India Waste Plastic Recycling Market Size, Share, Trends and Forecast by Treatment, Material, Application, Recycling Process, and Region, 2026-2034

India Waste Plastic Recycling Market Summary:

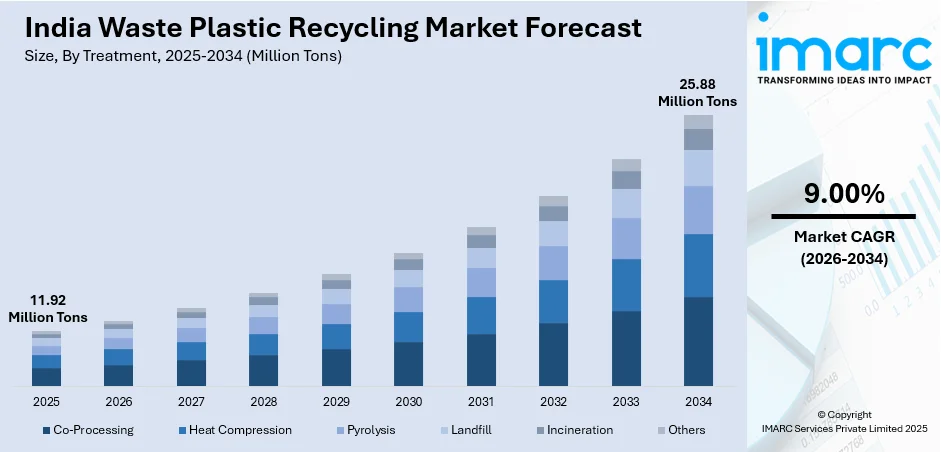

The India waste plastic recycling market size reached 11.92 Million Tons in 2025 and is projected to reach 25.88 Million Tons by 2034, growing at a compound annual growth rate of 9.00% from 2026-2034.

The India waste plastic recycling market is propelled by the increasing demand for recycled plastics in packaging, construction, and automotive industries, driven by heightened environmental consciousness and the national push toward a circular economy. The rise of the food and beverage industry, along with the rise in e-commerce, has made the consumption of plastic packaging grow considerably, which has in turn led to the rise in recycling demand. Strict government policies, such as the Extended Producer Responsibility system and bans on single-use plastics, are forcing manufacturers and brand owners to implement sustainable waste management, which is intensifying the India waste plastic recycling market share.

Key Takeaways and Insights:

-

By Treatment: Pyrolysis dominates the market with a share of 26% in 2025, driven by its ability to convert mixed plastic waste into valuable hydrocarbon fuels while offering environmental advantages over traditional disposal methods.

-

By Material: High-density polyethylene (HDPE) leads the market with a share of 23% in 2025, owing to its extensive applications in rigid packaging, pipes, and construction materials, along with established recycling infrastructure across the country.

-

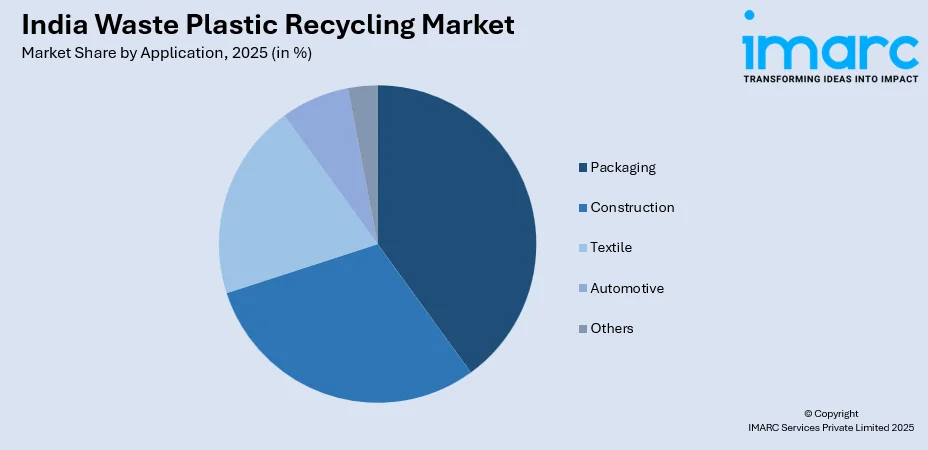

By Application: Packaging represents the largest segment with a market share of 40% in 2025, attributed to the surging demand from FMCG, pharmaceuticals, and e-commerce sectors adopting sustainable packaging solutions.

-

By Recycling Process: Mechanical leads the market with a share of 78% in 2025, preferred for its cost-effectiveness, lower energy consumption, and reduced carbon emissions compared to alternative recycling methods.

-

By Region: North India dominates with 27% market share in 2025, supported by extensive industrial activity, higher recycling awareness, and well-established waste collection infrastructure in major urban centers.

-

Key Players: India waste plastic recycling market has a heterogeneous nature of competition with small and large companies operating in the market because of the easy entry and government-favorable attitude to startups that have novel recycling technology. Some of the major players include A1 Impex, Addonn Polycompounds Private Limited, GD Plast, Gravita India Limited, Jairam Plastic Industries, Key Exports, Luckystar International Pvt. Ltd., Manjushree Technopack Limited (AI Lenarco Midco Limited), Parkash Plastic, Polyraw Enterprises, R.B. Polymers, Yadav Infrapolymers Private Limited, etc.

To get more information on this market Request Sample

The India waste plastic recycling market is experiencing a robust transformation driven by the convergence of regulatory mandates, corporate sustainability commitments, and technological advancement. The ambitious roadmap of the circular economy developed by the government focuses on achieving an even higher rate of recycling than the existing one by decreasing the landfill dependence and increasing the rate at which resources are recovered. Large corporations in the FMCG industry have already made it their mission to eliminate the use of virgin plastics in their packaging, allowing high-grade recycled plastics to be in high demand. The implementation of the Plastic Waste Management Rules, including digital tracking through the centralized EPR portal, is strengthening traceability across the value chain. In January 2025, Huhtamaki's Think Circle initiative convened industry stakeholders in India to collaborate on enhancing the recyclability of flexible plastic packaging, demonstrating the growing corporate engagement in advancing circular economy practices across the country.

India Waste Plastic Recycling Market Trends:

Rising Adoption of Advanced Chemical Recycling Technologies

The India waste plastic recycling sector is increasingly adopting advanced chemical recycling methods, such as pyrolysis and gasification, which allow the processing of mixed and contaminated plastic waste that traditional mechanical recycling cannot manage effectively. These technologies transform plastic waste into hydrocarbon feedstocks, enabling the production of high-quality virgin plastics and promoting more sustainable waste management solutions. For instance, in January 2025, Chandigarh-based circular economy start-up PolyCycl unveiled its patented technology designed to transform hard-to-recycle plastics into food-grade polymers, renewable chemicals, and sustainable fuels, offering an innovative solution for tackling challenging plastic waste streams.

Expanding Extended Producer Responsibility Framework

The strengthening of Extended Producer Responsibility regulations is reshaping the India waste plastic recycling landscape by mandating producers, importers, and brand owners to take accountability for the end-of-life management of their plastic packaging. The EPR framework establishes category-specific collection, recycling, and reuse targets that progressively increase through fiscal year 2028-29. The Central Pollution Control Board's centralized online EPR portal, launched for plastic packaging, has enhanced compliance monitoring and certificate trading mechanisms, enabling systematic tracking of plastic waste management activities across the value chain.

Integration of Artificial Intelligence in Waste Sorting Operations

The India waste plastic recycling industry is being enhanced by technological advances in the form of the implementation of artificial intelligence-powered sorting machines and sensor-enhanced waste recognition systems. These are high-technological approaches that can precisely separate one type of plastic polymer from the other, enhancing the quality of recycled products and minimizing pollution. The adoption of AI-based waste collection is accelerating throughout the largest Indian cities, and municipal communities are seeking to revive their plastic waste sorting systems by collaborating with technology providers to update their facilities by implementing new, modernized systems.

Market Outlook 2026-2034:

The India waste plastic recycling market outlook remains highly favorable as the country accelerates its transition toward a circular plastic economy with comprehensive policy support and infrastructure development. The establishment of plastic parks with government financial incentives is attracting investments in modern recycling facilities, while mandatory recycled content requirements are creating sustained demand for processed plastic materials. The growing emphasis on traceability and quality certification is expected to formalize the sector, integrating informal waste collectors into organized supply chains. The market size was estimated at 11.92 Million Tons in 2025 and is expected to reach 25.88 Million Tons by 2034, reflecting a compound annual growth rate of 9.00% over the forecast period 2026-2034.

India Waste Plastic Recycling Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Treatment | Pyrolysis | 26% |

| Material | High-Density Polyethylene (HDPE) | 23% |

| Application | Packaging | 40% |

| Recycling Process | Mechanical | 78% |

| Region | North India | 27% |

Treatment Insights:

- Co-Processing

- Heat Compression

- Pyrolysis

- Landfill

- Incineration

- Others

Pyrolysis dominates the India waste plastic recycling market with a 26% share in 2025.

Pyrolysis technology has emerged as a leading treatment method in the India waste plastic recycling market due to its capability to process mixed and multi-layered plastic waste that conventional mechanical recycling cannot efficiently handle. This thermal decomposition process converts plastic waste into valuable hydrocarbon products, including pyrolysis oil, synthetic gas, and carbon black, which serve as feedstocks for fuel production and chemical manufacturing. The technology offers significant environmental advantages by diverting plastic from landfills while generating energy and raw materials for industrial applications.

The adoption of pyrolysis technology is accelerating across India as cement manufacturers increasingly utilize plastic-derived fuels as alternative energy sources in their kilns. Chemical recycling through pyrolysis enables the recycling of contaminated and difficult-to-recycle plastics, addressing one of the major challenges in India's plastic waste management ecosystem. Government initiatives supporting waste-to-energy projects and the establishment of dedicated plastic waste processing facilities are driving investments in pyrolysis infrastructure across industrial clusters nationwide.

Material Insights:

- Poly Vinyl Chloride (PVC)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Acrylonitrile Butadiene Styrene (ABS)

- Others

High-density polyethylene (HDPE) leads the India waste plastic recycling market with a 23% share in 2025.

HDPE commands the largest material share in the India waste plastic recycling market owing to its widespread applications across packaging, construction, and infrastructure sectors. The recycled HDPE, commonly known as rHDPE, finds extensive use in manufacturing pipes, crates, containers, and various industrial products due to its excellent durability and chemical resistance properties. The established collection and segregation infrastructure for HDPE packaging waste, particularly from household and commercial sources, facilitates consistent feedstock availability for recycling operations.

The construction industry's growing preference for recycled HDPE pipes and fittings is significantly boosting demand for processed HDPE materials in India. Reprocessing capabilities among plastic waste processors are highest for polyethylene materials, making HDPE recycling economically attractive for both large-scale industrial recyclers and smaller processing units. The government's infrastructure development programs and housing projects are creating sustained demand for recycled HDPE products, supporting the material's leading position in the market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging

- Construction

- Textile

- Automotive

- Others

Packaging represents the largest application share with 40% of the India waste plastic recycling market in 2025.

The packaging sector leads the India waste plastic recycling market, fueled by the rising demand for sustainable packaging across FMCG, food and beverage, pharmaceutical, and e-commerce industries. Companies are increasingly using recycled plastics in their packaging to achieve sustainability objectives and adhere to regulations mandating minimum recycled content. Collaborative initiatives are encouraging businesses and stakeholders to foster a circular economy for plastic packaging, promoting higher utilization of recycled materials, reducing environmental impact, and supporting responsible resource management throughout the supply chain.

The ban on single-use plastics is driving a shift toward recyclable and recycled packaging materials nationwide. Advanced recycling technologies that handle contaminated films and rigid plastics are producing higher-quality recycled materials suitable for food-contact use. Across industries, there is increasing adoption of recycled packaging, reflecting a commitment to minimizing environmental impact and promoting sustainable practices throughout the supply chain.

Recycling Process Insights:

- Mechanical

- Others

Mechanical leads the India waste plastic recycling market with a 78% share in 2025.

Mechanical recycling dominates the India waste plastic recycling market due to its established infrastructure, cost-effectiveness, and lower energy requirements compared to chemical recycling alternatives. The process involves physical operations including sorting, washing, shredding, and extrusion, to convert plastic waste into reusable pellets or flakes without altering the material's chemical structure. India's extensive network of small and medium-scale recyclers primarily employs mechanical recycling methods, leveraging the informal sector's collection efficiency and the technology's relatively lower capital investment requirements.

The mechanical recycling segment benefits from the high reprocessing capabilities among Indian processors for commonly recycled polymers including polyethylene and polypropylene. The technology's lower carbon footprint and reduced greenhouse gas emissions align with India's climate commitments and sustainable development objectives. Investments in modernizing mechanical recycling facilities with automated sorting systems and quality control equipment are improving the output quality, enabling recycled materials to compete with virgin plastics in demanding applications.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates the India waste plastic recycling market with 27% share in 2025.

North India leads the waste plastic recycling market driven by the concentration of manufacturing industries, dense urban populations, and well-developed waste collection infrastructure across major metropolitan areas including Delhi-NCR. The region benefits from higher environmental awareness among consumers and businesses, resulting in better source segregation and consistent feedstock availability for recycling facilities. The expansion of e-commerce platforms and organized retail chains in North India has significantly increased plastic packaging waste generation, creating substantial recycling opportunities.

The presence of numerous recycling clusters and plastic processing units in states such as Uttar Pradesh, Punjab, and Haryana supports the region's market leadership position. For instance, ReCircle, a leading waste management company, announced plans to commission a new facility in Bhiwani, Haryana, in 2025-26 to produce high-quality recycled PET flakes, including bottle-to-bottle grade material. Government initiatives promoting industrial waste management and the establishment of material recovery facilities in urban local bodies are further strengthening North India's recycling infrastructure.

Market Dynamics:

Growth Drivers:

Why is the India Waste Plastic Recycling Market Growing?

Stringent Government Regulations and Policy Support

The India waste plastic recycling market is experiencing robust growth driven by comprehensive government regulations aimed at addressing plastic pollution and promoting circular economy principles. The Plastic Waste Management Rules mandate Extended Producer Responsibility for producers, importers, and brand owners, requiring them to establish systems for collecting and recycling plastic packaging waste. The progressive amendments to these rules have introduced stricter compliance requirements including mandatory recycled content targets starting from fiscal year 2025-26, with Category I rigid plastic packaging required to incorporate specified recycled content percentages that increase annually. The 2025 amendments introduce complete traceability through a centralized online portal, digital EPR certificates, and enhanced penalties for non-compliance, creating a strong regulatory framework that compels industry participation in plastic waste recycling activities.

Growing Demand from End-Use Industries for Sustainable Materials

The increasing adoption of recycled plastics by major end-use industries is significantly propelling the India waste plastic recycling market growth. The packaging industry, representing the largest application segment, is witnessing a paradigm shift as consumer goods companies commit to ambitious sustainability targets and incorporate recycled content into their product packaging. The automotive sector is increasingly utilizing recycled plastics for manufacturing interior components, under-hood parts, and various non-structural applications to reduce vehicle weight and environmental impact. The construction industry's adoption of recycled plastic products including pipes, sheets, and composites, is growing as builders seek sustainable materials that meet performance requirements while supporting green building certifications and environmental compliance mandates.

Technological Advancements in Recycling Infrastructure

Technological advancements are reshaping the India waste plastic recycling sector by boosting processing efficiency, enhancing the quality of recycled materials, and widening the types of plastics that can be effectively recycled. Cutting-edge sorting solutions, incorporating near-infrared spectroscopy and artificial intelligence, enable precise identification and separation of different polymer types, reducing contamination and improving recycling yields. In parallel, chemical recycling methods such as pyrolysis and depolymerization are gaining prominence, allowing mixed and contaminated plastics to be converted into high-quality feedstocks. These innovations reflect growing industry efforts to strengthen sustainable recycling infrastructure and capabilities nationwide.

Market Restraints:

What Challenges the India Waste Plastic Recycling Market is Facing?

Inadequate Waste Collection and Segregation Infrastructure

The India waste plastic recycling market faces significant challenges from inadequate waste collection and improper segregation at source, limiting the availability of quality feedstock for recycling operations. Manual segregation processes remain labor-intensive and prone to errors, resulting in contaminated recyclable materials that reduce recycling efficiency and increase processing costs for recyclers.

Dominance of Informal Sector and Quality Inconsistency

The prevalence of informal recycling operations lacking modern facilities and standardized processes poses quality and consistency challenges for the India waste plastic recycling market. These informal sector operations often lack proper technology and quality controls, resulting in recycled materials with variable specifications that limit their application in high-value end-uses requiring consistent quality standards.

High Capital Requirements for Modern Recycling Technologies

The substantial capital investments required for establishing modern recycling facilities equipped with advanced sorting, processing, and quality control systems present barriers for market expansion. Chemical recycling technologies, while capable of handling complex plastic waste streams, require sophisticated infrastructure and skilled operations that increase project costs and extend payback periods for potential investors.

Competitive Landscape:

The India waste plastic recycling market exhibits a fragmented competitive landscape characterized by the presence of numerous small and medium enterprises alongside established players, driven by relatively low entry barriers and favorable government support for recycling startups. The market structure encourages innovation as new entrants with advanced technologies compete with traditional recyclers to capture emerging opportunities in the circular economy transition. Major players are focusing on capacity expansion, technological upgrades, and strategic partnerships to strengthen their market positions, while startups are introducing innovative solutions for collection, sorting, and processing operations. The evolving regulatory framework and increasing corporate demand for traceable, high-quality recycled plastics are reshaping competitive dynamics as companies invest in compliance capabilities and quality assurance systems.

Some of the key players:

- A1 Impex

- Addonn Polycompounds Private Limited

- GD Plast

- Gravita India Limited

- Jairam Plastic Industries

- Key Exports

- Luckystar International Pvt. Ltd.

- Manjushree Technopack Limited (AI Lenarco Midco Limited)

- Parkash Plastic

- Polyraw Enterprises

- R.B. Polymers

- Yadav Infrapolymers Private Limited

Recent Developments:

-

January 2025: India's Ministry of Environment, Forest and Climate Change amended the Plastic Waste Management Rules to mandate plastic packaging information via on-pack barcode or QR code starting July 2025, enhancing traceability and compliance monitoring across the value chain.

-

July 2025: The Central Road Research Institute (CRRI), in collaboration with Bharat Petroleum Corporation Limited (BPCL), introduced Geocells, three-dimensional, block-like structures fabricated from waste plastics. These modules can be filled with soil or construction debris and utilized for constructing roads, especially in areas with difficult terrain, offering an innovative solution for managing end-of-life plastic waste.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Billion, Million Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Treatment Covered | Co-Processing, Heat Compression, Pyrolysis, Landfill, Incineration, Others |

| Material Covered | Poly Vinyl Chloride (PVC), Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), Polypropylene (PP), Acrylonitrile Butadiene Styrene (ABS), Others |

| Application Covered | Packaging, Construction, Textile, Automotive, Others |

| Recycling Process Covered | Mechanical, Others |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | A1 Impex, Addonn Polycomponds Private Limited, GD Plast, Gravita India Limited, Jairam Plastic Industries, Key Exports, Luckystar International Pvt. Ltd., Manjushree Technopack Limited (AI Lenarco Midco Limited), Parkash Plastic, Polyraw Enterprises, R.B. Polymers, Yadav Infrapolymers Private Limited. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India waste plastic recycling market size reached 11.92 Million Tons in 2025.

The India waste plastic recycling market is expected to grow at a compound annual growth rate of 9.00% from 2026-2034 to reach 25.88 Million Tons by 2034.

Pyrolysis dominated the treatment segment with a 26% market share in 2025, driven by its ability to process mixed and contaminated plastic waste into valuable hydrocarbon products while offering environmental advantages over conventional disposal methods.

Key factors driving the India waste plastic recycling market include stringent government regulations such as Extended Producer Responsibility mandates, increasing demand for sustainable packaging from end-use industries, technological advancements in recycling infrastructure, and the national transition toward a circular economy.

Major challenges include inadequate waste collection and segregation infrastructure, dominance of informal recycling operations lacking modern facilities, high capital requirements for advanced recycling technologies, inconsistent feedstock quality, and limited awareness about proper waste disposal practices among consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)