India Veterinary Nutritional Supplements Market Size, Share, Trends and Forecast by Supplement Type, Animal Type, Formulation Type, Distribution Channel, and Region, 2025-2033

India Veterinary Nutritional Supplements Market Size and Share:

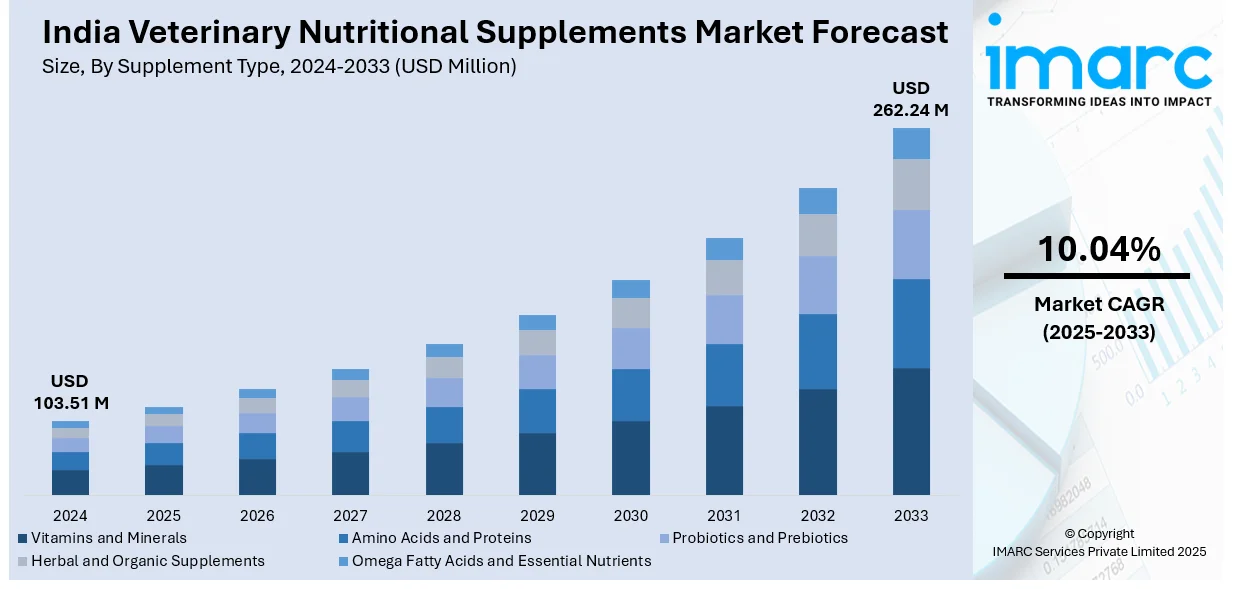

The India veterinary nutritional supplements market size reached USD 103.51 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 262.24 Million by 2033, exhibiting a growth rate (CAGR) of 10.04% during 2025-2033. Factors driving the market include an growing livestock population, increased awareness of animal health, rising demand for quality animal-derived products, and the prevalence of nutritional deficiencies. Further, growth in pet ownership, advancements in supplement formulations, and government initiatives that support animal welfare are also promoting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 103.51 Million |

| Market Forecast in 2033 | USD 262.24 Million |

| Market Growth Rate 2025-2033 | 10.04% |

India Veterinary Nutritional Supplements Market Trends:

Rising Popularity of Functional and Specialty Supplements

The market is seeing a significant move towards functional and specialty supplements that are intended to provide solutions for particular health issues in animals. Supplements that are probiotic, prebiotic, and omega fatty acid enriched are becoming popular, especially for use in digestive health, joint care, and skin and coat condition. Livestock producers and pet owners are being more inclined towards these specific solutions for delivering maximum animal welfare and productivity. Manufacturers are paying attention to research-based formulations and clinical trials for supporting product claims, adding yet another level of consumer confidence. Moreover, increased focus on preventive healthcare and inclusion of plant or natural ingredients is influencing product formulation strategies in this segment. For instance, in February 2025, Elanco Animal Health, which operates in India through its subsidiary, Elanco India Private Limited, launched Pet Protect, a new line of veterinarian-formulated supplements for dogs and cats. Designed for complete pet wellness, the range includes products for joint health, multivitamins, Omega-3, calming support, allergy relief, and digestive health. Backed by science and bearing the Advantage brand name, Pet Protect targets the growing demand for proactive pet care. Elanco aims to strengthen its market presence by offering accessible, high-quality supplements to pet owners seeking preventive healthcare solutions.

To get more information of this market, Request Sample

Increasing Emphasis on Livestock Productivity and Sustainability

The growing demand for high-quality dairy, meat, and poultry products is driving the adoption of veterinary nutritional supplements to enhance livestock productivity. Farmers are incorporating feed additives fortified with vitamins, minerals, amino acids, and other essential nutrients to optimize animal growth, reproductive health, and immunity. Moreover, sustainability considerations are leading to the development of supplements that promote efficient feed conversion and reduce methane emissions. Industry players are collaborating with agricultural organizations and veterinary experts to offer tailored nutrition programs, fostering responsible livestock management. Additionally, government initiatives supporting animal husbandry practices and productivity enhancement are further encouraging supplement usage in commercial livestock farming. For instance, in March 2025, the Union Cabinet approved a ₹3,880 crore revision for the Livestock Health and Disease Control Programme (LHDCP) for 2024-25 and 2025-26. It includes ₹75 crore for the newly introduced Pashu Aushadhi component, offering quality and affordable generic veterinary medicines. The scheme has three main components: the National Animal Disease Control Programme, LHDCP, and Pashu Aushadhi, with sub-components focusing on critical disease control, veterinary hospital development, and state-level disease management

India Veterinary Nutritional Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on supplement type, animal type, formulation type, and distribution channel.

Supplement Type Insights:

- Vitamins and Minerals

- Amino Acids and Proteins

- Probiotics and Prebiotics

- Herbal and Organic Supplements

- Omega Fatty Acids and Essential Nutrients

The report has provided a detailed breakup and analysis of the market based on the supplement type. This includes vitamins and minerals, amino acids and proteins, probiotics and prebiotics, herbal and organic supplements, and omega fatty acids and essential nutrients.

Animal Type Insights:

- Livestock

- Cattle

- Poultry

- Sheep

- Goat

- Companion Animals

- Dogs

- Cats

- Horses

- Aquaculture

- Fish

- Shrimp

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes livestock (cattle, poultry, sheep, and goat), companion animals (dogs, cats, and horses), and aquaculture (fish and shrimp).

Formulation Type Insights:

- Tablets and Capsules

- Powders

- Liquids and Syrups

- Injectable Supplements

A detailed breakup and analysis of the market based on the formulation type have also been provided in the report. This includes tablets and capsules, powders, liquids and syrups, and injectable supplements.

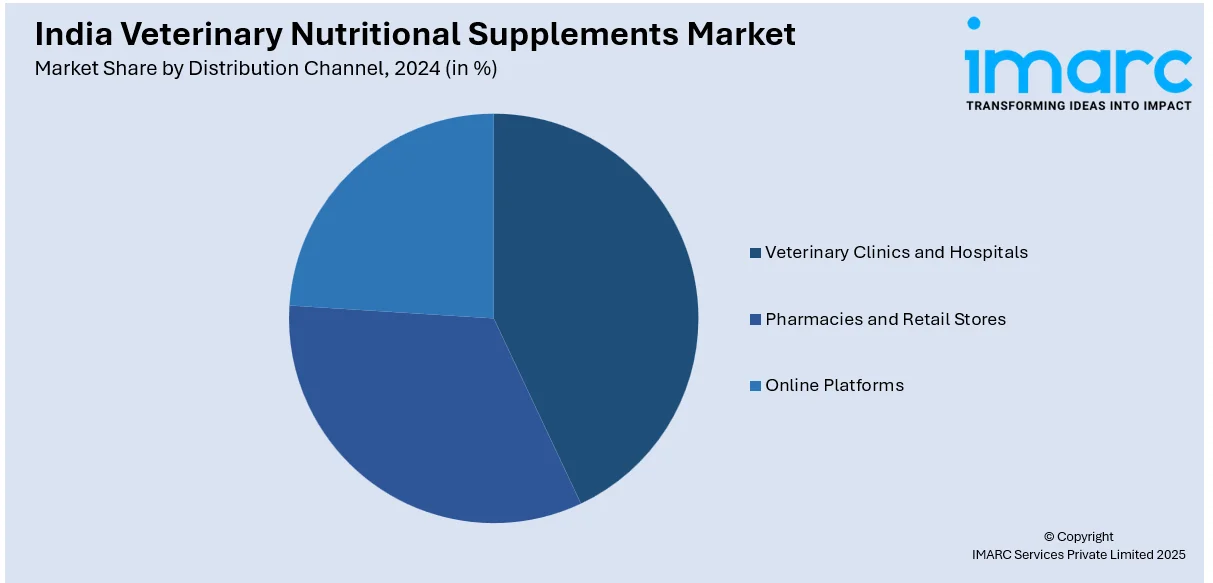

Distribution Channel Insights:

- Veterinary Clinics and Hospitals

- Pharmacies and Retail Stores

- Online Platforms

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes veterinary clinics and hospitals, pharmacies and retail stores, and online platforms.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Veterinary Nutritional Supplements Market News:

- In August 2024, Boehringer Ingelheim India partnered with Vvaan Lifesciences to expand its reach in Tier 2 cities. This collaboration supports Boehringer Ingelheim’s Animal Health Accelerated Growth Plan, targeting underserved regions to improve pet healthcare. Vvaan Lifesciences’ strong presence in these areas will enhance accessibility to veterinary care. Leaders from both companies emphasized their commitment to advancing pet health through innovative products and broader market coverage across India.

- In March 2024, EW Nutrition launched Axxess XY, a thermostable xylanase enzyme, at VICTAM 2024 in Bangkok. Designed to break down both soluble and insoluble fibers from feed ingredients like corn, wheat, and oilseed cakes, Axxess XY enhances nutrient release, reduces feed viscosity, and supports gut health. It offers feed producers flexibility and cost savings in formulation. The launch highlights EW Nutrition's commitment to innovative animal nutrition solutions. The enzyme is expected to strengthen the company's presence in the enzyme market.

India Veterinary Nutritional Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Supplement Types Covered | Vitamins and Minerals, Amino Acids and Proteins, Probiotics and Prebiotics, Herbal and Organic Supplements, Omega Fatty Acids and Essential Nutrients |

| Animal Types Covered |

|

| Formulation Types Covered | Tablets and Capsules, Powders, Liquids and Syrups, Injectable Supplements |

| Distribution Channels Covered | Veterinary Clinics and Hospitals, Pharmacies and Retail Stores, Online Platforms |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India veterinary nutritional supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the India veterinary nutritional supplements market on the basis of supplement type?

- What is the breakup of the India veterinary nutritional supplements market on the basis of animal type?

- What is the breakup of the India veterinary nutritional supplements market on the basis of formulation type?

- What is the breakup of the India veterinary nutritional supplements market on the basis of distribution channel?

- What are the various stages in the value chain of the India veterinary nutritional supplements market?

- What are the key driving factors and challenges in the India veterinary nutritional supplements market?

- What is the structure of the India veterinary nutritional supplements market and who are the key players?

- What is the degree of competition in the India veterinary nutritional supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India veterinary nutritional supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India veterinary nutritional supplements market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India veterinary nutritional supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)