India Vehicle Leasing Market Size, Share, Trends and Forecast by Type, Mode of Booking, and Region, 2025-2033

India Vehicle Leasing Market Size and Share:

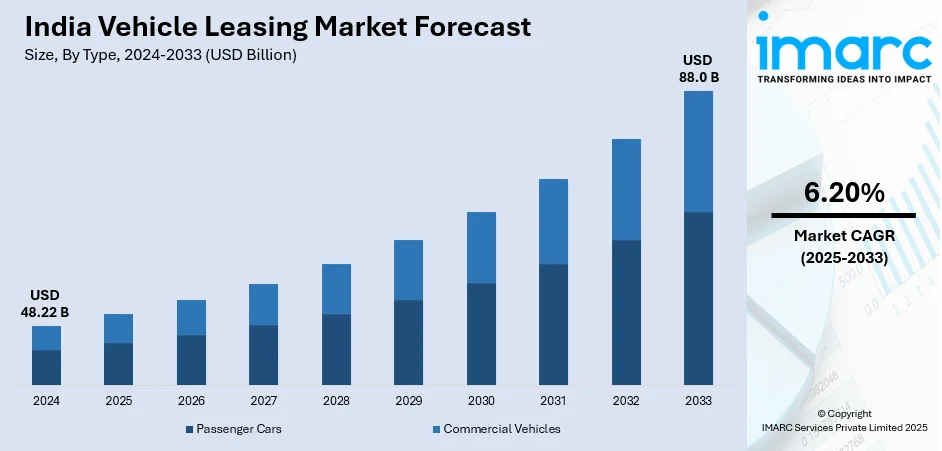

The India vehicle leasing market size was valued at USD 48.22 Billion in 2024. The market is projected to reach USD 88.0 Billion by 2033, exhibiting a CAGR of 6.20% from 2025-2033. The market is growing steadily due to urbanization, shifts in consumer choice, and the demand for low-cost, flexible mobility solutions. The use of leasing by corporate fleets and technology-savvy individuals is transforming the conventional model of ownership. Technology developments, improving demand for electric vehicles, and encouraging government policies are also fueling business growth. With increasing mobility patterns and a greater emphasis on operational efficiency, leasing is gaining popularity across industries, driving the increasing India vehicle leasing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 48.22 Billion |

| Market Forecast in 2033 | USD 88.0 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

Rising demand for flexible mobility solutions among urban professionals and enterprises to lower initial capital outlay is one of the principal drivers of the India vehicle leasing market. For instance, in December 2024, Zoomcar planned to introduce a chauffeur-driven cab rental service in Bengaluru, going beyond the self-drive offerings to experiment with wider demand in India's transportation and vehicle leasing industry. Furthermore, leasing provides a competing model of ownership that enables clients to reap the advantages of a vehicle without the long-term financial obligation of a purchase. This is particularly the case in a world where lifestyle trends are changing, and people value convenience and cost-effectiveness above the ownership of assets. Additionally, companies are increasingly favoring leasing in order to retain up-to-date, fuel-efficient fleets without taking on the depreciation risk and administrative costs of conventional ownership. Subscription-based models and operating lease structures extend this trend further by providing value-added services in the form of maintenance, insurance, and roadside assistance. Further, these benefits provide amplified cost predictability, operational flexibility, and simpler fleet management, thus driving long-term growth in the demand for vehicle leasing across corporate and individual consumer segments in India.

To get more information on this market, Request Sample

The increasing realization among businesses of the total cost of ownership (TCO) and its influence on budgeting and utilization of assets is playing a major role in driving India vehicle leasing market trends. Leasing deals facilitate consumers and businesses to maximize the use of vehicles with diffused costs over a known duration. For firms, this arrangement eliminates cash flow management challenges and provides room for improved management of financial resources toward key business activities. Moreover, the lease agreement structure also usually incorporates packaged services such as maintenance, insurance, and telematics to help mitigate unexpected costs and optimize fleet uptime. As per the sources, in May 2024, Mufin Green Finance collaborated with Roadcast to lease GPS-equipped electric three-wheelers in India. This partnership combines IoT technology for vehicle tracking, with the objective of revolutionizing electric vehicle leasing efficiency and risk management in the Indian market. Furthermore, the leasing model is also congruent with growing regulatory emphasis on environmental sustainability and emissions control, as lessees can update to newer models that are environment friendly on a regular basis. Technological innovation and the rise of digital leasing platforms have simplified and increased transparency in the leasing process. Together, these developments are enabling well-informed and financially savvy consumers to more easily transition to vehicle leasing within India’s rapidly evolving transportation landscape.

India Vehicle Leasing Market Trends:

Growth of SUVs in Vehicle Leasing

The robust upsurge in the demand for sport utility vehicles (SUVs) is transforming India's vehicle leasing industry. SUVs in 2024 represented approximately 55% of total passenger vehicle sales for the year, up from below 50% in 2023, as reported by SIAM. These cars are appreciated due to their roomy interiors, elevated seating level, and higher ground clearance, making them popular with family consumers and business users alike. Leasing is now a popular option for using SUVs, with affordable monthly packages without the need for vehicle ownership. It allows customers to enjoy luxurious vehicles with fewer financial commitments and simpler upgrade paths. Moreover, the availability of electric and hybrid SUVs also backs leasing adoption since customers are more willing to experiment with newer technologies without committing long-term. Expansion in availability of SUV-specific lease packs that align with varying user requirements also sees a rise. SUV leasing will find increasing importance in India's mobility mix as customers look for comfort, safety, and technology. According to recent India vehicle leasing market forecast, this trend is expected to significantly accelerate overall leasing penetration, positioning SUVs as a cornerstone in the country’s evolving leasing landscape.

Integration of Vehicle Leasing into the MaaS Ecosystem

Car leasing is becoming a vital support beam in India's growing Mobility-as-a-Service (MaaS) ecosystem. As cities grow and congestions worsen, urban shoppers are trending toward flexible mobility patterns like ride-hailing, car sharing, and vehicle subscription. Leasing allows mobility platforms and fleet operators to expand business without shouldering the entire burden of automobile ownership. Leasing is bringing about capital efficiency, ease in fleet management, and constant access to new model vehicles. This makes it the perfect option for companies looking to adjust to dynamic demand and shifting regulatory landscapes. The trend towards electric mobility in MaaS also increases the appeal of leasing, since it resolves issues of high initial upfront EV expenditure and battery duration. Government initiatives promoting sustainable transport and intelligent mobility solutions are also driving leasing expansion. As India's digital mobility platforms continue to develop, vehicle leasing is assuming a central role in providing operational agility, economic sustainability, and user-satisfying service delivery within emerging urban transport systems.

Consumer Taste for Flexibility and Cost-Effectiveness

One significant trend driving India's vehicle leasing industry is the increasing taste for flexibility and financial certainty among consumers. People highly value access over ownership, and prefer leasing as a package that offers mobility without the long-term cost commitment. Leasing is characterized by lower upfront payments, fixed tenures, and inclusive packages that commonly include insurance, maintenance, and roadside assistance. Salaried individuals, gig economy workers, and younger consumers are the primary beneficiaries of these characteristics, which include convenience, transparent budgeting, and frequent upgrades. At a time when car prices are on the increase and interest on loans remains unstable, leasing provides stable monthly expenses without compromising lines of credit. The model also promotes sustainability through the rotation of newer, lower-fuel-consumption or electric vehicles, harmonizing with changing green priorities. With increasing awareness and leasing platforms growing accessible through online channels, the transition toward low-cost, agile, and service-based mobility solutions is likely to speed up in India's personal and business transport sectors.

India Vehicle Leasing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India vehicle leasing market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and mode of booking.

Analysis by Type:

- Passenger Cars

- Commercial Vehicles

Passenger vehicles comprise a significant portion of India's vehicle leasing business owing to growing demand from urban professionals, small enterprises, and families. Leasing provides access to higher-end models, reduced initial costs, and flexible duration, which makes it a sought-after mobility solution for city users looking for convenience and value.

Commercial vehicles are being increasingly leased by logistics companies, fleet operators, and corporate players looking to maximize transport without major capital outlays. Leasing ensures fixed maintenance, tax benefits, and fleet upgrade options, and it is ideal for industries such as goods delivery, employee transport, and service-based operations in India.

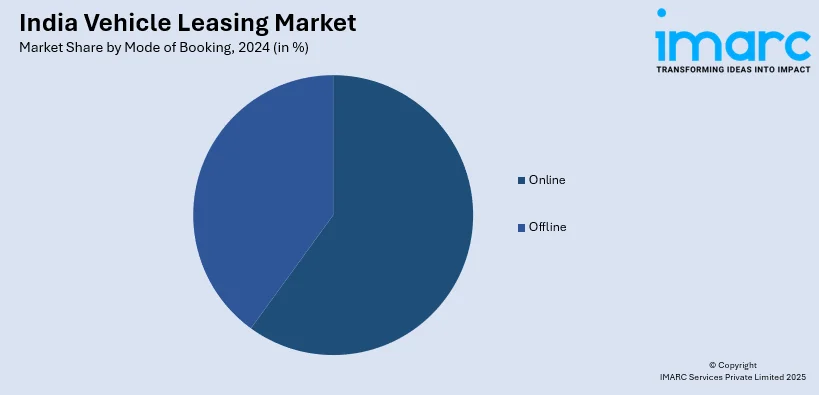

Analysis by Mode of Booking:

- Online

- Offline

Online booking channels are picking up pace as digital adoption accelerates in India. Consumers like online platforms for their transparency, ease of comparison, and paperless processing. Leasing providers are making their websites and mobile apps more superior to provide customized plans, real-time approvals, and end-to-end services, driving digital leasing penetration.

Off-line leasing continues to exist despite the growth of digitalization, particularly in tier-2 and tier-3 cities. Offline interactions at physical dealerships are more about trust and customized consultations. A lot of customers are dependent on visitations for paperwork verification, test rides, and negotiation to ensure that conventional modes of booking still go hand-in-hand with online services.

Regional Analysis:

- North India

- South India

- East India

- West India

As per the India vehicle leasing market analysis North India's vehicle leasing business is growing with high urbanization, business expansion, and increasing demand for flexible motor ownership models. Metro markets, with robust infrastructure development, enable lease uptake by both individual customers and corporate fleets, particularly within the National Capital Region and its neighboring districts.

South India is at the forefront of technology usage and structured fleet operations, directly driving growth in vehicle leasing. Being home to a number of IT centers, industrial clusters, and high urban mobility, the region demonstrates high demand for leased vehicles, especially among corporate mobility service providers and young professionals.

East India car leasing is growing steadily as more people become aware and companies seek affordable fleet options. Although still a developing phenomenon relative to other areas, the region has potential because of infrastructure developments, urbanization, and government initiatives to encourage non-traditional ownership structures in cities and business areas.

West India shows strong vehicle leasing activity, fueled by economic centers and high demand for vehicles. Large cities with high commercial activity support leasing between logistics companies and urban travelers. Good demographics, increasing disposable incomes, and access to digital platforms underpin the growing popularity of leasing compared to traditional car ownership.

Competitive Landscape:

India vehicle leasing market outlook is a combination of incumbent leasing players, new mobility startups, and traditional automobile manufacturers venturing into the leasing segment. The players provide varied leasing options such as operational leases, finance leases, and subscription-based models to individual and corporate clients. Market players are distinguishing themselves via bespoke plans, all-inclusive service bundles, and digital-native platforms to reach urban consumers who are looking for affordable and flexible mobility. Integration of technology in the form of telematics and app-based management of services further boosts user experience and operational performance. Partnerships with automotive original equipment manufacturers, fintech companies, and ride-hailing platforms are becoming increasingly prevalent, facilitating India vehicle leasing market growth and exposure to new consumer groups. In addition, the move towards electric cars is encouraging leasing companies to introduce EV-specific plans that attract green-conscious users. On the whole, the competitive landscape is shifting with firms utilizing innovation, services quality, and online accessibility as tools for solidifying their stance in an increasingly dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the India vehicle leasing market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Tata Motors partnered with Vertelo to offer customized leasing solutions for electric commercial vehicles across India. The MoU supports EV adoption with end-to-end services including financing, charging, and fleet management. Vertelo, backed by USD 200 Million from the Green Climate Fund, aims to scale sustainable transport nationwide.

- March 2025: Rilox EV announced the April launch of its leasing arm, Rilox E-Mobility, targeting 25,000 EV leases by its third year. The division integrates IoT-based fleet management, OEM manufacturing strengths, and partnerships with battery-swapping providers to offer efficient, localized, and sustainable electric mobility solutions for Indian conditions.

- January 2025: MoEVing acquired Euler Motors’ EVonGO, becoming India’s largest commercial EV fleet operator. The deal expanded MoEVing’s fleet by 30%, adding 300 L5 vehicles and strengthening presence in Delhi NCR, Bangalore, and Hyderabad. EVonGO's institutional EV leasing model enhances MoEVing’s logistics and fleet leasing capabilities nationwide.

- December 2024: BluSmart announced that its asset-leasing program, Assure by BluSmart, crossed INR 100 Crore in financing within a year, growing tenfold monthly. Backed by green finance partners, the initiative supports EV fleet expansion and offers investors strong returns and tax benefits, reinforcing BluSmart’s zero-emission transport mission in India.

- August 2024: Kia India launched the 'Kia Subscribe' plan in partnership with ALD Automotive, offering 12–36-month flexible leases across 14 cities. Complementing the earlier 'Kia Lease' program, it targets customers seeking short-term mobility solutions without ownership, with added perks like maintenance and insurance included.

India Vehicle Leasing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passenger Cars, Commercial Vehicles |

| Mode of Bookings Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vehicle leasing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vehicle leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vehicle leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vehicle leasing market the India was valued at USD 48.22 Billion in 2024.

The India vehicle leasing market is projected to exhibit a CAGR of 6.20% during 2025-2033, reaching a value of USD 88.0 Billion by 2033.

The major driving forces for the India vehicle leasing market are growing need for affordable mobility, preference for access rather than ownership, corporate fleet expansion, urbanization growth, and rising awareness of total cost of ownership. Electric vehicles and digital platforms also enable leasing as a convenient transportation option.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)