India Vibration Monitoring Equipment Market Size, Share, Trends and Forecast by Product, Component, Application, and Region, 2025-2033

India Vibration Monitoring Equipment Market Overview:

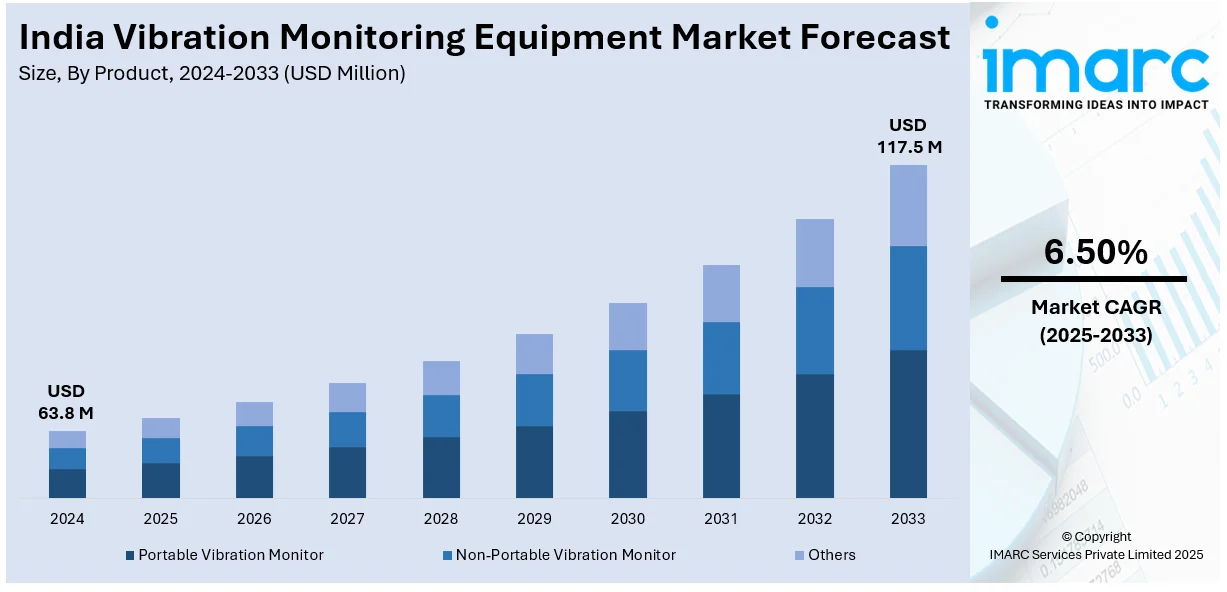

The India vibration monitoring equipment market size reached USD 63.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 117.5 Million by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The rising demand for predictive maintenance, increasing industrial automation, government support for manufacturing, expansion in power and oil & gas sectors, and rising awareness about equipment reliability, operational safety, and unplanned downtime reduction across industries are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 63.8 Million |

| Market Forecast in 2033 | USD 117.5 Million |

| Market Growth Rate 2025-2033 | 6.50% |

India Vibration Monitoring Equipment Market Trends:

Rising Adoption of AI-Based Vibration Monitoring Solutions

India’s industrial sector is rapidly embracing AI-powered vibration monitoring systems to improve asset performance, reduce downtime, and enhance energy efficiency. These systems enable real-time diagnostics and early fault detection, allowing maintenance teams to address issues before they escalate. Manufacturing and process industries are especially focusing on predictive maintenance to avoid production halts and lower operational costs. The integration of advanced sensors, analytics, and cloud connectivity is transforming traditional maintenance practices into intelligent, data-driven strategies. This shift is being fueled by the need to maintain competitiveness, extend equipment lifespan, and comply with stricter efficiency standards. As industries scale their digital infrastructure, the adoption of smart vibration monitoring tools is becoming an essential component of modern industrial reliability programs in India. For example, in March 2025, Thermax partnered with Schaeffler India to offer AI-driven solutions for industrial energy efficiency and reliability. The collaboration includes advanced condition monitoring and predictive maintenance tools, enhancing equipment performance and uptime. This reflects the rising adoption of smart vibration monitoring systems in India, driven by increasing demand across manufacturing and process industries for real-time diagnostics, reduced downtime, and optimized maintenance strategies.

To get more information of this market, Request Sample

Shift toward Non-Contact and AI-Enabled Vibration Monitoring

Industrial facilities in India are increasingly using non-contact and AI-driven vibration monitoring technology to improve maintenance efficiency and operational dependability. These systems identify abnormalities by visual analysis rather than physical sensors, making them suited for distant or dangerous situations. Such systems save unexpected downtime and increase equipment life by allowing for continuous condition monitoring and early fault identification. Edge computing enables real-time data processing at the source, which reduces latency and improves responsiveness. Adoption is increasing in industries such as manufacturing, energy, and infrastructure, where predictive maintenance is critical for sustaining uptime and minimizing maintenance costs. This trend is changing the way companies monitor mechanical health and maximize performance by utilizing smart, sensor-free diagnostic technologies. For instance, in February 2024, RDI Technologies launched Iris Edge, a compact and edge-computing device offering real-time, camera-based vibration analysis. Designed for continuous condition monitoring, it enables early fault detection without physical sensors. This innovation supports India’s increasing adoption of non-contact, AI-enabled vibration monitoring solutions, particularly in industries prioritizing predictive maintenance, operational efficiency, and equipment reliability.

India Vibration Monitoring Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, component, and application.

Product Insights:

- Portable Vibration Monitor

- Non-Portable Vibration Monitor

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes portable vibration monitor, non-portable vibration monitor, and others.

Component Insights:

- Accelerometer

- Eddy Current Proximity Probe

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes an accelerometer, eddy current proximity probe, and others.

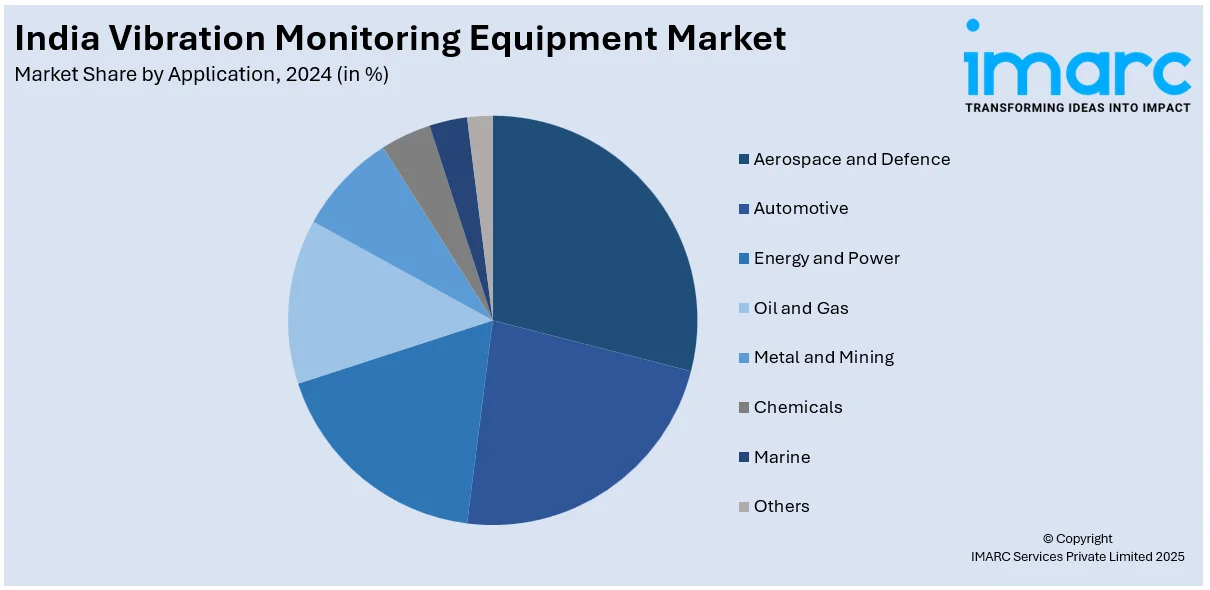

Application Insights:

- Aerospace and Defence

- Automotive

- Energy and Power

- Oil and Gas

- Metal and Mining

- Chemicals

- Marine

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes aerospace and defence, automotive, energy and power, oil and gas, metal and mining, chemicals, marine, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vibration Monitoring Equipment Market News:

- In April 2024, Preformed Line Products (PLP) introduced Aeolus, an advanced system for real-time monitoring of overhead power line conductor motion. By addressing aeolian vibration, galloping, and sub-span oscillation, Aeolus enhances reliability in power transmission. This innovation aligns with the growing demand for vibration monitoring equipment in India’s power sector, supporting predictive maintenance and reducing failure risks in transmission infrastructure under increasing grid load and environmental stress.

India Vibration Monitoring Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Portable Vibration Monitor, Non-Portable Vibration Monitor, Others |

| Components Covered | Accelerometer, Eddy Current Proximity Probe, Others |

| Applications Covered | Aerospace and Defence, Automotive, Energy and Power, Oil and Gas, Metal and Mining, Chemicals, Marine, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vibration monitoring equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vibration monitoring equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vibration monitoring equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vibration monitoring equipment market in India was valued at USD 63.8 Million in 2024.

The India vibration monitoring equipment market is projected to exhibit a CAGR of 6.50% during 2025-2033, reaching a value of USD 117.5 Million by 2033.

The India vibration monitoring equipment market is driven by increasing industrial automation, the growing need for predictive maintenance, rising adoption of condition-based monitoring systems, and expanding manufacturing and power generation sectors. Additionally, stringent safety regulations and the emphasis on minimizing equipment downtime further propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)