India Warehouse Management Systems Market Size, Share, Trends, and Forecast by Component, Deployment, Function, Application, and Region, 2025-2033

India Warehouse Management Systems Market Size and Share:

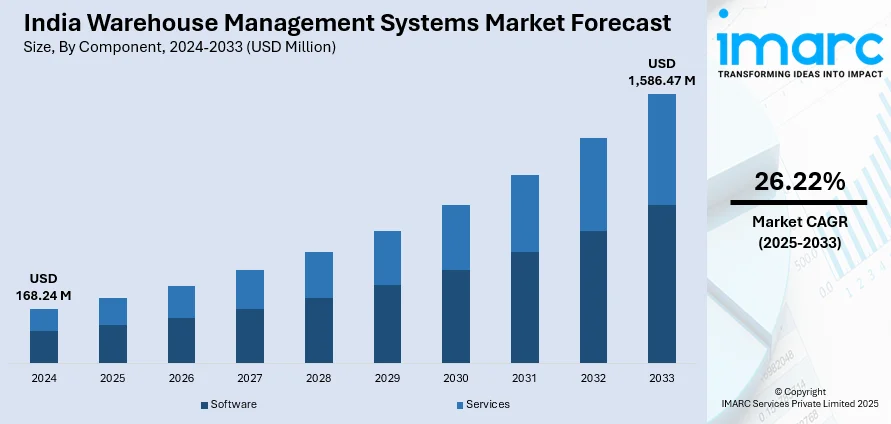

The India warehouse management systems market size reached USD 168.24 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,586.47 Million by 2033, exhibiting a growth rate (CAGR) of 26.22% during 2025-2033. The market is expanding due to rising e-commerce, automation adoption, and supply chain optimization. Advanced WMS solutions enhance inventory tracking, reduce operational costs, and improve logistics efficiency, driving demand across industries, including retail, manufacturing, and third-party logistics (3PL).

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 168.24 Million |

| Market Forecast in 2033 | USD 1,586.47 Million |

| Market Growth Rate (2025-2033) | 26.22% |

India Warehouse Management Systems Market Trends:

Adoption of AI and Automation in Warehouse Management

The market for warehouse management systems (WMS) across India is currently undergoing an intense transformation inclining steeply towards AI-powered automation to improve precision, efficacy, and operational speed. With the increased utilization of machine learning (ML) algorithms, robotics, and Internet of Things (IoT) sensors, warehouses can currently upgrade inventory tracking, minimize manual errors, and streamline space utilization. AI-based predictive analytics facilitate demand forecasting, guaranteeing greater inventory management and lowered stockouts. In addition to this, robotic picking systems as well as automated guided vehicles (AGVs) are notably enhancing rates of order fulfillment. The increasing proliferation of supply chain frameworks and rapid emergence in e-commerce further bolster the requirement for AI-incorporated WMS solutions, making operations more resilient and cost-effective. For instance, as per industry reports, gross merchandise value of e-commerce segment in India is anticipated to increase to USD 12 Billion in Q3 20204, reflecting a 23% growth from 2023. Moreover, companies are increasingly investing in intelligent WMS platforms to achieve real-time visibility, enhance security, and minimize delays in logistics. As automation technology advances, the integration of AI-driven solutions within WMS is expected to become an industry standard, improving overall efficiency in India's warehousing sector.

Cloud-Based WMS for Scalability and Flexibility

The transition toward cloud-based warehouse management systems is gaining momentum in India due to their scalability, cost-effectiveness, and remote accessibility. Traditional on-premise WMS solutions often require high upfront costs and extensive IT infrastructure, whereas cloud-based systems provide a flexible and scalable alternative. Businesses benefit from real-time inventory tracking, seamless integration with ERP and supply chain management software, and enhanced data security. The rising demand for omnichannel fulfillment, especially in e-commerce, has accelerated the adoption of cloud-based WMS, enabling businesses to manage multiple warehouses from a centralized platform. Additionally, software-as-a-service (SaaS) models offer continuous updates and maintenance, reducing operational disruptions. The ability to access WMS remotely supports decentralized logistics and enhances supply chain agility. With increasing digital transformation efforts, businesses in India are investing in cloud-based WMS solutions to improve operational efficiency, reduce downtime, and ensure smooth warehouse operations across multiple locations. For instance, increasing digital initiatives are expected to lead India to become a digital economy worth USD 1 Trillion by the year 2028.

India Warehouse Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, deployment, function, and application.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Insights:

- On-premise

- Cloud

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premise and cloud.

Function Insights:

- Labor Management System

- Analytics and Optimization

- Billing and Yard Management

- Systems Integration and Maintenance

- Consulting Services

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes labor management system, analytics and optimization, billing and yard management, systems integration and maintenance, and consulting services.

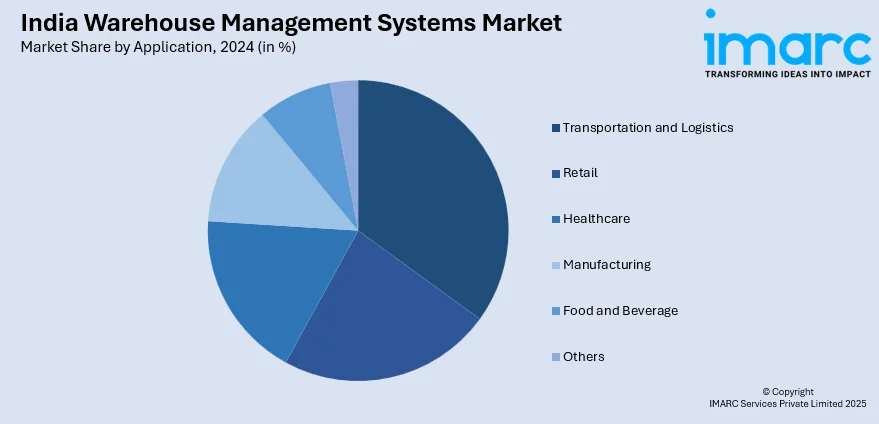

Application Insights:

- Transportation and Logistics

- Retail

- Healthcare

- Manufacturing

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transportation and logistics, retail, healthcare, manufacturing, food and beverage, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Warehouse Management Systems Market News:

- In February 2024, Accio Robotics, a major startup for warehouse robotics announced the launch AccioPick Air, a new product designed to enhance metrics of warehouse performance by improving dependability, performance, and efficacy of order picking. This move is focused for key markets, including India.

- In July 2024, Bigbasket announced partnership with BB Matrix, SaaS-based platform for supply chain, to manage their operations and supply chain networks. As per the agreement, BB will provide Bigbasket with order management system, WMS, and tarnsport management system.

India Warehouse Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployments Covered | On-premise, Cloud |

| Functions Covered | Labor Management System, Analytics and Optimization, Billing and Yard Management, Systems Integration and Maintenance, Consulting Services |

| Applications Covered | Transportation and Logistics, Retail, Healthcare, Manufacturing, Food and Beverage, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India warehouse management systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India warehouse management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India warehouse management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India warehouse management systems market was valued at USD 168.24 Million in 2024.

The India warehouse management systems market is projected to exhibit a CAGR of 26.22% during 2025-2033, reaching a value of USD 1,586.47 Million by 2033.

The India warehouse management systems market is driven by rapid e-commerce expansion, demand for supply chain efficiency, and increased adoption of automation technologies like robotics and IoT. Integration with ERP and cloud platforms enhancing visibility and scalability, along with regulatory reforms and infrastructure development, are also supporting industry-wide digital transformation and logistics optimization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)