India Washing Machine Market Size, Share, Trends and Forecast by Type, Capacity, Distribution Channel, End Use, and Region, 2026-2034

India Washing Machine Market Summary:

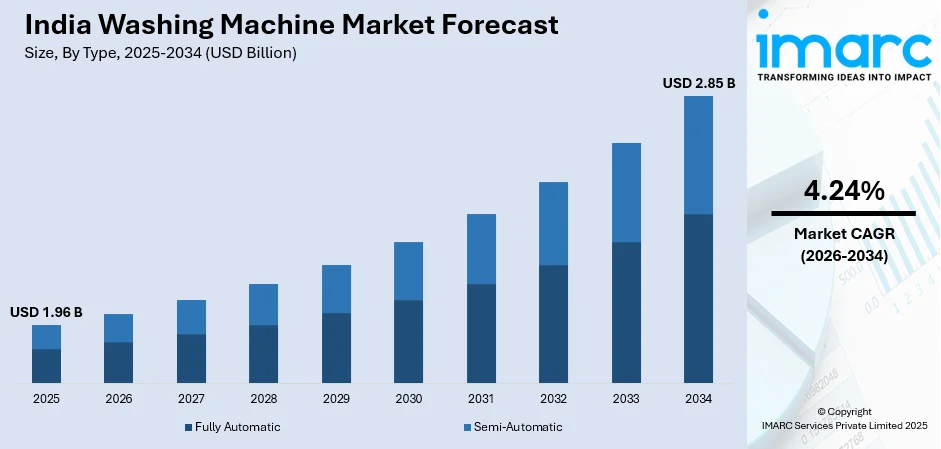

The India washing machine market size was valued at USD 1.96 Billion in 2025 and is projected to reach USD 2.85 Billion by 2034, growing at a compound annual growth rate of 4.24% from 2026-2034.

The market is driven by rapid urbanization, rising disposable incomes among middle-class households, and growing preference for energy-efficient and technologically advanced home appliances. Expanding electrification and piped water supply in rural and semi-urban regions are catalyzing adoption. The shift towards nuclear families, increasing female workforce participation, and demand for convenient automated laundry solutions are contributing to the expanding India washing machine market share.

Key Takeaways and Insights:

-

By Type: Fully automatic dominates the market with a share of 64% in 2025, driven by push-button convenience, time efficiency, and smart features such as AI-enabled wash programs and IoT connectivity enhancing modern laundry experiences.

-

By Capacity: 6 Kg to 8 Kg leads the market with a share of 42% in 2025, owing to demand from nuclear families and urban households seeking balanced drum capacity, efficient weekly washing, and suitability for compact living spaces.

-

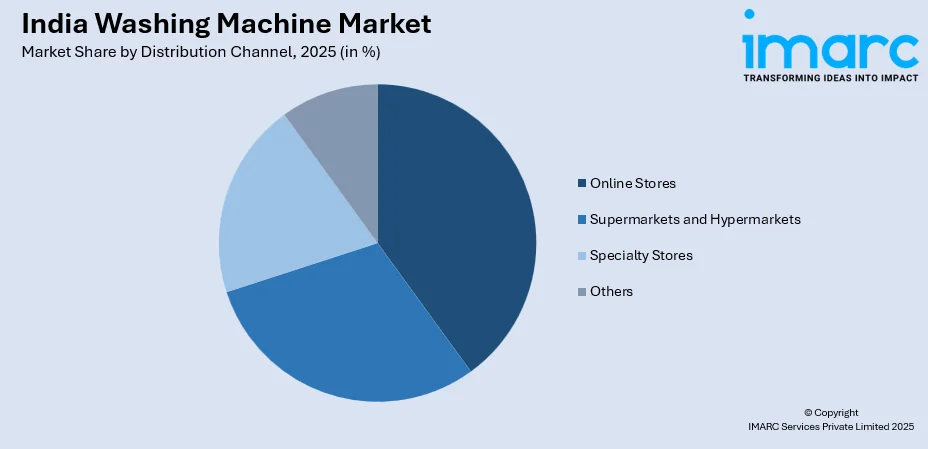

By Distribution Channel: Online stores represent the largest segment with a market share of 37% in 2025, driven by strong e-commerce penetration, doorstep delivery, competitive pricing, broad product choices, and easy feature comparisons attracting digitally savvy consumers.

-

By End Use: Residential dominates the market with a share of 91% in 2025, owing to rising household penetration, nuclear family growth, rapid urbanization, and improving purchasing power across tier-II and tier-III cities.

-

By Region: West and Central India leads the market with a share of 30% in 2025, driven by dense urban populations, higher disposable incomes, robust retail networks, and strong e-commerce adoption across major metropolitan regions.

-

Key Players: The India washing machine market exhibits moderate to highly competitive landscape, with multinational consumer electronics corporations competing alongside domestic manufacturers across diverse price segments. Market participants are focusing on product innovation, smart technology integration, and expanding distribution networks to capture growing consumer demand.

To get more information on this market Request Sample

The India washing machine market is experiencing substantial growth propelled by transformative socioeconomic factors reshaping consumer behaviour. Accelerating urbanization has led to the proliferation of nuclear families and dual-income households, creating demand for time-saving home appliances. Rising disposable incomes among the expanding middle-class population are enabling consumers to invest in automated laundry solutions. Government initiatives promoting domestic manufacturing through production linked incentive (PLI) schemes are strengthening the local component ecosystem while reducing production costs. As per sources, in December 2025, Bharti Enterprises and Warburg Pincus acquired a combined 49% stake in Haier India to strengthen local manufacturing, innovation capabilities, and long-term growth in India’s consumer appliances sector. Moreover, the expansion of rural electrification programs and improved water infrastructure are unlocking previously untapped markets. Additionally, growing environmental consciousness is driving consumer preference for energy-efficient and water-saving appliances, while technological advancements including Internet of Things (IoT) connectivity and artificial intelligence (AI) powered features are elevating product appeal across urban demographics.

India Washing Machine Market Trends:

Smart Technology Integration and IoT-Enabled Appliances

The integration of smart technologies into washing machines represents a transformative trend reshaping the India market landscape. Consumers are increasingly gravitating toward appliances featuring Wi-Fi connectivity, smartphone app controls, and voice assistant compatibility. These intelligent features enable remote monitoring, customized wash cycles, and diagnostic alerts that enhance user convenience. AI powered wash systems are gaining traction by automatically detecting fabric types and soil levels to optimize water usage and detergent dispensation. According to sources, in December 2025, LG Electronics India launched a new washing machine range featuring AI DD 2.0 technology, introducing 10 models with smart connectivity, intelligent fabric detection, and sustainability-focused features for Indian households. Furthermore, the growing tech-savvy urban population and rising aspirations for connected home ecosystems are accelerating the adoption of these advanced laundry solutions across metropolitan and tier-II cities.

Shift Toward Energy-Efficient and Sustainable Solutions

Environmental consciousness is driving a pronounced shift toward energy-efficient and water-saving washing machines across India. Consumers are becoming increasingly aware of utility consumption patterns and seeking appliances that minimize electricity and water usage while delivering superior cleaning performance. Manufacturers are responding by developing inverter motor technologies and eco-wash cycles that significantly reduce resource consumption. Government energy rating programs are influencing purchasing decisions as consumers prioritize appliances with higher star ratings. As per sources, in July 2025, India’s BEE updated washing machine labels with star ratings, QR codes, and origin details, guiding consumers toward energy-efficient, water-saving appliances while promoting sustainable household choices. Further, this sustainability-focused trend is particularly pronounced among urban educated demographics who balance environmental responsibility with long-term cost savings through reduced utility bills.

Expansion of Premium Fully Automatic Segment

The India washing machine market is witnessing a notable transition from semi-automatic to fully automatic models as consumers prioritize convenience and time efficiency. Rising disposable incomes and changing lifestyle patterns are enabling households to upgrade to premium appliances offering enhanced features and superior wash quality. Front-load washing machines are gaining popularity in urban areas due to their water efficiency, gentler fabric care, and contemporary aesthetics. Manufacturers are introducing feature-rich entry-level fully automatic models with competitive pricing to capture the mass-market segment while simultaneously offering premium variants with advanced technologies to cater to affluent consumers seeking sophisticated laundry solutions. In September 2025, Samsung India launched its Bespoke AI Washer Dryer (12 kg wash/7 kg dry) with AI Wash, Auto Dispense, and AI Control, offering smarter, faster, and more sustainable laundry solutions.

Market Outlook 2026-2034:

The India washing machine market revenue is poised for sustained expansion during the forecast period, underpinned by favorable demographic shifts and evolving consumer preferences. Accelerating urbanization, rising middle-class population, and increasing household electrification rates are expected to drive robust demand across product categories. The growing penetration of e-commerce platforms will enhance market accessibility in underserved regions while competitive pricing strategies attract first-time buyers. Smart technology adoption and premiumization trends are anticipated to elevate average selling prices and expand revenue potential. The market generated a revenue of USD 1.96 Billion in 2025 and is projected to reach a revenue of USD 2.85 Billion by 2034, growing at a compound annual growth rate of 4.24% from 2026-2034.

India Washing Machine Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Fully Automatic |

64% |

|

Capacity |

6 Kg to 8 Kg |

42% |

|

Distribution Channel |

Online Stores |

37% |

|

End Use |

Residential |

91% |

|

Region |

West and Central India |

30% |

Type Insights:

- Fully Automatic

- Front Load

- Top Load

- Semi-Automatic

Fully automatic dominates with a market share of 64% of the total India washing machine market in 2025.

The fully automatic commands the leading market share, reflecting consumer preference for appliances offering complete automation and convenience. These machines eliminate manual intervention throughout the wash cycle, from water filling to spinning and draining, appealing to busy urban households and working professionals. The segment encompasses both front-load and top-load variants, with front-load models gaining momentum due to superior water efficiency and gentle fabric handling capabilities that protect delicate garments during washing.

Technological advancements have significantly enhanced the value proposition of fully automatic machines, incorporating features such as multiple wash programs, steam sanitization, and allergen removal cycles. The declining price differential between semi-automatic and fully automatic models, driven by local manufacturing expansion and component localization, is accelerating segment migration. In October 2025, LG India launched its Essential Series, featuring a fully automatic top-load washing machine built for Indian conditions with low-pressure fill, dust-resistant controls, and durable, practical design. Moreover, consumer willingness to invest in premium appliances offering long-term convenience and superior performance continues strengthening this segment's market leadership position across urban and semi-urban markets.

Capacity Insights:

- Below 6 Kg

- 6 Kg to 8 Kg

- Above 8 Kg

6 Kg to 8 Kg leads with a share of 42% of the total India washing machine market in 2025.

The capacity ranging from 6 Kg to 8 Kg represents the best spot for Indian households, capturing the largest India washing machine market share among capacity categories. As per sources, in May 2025, Cellecor, in partnership with Dixon Technologies, launched fully automatic 7 kg and 8 kg washing machines for Bharat 2.0, expanding premium appliance access beyond urban Indian markets. Moreover, this capacity range optimally serves the laundry requirements of nuclear families typically comprising three to five members, accommodating weekly wash loads efficiently. Urban space constraints further favor this segment as these machines offer balanced drum sizes without occupying excessive floor area in compact urban apartments.

Consumer purchasing behaviour demonstrates preference for versatile machines capable of handling mixed laundry loads including regular clothing, bedsheets, and curtains without requiring multiple wash cycles. Manufacturers have responded by offering extensive product portfolios within this capacity range featuring diverse price points and feature sets to accommodate varying household budgets. The segment benefits from optimal energy and water consumption ratios that align with growing sustainability consciousness among environmentally aware consumers seeking to minimize utility expenses while reducing their overall environmental footprint.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Online stores exhibit a clear dominance with a 37% share of the total India washing machine market in 2025.

The online stores have emerged as the dominant distribution pathway for washing machines in India, reflecting broader digital transformation in consumer purchasing behavior. According to reports, in December 2024, India’s online electronics sales reached a 34% market share, driving a Rs 11,000 crore shift from retail stores, reflecting growing consumer confidence in e-commerce platforms. Moreover, e-commerce platforms offer compelling value propositions including extensive product assortments, competitive pricing, transparent customer reviews, and convenient doorstep delivery with professional installation services. The proliferation of smartphone penetration and improving internet connectivity across tier-II and tier-III cities has democratized access to online shopping platforms, enabling consumers in previously underserved regions to explore and purchase appliances conveniently.

Digital marketplaces enable consumers to compare specifications, features, and prices across multiple brands simultaneously, facilitating informed purchasing decisions. Attractive financing options including no-cost EMI schemes and exchange programs have lowered entry barriers for first-time buyers seeking affordable acquisition pathways. Seasonal sales events and festive promotions generate significant purchase volumes through substantial discounts and bundled offers. The integration of augmented reality (AR) features allowing virtual product visualization is enhancing online shopping experiences, enabling consumers to assess appliance dimensions and aesthetics before purchasing.

End Use Insights:

- Residential

- Commercial

Residential leads with a market share of 91% of the total India washing machine market in 2025.

The residential highly dominates the India washing machine market, reflecting the appliance's fundamental role as a household necessity rather than commercial equipment. Rising household formation rates driven by rapid urbanization and nuclear family proliferation are expanding the residential consumer base significantly across urban and semi-urban regions. Improving living standards and growing awareness of hygiene have elevated washing machine ownership aspirations among middle-class households nationwide, transforming these appliances from perceived luxury items into essential household requirements for modern Indian families.

Electrification expansion in rural and semi-urban areas is unlocking substantial untapped demand potential within the residential segment, enabling first-time appliance purchases among previously underserved consumer populations. Government housing initiatives and real estate development projects are creating new households equipped with modern amenities including washing machines. According to reports, in 2025, Wybor was selected under the PM Vishwakarma scheme to supply, install, and service 75,000 semi-automatic washing machines across India’s remote and underserved regions. Moreover, consumer preference for automated laundry solutions driven by increasing female workforce participation and time constraints in dual-income households continues strengthening residential demand while diverse product offerings spanning multiple price points cater to varied budget considerations.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

West and Central India dominates with a market share of 30% of the total India washing machine market in 2025.

West and Central India leads the regional market landscape, benefiting from the concentration of major metropolitan centers including Mumbai, Pune, and Ahmedabad. These urban agglomerations feature higher disposable income levels, established retail infrastructure, and strong e-commerce penetration that collectively drive robust washing machine demand across consumer segments. The region's advanced electrification status and reliable water supply infrastructure enable widespread appliance adoption among urban and semi-urban households seeking modern conveniences and automated home solutions that significantly enhance quality of daily living.

Industrial development and robust employment opportunities throughout the region have attracted migrant populations forming new households seeking modern amenities including automated washing machines. The strategic presence of established manufacturing facilities and well-connected distribution hubs ensures consistent product availability and highly competitive pricing across diverse market segments. Tier-II and tier-III cities within the region are emerging as significant growth frontiers as rising household incomes, improving infrastructure, and accelerating urbanization patterns expand the addressable consumer base substantially beyond traditional metropolitan market boundaries.

Market Dynamics:

Growth Drivers:

Why is the India Washing Machine Market Growing?

Accelerating Urbanization and Nuclear Family Formation

Rapid urbanization across India is fundamentally reshaping household structures and consumer appliance preferences, driving substantial washing machine market growth. Metropolitan expansion and migration to urban centers are creating millions of new households annually, each representing potential first-time appliance purchasers. As per sources, the UN reports India will contribute over 20 Crore new urban residents by 2050, making it the world’s largest driver of urban population growth, reshaping housing and appliance demand. Furthermore, the transition from traditional joint families to nuclear units has elevated individual household requirements for essential appliances including washing machines. Urban lifestyles characterized by time constraints, space limitations, and convenience orientation favor automated laundry solutions over manual washing methods. The concentration of employment opportunities in cities continues attracting working-age populations who prioritize modern home amenities.

Rising Disposable Incomes Among Middle-Class Households

The expanding Indian middle class represents a powerful demand driver for washing machines as rising disposable incomes enable household appliance investments. Economic development and employment growth across sectors have elevated purchasing power among millions of families who previously considered washing machines luxury items. Income growth in tier-II and tier-III cities is particularly impactful as these markets transition from low penetration to active growth phases. Consumer financing options including affordable EMI schemes have democratized access to premium appliances among aspirational middle-class segments. The replacement cycle is strengthening as households upgrade from basic to feature-rich models reflecting improved financial circumstances.

Government Initiatives Supporting Domestic Manufacturing

Strategic government policies promoting domestic manufacturing are catalyzing India washing machine market development through multiple mechanisms. According to sources, the Indian government reopened the PLI Scheme application window for white goods, to attract investments, strengthen local manufacturing, and support domestic value chains. Furthermore, the Production Linked Incentive scheme is attracting investments in local component production and assembly facilities, reducing import dependency and manufacturing costs. Make in India initiatives are encouraging multinational corporations to establish production bases domestically, enhancing supply chain resilience and product availability. Rural electrification programs are extending grid connectivity to previously unserved areas, unlocking substantial untapped demand potential. Energy efficiency labeling requirements are guiding consumers toward sustainable appliances while driving manufacturer innovation in resource-efficient technologies.

Market Restraints:

What Challenges the India Washing Machine Market is Facing?

Low Penetration in Rural Markets

Despite rural electrification progress, washing machine penetration in rural India remains substantially below urban levels, limiting overall market expansion. Cultural preferences for traditional handwashing methods persist among rural households, creating adoption barriers. High upfront appliance costs relative to rural income levels deter potential first-time buyers. Limited awareness of product benefits and lack of targeted marketing efforts further constrain rural demand potential.

Infrastructure Limitations in Underserved Regions

Inadequate infrastructure in semi-urban and rural areas poses significant barriers to washing machine market expansion. Unreliable electricity supply disrupts appliance operation and discourages purchases in regions experiencing frequent power outages. Inconsistent piped water availability necessitates manual water filling, undermining the convenience proposition of automatic machines. Limited after-sales service networks and spare parts availability in remote areas create consumer hesitation regarding maintenance concerns.

Price Sensitivity Among Mass-Market Consumers

Significant price sensitivity among Indian consumers constrains premium segment growth and margin expansion opportunities. Entry barriers for first-time buyers remain substantial despite financing availability. Competition from lower-priced semi-automatic models limits fully automatic segment penetration in price-conscious markets. Rising input costs and currency fluctuations create pricing pressures that manufacturers struggle to pass through to value-conscious consumers.

Competitive Landscape:

The India washing machine market features a moderately consolidated competitive structure characterized by the presence of established multinational corporations alongside emerging domestic manufacturers. Market participants compete across multiple dimensions including product innovation, pricing strategies, distribution network expansion, and after-sales service quality. Leading players are investing substantially in research and development to introduce technologically advanced features including artificial intelligence integration, smart connectivity, and energy-efficient operations. Strategic partnerships with e-commerce platforms are enhancing market reach while manufacturing localization initiatives are improving cost competitiveness. Brand building through advertising campaigns targeting diverse consumer segments remains a key competitive strategy. The market is witnessing intensifying competition as domestic manufacturers leverage local manufacturing advantages to challenge established international brands across price segments.

Recent Developments:

-

In July 2025, Haier Appliances India launched its F9 Front Load Washing Machine series, featuring India’s first AI Color Panel with One Touch technology. The 12 kg machines, equipped with AI One Touch, Direct Motion Motor, and a 525 mm Super Drum, provide advanced fabric care, energy efficiency, and remote control via the Hai Smart App.

-

In January 2025, Samsung India introduced its new 9 kg Front Load Washing Machines as part of the Bespoke AI Laundry Series. Equipped with AI Energy, AI Control, Ecobubble, Super Speed, and Hygiene Steam, these compact machines deliver efficient large load washing, superior fabric care, energy savings, and a sleek, modern design for Indian households.

India Washing Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Capacities Covered | Below 6 Kg, 6 Kg to 8 Kg, Above 8 Kg |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India washing machine market size was valued at USD 1.96 Billion in 2025.

The India washing machine market is expected to grow at a compound annual growth rate of 4.24% from 2026-2034 to reach USD 2.85 Billion by 2034.

Fully automatic held the largest market share, driven by consumer preference for convenience, minimal manual effort, time-saving operation, and growing adoption of smart features that enhance ease of use and overall washing efficiency.

Key factors driving the India washing machine market include accelerating urbanization, rising disposable incomes among middle-class households, nuclear family proliferation, government manufacturing initiatives, e-commerce expansion, growing female workforce participation, and increasing demand for smart and energy-efficient appliances.

Major challenges include low penetration in rural markets, infrastructure limitations including unreliable electricity and water supply, price sensitivity among mass-market consumers, competition from lower-priced semi-automatic models, and limited after-sales service networks in remote areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)