India Video Streaming Market Size, Share, Trends and Forecast by Component, Streaming Type, Revenue Model, End User, and Region, 2025-2033

India Video Streaming Market Size and Share:

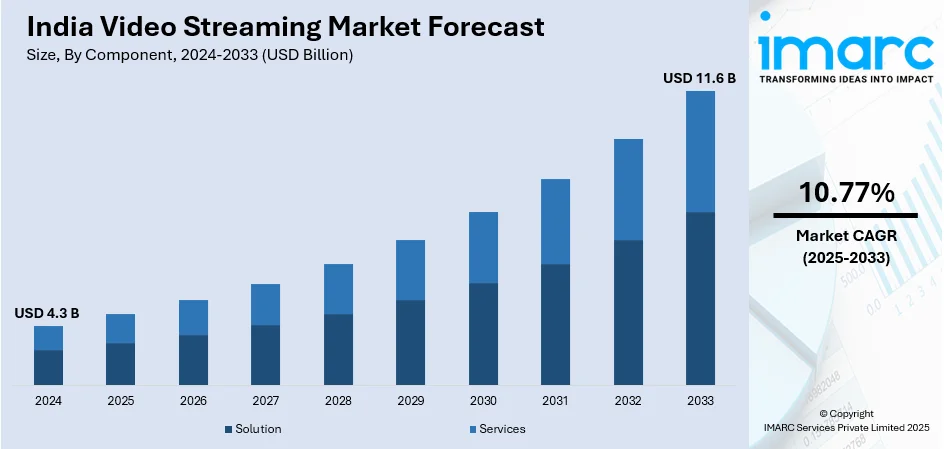

The India video streaming market size reached USD 4.3 Billion in 2024. The market is expected to reach USD 11.6 Billion by 2033, exhibiting a growth rate (CAGR) of 10.77% during 2025-2033. The market growth is attributed to the increasing proliferation of smart devices including smartphones, smart TVs, and tablets which has made it easier for users to access streaming platforms from various devices, proliferation of high-speed internet connectivity expanding the user base for video streaming services, widespread adoption of smartphones and smart devices transforming the way consumers access and consume content, accelerated shift towards digital entertainment, and intensification of original content production by streaming providers.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of component, the market has been divided into solution (IPTV, over-the-top, and pay TV) and services (consulting, managed services, and training and support).

- On the basis of streaming type, the market has been divided into live/linear video streaming and non-linear video streaming.

- On the basis of revenue model, the market has been divided into subscription, transactional, advertisement, and hybrid.

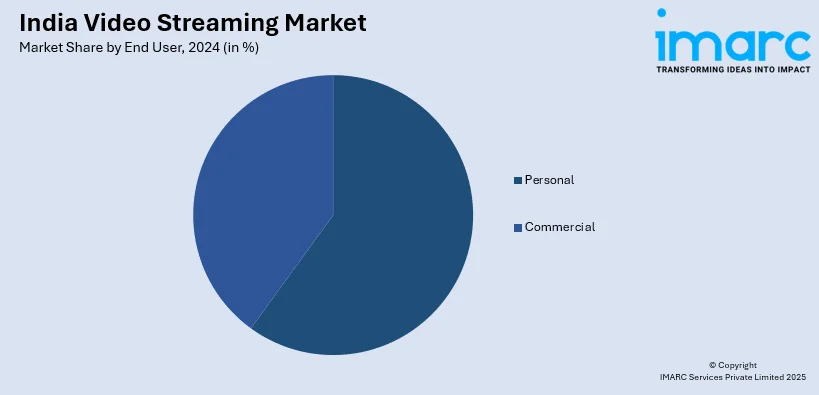

- On the basis of end user, the market has been divided into personal and commercial.

Market Size and Forecast:

- 2024 Market Size: USD 4.3 Billion

- 2033 Projected Market Size: USD 11.6 Billion

- CAGR (2025-2033): 10.77%

Video streaming is the process of delivering video content over the internet in real time. Instead of downloading the entire video file before playback, streaming allows users to watch videos instantly without waiting for the entire file to download. The content is delivered in small, manageable chunks, enabling continuous playback. Popular streaming services, such as Netflix, YouTube, and Hulu, use this technology to provide on-demand access to a vast array of videos, including movies, TV shows, and user-generated content. Streaming relies on a stable internet connection, and the quality of playback can be adjusted based on available bandwidth. It has revolutionized how people consume video content, offering convenience and flexibility for users to watch their favorite shows and movies anytime, anywhere.

To get more information on this market, Request Sample

The India video streaming market size is experiencing unprecedented growth, driven by several key factors. Firstly, the proliferation of high-speed internet connectivity has played a pivotal role in expanding the user base for video streaming services. As more households gain access to reliable and fast internet, the barrier to entry for streaming platforms diminishes, fostering a larger and more diverse audience. Furthermore, the widespread adoption of smartphones and smart devices has transformed the way consumers access and consume content. The ubiquity of these devices has enabled users to stream videos on the go, contributing to the surge in demand for streaming services. In addition, the accelerated shift towards digital entertainment, which prompted individuals to turn to streaming platforms for entertainment and information, is also augmenting the market growth. Moreover, the intensification of original content production by streaming providers has become a significant driver. Exclusive and high-quality content attracts subscribers, creating a competitive edge in the market. The rise of streaming platforms as major content producers has reshaped the dynamics of the entertainment industry, with consumers increasingly drawn to the convenience and diversity offered by on-demand streaming services. Collectively, these interconnected factors continue to propel the regional video streaming market forward, shaping the future of the digital entertainment landscape.

India Video Streaming Market Trends:

Rise of Short-Form Video (SFV) and Micro-Episodic Content Revolution

The India video streaming market is witnessing a shift of model to go toward video content that is short-form as well as programming that is micro-episodic because it transforms viewer consumption patterns in such a fundamental way with platform strategies. The explosive popularity of vertical video formats, driven by the success of platforms like Instagram Reels, YouTube Shorts, and TikTok-style content, has compelled traditional streaming services to integrate short-form content segments into their offerings to capture millennial and Gen Z audiences who prefer bite-sized entertainment. Micro-episodic content, featuring episodes ranging from 5-15 minutes, is gaining significant traction as busy urban professionals and students seek quick entertainment fixes that can be consumed during commutes, lunch breaks, or between daily activities, is a major factor propelling the India video streaming market growth. Major platforms are investing heavily in the creation of original short-form series, comedy sketches, and factual content for mobile consumption since many platforms are commissioning content creators for platform-exclusive short-form programming. The format's inherent shareability and virality factor has proven effective for audience acquisition and retention, as viewers frequently share compelling short clips across social media platforms, creating organic marketing loops that amplify content reach. Additionally, the lower production costs associated with short-form content enable platforms to experiment with diverse genres, regional themes, and emerging talent, fostering a more inclusive and innovative content ecosystem that reflects India's cultural diversity while maintaining commercial viability in an increasingly competitive streaming landscape, as per the India video streaming market analysis.

Regional and Hyper-Local Content Boom Driving Market Expansion

The India video streaming market is experiencing an unprecedented surge in regional and hyper-local content production, reflecting the nation's linguistic diversity and cultural richness while unlocking previously untapped audience segments across tier-II and tier-III cities. Streaming platforms are strategically investing in vernacular content across multiple Indian languages including Tamil, Telugu, Malayalam, Kannada, Bengali, Marathi, Gujarati, and Punjabi, recognizing that localized storytelling resonates more deeply with regional audiences than generic national content, as per the India video streaming market forecast. Hyper-local content creation is extending beyond language barriers to incorporate regional dialects, cultural nuances, local folklore, and community-specific narratives that create authentic connections with audiences who have historically been underserved by mainstream entertainment. Major platforms like Netflix, Amazon Prime Video, Disney+ Hotstar, and ZEE5 are establishing regional content studios and collaborating with local production houses to develop original series, documentaries, and films that showcase regional talent while addressing themes relevant to specific geographic and cultural contexts. The success of regional blockbusters and web series has demonstrated the commercial viability of vernacular content, with several Tamil and Telugu originals achieving viewership numbers comparable to Hindi mainstream productions. Furthermore, the growing internet penetration in rural and semi-urban areas, coupled with affordable data plans and smartphone adoption, has created a massive addressable market for regional content that traditional broadcasting struggled to capture effectively, which is creating a positive outlook for video streaming industry in India. This trend is also fostering the emergence of local content creators, independent filmmakers, and regional celebrities who are building dedicated fan bases and contributing to a more democratized entertainment ecosystem that celebrates India's cultural plurality while driving sustainable business growth for streaming platforms.

Growth, Opportunities, and Challenges in the India Video Streaming Market:

- Growth Drivers of the India Video Streaming market: The primary growth drivers include massive smartphone penetration with over 750 million users creating a mobile-first viewing ecosystem, rapid 4G and 5G network expansion improving streaming quality and accessibility across urban and rural areas, and affordable data plans making video consumption economically viable for broader demographics. The surge in original content production by platforms like Netflix, Amazon Prime Video, and Disney+ Hotstar is attracting diverse audiences through region-specific programming and exclusive releases.

- Opportunities in the India Video Streaming market: The market presents substantial opportunities through the development of hyper-local and regional language content catering to India's linguistic diversity, integration of emerging technologies like AR/VR for immersive viewing experiences, and expansion into tier-II and tier-III cities where internet adoption is accelerating rapidly. Live streaming of sports events, educational content, and interactive entertainment formats offer significant revenue diversification potential, while partnerships with telecom operators for bundled subscriptions can drive user acquisition.

- Challenges in the India Video Streaming market: The industry faces challenges including intense competition from over 40 OTT platforms leading to content cost inflation and subscriber acquisition difficulties, piracy concerns affecting revenue streams, and the need for continuous infrastructure investments to support high-quality streaming. Subscription fatigue among consumers juggling multiple platform subscriptions poses retention challenges, while varying internet connectivity quality across regions creates inconsistent user experiences requiring adaptive streaming technologies.

India Video Streaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, streaming type, revenue model, and end user.

Component Insights:

- Solution

- IPTV

- Over-the-top

- Pay TV

- Services

- Consulting

- Managed Services

- Training and Support

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (IPTV, over-the-top, and pay TV) and services (consulting, managed services, and training and support).

Streaming Type Insights:

- Live/Linear Video Streaming

- Non-Linear Video Streaming

A detailed breakup and analysis of the market based on the streaming type have also been provided in the report. This includes live/linear video streaming and non-linear video streaming.

Revenue Model Insights:

- Subscription

- Transactional

- Advertisement

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the revenue model. This includes subscription, transactional, advertisement, and hybrid.

End User Insights:

- Personal

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal and commercial.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The companies in the market are adopting various strategic initiatives including new product launches and business alliances to gain a significant India video streaming market share.

Latest News and Developments:

- May 2025: Amazon Prime Video announced plans to introduce limited advertisements for Indian subscribers starting in June 2025 to support increased content investment. The ad load will be lighter than traditional TV, and an optional ad-free upgrade will be available for a fee. Prime Video continues to invest in localized and exclusive content, retaining a strong position in India’s OTT landscape.

- February 2025: JioStar officially launched JioHotstar by merging Disney+ Hotstar and JioCinema services, creating India's largest streaming platform with over 50 crore users and 300,000 hours of content, positioning it to compete directly with Netflix and Amazon Prime Video.

India Video Streaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Streaming Types Covered | Live/Linear Video Streaming, Non-Linear Video Streaming |

| Revenue Models Covered | Subscription, Transactional, Advertisement, Hybrid |

| End Users Covered | Personal, Commercial |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India video streaming market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India video streaming market?

- What is the breakup of the India video streaming market on the basis of component?

- What is the breakup of the India video streaming market on the basis of streaming type?

- What is the breakup of the India video streaming market on the basis of revenue model?

- What is the breakup of the India video streaming market on the basis of end user?

- What are the various stages in the value chain of the India video streaming market?

- What are the key driving factors and challenges in the India video streaming?

- What is the structure of the India video streaming market and who are the key players?

- What is the degree of competition in the India video streaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India video streaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India video streaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India video streaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)