India Veneer Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Veneer Market Overview:

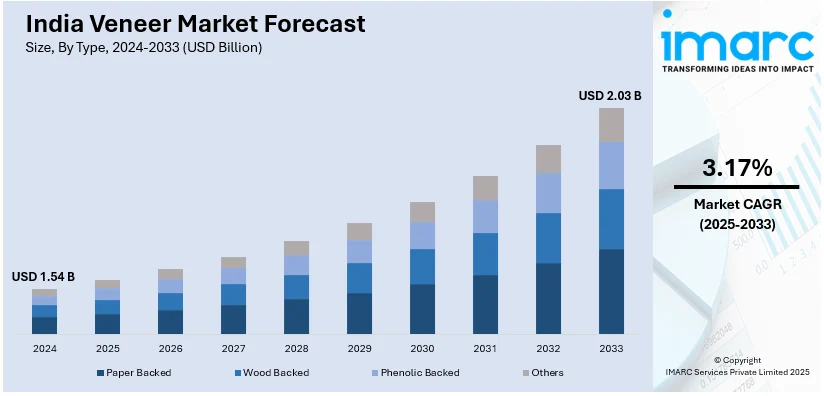

The India veneer market size reached USD 1.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.03 Billion by 2033, exhibiting a growth rate (CAGR) of 3.17% during 2025-2033. The market is growing due to rising demand for premium interior solutions, especially in urban housing and commercial spaces. Consumers are preferring natural textures, boosting interest in sustainable and decorative wood veneers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.54 Billion |

| Market Forecast in 2033 | USD 2.03 Billion |

| Market Growth Rate 2025-2033 | 3.17% |

India Veneer Market Trends:

Rising Demand from Urban Interiors

The India veneer market is observing strong traction from urban residential and commercial sectors. Rapid urbanization, growing disposable income, and rising aesthetic awareness are encouraging homeowners and interior designers to opt for wood veneers over alternatives like laminates or paints. Veneers offer a natural look and premium feel, which is becoming a key differentiator in high-end home décor. The demand is especially visible in metro cities, where consumers are willing to invest more in customized, elegant interiors that combine quality with sustainability. Offices, hotels, and retail stores are also adopting veneer finishes for furniture, wall panels, and cabinetry to reflect a modern and luxurious style. In recent developments, several veneer producers are introducing advanced finishing techniques that enhance texture and durability. Some Indian brands are launching collections with smoke-finished, hand-scraped, or wire-brushed effects to appeal to design-conscious buyers. Manufacturers are also offering tailor-made designs for modular furniture brands and architects. The shift toward ready-to-install veneer panels is simplifying installation for contractors and reducing on-site labor time. Additionally, local production is expanding to meet demand, reducing dependence on imports and offering regionally sourced options for buyers. These changes are strengthening the position of veneers in India’s premium surface material segment.

To get more information of this market, Request Sample

Sustainability Shaping Purchase Choices

Sustainability is becoming a major consideration among Indian consumers and businesses in the surface materials market. As awareness around deforestation and ecological impact increases, customers are showing interest in responsibly sourced wood veneers. This trend is influencing both manufacturers and retailers to adjust their sourcing and production practices. Certifications like FSC (Forest Stewardship Council) are gaining visibility among builders and furniture makers, who are now expected to provide eco-friendly options. Veneers made from plantation-grown wood or fast-replenishing species are gaining preference, especially in institutional projects and green-certified buildings. Over the past year, several Indian veneer companies have started highlighting their use of low-emission adhesives and water-based coatings. Some are adopting energy-efficient manufacturing methods and publishing sustainability reports to attract eco-conscious buyers. Additionally, partnerships with forestry organizations and local communities are being used to ensure ethical timber sourcing. These initiatives are not only helping brands build trust but also aligning them with global procurement standards. As large furniture and real estate firms adopt environmental compliance practices, veneer makers supplying to these sectors are being encouraged to maintain transparency in their supply chains. This shift is gradually establishing sustainability as a competitive advantage in the Indian veneer industry.

India Veneer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Paper Backed

- Wood Backed

- Phenolic Backed

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes paper backed, wood backed, phenolic backed, and others.

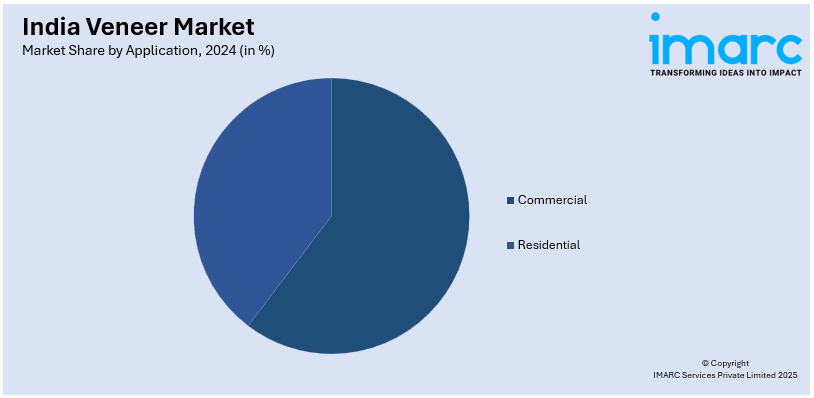

Application Insights:

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Veneer Market News:

- August 2024: Duroply Industries showcased its premium veneer collections, including Nature's Signature and Masterpiece, at Matecia 2024 in New Delhi. This strengthened brand visibility, promoted sustainable veneer design, and reinforced industry growth through innovation and industry collaboration in India’s decorative surfaces segment.

- April 2024: Sloan Valve Company launched its flagship experience center in Gurugram, integrating veneers in its interior design. This enhanced veneer visibility in commercial spaces, highlighting demand for premium finishes and contributing to growth in India’s decorative surface materials and architectural design segments.

India Veneer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Paper Backed, Wood Backed, Phenolic Backed, Others |

| Applications Covered | Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India veneer market performed so far and how will it perform in the coming years?

- What is the breakup of the India veneer market on the basis of type?

- What is the breakup of the India veneer market on the basis of application?

- What are the various stages in the value chain of the India veneer market?

- What are the key driving factors and challenges in the India veneer market?

- What is the structure of the India veneer market and who are the key players?

- What is the degree of competition in the India veneer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India veneer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India veneer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India veneer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)