India Waste Heat Recovery Systems Market Size, Share, Trends and Forecast by Phase System, Application, End Use, and Region, 2025-2033

India Waste Heat Recovery Systems Market Overview:

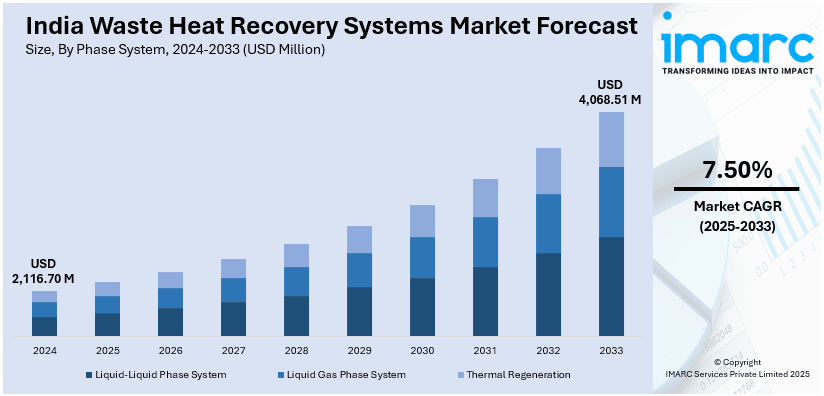

The India waste heat recovery systems market size reached USD 2,116.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,068.51 Million by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. The India waste heat recovery systems market share is driven by industrial expansion, rising energy costs, and government regulations. Besides this, increasing production capacities catalyzes demand, while high fuel prices encourage industries to adopt energy-efficient solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,116.70 Million |

| Market Forecast in 2033 | USD 4,068.51 Million |

| Market Growth Rate 2025-2033 | 7.50% |

India Waste Heat Recovery Systems Market Trends:

Technological Advancements

Innovations in heat exchangers, boilers, and organic Rankine cycle (ORC) systems are improving energy efficiency. Advanced heat exchangers enhance heat transfer, enabling industries to utilize waste heat more effectively. ORC technology allows low-grade waste heat to be converted into electricity, increasing energy savings for industries. Automation and smart monitoring systems are optimizing waste heat recovery operations, ensuring maximum efficiency. Enhanced material engineering is improving heat resistance and durability, making systems more reliable in industrial applications. Industries are adopting modular and scalable waste heat recovery solutions to meet specific energy requirements. Companies like Eastern Recuperators, with over 40 years of expertise and 4,500+ installations worldwide, are driving innovation in the sector. At METEC India 2024, held from November 27-29 at the Bombay Exhibition Centre, Mumbai, Eastern Recuperators showcased cutting-edge waste heat recovery systems achieving up to 88% energy recovery efficiency. These advancements are helping industries significantly reduce fuel costs while lowering carbon emissions. Digitalization and Internet of Thing (IoT) integration are enabling real-time monitoring, reducing maintenance costs and improving system performance. Research and development (R&D) efforts are introducing compact and efficient waste heat recovery technologies for various industrial sectors. As technology continues evolving, waste heat recovery systems are becoming more efficient, thereby strengthening India waste heat recovery systems market growth.

To get more information of this market, Request Sample

Expansion of Industries

Rapid industrialization in cement, steel, chemicals, and refineries is driving energy consumption across various manufacturing processes. Industries are actively seeking energy-efficient solutions to optimize production costs and enhance operational sustainability. Waste heat recovery systems help industries utilize excess heat generated during production, reducing fuel dependency and improving efficiency. Rising production capacities and new manufacturing facilities are further amplifying the need for energy-efficient technologies. The Index of Industrial Production (IIP) growth rate for December 2024 stood at 3.2%, reflecting ongoing industrial expansion, though slightly lower than the 5.2% recorded in November 2024. Large-scale industries are integrating waste heat recovery to improve profitability and achieve long-term cost savings, which is positively influencing the India waste heat recovery systems market outlook. The demand for sustainable energy solutions is increasing as industries focus on reducing their environmental impact. Expanding industrial operations are creating higher waste heat volumes, providing opportunities for system deployment across sectors. Industries with high-temperature processes are adopting waste heat recovery to comply with energy efficiency regulations. Government policies and incentives are further encouraging industries to implement waste heat recovery technologies. As industries expand, the need for uninterrupted energy supply is growing, making waste heat recovery systems a viable alternative for power generation and energy cost reduction.

India Waste Heat Recovery Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on phase system, application, and end use.

Phase System Insights:

- Liquid-Liquid Phase System

- Liquid Gas Phase System

- Thermal Regeneration

The report has provided a detailed breakup and analysis of the market based on the phase system. This includes liquid-liquid phase system, liquid gas phase system, and thermal regeneration.

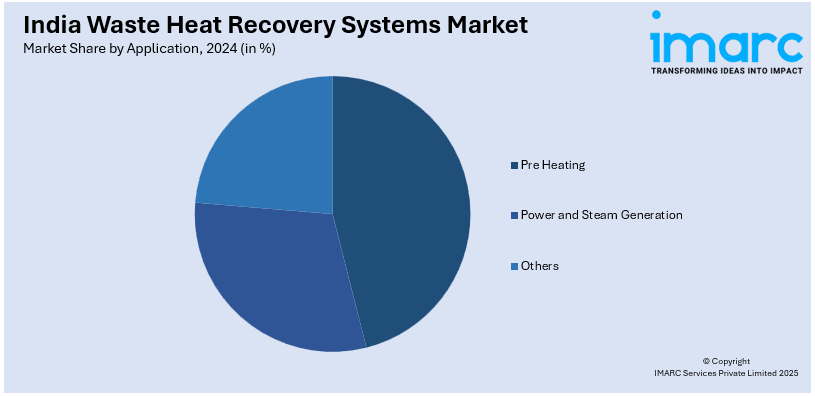

Application Insights:

- Pre Heating

- Power and Steam Generation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes pre heating, power and steam generation, and others.

End Use Insights:

- Petroleum Refinery

- Power

- Cement

- Chemical

- Metal Production and Casting

- Pulp and Paper

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes petroleum refinery, power, cement, chemical, metal production and casting, pulp and paper, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Waste Heat Recovery Systems Market News:

- In November 2024, GEA announced to deliver two waste heat recovery (WHR) systems to Asahi India Glass Limited (AIS) for its glass manufacturing units in Soniyana, Rajasthan, and Roorkee, Uttarakhand. Each 1.8 MWel WHR system will generate 15,500 MWh of electricity annually, cutting carbon emissions by 13,000 tons per plant. The Rajasthan plant will source 94% of its power from WHR.

India Waste Heat Recovery Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phase Systems Covered | Liquid-Liquid Phase System, Liquid Gas Phase System, Thermal Regeneration |

| Applications Covered | Pre Heating, Power and Steam Generation, Others |

| End Uses Covered | Petroleum Refinery, Power, Cement, Chemical, Metal Production and Casting, Pulp and Paper, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India waste heat recovery systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India waste heat recovery systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India waste heat recovery systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The waste heat recovery systems market in India was valued at USD 2,116.70 Million in 2024.

The India waste heat recovery systems market is projected to exhibit a CAGR of 7.50% during 2025-2033, reaching a value of USD 4,068.51 Million by 2033.

The India waste heat recovery systems market is largely influenced by increasing energy demands in industries, a heightened focus on energy efficiency, and strict environmental regulations. The greater adoption in industries such as cement, steel, and chemicals, along with the associated cost savings that come with implementing these systems are also driving the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)