India Virtual Private Server Market Size, Share, Trends and Forecast by Type, Operating System, Organization Size, Industry Vertical, and Region, 2025-2033

India Virtual Private Server Market Overview:

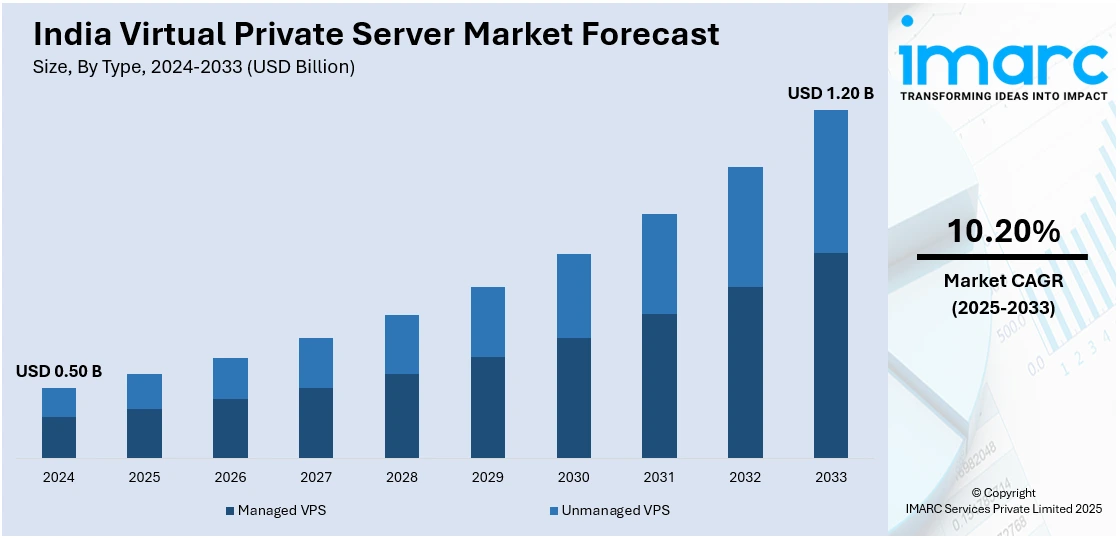

The India virtual private server market size reached USD 0.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.20 Billion by 2033, exhibiting a growth rate (CAGR) of 10.20% during 2025-2033. The India Virtual Private Server (VPS) market is driven by government-led digital transformation initiatives, rapid cloud adoption by SMEs and startups, escalating demand for secure and scalable hosting solutions, expanding data center infrastructure, and regulatory policies promoting data localization, all contributing to a robust and competitive VPS ecosystem in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.50 Billion |

| Market Forecast in 2033 | USD 1.20 Billion |

| Market Growth Rate 2025-2033 | 10.20% |

India Virtual Private Server Market Trends:

Cost-Effectiveness and Enhanced Performance

One of the key propellers of the Indian VPS market is the cost-effectiveness of virtual private servers over dedicated hosting. For startups, SMEs, and even expanding businesses, VPS presents a middle-of-the-road solution that delivers considerable computational capability without the hefty price tag of dedicated servers. In contrast to shared hosting, where several websites utilize the same resources, VPS allocates dedicated amounts of CPU, RAM, and bandwidth. This provides improved uptime, quicker page loading times, and enhanced overall performance. In addition, VPS hosting enables companies to only pay for what they need and to scale up accordingly. This is especially beneficial in India's digital economy, where businesses must absorb sudden increases in traffic or the expansion of their business. For example, e-commerce websites and online service providers tend to see traffic surge seasonally, VPS helps them absorb this without a corresponding decline in performance. Another significant advantage is the simplicity of customization. Companies can install software, set security options, and alter server environments according to their individual requirements, a feature that is not always available with shared hosting. Moreover, most VPS providers offer managed services, so companies lacking technical skills can also enjoy high-performance servers without having to maintain an in-house IT department.

To get more information of this market, Request Sample

Rising Adoption of Cloud Computing and Virtualization

Another major force behind the India virtual private server (VPS) market is the growing use of cloud computing and virtualization technologies. With companies shifting away from on-premises infrastructure, VPS is becoming an essential part of cloud strategies because of its scalability, flexibility, and cost-effectiveness. India has witnessed a cloud adoption boom, fueled by the demand for remote access, data security, and uninterrupted business operations. Organizations are widely using VPS hosting to launch cloud-based applications, host websites, store databases, and run enterprise applications. Unlike conventional hosting options, VPS offers a separate virtualized space that works like a dedicated server but is more affordable. This makes it a popular option for firms seeking high-performance computing without the need to invest in costly hardware. In addition, improvements in virtualization technology have optimized VPS to become more efficient and dependable. Virtualization allows multiple virtual servers to be created on one physical server, maximizing resource use and minimizing operating costs. The extensive use of hypervisors such as KVM (Kernel-based Virtual Machine) and VMware further optimized VPS performance, security, and administration.

India Virtual Private Server Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, operating system, organization size, and industry vertical.

Type Insights:

- Managed VPS

- Unmanaged VPS

The report has provided a detailed breakup and analysis of the market based on the type. This includes managed VPS and unmanaged VPS.

Operating System Insights:

- Windows

- Linux

A detailed breakup and analysis of the market based on the operating system have also been provided in the report. This includes windows and linux.

Organization Size Insights:

- Large Enterprises

- Small and Medium-Sized Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

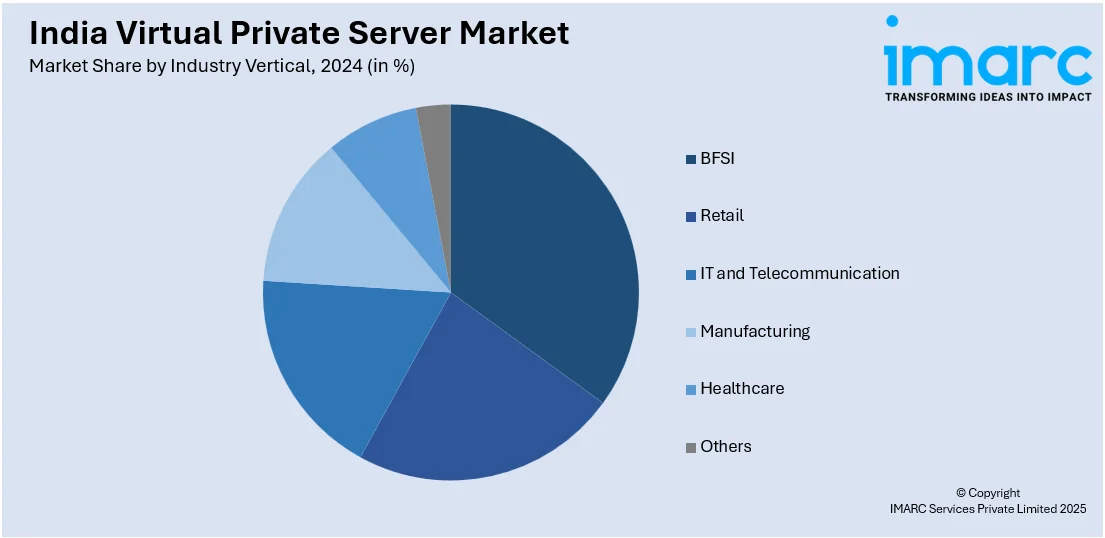

Industry Vertical Insights:

- BFSI

- Retail

- IT and Telecommunication

- Manufacturing

- Healthcare

- Others

A detailed breakup and analysis of the market based on the industry vertical size have also been provided in the report. This includes BFSI, retail, IT and telecommunication, manufacturing, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Virtual Private Server Market News:

- March 2025: Onlive Server launched high-performance dedicated server hosting in India with innovative features, serving businesses and developers. This expansion boosted hosting features, resulting in improved scalability and reliability for VPS users. Greater availability of robust infrastructure helped drive the VPS market in India by catering to varied digital demands.

- June 2024: Contabo, one of Germany's leading cloud computing companies, opened a cutting-edge data center in Mumbai, India. The move strengthens the country's digital infrastructure, providing lower latency and more affordable cloud solutions to organizations in India and South Asia. These advancements support the Virtual Private Server (VPS) space in the country by creating more localized and efficient hosting options.

India Virtual Private Server Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Managed VPS, Unmanaged VPS |

| Operating Systems Covered | Windows, Linux |

| Organization Sizes Covered | Large Enterprises, Small, Medium-Sized Enterprises |

| Industry Verticals Covered | BFSI, Retail, IT, Telecommunication, Manufacturing, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India virtual private server market performed so far and how will it perform in the coming years?

- What is the breakup of the India virtual private server market on the basis of type?

- What is the breakup of the India virtual private server market on the basis of operating system?

- What is the breakup of the India virtual private server market on the basis of organization size?

- What is the breakup of the India virtual private server market on the basis of industry vertical?

- What are the various stages in the value chain of the India virtual private server market?

- What are the key driving factors and challenges in the India virtual private server market?

- What is the structure of the India virtual private server market and who are the key players?

- What is the degree of competition in the India virtual private server market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India virtual private server market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India virtual private server market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India virtual private server industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)