India Version Control Systems Market Size, Share, Trends and Forecast by Type, Deployment Type, Enterprise Size, End Use and Region, 2025-2033

India Version Control Systems Market Overview:

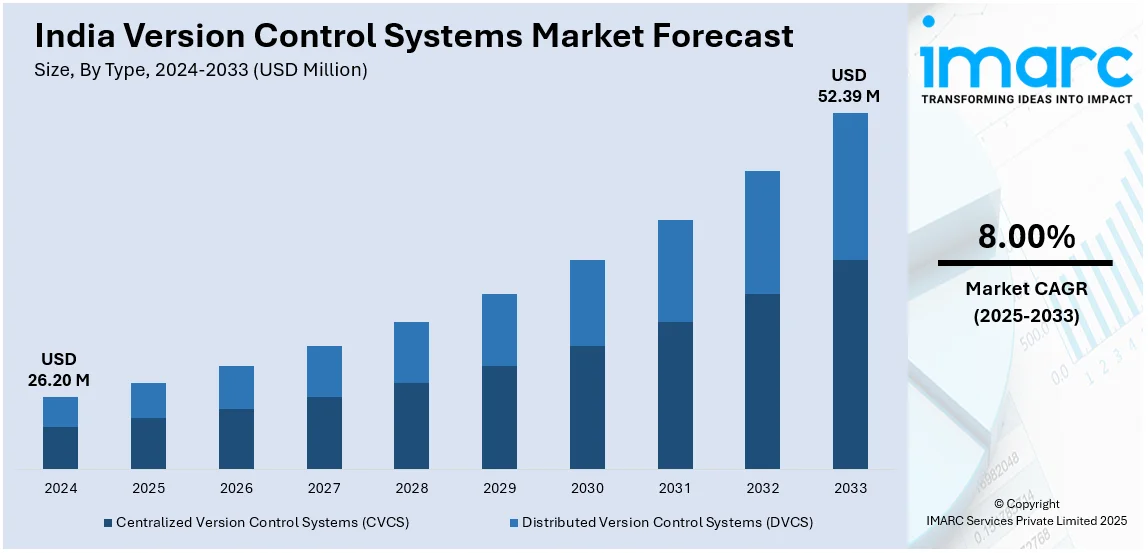

The India version control systems market size reached USD 26.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 52.39 Million by 2033, exhibiting a growth rate (CAGR) of 8.00% during 2025-2033. The rising software development activities, increasing adoption of DevOps and Agile methodologies, growing demand for cloud-based collaboration tools, heightened focus on software security, and the implementation of government initiatives supporting digital transformation are some of the major factors augmenting India version control systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.20 Million |

| Market Forecast in 2033 | USD 52.39 Million |

| Market Growth Rate 2025-2033 | 8.00% |

India Version Control Systems Market Trends:

Rising Adoption of Cloud-Based Version Control Systems

The shift towards cloud-based solutions due to the increasing need for remote collaboration, scalability, and cost efficiency is positively impacting the India version control systems market outlook. Businesses are increasingly adopting cloud-based version control systems like GitHub, GitLab, and Bitbucket to streamline software development across distributed teams. In addition to this, cloud platforms' seamless integration with CI/CD pipelines enables faster deployment cycles and enhancing operational efficiency. Furthermore, the pay-as-you-go pricing model appeals to startups and SMEs by reducing infrastructure costs while offering automatic updates, further accelerating cloud adoption in India's developer ecosystem. Cloud systems deliver enhanced security from encrypted storage to multi-factor authentication and support of international standards. Hybrid solutions blending on-premises and cloud-based repositories also gain traction within enterprises demanding control over data as well as adherence to regulatory rules. The surge in digital transformation projects, especially in banking, e-commerce, and IT services, is fueling this trend. For instance, on November 18, 2024, the Reserve Bank of India (RBI) announced plans to launch a pilot program in 2025 to provide affordable local cloud services for financial institutions, aiming to challenge the dominance of global providers. This initiative seeks to support smaller banking and financial services firms that find existing cloud offerings unaffordable. Also, the implementation of government initiatives supports cloud deployment as it urges businesses to move to digital infrastructure. Therefore, version control systems in the cloud are turning out to be the go-to option for companies seeking agility, automation, and higher-level collaboration in software development.

To get more information of this market, Request Sample

Integration of Artificial Intelligence (AI) and Automation in Version Control Systems

Artificial Intelligence (AI) powered automation is facilitating India version control systems market growth as it improves code quality, reduces development time, and enhances efficiency. Advanced AI-driven features like intelligent code review, automated bug detection, and predictive analytics are being integrated. These tools benefit developers by providing optimized code suggestions, vulnerability detection, and compliance with coding standards. Artificial intelligence-powered branch management eliminates the need for manual merge conflict resolution, decreasing human intervention and enhancing the efficiency of workflows. Businesses are also using AI-driven analytics to capture insights on developer productivity, commit patterns, and project schedules. Version control automation is especially useful in the case of projects with large scales regular updates and multiple team collaborations. Indian fintech, IT services, and telecommunication businesses are implementing AI-powered version control systems to speed up software development and enhance security. According to an industry report, about 30% of Indian businesses have fully tapped AI's potential, surpassing the global average of 26%, highlighting the country's rapid AI adoption. As enterprises increasingly leverage AI-driven automation for software development, version control systems integrating AI capabilities are becoming a critical asset, enhancing code quality, efficiency, and security across development workflows.

India Version Control Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, deployment type, enterprise size, and end use.

Type Insights:

- Centralized Version Control Systems (CVCS)

- Distributed Version Control Systems (DVCS)

The report has provided a detailed breakup and analysis of the market based on the type. This includes centralized version control systems (CVCS) and distributed version control systems (DVCS).

Deployment Type Insights:

- On-premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprise and small and medium enterprises.

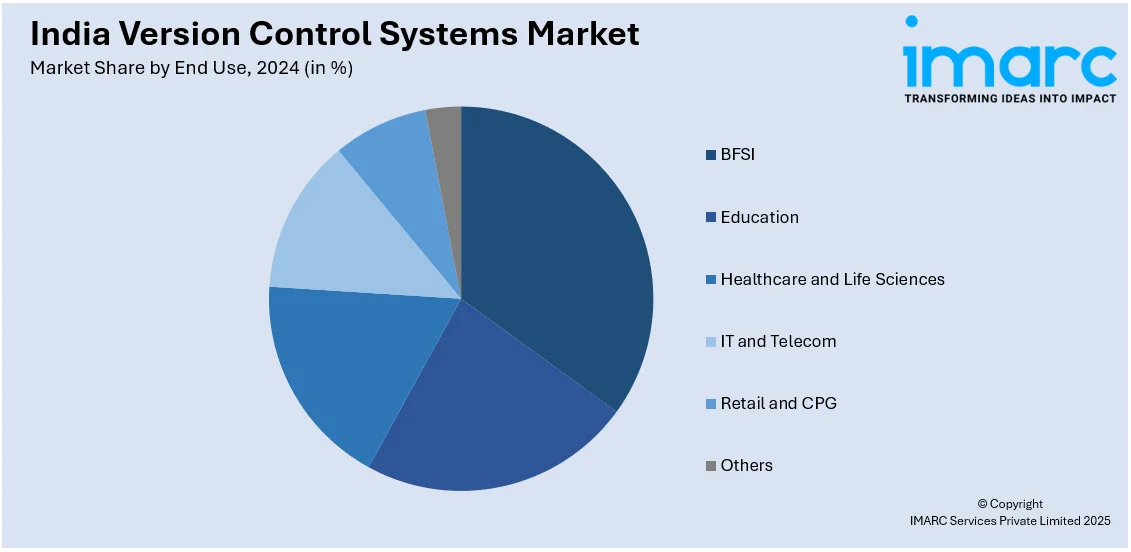

End Use Insights:

- BFSI

- Education

- Healthcare and Life Sciences

- IT and Telecom

- Retail and CPG

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes BFSI, education, healthcare and life sciences, IT and telecom, retail and CPG, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Version Control Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Centralized Version Control Systems (CVCS), Distributed Version Control Systems (DVCS) |

| Deployment Types Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium Enterprises |

| End Uses Covered | BFSI, Education, Healthcare and Life Sciences, IT and Telecom, Retail and CPG, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India version control systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India version control systems market on the basis of type?

- What is the breakup of the India version control systems market on the basis of deployment type?

- What is the breakup of the India version control systems market on the basis of enterprise size?

- What is the breakup of the India version control systems market on the basis of end uses?

- What is the breakup of the India version control systems market on the basis of region?

- What are the various stages in the value chain of the India version control systems market?

- What are the key driving factors and challenges in the India version control systems market?

- What is the structure of the India version control systems market and who are the key players?

- What is the degree of competition in the India version control systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India version control systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India version control systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India version control systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)