India Wall Covering Market Size, Share, Trends, and Forecast by Product Type, Printing Type, Application, End User, and Region, 2025-2033

India Wall Covering Market Overview:

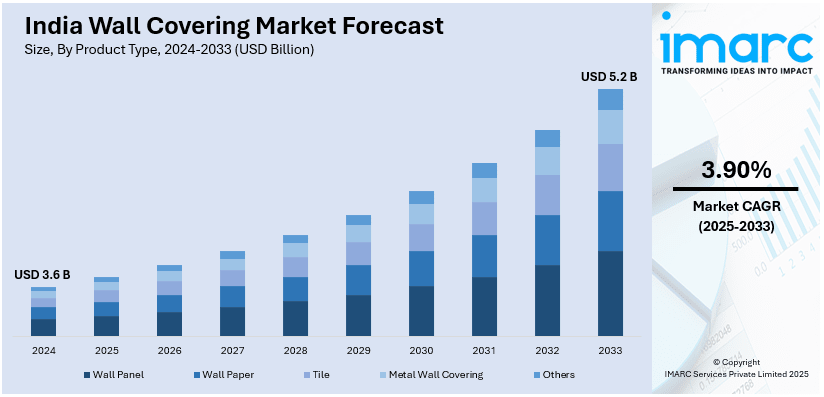

The India wall covering market size reached USD 3.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is growing because of urbanization increase, rising disposable incomes, and intense demand for beauty-conscious interiors. The market-leading segments are wallpapers, decorative laminates, and paints. Growth in the market is due to real estate growth, changing customer tastes, and material technological changes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.6 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Market Growth Rate 2025-2033 | 3.90% |

India Wall Covering Market Trends:

Rising Demand for Sustainable and Eco-Friendly Wall Coverings

The India wall covering market is witnessing a shift toward sustainable and eco-friendly materials due to growing consumer awareness and stringent environmental regulations. Manufacturers are increasingly offering wallpapers, decorative laminates, and paints with low or zero volatile organic compounds (VOCs) to minimize indoor air pollution. The adoption of recycled, biodegradable, and natural materials, such as bamboo-based wallpapers and water-based paints, is gaining traction. Additionally, government initiatives promoting green building certifications, like the Indian Green Building Council (IGBC) and LEED India, are encouraging the use of sustainable wall coverings. For instance, as per industry reports, during 2024, India witnessed 370 projects with LEED certification, a notable elevation in comparison to previous years. The green-certified spaces in total increased to 8.50 Million GSM, highlighting a stable acceleration in sustainability across residential, industrial, and commercial buildings. As urban consumers become more environmentally conscious, demand for products with certifications like GreenGuard and Ecolabel is rising. Market players are investing in R&D to develop durable and cost-effective eco-friendly alternatives to traditional PVC-based wallpapers and solvent-based paints. This trend is expected to strengthen as the construction and interior design sectors increasingly prioritize sustainability in new and renovation projects.

To get more information of this market, Request Sample

Increasing Popularity of Digital and Customizable Wall Coverings

Advancements in digital printing technology are driving the demand for personalized and customizable wall coverings in India. Consumers are seeking unique designs that reflect their personal style, leading to a growing market for bespoke wallpapers, murals, and textured finishes. High-resolution digital printing enables manufacturers to offer intricate patterns, photorealistic images, and customizable designs with greater precision and durability. Hospitality, retail, and commercial spaces are adopting digitally printed wall coverings to create branded and immersive environments. In addition to this, the notable emergence of e-commerce platforms has made it convenient for customers to avail a broad range of designs and order custom-made wallpapers online. For instance, as per industry reports, in 2024, e-commerce segment across India witnessed robust growth of 15%-20% among key platforms, typically being driven by technology utilization. Companies are leveraging augmented reality (AR) applications as well as AI-powered design tools to allow customers to visualize wall coverings before purchase. With increasing disposable income and changing aesthetic preferences, digital and customizable wall coverings are becoming a preferred choice among Indian consumers, particularly in urban and semi-urban regions.

India Wall Covering Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, printing type, application, and end user.

Product Type Insights:

- Wall Panel

- Wall Paper

- Vinyl Wallpaper

- Non-woven Wallpaper

- Paper-based Wallpaper

- Fabric Wallpaper

- Others

- Tile

- Metal Wall Covering

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wall panel, wall paper (vinyl wallpaper, non-woven wallpaper, paper-based wallpaper, fabric wallpaper, and others), tile, metal wall covering, and others.

Printing Type Insights:

- Digital

- Traditional

A detailed breakup and analysis of the market based on the printing type have also been provided in the report. This includes digital and traditional.

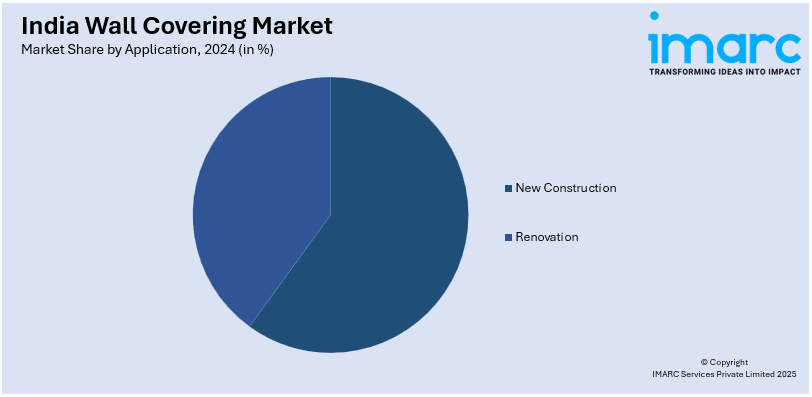

Application Insights:

- New Construction

- Renovation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes new construction and renovation.

End User Insights:

- Commercial

- Residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes commercial and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wall Covering Market News:

- In November 2024, VOX India announced the launch of its new versatile line for ceiling and wall panels, encompassing Welo SV22, Infratop Four Lamella SV26, and Fronto SV24. Such panels address the escalating need for visually appealing, multi-functional, and robust materials that innovate spaces across both commercial and residential ecosystem.

India Wall Covering Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Printing Types Covered | Digital, Traditional |

| Applications Covered | New Construction, Renovation |

| End Users Covered | Commercial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India wall covering market performed so far and how will it perform in the coming years?

- What is the breakup of the India wall covering market on the basis of product type?

- What is the breakup of the India wall covering market on the basis of printing type?

- What is the breakup of the India wall covering market on the basis of application?

- What is the breakup of the India wall covering market on the basis of end user?

- What is the breakup of the India wall covering market on the basis of region?

- What are the various stages in the value chain of the India wall covering market?

- What are the key driving factors and challenges in the India wall covering market?

- What is the structure of the India wall covering market and who are the key players?

- What is the degree of competition in the India wall covering market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wall covering market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wall covering market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wall covering industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)