India Vitamins Market Size, Share, Trends and Forecast by Type, Source, Application, and Region, 2025-2033

India Vitamins Market Overview:

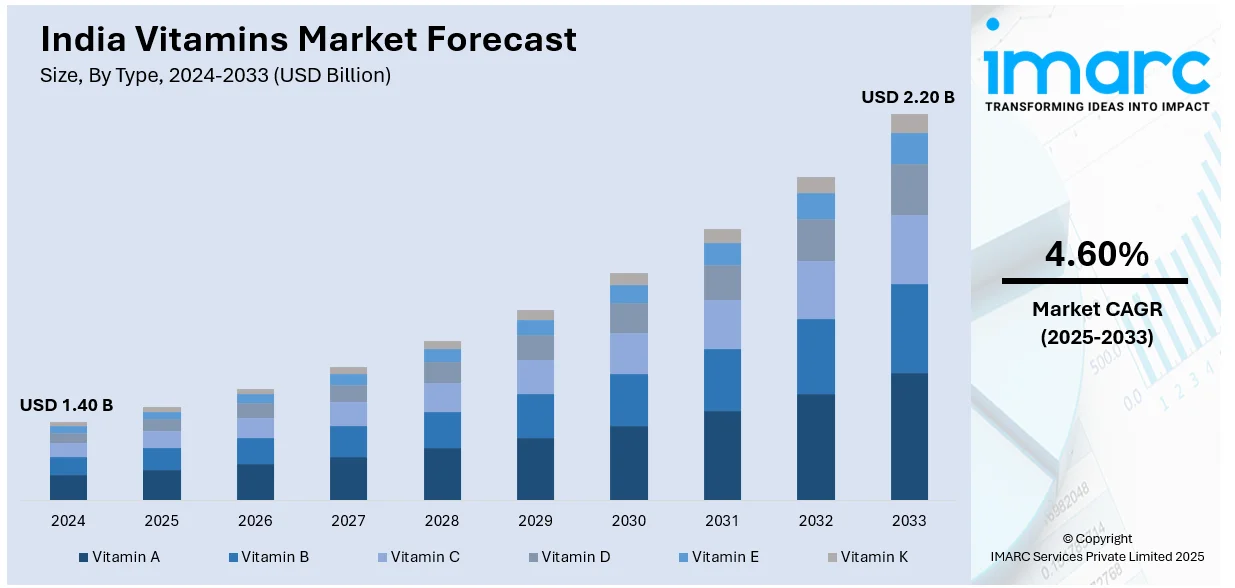

The India vitamins market size reached USD 1.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.20 Billion by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. The rising health awareness, increasing disposable income, growing preventive healthcare trends, and changing dietary habits are driving the India vitamins market growth. Furthermore, the demand for nutritional supplements, fortified foods, and immunity-boosting products, and government initiatives promoting nutrition and wellness are providing a positive impact on the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.40 Billion |

| Market Forecast in 2033 | USD 2.20 Billion |

| Market Growth Rate 2025-2033 | 4.60% |

India Vitamins Market Trends:

Rising Health Awareness and Preventive Healthcare Trends

Growing awareness about nutrition, wellness, and disease prevention is a key driver of the Indian vitamins market. Consumers are increasingly focusing on immunity, energy, and overall well-being, leading to a higher demand for vitamin supplements, fortified foods, and functional beverages. Post-pandemic health consciousness has accelerated the shift toward preventive healthcare, with more individuals incorporating vitamins into their daily routines. In April 2023, Centrum also revealed its expansion into a new range of advanced science supplements for diverse advantages, presented in a tasty gummy form – ‘Benefit Blends’ in India. The multivitamin brand, a division of Haleon (previously GlaxoSmithKline Consumer Healthcare), launched in the Indian market in September of the previous year. The company asserts that the brand aims to address the new nutrition deficiencies that Indian consumers encounter daily because of their busy lifestyles. The company asserted that the new specialized nutrition line is entirely vegetarian, inherently gluten-free, and does not create dependency. Additionally, digital health platforms, social media, and fitness influencers are educating consumers about the benefits of vitamins, further creating a positive India vitamins market outlook. The preference for natural and organic supplements is also rising, shaping purchasing decisions and fueling demand.

To get more information of this market, Request Sample

Expansion of the Nutraceutical and E-commerce Sectors

The rapid growth of India’s nutraceutical industry and online retail platforms has made vitamins more accessible to a wider audience. E-commerce giants like Amazon, Flipkart, and specialized health marketplaces such as HealthKart and 1mg have simplified the purchase of vitamin supplements and functional foods. The presence of domestic and international brands offering customized vitamins, vegan supplements, and Ayurveda-based solutions is also expanding consumer choices. Additionally, innovations such as personalized nutrition, chewable vitamins, and plant-based alternatives are attracting health-conscious consumers, contributing to the rapid increase of the India vitamins market share. For instance, in February 2024, Wedjat Health Solutions, established by physicians Dr. Hema and Dr. Sathish, introduced Health Etc., India's first doctor-formulated gummy vitamin brand, in keeping with a developing approach to well-being. These tasty, chewable snacks enriched with natural ingredients, essential vitamins, and minerals provide an efficient alternative to the conventional pill regimen for meeting a particular nutritional need. Soon, more candies will be developed for children, diabetics, and skin conditions to address specific health issues.

India Vitamins Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, source, and application.

Type Insights:

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Vitamin E

- Vitamin K

The report has provided a detailed breakup and analysis of the market based on the type. This includes Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, and Vitamin K.

Source Insights:

- Natural

- Synthetic

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes natural and synthetic.

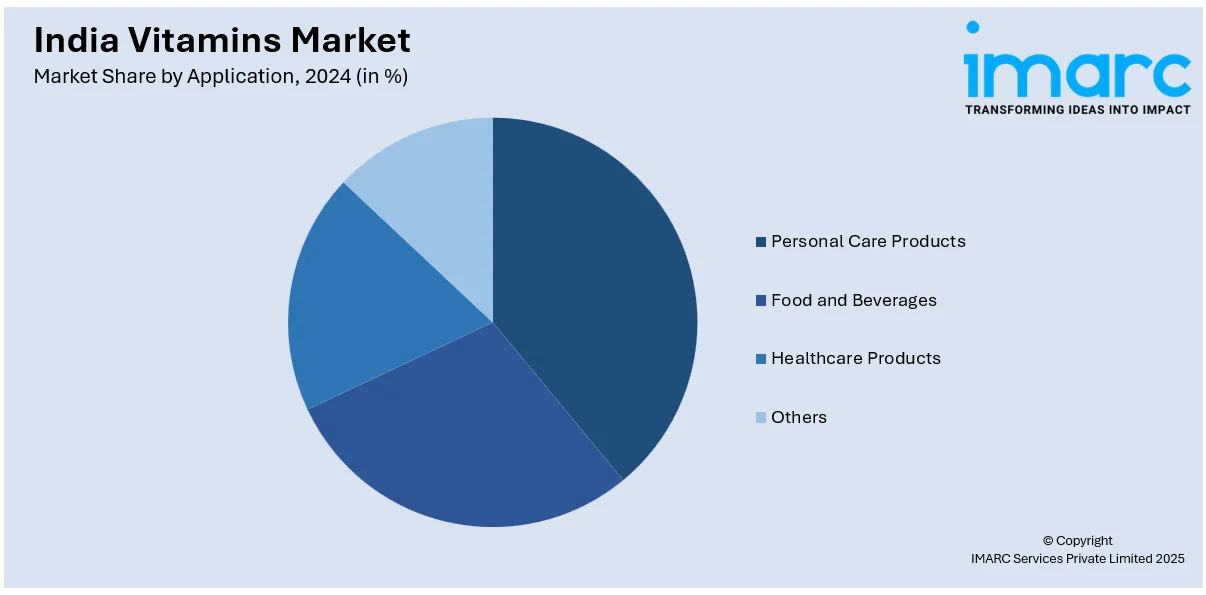

Application Insights:

- Personal Care Products

- Food and Beverages

- Healthcare Products

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes personal care products, food and beverage, healthcare products, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vitamins Market News:

- In January 2024, Tata 1mg, a digital health platform, announced that it had formed an exclusive partnership with Vitonnix UK to introduce products in India. The company recently launched a variety of Vitamin Sublingual Sprays. This sublingual spray is used directly beneath the tongue, allowing the vitamins and supplements to be absorbed directly through the mouth's mucosal lining, which has a highly abundant blood supply.

- In July 2023, Oriflame India, a comprehensive beauty and wellness brand, recently introduced two new health supplements in its Wellosophy line – Iron Complex, specifically designed for women, and Calcium enriched with Vitamin D and Magnesium.

India Vitamins Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, Vitamin K |

| Sources Covered | Natural, Synthetic |

| Applications Covered | Personal Care Products, Food and Beverage, Healthcare Products, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vitamins market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vitamins market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vitamins industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India vitamins market was valued at USD 1.40 Billion in 2024.

The vitamins market in India is projected to exhibit a CAGR of 4.60% during 2025-2033, reaching a value of USD 2.20 Billion by 2033.

The vitamins market in India is driven by increasing health awareness, rising lifestyle diseases, and government initiatives promoting nutrition. Growth in e-commerce and easy product availability also boost demand. Additionally, an aging population and a preference for preventive healthcare are key factors supporting market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)