adopt modern home appliances. For example, in December 2025, ECOVACS recently launched its advanced DEEBOT X11 OmniCyclone robotic vacuum cleaner in India, reflecting rising adoption of intelligent home appliances among Indian consumers. The expanding working population with time constraints is fueling preference for automated and convenient cleaning devices. Rising awareness regarding allergens, dust-related health issues, and indoor air quality is encouraging vacuum cleaner adoption across demographics. Government initiatives promoting cleanliness and sanitation have positively influenced market penetration. The emergence of smart home ecosystems is accelerating demand for connected and intelligent vacuum cleaners with advanced features including artificial intelligence navigation and voice-controlled operations.

India Vacuum Cleaner Market Trends:

Rising Adoption of Smart and Robotic Vacuum Cleaners

The India vacuum cleaner market is witnessing significant momentum toward smart and robotic models equipped with artificial intelligence and Internet of Things capabilities. For instance, in August 2025, Milagrow launched the BlackCat 25 Ultra, India’s first AI‑powered, self‑emptying bagless robotic vacuum cleaner with real‑time obstacle avoidance and intelligent path planning, reflecting rapid adoption of advanced automation in homes. Consumers are increasingly gravitating toward automated cleaning solutions that offer hands-free operation, advanced navigation systems, and seamless integration with smart home ecosystems. These intelligent devices feature app-controlled scheduling, voice assistant compatibility, and self-charging capabilities that appeal to tech-savvy urban households seeking convenience and efficiency in their cleaning routines.

Growing Preference for Cordless and Portable Models

Cordless vacuum cleaners are gaining considerable traction in the Indian market due to their enhanced portability, ease of use, and elimination of cord-related limitations. For example, Dreame expanded its product lineup in India in 2024 to include a range of cordless stick vacuums alongside robotic and wet/dry models, with prices starting at ₹7,999, underscoring how brands are increasingly catering to demand for lightweight, battery‑powered cleaning devices. Advancements in battery technology, particularly lithium-ion cells, have enabled longer runtime and improved suction performance in cordless models.

Expansion of Multi-Functional Wet and Dry Vacuum Cleaners

The demand for versatile wet and dry vacuum cleaners is expanding across residential and commercial segments as consumers seek multi-purpose cleaning solutions. For example, Kärcher India launched its locally‑manufactured WD 3–17L wet and dry vacuum cleaner in 2025 under the Government’s “Make in India” initiative, enhancing availability and affordability of dual‑function models for Indian households and workshops. These devices offer comprehensive cleaning capabilities for both liquid spills and dry debris, making them suitable for diverse applications including kitchen cleaning, garage maintenance, and workshop environments. Advanced models feature intelligent dirt detection, separate collection tanks, and specialized filtration systems that enhance cleaning efficiency across multiple surface types.

Market Outlook 2026-2034:

The India vacuum cleaner market is positioned for substantial growth over the forecast period, supported by favorable demographic trends, rising disposable incomes, and accelerating urbanization. The expanding middle-class population with increasing spending capacity will drive demand for premium and technologically advanced cleaning appliances. Government initiatives promoting cleanliness and sanitation continue to create positive market conditions. Innovation in product design, energy efficiency, and smart connectivity will remain critical growth drivers. The market generated a revenue of USD 537.99 Million in 2025 and is projected to reach a revenue of USD 1,190.41 Million by 2034, growing at a compound annual growth rate of 9.23% from 2026-2034.

India Vacuum Cleaner Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Canister |

26% |

|

Power Source |

Corded |

59% |

|

Application |

Residential |

50% |

|

Distribution Channel |

Offline |

67% |

|

Region |

North India |

31% |

Product Insights:

- Canister

- Central

- Drum

- Robotic

- Upright

- Wet and Dry

- Others

The canister dominates with a market share of 26% of the total India vacuum cleaner market in 2025.

Canister vacuum cleaners maintain their leading position in the India market due to their exceptional versatility and effectiveness across multiple cleaning applications. These devices excel in reaching challenging areas such as stairs, underneath furniture, drapes, and tight corners that are difficult to access with other vacuum types. The compact and portable design makes canister models highly appealing across industrial, commercial, and residential sectors seeking comprehensive cleaning solutions.

The segment benefits from a favorable price-to-performance ratio that appeals to cost-conscious Indian consumers while delivering reliable suction power and dust collection efficiency. Canister vacuums offer the advantage of separating the motor unit from the cleaning head, resulting in quieter operation and improved maneuverability. Manufacturers continue to enhance canister models with advanced filtration systems, bagless designs, and ergonomic features that address evolving consumer expectations.

Power Source Insights:

- Corded

- Cordless

The corded leads with a share of 59% of the total India vacuum cleaner market in 2025.

Corded vacuum cleaners maintain market dominance in India due to their consistent suction power, unlimited runtime capability, and lower price points compared to cordless alternatives. For example, in December 2024, Dyson recently expanded its India portfolio with the launch of the Big Ball corded vacuum cleaner, designed with powerful suction and easy‑maneuver technology aimed at meeting the needs of larger homes and more thorough cleaning tasks. These devices are particularly favored for extensive cleaning tasks in larger homes and commercial establishments where continuous operation is essential. The reliable performance without concerns about battery depletion makes corded models the preferred choice for thorough cleaning requirements.

The segment benefits from established consumer familiarity and trust in traditional corded appliance technology. Industrial and commercial users particularly favor corded models for their ability to deliver sustained high-power suction during prolonged cleaning sessions. While cordless models are gaining popularity among urban consumers seeking convenience, corded vacuum cleaners continue to dominate due to their cost-effectiveness, durability, and proven performance track record in the Indian market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Manufacturing

- Food and Beverages

- Pharmaceuticals

- Construction

- Others

- Residential

- Commercial

- Hospital

- Retail Stores

- Hospitality

- Shopping Malls

- Others

The residential dominates with a market share of 50% of the total India vacuum cleaner market in 2025.

The residential segment commands the largest share of the India vacuum cleaner market, driven by the rapidly expanding working population and evolving household cleaning preferences. Urban households increasingly adopt vacuum cleaners to manage daily cleaning tasks efficiently within time-constrained lifestyles. Rising health consciousness regarding dust-related allergies and respiratory issues is motivating families to invest in effective cleaning appliances that ensure healthier living environments.

The proliferation of nuclear families and dual-income households has intensified demand for convenient cleaning solutions that minimize manual effort. Improved economic conditions and increasing disposable incomes enable more households to afford vacuum cleaners across various price segments. The segment continues to expand as urbanization drives population shifts toward apartments and smaller living spaces where vacuum cleaners offer superior cleaning efficiency compared to traditional methods.

Distribution Channel Insights:

- Online

- Offline

The offline leads with a share of 67% of the total India vacuum cleaner market in 2025.

Offline distribution channels maintain their dominant position in the India vacuum cleaner market, driven by consumer preference for physical product examination and demonstration before purchase. For example, consumer electronics and home appliance maker Hisense India partnered with Great Eastern Retail in 2025 to expand its offline presence across more than 90 stores, broadening the reach of its home appliance lineup, including vacuum cleaners, in key states such as West Bengal, Odisha, and Uttar Pradesh. Electronics specialty stores, multi-brand outlets, and hypermarkets offer customers the opportunity to experience product features, assess build quality, and compare different models directly. The established presence of retail networks across urban and semi-urban centers ensures widespread product accessibility.

Offline channels benefit from personal sales assistance, after-sales service support, and the ability to provide immediate product delivery. Consumers value the trust and reliability associated with purchasing from established retail outlets, particularly for higher-value appliances. While e-commerce channels are experiencing rapid growth, traditional retail continues to dominate due to the tactile nature of appliance purchases and the importance of experiencing suction power and noise levels before buying.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 31% share of the total India vacuum cleaner market in 2025.

North India represents the largest regional market for vacuum cleaners, supported by high urbanization rates, substantial population density, and elevated consumer awareness regarding hygiene and cleanliness. The region encompasses major metropolitan centers including Delhi NCR, which drives significant demand for residential and commercial cleaning solutions. Strong retail infrastructure, presence of major electronics chains, and established distribution networks facilitate product accessibility across the region.

The region benefits from relatively higher disposable incomes and greater exposure to modern home appliances among urban consumers. Seasonal factors including dust-prone weather conditions create consistent year-round demand for effective cleaning solutions. The concentration of corporate offices, hospitality establishments, and healthcare facilities in North India further contributes to commercial segment demand. Growing awareness about indoor air quality and allergen management is driving residential adoption across the region.

Market Dynamics:

Growth Drivers:

Why is the India Vacuum Cleaner Market Growing?

Rapid Urbanization and Changing Lifestyle Patterns

India's accelerating urbanization is fundamentally transforming consumer cleaning preferences and driving vacuum cleaner adoption. The migration of population toward metropolitan areas and emerging urban centers is creating concentrated demand for efficient home cleaning solutions. Urban households face unique challenges including smaller living spaces, time constraints, and heightened exposure to dust and pollutants that make vacuum cleaners increasingly essential. Retailers in cities such as Mumbai have reported a notable surge in home appliance sales, including smart and energy-efficient products, driven by rising urban incomes and growing consumer preference for modern, convenience-oriented devices. The shift toward apartment living and nuclear family structures amplifies the need for convenient, effective cleaning appliances that complement modern lifestyles. Rising workforce participation, particularly among women, has reduced availability of time for manual cleaning activities, positioning vacuum cleaners as practical household investments.

Growing Health Consciousness and Hygiene Awareness

Heightened awareness regarding indoor air quality, allergens, and dust-related health issues is significantly driving vacuum cleaner adoption across Indian households. Consumers are increasingly recognizing the connection between effective cleaning and respiratory health, particularly in households with children, elderly members, or individuals with allergies. According to reports, 84% of Indians acknowledge that HEPA filters are highly effective in removing dust particles, allergens, and viruses, and this recognition has boosted interest in vacuum cleaners with advanced filtration systems. The emphasis on maintaining hygienic living environments has elevated vacuum cleaners from luxury items to essential household appliances. Government initiatives promoting cleanliness and sanitation, including the Swachh Bharat Mission, have positively influenced public attitudes toward modern cleaning solutions. Healthcare professionals increasingly recommend vacuum cleaners with advanced filtration systems for households seeking to minimize allergen exposure.

Technological Advancements and Smart Home Integration

Continuous technological innovation in vacuum cleaner design and functionality is expanding market appeal and driving consumer upgrades. The introduction of smart vacuum cleaners with artificial intelligence, app connectivity, and voice assistant integration has transformed cleaning appliances into sophisticated home automation devices. For example, Haier India launched its CIVIC X11 robot vacuum cleaner series in 2025 featuring advanced laser navigation, smart obstacle detection, Google Voice Control, and integration with the HaiSmart app for intuitive smart home connectivity. Advanced features including automated scheduling, room mapping, obstacle detection, and self-emptying capabilities are attracting tech-savvy consumers seeking convenience and efficiency. Improvements in battery technology have enhanced cordless vacuum performance, extending runtime and suction power while reducing charging times. Manufacturers are incorporating advanced filtration systems, noise reduction technologies, and energy-efficient motors that address diverse consumer requirements.

Market Restraints:

What Challenges the India Vacuum Cleaner Market is Facing?

High Initial Cost and Price Sensitivity

The relatively high upfront cost of quality vacuum cleaners poses a significant barrier to mass market adoption in price-sensitive India. Many households, particularly in semi-urban and rural areas, perceive vacuum cleaners as premium products beyond their budget constraints. The cost differential between vacuum cleaners and traditional cleaning methods influences purchase decisions, especially among lower-income segments. Premium features and advanced technologies further elevate price points, limiting accessibility for budget-conscious consumers.

Limited Awareness in Rural and Semi-Urban Markets

Insufficient consumer awareness and understanding about vacuum cleaner benefits represents a significant market challenge, particularly in rural and smaller urban centers. Many potential consumers remain unfamiliar with product features, applications, and advantages over traditional cleaning methods. Limited exposure to product demonstrations and educational marketing constrains demand expansion beyond metropolitan areas. The perception that vacuum cleaners are unsuitable for Indian home environments and flooring types further inhibits adoption.

Competition from Affordable Domestic Labor

The availability of affordable domestic help in India presents a unique competitive challenge for vacuum cleaner adoption. Many households, particularly in urban areas, continue to rely on domestic workers for cleaning tasks, reducing perceived necessity for automated cleaning appliances. The cultural preference for manual cleaning by domestic help and the associated employment considerations influence household purchasing decisions. This factor particularly affects demand in regions where domestic labor remains readily accessible and economically viable.

Competitive Landscape:

The India vacuum cleaner market exhibits a competitive landscape characterized by the presence of established multinational brands alongside emerging domestic manufacturers. Market participants are differentiated through product innovation, pricing strategies, distribution network strength, and after-sales service capabilities. International brands leverage technological expertise and premium positioning while domestic players compete through affordable pricing and localized product adaptations. Key competitive strategies include expanding retail presence, strengthening e-commerce capabilities, launching feature-rich products at competitive price points, and building brand awareness through marketing campaigns. The market witnesses ongoing product launches targeting specific consumer segments, from budget-conscious households to premium smart home enthusiasts. Strategic partnerships with retailers, appliance chains, and online platforms are critical for market reach expansion.

Recent Developments:

- In October 2025, Milagrow launches the iMap 15 AI Plus, the world’s first convertible AI robot vacuum cleaner in India. Featuring advanced autonomy and multiple cleaning modes, it aims to redefine smart home cleaning for urban households.

India Vacuum Cleaner Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Canister, Central, Drum, Robotic, Upright, Wet and Dry, Others |

| Power Sources Covered | Corded, Cordless |

| Applications Covered |

|

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India vacuum cleaner market size was valued at USD 537.99 Million in 2025.

The India vacuum cleaner market is expected to grow at a compound annual growth rate of 9.23% from 2026-2034 to reach USD 1,190.41 Million by 2034.

The canister dominated the market with a 26% share, driven by its versatility, compact portable design, and effectiveness in reaching hard-to-access areas across residential, commercial, and industrial applications.

Key factors driving the India vacuum cleaner market include rapid urbanization, growing health consciousness and hygiene awareness, rising disposable incomes, technological advancements in smart and robotic cleaners, expanding working population, and government cleanliness initiatives.

Major challenges include high initial product costs affecting price-sensitive consumers, limited awareness in rural and semi-urban markets, competition from affordable domestic labor, inadequate understanding of product benefits, and infrastructure limitations in certain regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)