India Valves Market Size, Share, Trends and Forecast by Type, End-User Vertical, and Region, 2025-2033

India Valves Market Overview:

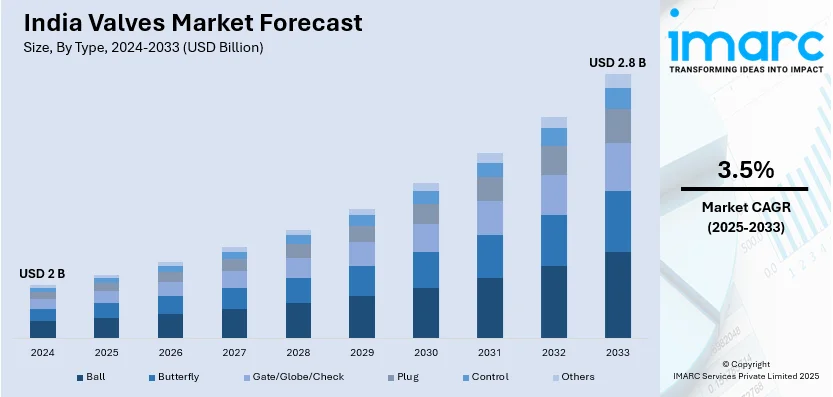

The India valves market size reached USD 2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. Rapid industrialization, infrastructure development, increasing demand in oil and gas, water treatment, and power sectors are some of the factors propelling the growth of the market. Government initiatives and rising automation in manufacturing also boost the demand for advanced valve technologies across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Market Growth Rate 2025-2033 | 3.5% |

India Valves Market Trends:

Expansion of High-Performance Valve Solutions

India’s industrial sectors, especially mining and power, are increasingly prioritizing access to advanced valve technologies designed for harsh conditions. Businesses are enhancing their footprint by integrating manufacturers that specialize in severe service valves with established infrastructure across the country. This approach not only broadens the availability of high-performance products but also improves after-sales support and field services. Emphasis is being placed on reducing downtime, extending equipment life, and meeting the stringent requirements of critical operations. With expanding energy needs and complex industrial processes, demand is shifting toward engineered flow control solutions backed by local service networks. This integration model is accelerating the delivery of reliable, efficient, and specialized valve systems across India's evolving industrial landscape. For example, in August 2024, Flowserve Corporation completed its acquisition of MOGAS Industries, a Houston-based manufacturer of severe service valves. MOGAS has established sales and service offices in India, among other countries, which are highly complementary to Flowserve’s served geographies. This acquisition is expected to strengthen Flowserve's presence in the Indian valves market, enhancing its product offerings and aftermarket services for industries such as mining and power.

To get more information on this market, Request Sample

Shift toward Integrated and Sustainable Valve Manufacturing

India is becoming a strategic hub for eco-conscious valve and plumbing solution providers. Companies are consolidating manufacturing, quality assurance, and corporate functions into unified facilities to streamline operations and reduce environmental impact. This integrated setup supports the growing need for green building materials and water-saving technologies. With increasing demand for sustainable infrastructure, the domestic market is also serving as a launchpad for exports across Southeast Asia and the Middle East. Local innovation, faster go-to-market strategies, and enhanced quality control are driving the adoption of water-efficient valve systems. These developments reflect a broader movement toward resource-efficient production models that cater to both regional infrastructure needs and global sustainability goals within the plumbing and valve segment. For instance, in April 2024, Sloan launched its first flagship experience center in Gurugram through its Indian subsidiary. The facility integrates manufacturing, quality control, and corporate operations under one roof. With the rising demand for eco-friendly valves and restroom solutions, this move positions the company to expand in India's plumbing and valve market. The center aims to support sustainable construction practices and local innovation for domestic use and future exports across Southeast Asia and the Middle East.

India Valves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and end-user vertical.

Type Insights:

- Ball

- Butterfly

- Gate/Globe/Check

- Plug

- Control

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes ball, butterfly, gate/globe/check, plug, control, and others.

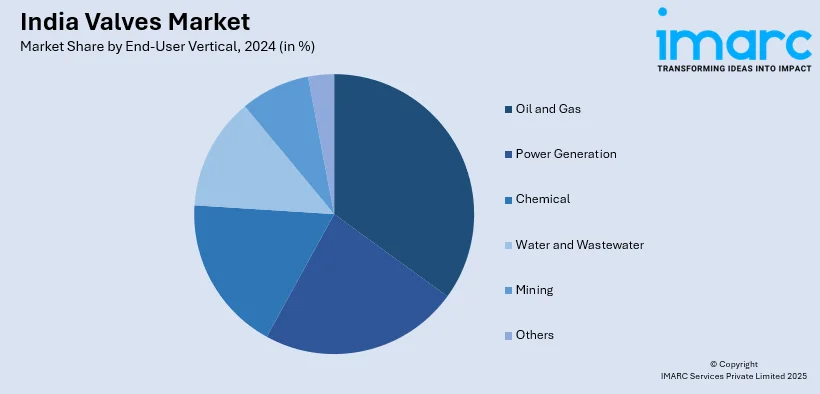

End-User Vertical Insights:

- Oil and Gas

- Power Generation

- Chemical

- Water and Wastewater

- Mining

- Others

A detailed breakup and analysis of the market based on the end-user vertical have also been provided in the report. This includes oil and gas, power generation, chemical, water and wastewater, mining, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Valves Market News:

- In November 2024, Raghu Vamsi Group acquired the UK-based PMC Group, a precision manufacturer of components used in oil and gas applications, including choke valve parts. This move enhances India’s capabilities in high-performance valve component production for global energy markets. With this acquisition, Raghu Vamsi aims to expand its manufacturing expertise and supply chain presence in critical valve assemblies, strengthening India's position in the global oil and gas equipment sector.

India Valves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ball, Butterfly, Gate/Globe/Check, Plug, Control, Others |

| End-User Verticals Covered | Oil, Gas, Power Generation, Chemical, Water, Wastewater, Mining, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India valves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India valves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India valves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The valves market in India was valued at USD 2 Billion in 2024.

The India valves market is projected to exhibit a CAGR of 3.5% during 2025-2033, reaching a value of USD 2.8 Billion by 2033.

The India valves market is driven by rapid industrialization, expanding oil and gas exploration, rising power generation needs, and growth in water and wastewater treatment projects. Increasing demand from chemical, pharmaceutical, and manufacturing sectors, along with infrastructure development and adoption of advanced automation technologies, further boost market growth and opportunities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)