India Veterinary Diagnostics Market Size, Share, Trends and Forecast by Product, Technology, Animal Type, Disease Type, End User, and Region, 2025-2033

India Veterinary Diagnostics Market Overview:

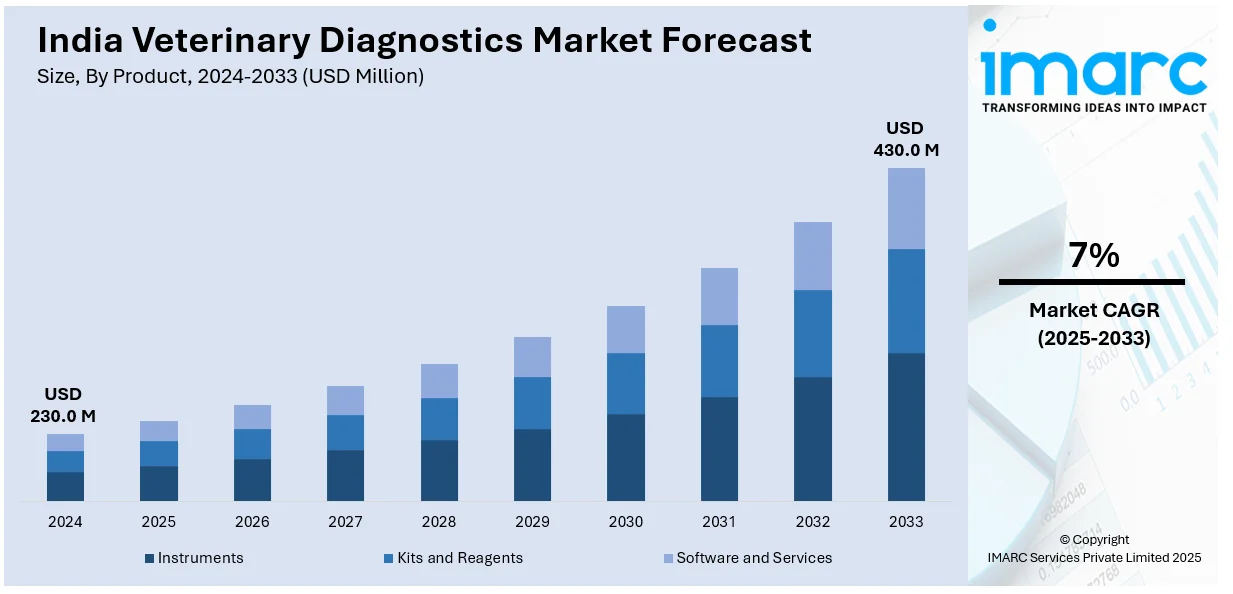

The India veterinary diagnostics market size reached USD 230.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 430.0 Million by 2033, exhibiting a growth rate (CAGR) of 7% during 2025-2033. The market is driven by a vast livestock population, increasing pet ownership, government initiatives like NADCP, advancements in diagnostic technology, rising awareness about zoonotic diseases, escalating demand for quality animal healthcare, expansion of veterinary research facilities, and digital platforms enhancing accessibility to diagnostic services across urban and rural areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 230.0 Million |

| Market Forecast in 2033 | USD 430.0 Million |

| Market Growth Rate (2025-2033) | 7% |

India Veterinary Diagnostics Market Trends:

Increasing Scale of Livestock Farming

Livestock farming in India is the backbone of India's agricultural sector, and with one of the biggest livestock in the world, India is positioned well. With data provided by the Department of Animal Husbandry and Dairying, the country produced about 230.58 million tons of milk in the year 2022-23, averaging per capita at 459 grams per day. This is a rise from 221.06 million tons during the 2021-22 financial year, with per capita availability being 444 grams per day. Egg production also touched 138.38 billion units in the same period. The large and varied population of livestock requires detailed veterinary diagnostic facilities to ensure the well-being and productivity of these animals. Health checks on a regular basis, surveillance for diseases, and timely medical care are integral parts of livestock management. With the rapid expansion of the livestock business, the necessity for advanced diagnostics and services has become quite imperative. This need includes regular screenings, disease diagnosis, and surveillance of animal health indicators, highlighting the central position of veterinary diagnostics in maintaining and improving livestock productivity.

To get more information of this market, Request Sample

Robust Government Initiatives

The Government of India has introduced a number of initiatives that directly impact the veterinary diagnostics market in terms of animal healthcare. Among these, the National Animal Disease Control Program (NADCP) was initiated with the ambitious target of eliminating Foot and Mouth Disease (FMD) and Brucellosis by 2030. Vaccinating 500 million livestock against FMD and 36 million female bovines against Brucellosis each year is the objective of the program, which demonstrates a strong resolve for animal health. Another significant initiative is the Rashtriya Gokul Mission, which aims to develop and conserve indigenous bovine breeds. The mission seeks to improve the genetic quality of cattle and bovine populations, including their productivity and health. The organization of Gokul Gram cattle care centers as part of this mission is a step to encourage rearing of high-genetic-merit indigenous breeds. In addition to that, the introduction of the e-Pashuhaat portal has transformed the livestock market by offering a computer platform for entrepreneurs and farmers. Through this platform, buying and selling of frozen semen, embryos, and livestock are enabled, as well as providing information on fodder and feed. By structuring the livestock market, e-Pashuhaat offers improved access to quality breeding material, hence promoting general health and productivity of livestock. These government programs have provided a favorable environment for the development of veterinary diagnostics in India. Through their focus on animal health and productivity, these programs have generated increased demand for effective diagnostic services, enabling early disease detection and control, and consequently contributing to the well-being of the livestock sector.

India Veterinary Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, technology, animal type, disease type, and end user.

Product Insights:

- Instruments

- Kits and Reagents

- Software and Services

The report has provided a detailed breakup and analysis of the market based on the product. This includes instruments, kits and reagents, and software and services.

Technology Insights:

- Immunodiagnostics

- Clinical Biochemistry

- Molecular Diagnostics

- Hematology

- Others

A detailed breakup and analysis of the market based on technology have also been provided in the report. This includes immunodiagnostics, clinical biochemistry, molecular diagnostics, hematology, and others.

Animal Type Insights:

- Companion Animals

- Dogs

- Cats

- Others

- Livestock Animals

- Cattle

- Swine

- Poultry

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes companion animals (dogs, cats, and others) and livestock animals (cattle, swine, poultry, and others).

Disease Type Insights:

- Infectious Diseases

- Non-Infectious Diseases

- Hereditary, Congenital and Acquired Diseases

- General Ailments

- Structural and Functional Diseases

A detailed breakup and analysis of the market based on the disease type have also been provided in the report. This includes infectious diseases, non-infectious diseases, hereditary, congenital and acquired diseases, general ailments, and structural and functional diseases.

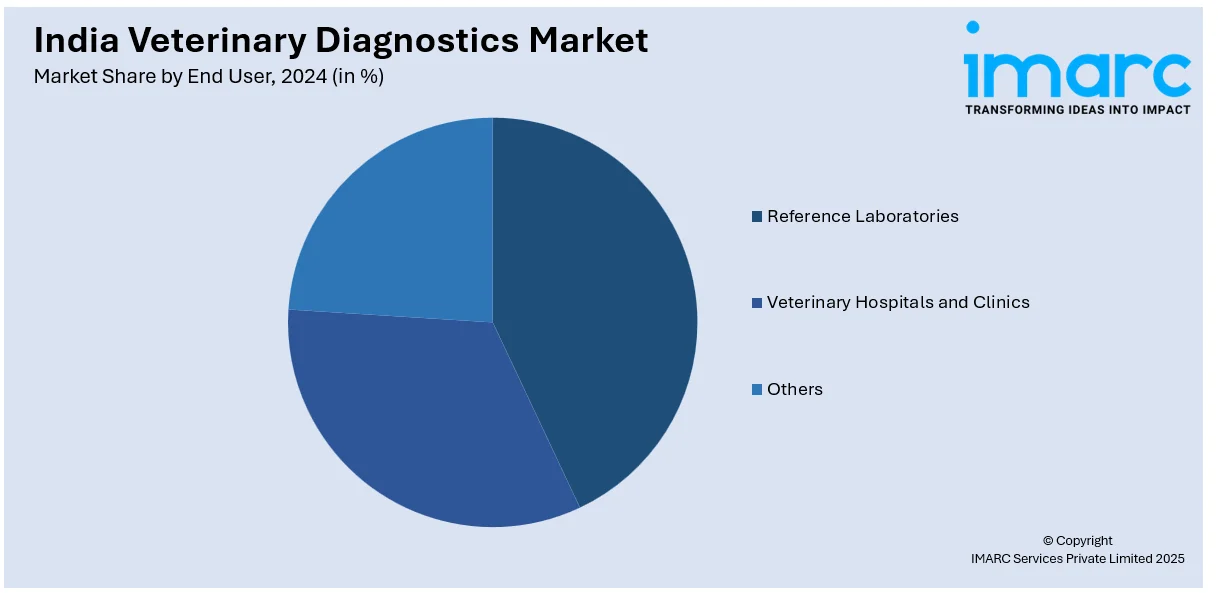

End User Insights:

- Reference Laboratories

- Veterinary Hospitals and Clinics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes reference laboratories, veterinary hospitals and clinics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Veterinary Diagnostics Market News:

- January 2025: A new leptospirosis reference laboratory was dedicated to ICAR-NIVEDI in Bengaluru, boosting India's diagnostic strength for zoonotic ailments. Fully equipped with high-end facilities, the lab enhances research and surveillance of diseases. In 2021-2024, around 11,205 samples were tested across the country, proving robust coverage. This move enables India's veterinary diagnostics industry by enhancing the early detection and control of animal diseases to ensure improved livestock health and productivity.

- October 2024: Guru Angad Dev Veterinary and Animal Sciences University, Ludhiana, was given INR 29 lakhs by India's Department of Biotechnology to create a sophisticated diagnostic device for pig disease. The project entails distinguishing between Porcine Parvovirus types by the use of Tetra ARMS PCR and computational tools. This grant improves veterinary diagnostics in India through enhanced detection of disease in commercial pig farming, aiding animal health, and accelerating research in veterinary microbiology.

- June 2024: The Indian government entered into an agreement to upgrade the Biocontainment Facility at CCSNAIH, improving veterinary vaccine and diagnostic testing. The improvement reinforces disease detection and quality control, leading to improved animal healthcare. With enhanced infrastructure, the veterinary diagnostics sector gains from enhanced research, helping in livestock health and productivity.

India Veterinary Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Instruments, Kits and Reagents, Software and Services |

| Technologies Covered | Immunodiagnostics, Clinical Biochemistry, Molecular Diagnostics, Hematology, Others |

| Animal Types Covered |

|

| Disease Types Covered | Infectious Diseases, Non-Infectious Diseases, Hereditary, Congenital and Acquired Diseases, General Ailments, Structural and Functional Diseases |

| End Users Covered | Reference Laboratories, Veterinary Hospitals and Clinics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India veterinary diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India veterinary diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India veterinary diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The veterinary diagnostics market in India was valued at USD 230.0 Million in 2024.

The India veterinary diagnostics market is projected to exhibit a CAGR of 7% during 2025-2033, reaching a value of USD 430.0 Million by 2033.

The veterinary diagnostics market in India is gaining momentum due to higher pet adoption, better disease awareness, and growth in livestock care. Technological improvements in testing methods and supportive government actions are also fueling demand for early and accurate animal health assessments nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)