India Vehicle Diagnostics Market Size, Share, Trends and Forecast by Vehicle Type, Connectivity, Application, and Region, 2025-2033

India Vehicle Diagnostics Market Overview:

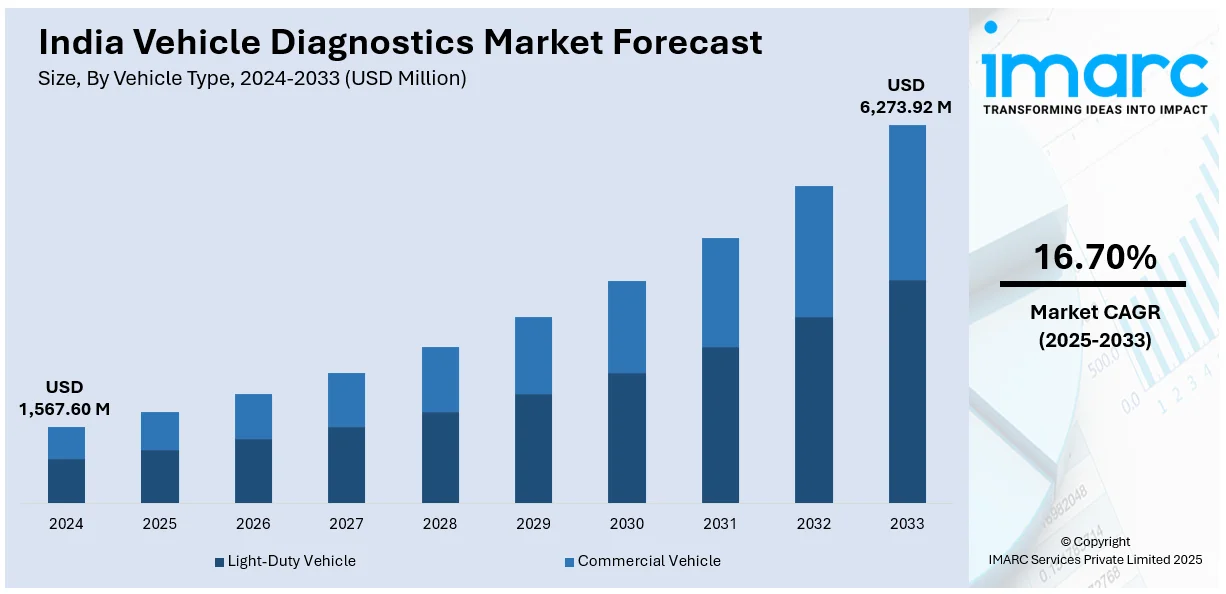

The India vehicle diagnostics market size reached USD 1,567.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,273.92 Million by 2033, exhibiting a growth rate (CAGR) of 16.70% during 2025-2033. The market is fueled by increasing adoption of connected cars, demand for real-time monitoring of vehicle health, and more stringent emissions regulations. Improved telematics, awareness of preventive maintenance among consumers, and the integration of OBD technology in advanced cars drive growth across automotive segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,567.60 Million |

| Market Forecast in 2033 | USD 6,273.92 Million |

| Market Growth Rate 2025-2033 | 16.70% |

India Vehicle Diagnostics Market Trends:

Rising Integration of Advanced Telematics and IoT in Vehicle Diagnostics

India’s vehicle diagnostics ecosystem is evolving rapidly with the growing adoption of telematics and Internet of Things (IoT) technologies. These systems allow real-time tracking of vehicle performance, predictive maintenance, and remote diagnostics, enhancing operational efficiency for both fleet operators and individual users. Automakers are now integrating telematics control units (TCUs) and cloud-based analytics into new vehicle models, enabling instant data transmission to service centers or mobile apps. This aligns with India’s smart mobility ambitions and the rising trend of connected vehicles. Government initiatives supporting smart transportation and road safety are further driving uptake. Reflecting this shift, the India automotive telematics market was valued at ₹555 crore in 2021, with the commercial vehicle segment accounting for 66% of the total market. The sector is poised for strong growth, reinforcing IoT-driven diagnostics as a vital component of modern mobility.

To get more information of this market, Request Sample

Increasing Demand for On-Board Diagnostics (OBD-II) Systems

Demand for OBD-II systems in India is increasing as regulatory environments and emission standards get more stringent. OBD-II systems enable real-time checks of engine health, emissions, fuel economy, and component failure. The adoption of Bharat Stage VI (BS-VI) emission standards has forced manufacturers to incorporate tough diagnostic systems to comply. OBD-II systems provide motorists and repair technicians with easily accessed diagnostic trouble codes (DTCs), allowing for timely repairs and lower long-term maintenance expenses. Additionally, growing consumer consciousness about vehicle health and maintenance prevention is driving aftermarket sales of portable OBD scanners. Increasing penetration of passenger vehicles and light commercial vehicles with inbuilt diagnostics is further boosting the market, as OBD-II becomes a mainstream technology in India's transforming automotive landscape.

Expansion of Digital Vehicle Health Monitoring and Predictive Analytics

Digital vehicle health monitoring systems based on AI-powered predictive analytics are gathering pace in India's diagnostics landscape. These solutions process real-time sensor data, past performance, and driver habits to predict component failures ahead of time. As cars become increasingly software-defined, predictive diagnostics supports reducing unplanned breakdowns and optimizing service intervals. OEMs and fleet managers are using these insights to maximize asset utilization and lower maintenance costs. This trend is also picking up in the electric vehicle space, where digital platforms play a key role in tracking battery health and motor efficiency. The transition from reactive to predictive maintenance is transforming the way diagnostics is viewed—not only as a repair tool, but as a strategic function that facilitates cost-effective, data-driven vehicle management.

India Vehicle Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vehicle type, connectivity, and application.

Vehicle Type Insights:

- Light-Duty Vehicle

- Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes light-duty vehicle, and commercial vehicle.

Connectivity Insights:

- 4G LTE

- 3G

- Bluetooth

- Wi-Fi

A detailed breakup and analysis of the market based on the connectivity have also been provided in the report. This includes 4G LTE, 3G, Bluetooth, and Wi-Fi.

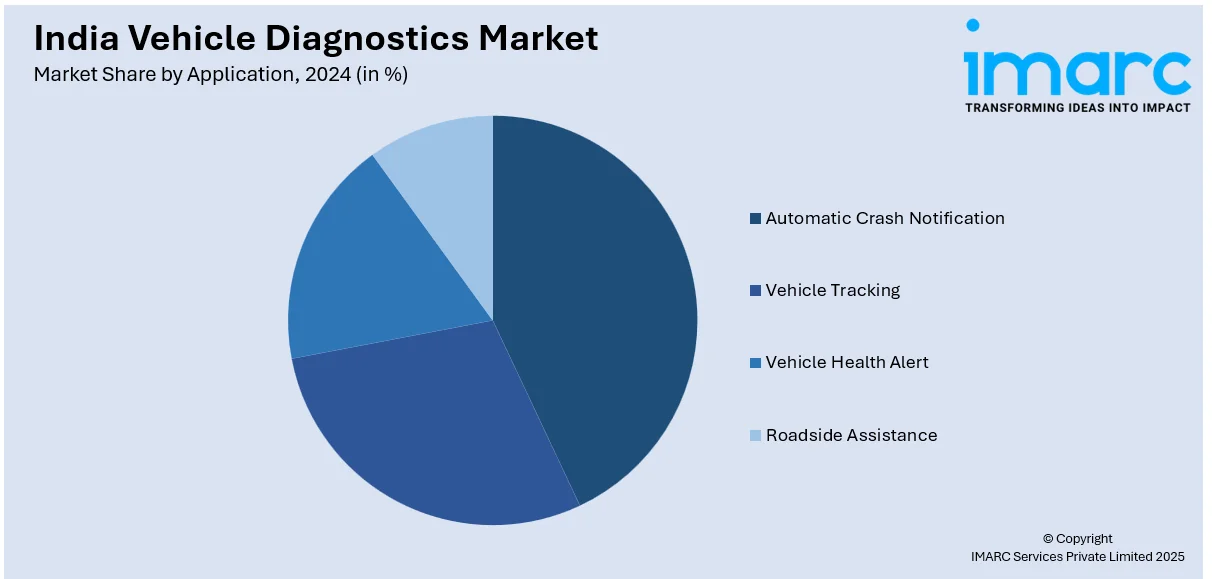

Application Insights:

- Automatic Crash Notification

- Vehicle Tracking

- Vehicle Health Alert

- Roadside Assistance

The report has provided a detailed breakup and analysis of the market based on the application. This includes automatic crash notification, vehicle tracking, vehicle health alert, and roadside assistance.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vehicle Diagnostics Market News:

- In August 2024, Ki Mobility's myTVS is set to launch an AI-driven diagnostics platform targeting the aftermarket car segment. Initially offered free, the company plans to monetize the service later. The platform aims to cater to an estimated 10-12 million vehicles, focusing primarily on cars over 4 meters in length, enhancing vehicle health monitoring and diagnostics capabilities in India’s growing automotive aftermarket landscape.

- In May 2024, Italy’s Texa launched the TXT Bharat, a multi-brand OBD diagnostic tool for commercial vehicles in India, targeting BS-III, BS-IV, and BS-VI compliant trucks, buses, LCVs, and off-highway vehicles. Paired with the IDC5 Bharat software, the tool is priced around ₹1.95 lakh and introduced in collaboration with Madhus Garage Equipment. It features advanced processing, Bluetooth, USB-C, and enhanced diagnostics capabilities to support India’s growing commercial vehicle aftermarket.

India Vehicle Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light-Duty Vehicle, Commercial Vehicle |

| Connectivitys Covered | 4G LTE, 3G, Bluetooth, Wi-Fi |

| Applications Covered | Automatic Crash Notification, Vehicle Tracking, Vehicle Health Alert, Roadside Assistance |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vehicle diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vehicle diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vehicle diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vehicle diagnostics market in India was valued at USD 1,567.60 Million in 2024.

The India vehicle diagnostics market is projected to exhibit a CAGR of 16.70% during 2025-2033, reaching a value of USD 6,273.92 Million by 2033.

The India vehicle diagnostics market is driven by the rising adoption of connected and smart vehicles, stricter emission and safety regulations, and growing demand for preventive maintenance. Increasing integration of advanced diagnostic tools and consumer preference for cost-efficient servicing further contribute to market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)