India Vocational Training Market Size, Share, Trends and Forecast by Type, Program Type, RTO Type, and Region, 2025-2033

India Vocational Training Market Overview:

The India vocational training market size reached USD 1,289.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,949.8 Million by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The market share is expanding, driven by the rising adoption of professional networking platforms that create more opportunities for skilled professionals, along with the ongoing collaborations between government agencies and private companies to offer industry-specific training.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,289.2 Million |

| Market Forecast in 2033 | USD 1,949.8 Million |

| Market Growth Rate (2025-2033) | 4.70% |

India Vocational Training Market Trends:

Expansion of gig economy

The growth of the gig economy is offering a favorable India vocational training market outlook. With freelancing, contract work, and on-demand jobs becoming more popular, individuals are realizing the need for short-term skill-based training to stay competitive. According to industry reports, India had 15 Million freelancers, indicating a significant segment of its overall population of 1.38 Billion in 2024. Many vocational training programs are focusing on gig-friendly skills like digital marketing, graphic design, data entry, and coding, helping workers find jobs in industries that do not require traditional degrees. Professional networking platforms are creating more opportunities for skilled professionals, encouraging people to upskill through vocational courses. Companies are also preferring skilled freelancers over full-time employees, thereby driving the demand for specialized training in fields, such as content creation, personal finance, and information technology (IT) services. The private training institutions are recognizing this shift and launching targeted skill development programs to support gig workers. As more people choose flexible careers, vocational training is becoming essential in securing stable and well-paying opportunities in the growing gig economy.

To get more information of this market, Request Sample

Increasing implementation of government initiatives

The rising execution of government initiatives that focus on equipping people with practical skills to improve employability is impelling the India vocational training market growth. Government agencies are launching skill development schemes like Skill India to provide affordable and job-oriented training across various industries. These initiatives are making vocational education more accessible to youth, women, and rural populations, ensuring that more people can benefit from skill-based learning. According to the PIB, the involvement of women in long-term training initiatives at National Skill Training Institutes (NSTIs) and Industrial Training Institutes (ITIs) grew from 9.8% in FY16 to 13.3% in FY24. Government agencies are also collaborating with private companies and educational institutions to offer industry-specific training, bridging the gap between education and employment. Special focus is being given to emerging fields like IT, healthcare, renewable energy, and manufacturing to prepare workers for the evolving job market. Subsidized training programs, financial aid, and incentives for training centers are further boosting participation. Online and hybrid training models, supported by government-led digital platforms, are expanding reach, making learning flexible and convenient. By promoting entrepreneurship, these initiatives are also encouraging people to start their own businesses.

India Vocational Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, program type, and RTO type.

Type Insights:

- Accredited

- Non-Accredited

The report has provided a detailed breakup and analysis of the market based on the type. This includes accredited and non-accredited.

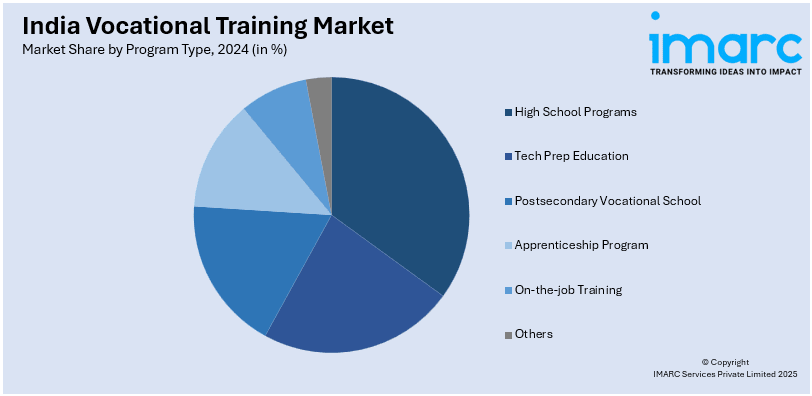

Program Type Insights:

- High School Programs

- Tech Prep Education

- Postsecondary Vocational School

- Apprenticeship Program

- On-the-job Training

- Others

A detailed breakup and analysis of the market based on the program type have also been provided in the report. This includes high school programs, tech prep education, postsecondary vocational school, apprenticeship program, on-the-job training, and others.

RTO Type Insights:

- Private RTOs

- TAFE Institutes

- Community RTOs

- Schools

- Enterprise RTOs

- Universities

The report has provided a detailed breakup and analysis of the market based on the RTO type. This includes private RTOs, TAFE institutes, community RTOs, schools, enterprise RTOs, and universities.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Vocational Training Market News:

- In January 2025, the Government of India teamed up with South Korea’s governing agencies to commence a two-year vocational training program, which was to be carried out by India’s National Council of Educational Research and Training at the Regional Institute of Education located in Bhopal. The goal was to create an environment that supported mechatronics education in India through the design of contemporary curricula, the development of textbooks, the creation of instructor manuals, and the provision of advanced tools and technologies for training centers.

- In November 2024, BluPine Energy introduced community programs in Punjab in India, which involved vocational training for 120 young individuals, including 50% females, mini science centers in educational institutions, and solar street lighting. The projects were aimed at enhancing skill development, gender equity, and sustainable infrastructure for self-reliant and resilient communities in the country.

India Vocational Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Accredited, Non-Accredited |

| Program Types Covered | High School Programs, Tech Prep Education, Postsecondary Vocational School, Apprenticeship Program, On-the-job Training, Others |

| RTO Types Covered | Private RTOs, TAFE Institutes, Community RTOs, Schools, Enterprise RTOs, Universities |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India vocational training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India vocational training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India vocational training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vocational training market in India was valued at USD 1,289.2 Million in 2024.

The India vocational training market is projected to exhibit a CAGR of 4.70% during 2025-2033, reaching a value of USD 1,949.8 Million by 2033.

Key factors driving the India vocational training market include rising youth unemployment, demand for industry-relevant skills, and increased government initiatives like Skill India. Growth in sectors like retail, healthcare, and logistics is also boosting the need for job-ready vocational education across urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)