India Voltage Tester Market Size, Share, Trends and Forecast by Product Type, Operation, Frequency, Application, and Region, 2025-2033

India Voltage Tester Market Overview:

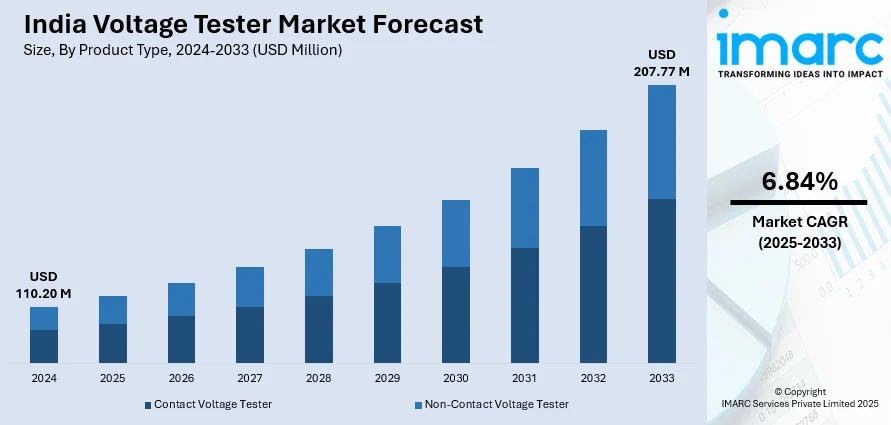

The India voltage tester market size reached USD 110.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 207.77 Million by 2033, exhibiting a growth rate (CAGR) of 6.84% during 2025-2033. The increasing industrial automation rates, rising number of electrical infrastructure projects, heightened focus on workplace safety, and elevating demand for reliable electrical testing tools in residential and commercial maintenance are among the key factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 110.20 Million |

| Market Forecast in 2033 | USD 207.77 Million |

| Market Growth Rate 2025-2033 | 6.84% |

India Voltage Tester Market Trends:

Expansion of Electrical Infrastructure and Industrial Automation

India’s rapid urbanization and industrialization have resulted in substantial investments in electrical infrastructures, driven by favorable government initiatives like “Power for All” and the rollout of smart grids. These efforts aim to modernize power distribution networks across the country. This surge in electrification and modernization projects directly elevates the demand for voltage testers, which are critical tools for verifying electrical safety and reliability. Simultaneously, the shift towards industrial automation and the integration of Industry 4.0 technologies like IoT and AI have amplified the need for advanced testing tools to ensure system uptime and operational efficiency. Together, these trends are fueling robust growth in India’s voltage tester market.

To get more information of this market, Request Sample

Emphasis on Electrical Safety and Regulatory Compliance

As electrical systems in India grow increasingly complex, there is a heightened focus on workplace safety and adherence to rigorous electrical safety standards. This shift has prompted organizations across sectors to invest in high-quality voltage testers to ensure regulatory compliance and safeguard both personnel and equipment from electrical hazards. Regulatory mandates requiring routine electrical inspections and maintenance have further driven the demand for voltage testing tools. Industries are now obligated to conduct periodic testing of electrical installations to minimize accident risks and maintain operational integrity, creating a consistent need for reliable voltage testers. While global trends highlight the rising significance of electrical safety, India is closely mirroring this trajectory with parallel growth in safety compliance and testing practices. Additionally, the increased involvement of public and private entities in promoting electrical safety awareness has led to the wider adoption of voltage testers by educational institutions, training centers, and safety organizations. This growing emphasis on preventive maintenance is not only fueling market expansion but also strengthening India's broader electrical safety culture.

India Voltage Tester Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, operation, frequency, and application.

Product Type Insights:

- Contact Voltage Tester

- Non-Contact Voltage Tester

The report has provided a detailed breakup and analysis of the market based on the product type. This includes contact voltage tester and non-contact voltage tester.

Operation Insights:

- Handheld

- Portable

- Fixed

A detailed breakup and analysis of the market based on the operation have also been provided in the report. This includes handheld, portable, and fixed.

Frequency Insights:

- High-Frequency Tester

- High-Frequency AC Tester

- High-Frequency DC Tester

- Low-Frequency Tester

- Low-Frequency AC Tester

- Low-Frequency DC Tester

The report has provided a detailed breakup and analysis of the market based on the frequency. This includes high-frequency tester, high-frequency AC tester, high-frequency DC tester, low-frequency tester, low-frequency AC tester, and low-frequency DC tester.

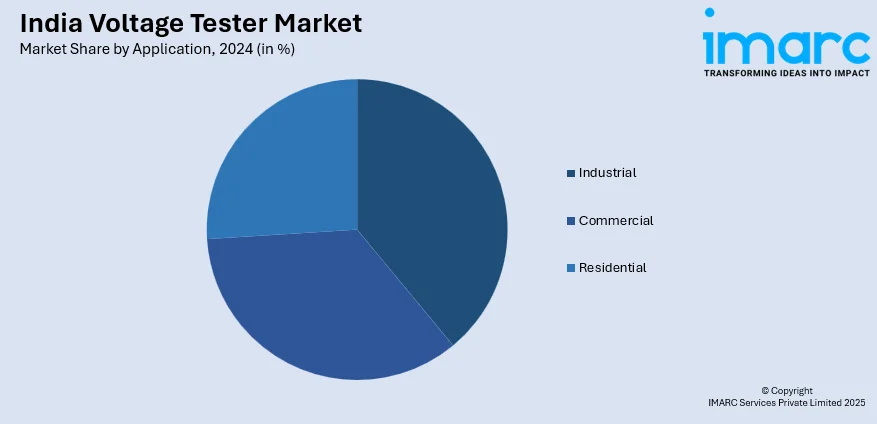

Application Insights:

- Industrial

- Commercial

- Residential

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial, commercial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Voltage Tester Market News:

- October 2024: Standex International Corporation acquired India-based Narayan Powertech Pvt. Ltd., a company specializing in low to medium voltage technologies. This strategic move aims to broaden Standex's technology platform and capabilities, facilitating growth in the electronics market and expanding its engineering expertise within India.

- March 2024: Bureau Veritas entered into definitive agreements to acquire Hi Physix Laboratory India Pvt. Ltd., a Pune-based testing and certification facility specializing in electrical and electronic products. This strategic acquisition broadens Bureau Veritas's offerings within the electrical and electronics sector.

India Voltage Tester Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Contact Voltage Tester, Non-Contact Voltage Tester |

| Operations Covered | Handheld, Portable, Fixed |

| Frequencies Covered | High-Frequency Tester, High-Frequency AC Tester, High-Frequency DC Tester, Low-Frequency Tester, Low-Frequency AC Tester, Low-Frequency DC Tester |

| Applications Covered | Industrial, Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India voltage tester market performed so far and how will it perform in the coming years?

- What is the breakup of the India voltage tester market on the basis of product type?

- What is the breakup of the India voltage tester market on the basis of operation?

- What is the breakup of the India voltage tester market on the basis of frequency?

- What is the breakup of the India voltage tester market on the basis of application?

- What are the various stages in the value chain of the India voltage tester market?

- What are the key driving factors and challenges in the India voltage tester market?

- What is the structure of the India voltage tester market and who are the key players?

- What is the degree of competition in the India voltage tester market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India voltage tester market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India voltage tester market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India voltage tester industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)