India Vitamin D Supplements Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

India Vitamin D Supplements Market Overview:

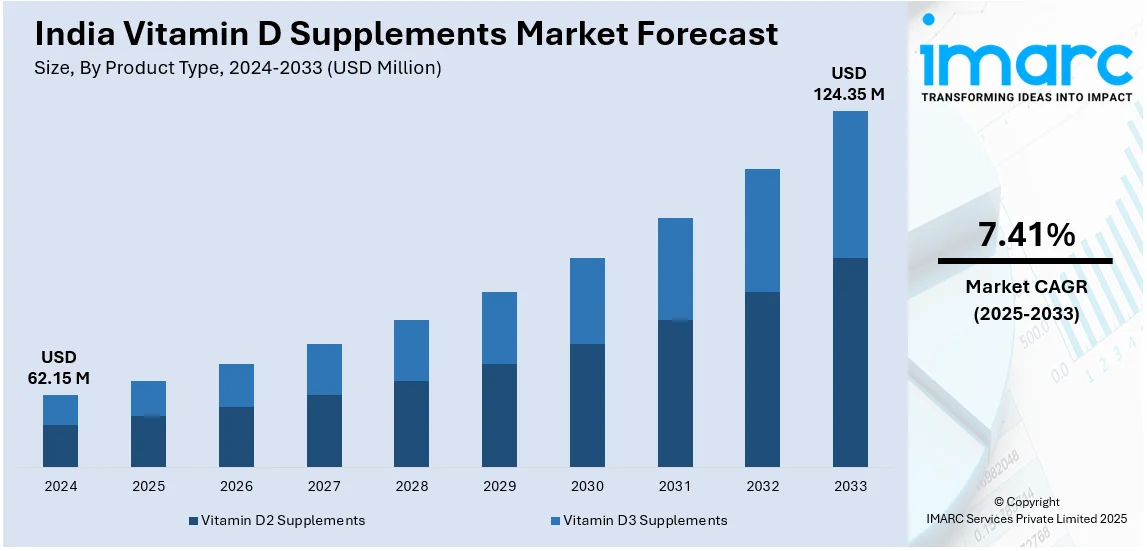

The India vitamin D supplements market size reached USD 62.15 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 124.35 Million by 2033, exhibiting a growth rate (CAGR) of 7.41% during 2025-2033. The market is experiencing strong growth, driven by rising health consciousness, urbanization, and increasing nutritional deficiencies. The demand for plant-based foods, customized nutrition, and fortified products is surging, supported by e-commerce and pharmacies, while vitamin D supplementation emerges as a mainstream wellness trend.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 62.15 Million |

| Market Forecast in 2033 | USD 124.35 Million |

| Market Growth Rate (2025-2033) | 7.41% |

India Vitamin D Supplements Market Trends:

Growing Consumer Awareness and Preventive Healthcare Adoption

The market for vitamin D supplements in India is growing with growing awareness of its critical role in overall well-being. For instance, in May 2024, ENTOD Pharmaceuticals launched India's first Vitamin D3 fortified lubricating eye drops for treating dry eye syndrome, improving tear stability, corneal healing, and overall eye health. Additionally, people are now better aware of the dangers of vitamin D deficiency, including weakened bones, muscle weakness, and an increased risk of chronic diseases. This is driven by health education campaigns by healthcare providers, online health platforms, and government initiatives focusing on preventive healthcare. Urbanization has also played a part in rates of deficiency because individuals spend more time indoors and get less sun, a natural vitamin D source. Modern diets tend to be vitamin D-poor as well, further encouraging supplementation. Self-care and healthy personal management have encouraged the desire for vitamin D supplementation as part of daily self-management. With growing health awareness and readily available supplements both on the Internet and in drugstores, the market is poised for further growth.

To get more information of this market, Request Sample

Surge in Vegan and Plant-Based Vitamin D Supplements

With the popularity of plant-based and vegan diets on the rise in India, the demand for vitamin D supplements of non-animal origin is on the rise. Till recently, most vitamin D3 supplements have been derived from lanolin (wool of sheep), which makes them only for non-vegans. But newer technologies now provide alternative plant-derived forms like lichen-based vitamin D3 and vitamin D2 from yeast or mushrooms. For example, in March 2025, Fermenta Biotech Limited launched VITADEE™ Green, 100% plant-derived Vitamin D3 for food and nutraceuticals developed in its world-class R&D plant in Thane, India. Furthermore, this trend is most applicable in India, where there is a wide majority of population that consumes vegetarian diets and chooses plant-based supplements. As there is increasing awareness among consumers about the source of ingredients and ethical consumption, manufacturers are reacting with the introduction of vegan-certified vitamin D offerings. Furthermore, food technology improvements have enabled vitamin D fortification of plant-based dairy substitutes, cereals, and drinks, offering consumers even more choices. As clean-label, sustainable nutrition becomes more popular, plant-based vitamin D supplements are poised to make considerable headway in the Indian market.

Personalized Nutrition and Fortified Food Innovations

The India vitamin D supplements market is experiencing a growth in customized nutrition solutions that meet the individual's unique health requirements. Consumers are now demanding personalized supplement regimes according to their age, lifestyle, and levels of deficiency. Health-tech services and diagnostic facilities have also started providing vitamin D tests, enabling people to find out their exact needs and choose customized supplementation. Also on the rise is food fortification with vitamin D as a substitute for conventional supplements. Milk and plant-based milk companies, breakfast foods, juices, and even oils are being fortified with vitamin D to enable consumers to achieve their daily requirements the natural way. Convenience and ease of use drive this trend as fortified foods are easily incorporated into daily intake without needing an additional supplement regime. With growing disposable incomes and greater health awareness, the market for value-added vitamin D solutions and food fortification products will grow more in India.

India Vitamin D Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Vitamin D2 Supplements

- Vitamin D3 Supplements

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamin D2 supplements and vitamin D3 supplements.

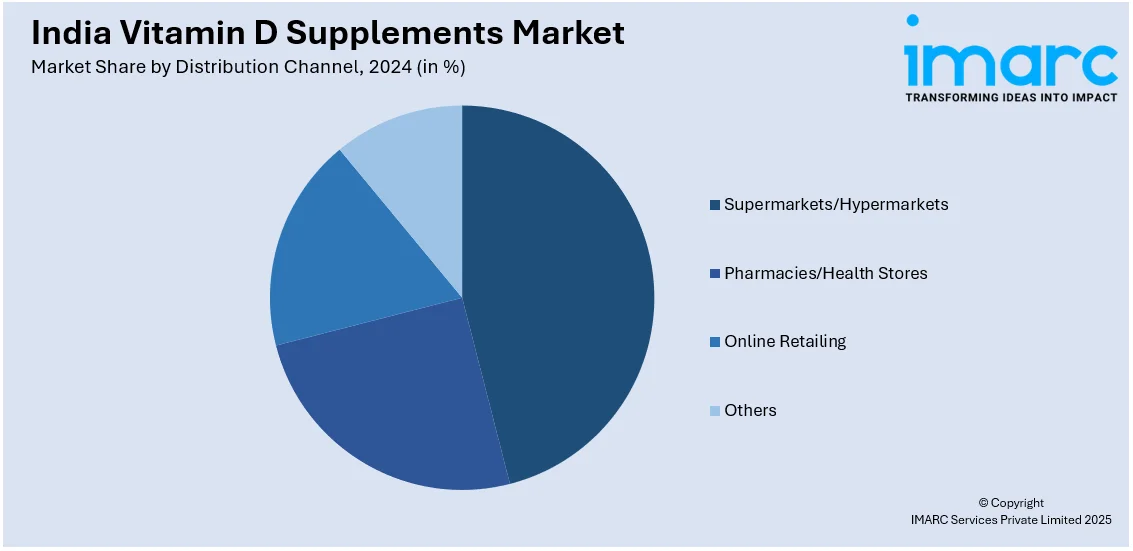

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Pharmacies/Health Stores

- Online Retailing

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, pharmacies/health stores, online retailing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vitamin D Supplements Market News:

- In February 2024, Cadila Pharmaceuticals Limited launched India's first aqueous Vitamin D injection which is poised to revolutionize Vitamin D treatment. The new formulation is designed to improve absorption and efficacy, treating deficiencies better and serving patients who need to correct Vitamin D levels quickly. The launch is a major leap in healthcare solutions.

- In August 2024, Abbott India seeks to consolidate its range of multi-specialty supplements like vitamin D and thyroid health-related products by increasing new product introductions and growing awareness. Some of the latest introductions, including Arachitol Gummies and Thyrowl Plus, add to its expanding portfolio and have helped push revenue up 11.8% in FY2023-24.

India Vitamin D Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamin D2 Supplements, Vitamin D3 Supplements |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Pharmacies/Health Stores, Online Retailing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vitamin D supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vitamin D supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vitamin D supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vitamin D supplements market in India was valued at USD 62.15 Million in 2024.

The India vitamin D supplements market is projected to exhibit a (CAGR) of 7.41% during 2025-2033, reaching a value of USD 124.35 Million by 2033.

The market is fueled by increased awareness of nutritional deficiencies, changing dietary patterns, and heightened interest in preventive care. Sedentary lifestyles, urbanization, and indoor work conditions lead to increased demand for supplements. Encouragement from health authorities, wellness drives, and the popularity of functional foods also contribute significantly.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)