India Waste to Energy Market Size, Share, Trends and Forecast by Technology, Waste Type, and Region, 2026-2034

India Waste to Energy Market Overview:

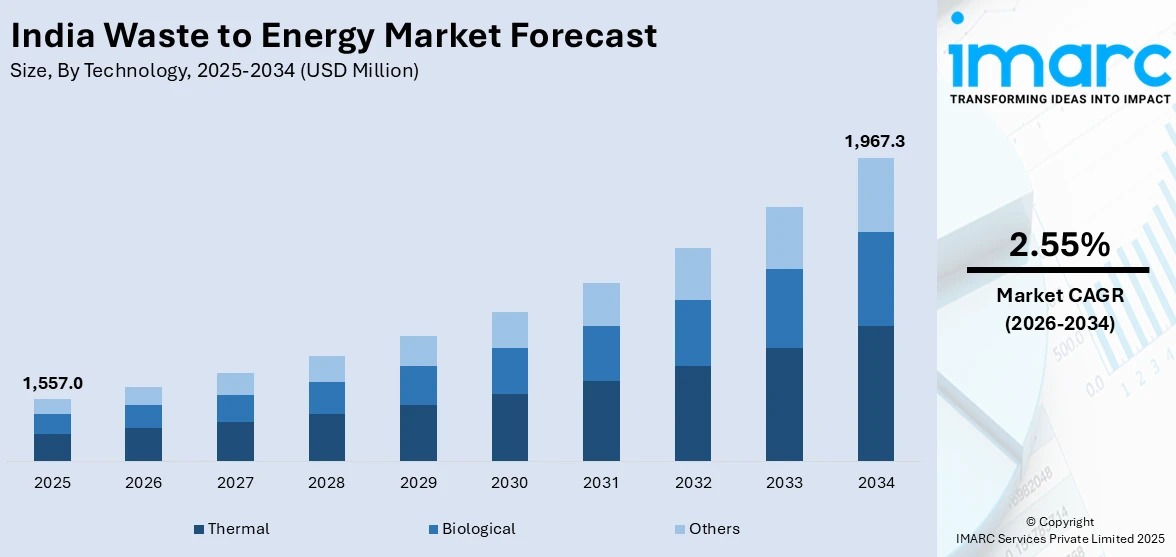

The India waste to energy market size was valued at USD 1,557.0 Million in 2025. Looking forward, the market is projected to reach USD 1,967.3 Million by 2034, exhibiting a CAGR of 2.55% from 2026-2034. Western and Central India dominates the market, holding a significant share in 2024. The market is expanding steadily, driven by rising urban waste, limited landfill space, and supportive government policies. Projects are gaining momentum through public-private collaborations and improved waste processing infrastructure. Private investments and technology upgrades are helping boost capacity and efficiency, contributing to an increase in overall India waste to energy market share across the country.

Market Insights:

- Western and Central India dominates the market, holding a significant share in 2024.

- Thermal stands as the largest technology in 2024, holding 84.2% of the market.

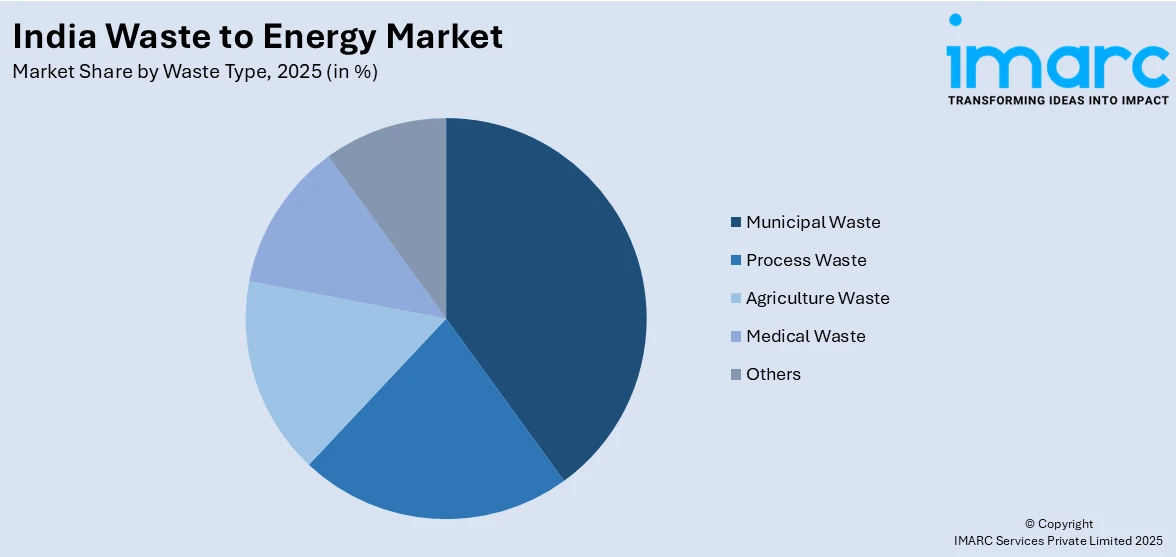

- Municipal waste leads the waste type segment with 60.8% of market share in 2024.

Market Size and Forecast:

- Market Size in 2025: USD 1,557.0 Million

- Market Forecast in 2034: USD 1,967.3 Million

- Market Growth Rate (2026-2034): 2.55%

- Largest Market in 2025: Western and Central India

Additionally, there is mounting pressure to lessen reliance on fossil fuels and achieve renewable energy goals. WTE facilities aid this transition by transforming organic and non-recyclable waste into electricity. For instance, Indore's GOBARdhan plant, Asia's largest, processes 17,000 kg of Bio-CNG daily from organic waste, preventing 130,000 tons of CO2 emissions annually. Launched under the Swachh Bharat Mission, it supports sustainable agriculture with over 100 tonnes of compost daily and has registered 1,300 biogas plants nationwide. Public awareness of sustainable waste management is also on the rise, facilitating better segregation of waste at the source, which is crucial for the effectiveness of WTE systems. Furthermore, the private sector is increasingly engaging through Public-Private Partnership (PPP) arrangements, recognizing the long-term benefits of turning waste challenges into energy opportunities.

To get more information of this market Request Sample

India Waste to Energy Market Trends:

Rising Adoption of RDF-Based Projects

Refuse-Derived Fuel (RDF) is gaining traction as a favored substitute for fuel in India's waste-to-energy sector, especially within the cement and thermal industries. Urban local bodies are advocating for enhanced waste segregation at the source and the establishment of secondary processing facilities that recover combustible materials from mixed municipal waste. For instance, in August 2024, Thiruvananthapuram Corporation inaugurated its first Refuse Derived Fuel (RDF) plant at Sanmathi Park, utilizing pyrolysis technology to convert unsegregated waste into fuel. This initiative aims to address legacy waste, with plans for a second plant at Chenthitta, enhancing the city’s waste management efforts under the Smart City Mission. These RDF production facilities generate fuel pellets or fluff that "meet industrial combustion standards." Cement kilns benefit significantly from RDF due to its high calorific value, which "reduces reliance on coal." States like Telangana and Maharashtra are facilitating long-term offtake agreements between municipalities and cement plants. The rise in RDF usage indicates a shift towards more sustainable waste disposal methods, thereby creating a positive India waste to energy market outlook.

Increased PPP and Private Investments

Public-Private Partnerships (PPPs) are emerging as a leading model for implementing waste-to-energy projects in India. Urban local bodies are entering into long-term contracts that enable private companies to design, build, finance, and manage WTE facilities, ensuring revenue through mechanisms like tipping fees and power purchase agreements. For instance, in June 2025, the Lucknow Municipal Corporation announced its plans to establish a waste-to-energy (WtE) plant at Shivri, processing refuse derived fuel (RDF) to generate 15 MW of electricity. Estimated at INR 450 Crore, the project will follow a public-private partnership (PPP) model, aiming to reduce logistics costs and support local waste management initiatives. These structures help mitigate financial risk and enhance project viability. Major infrastructure firms and international players are venturing into this sector, recognizing the long-term benefits of waste management. Additionally, government initiatives such as subsidies, viability gap funding, and streamlined approvals are encouraging greater participation. This collaborative effort is anticipated to bolster project implementation capabilities and elevate operational efficiency, according to India waste to energy market forecast.

Focus on Circular Economy and Resource Recovery

The Indian waste-to-energy sector is progressively moving from traditional waste management methods to prioritizing resource recovery as a fundamental goal. Rather than viewing waste solely as a problem, new initiatives aim to extract useful products such as electricity, biogas, compost, and recyclable materials. This is in line with circular economy principles, which seek to maintain the value of materials within the system for as long as possible. Advanced material recovery facilities are being established in conjunction with WTE plants to optimize the recovery of plastics, metals, and inert materials prior to combustion or digestion. These integrated strategies are effective in reducing landfill sizes and creating diverse revenue streams. Such developments are vital to the ongoing evolution of India waste to energy market trends.

AI/IoT Integration and Advanced Technologies

The integration of Artificial Intelligence and Internet of Things technologies is revolutionizing waste sorting and processing efficiency in India's waste-to-energy sector. Smart waste sorting systems utilizing AI algorithms can automatically segregate different waste types with precision rates exceeding 95%, significantly improving feedstock quality for energy conversion. IoT-enabled sensors monitor real-time parameters such as temperature, moisture content, and gas emissions, optimizing plant operations and reducing maintenance costs. Plasma gasification technology is gaining momentum as an advanced thermal treatment method that operates at extremely high temperatures, breaking down waste at molecular levels while producing minimal emissions. These technologies enable remote monitoring and predictive maintenance, reducing operational costs and enhancing plant reliability. Cities like Bangalore and Hyderabad are piloting smart waste management systems that integrate collection, sorting, and processing through digital platforms. The adoption of these technologies significantly improves energy recovery rates while reducing environmental impact, supporting the growth of the waste to energy market size in India.

State-Specific Implementation Approaches

Regional governments across India are developing customized waste-to-energy strategies tailored to their unique demographic and geographic characteristics. Kerala's approach focuses on scientific landfill management combined with decentralized waste processing units, emphasizing biogas generation from organic waste streams. The state's Haritha Keralam Mission promotes community-based waste management with small-scale energy recovery systems in rural areas. Pune has pioneered the integration of informal waste picker communities into formal waste-to-energy value chains through initiatives like the NAMASTE program, providing social security and skill development while improving waste segregation quality. Punjab is addressing agricultural stubble burning through innovative biomass-to-energy solutions, converting rice straw and wheat residues into compressed biogas and electricity. These state-specific approaches demonstrate the importance of localized solutions that consider cultural practices, economic conditions, and available infrastructure. The success of these regional models provides replicable frameworks for other states, contributing to the expansion of the waste to energy industry size in India.

Alternative Energy Sources and Resource Diversification

The diversification of feedstock sources is expanding beyond municipal solid waste to include agricultural residues, industrial byproducts, and organic waste streams. Bagasse cogeneration in sugar mills has become a significant contributor to India's renewable energy portfolio, with states like Maharashtra and Uttar Pradesh leading in capacity additions. Rice husk, wheat straw, and cotton stalks are being processed through advanced gasification and pyrolysis technologies to produce clean energy while addressing agricultural waste burning issues. Industrial symbiosis models are emerging where waste from one industry becomes feedstock for energy generation in another, creating circular economy loops in industrial clusters. Food processing industries are increasingly adopting on-site biogas plants to convert organic waste into energy, reducing disposal costs and carbon footprint. Pharmaceutical and textile industries are exploring waste-to-energy solutions for their specific waste streams, creating specialized processing technologies. These diversified approaches reduce dependence on single waste sources while creating multiple revenue streams for energy producers, significantly impacting the overall waste to energy market share in India.

Waste Picker Formalization and Decentralized Solutions

The formalization of waste picker communities is transforming India's waste management landscape while promoting social inclusion and economic empowerment. Programs like Pune's NAMASTE initiative provide identity cards, social security benefits, and skill development training to waste pickers, integrating them into formal waste-to-energy value chains. These formalized networks improve waste segregation quality at source, crucial for efficient energy recovery processes. Decentralized micro-plants are being promoted in rural areas to handle localized waste generation while providing community-level energy solutions. Self-Help Groups are operating small-scale biogas plants that process household and agricultural waste, generating cooking gas and electricity for local consumption. Cooperative models allow communities to own and operate waste-to-energy facilities, ensuring sustainable operations and equitable benefit distribution. Technology providers are developing modular, scalable systems suitable for small communities with minimal technical expertise requirements. These grassroots approaches ensure inclusive growth while addressing waste management challenges at the community level, contributing to the expansion of the WTE market in India.

Industrial Integration and Circular Economy

The strengthening of Refuse-Derived Fuel utilization in cement industry kilns is creating stable demand for processed waste materials while reducing coal dependency. Cement manufacturers like UltraTech and ACC are establishing long-term agreements with municipalities to source RDF, providing guaranteed offtake for waste-to-energy projects. Solar-waste-to-energy hybrid systems are being developed to provide consistent power output by combining solar generation during daytime with waste-based energy during evening hours. Industrial clusters are implementing circular economy principles where waste heat from manufacturing processes is captured and converted to electricity, while solid waste is processed for energy recovery. Steel plants and aluminum smelters are integrating waste-to-energy systems to handle their internal waste streams while generating auxiliary power for operations. Textile hubs are exploring innovative solutions to process fabric waste and dyeing sludge through specialized thermal treatment technologies. These industrial integrations create synergistic relationships that maximize resource utilization while minimizing environmental impact, significantly influencing the waste to energy industry in India.

Growth, Opportunities, and Challenges in the India Waste to Energy Market:

- Growth Drivers of the India Waste to Energy Market: The market is experiencing robust growth driven by rapidly increasing urban waste generation coupled with limited landfill space availability across major cities. Government initiatives including the Swachh Bharat Mission and supportive policies promoting renewable energy adoption are accelerating project implementations nationwide. Rising environmental consciousness among citizens and mounting pressure to reduce fossil fuel dependency are creating favorable conditions for waste-to-energy sector expansion.

- Opportunities in the India Waste to Energy Market: Significant opportunities exist in integrating agricultural waste management with energy generation, particularly addressing stubble burning issues in northern states. The formalization of waste picker communities and development of decentralized rural energy solutions present untapped market potential for inclusive growth. Advanced technologies including AI-enabled waste sorting and plasma gasification offer prospects for improving operational efficiency and emission reduction.

- Challenges in the India Waste to Energy Market: Key challenges include inadequate waste segregation at source level, which affects feedstock quality and energy recovery efficiency in processing facilities. High initial capital requirements and complex regulatory approval processes continue to deter private sector participation in smaller projects. Technical challenges related to handling mixed waste streams and maintaining consistent calorific values pose operational difficulties for existing plants.

India waste to energy Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India waste to energy market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on technology and waste type.

Analysis by Technology:

- Thermal

- Incineration

- Pyrolysis

- Gasification

- Biological

- Others

Thermal stand as the largest technology in 2024, holding 84.2% of the market, primarily due to its efficiency in processing unsegregated and mixed solid waste. Incineration is the predominant method utilized, celebrated for its capacity to significantly lessen waste volume while simultaneously producing energy. Additionally, pyrolysis and gasification are becoming increasingly popular, particularly in urban settings where the characteristics of waste and energy needs are compatible with their operational frameworks. These approaches are ideal for large-scale initiatives and benefit from established technological familiarity, straightforward integration into municipal waste systems, and consistent regulatory support. Their proven reliability and adaptability make thermal processes the preferred option for numerous municipalities and private enterprises.

Analysis by Waste Type:

Access the comprehensive market breakdown Request Sample

- Municipal Waste

- Process Waste

- Agriculture Waste

- Medical Waste

- Others

Municipal waste leads the market with 60.8% of market share in 2024, given the daily waste generated by urban households, commercial establishments, and public areas. The abundance of this waste type across cities guarantees a reliable supply chain for energy conversion initiatives. Municipalities often have pre-existing systems for collection and transport, facilitating their integration with waste-to-energy operations. The increasing urban population and the strain on landfill capacity further advocate for solutions that can transform everyday household waste into usable energy. Its steady volume, combined with a policy emphasis on urban waste management, drives the India waste to energy market demand.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

Western and Central India is the frontrunner in the regional waste-to-energy market, attributed to robust institutional frameworks, elevated urbanization, and enhanced participation from the private sector. States in this area have proactively embraced integrated waste management models that encompass energy recovery. The combination of industrial growth and rising municipal waste production has compelled local governments to invest in sustainable waste-to-energy solutions. Furthermore, supportive state policies and the availability of land and financing have facilitated the launch of large-scale projects. This region has also experienced active collaborations between public entities and private developers, positioning it as a key area for the expansion of waste-to-energy initiatives.

Competitive Landscape:

The landscape of the India waste to energy market is evolving into a more organized framework, with a growing number of participants entering through both public-private partnerships and independent project initiatives. Companies are prioritizing the establishment of long-term agreements with municipalities to ensure reliable feedstock supply and consistent revenue. There is also an increasing interest from infrastructure developers who have experience in power generation and environmental services. Businesses are setting themselves apart by specializing in technology, enhancing operational efficiency, and efficiently managing large-scale waste logistics. The trend of bundling projects with recycling and composting elements is gaining popularity. Given the rise in urban waste and supportive government incentives, competition is likely to become more intense across various regions and technologies, thereby driving the overall India waste to energy market growth in the years ahead.

The report provides a comprehensive analysis of the competitive landscape in the India waste to energy market with detailed profiles of all major companies.

Latest News and Developments:

- September 2025: Antony Waste Handling Cell announced the development of a 15 MW waste-to-energy project in Andhra Pradesh through its subsidiary, Antony Lara Enviro Solutions. The project, awarded by the New and Renewable Energy Development Corporation of Andhra Pradesh, will involve processing municipal solid waste and incinerating it at a dedicated facility. The new entity, Kadapa Renew Energy, will be responsible for executing the project, with Antony Waste Handling Cell holding a 73% indirect stake in the venture.

- April 2025: India advanced sustainable solid waste management with innovative technologies, including bio-methanation for organic waste, decentralized processing, and plastic waste recycling. Notable projects include fly ash aggregates, solar panel recycling, and upcycling e-waste plastics. The government's Swachh Bharat Mission continues to boost urban waste management infrastructure.

- April 2025: Kundan Green Energy acquired an 11.5 MW waste-to-energy project in Jabalpur for INR 650 Million (USD 7.5 Million). The project, previously operated by Essel Group, processes 450 tons of waste daily and generates energy for the state grid. Kundan Green Energy aims for 300 MW capacity by 2027.

- March 2025: Indore launched India’s first PPP-based green waste processing plant under the Swachh Bharat Mission-Urban. The facility will recycle green waste into eco-friendly products like sawdust and wooden pellets, generating revenue and promoting sustainability by offering alternative energy sources and reducing pollution.

- February 2025: Oswal Energies showcased its green hydrogen, waste-to-energy, and carbon capture technologies at India Energy Week 2025. The company highlighted its Plasma-Enhanced Gasification System (PEGS®), designed to convert waste into clean synthesis gas, underscoring its commitment to sustainable energy solutions. Oswal also announced a strategic partnership with UK-based Sinclair to further advance clean energy technologies.

- February 2025: AIIMS Delhi launched "Srjanam," an automated biomedical waste conversion system developed by CSIR-NIIST. The environmentally friendly technology neutralizes hazardous waste without incinerators, improving efficiency. It can process 400 kg/day and offers a safer, more economical waste disposal solution, with full implementation pending approval.

- December 2024: Nagpur inaugurated India’s first mobile dry fermentation waste-to-energy plant at Bhandewadi landfill. Developed in partnership with SusBDe and WTT Technology, the plant processes 200 Metric Tons of waste daily, aiming for full-scale operations by March 2025, converting waste into biogas and energy.

- November 2024: Union Home Minister Amit Shah launched the largest waste-to-energy power plant in Gujarat, located in Ahmedabad. This facility, with a capacity of 15 megawatts, was developed at a cost of INR 375 crores under a public-private partnership model. It will convert solid waste into electricity, contributing to the city's cleanliness and helping to mitigate pollution.

India Waste to Energy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Waste Types Covered | Municipal Waste, Process Waste, Agriculture Waste, Medical Waste, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India waste to energy market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India waste to energy market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India waste to energy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The waste to energy market in India was valued at USD 1,557.0 Million in 2025.

The India waste to energy market is projected to exhibit a CAGR of 2.55% during 2026-2034, reaching a value of USD 1,967.3 Million by 2034.

Rising urban waste volumes, shrinking landfill availability, supportive government schemes, and growing demand for renewable power are major drivers. Public-private partnerships, improved waste segregation, and technological advancements are also pushing project development and attracting private investment.

Western and Central India holds the largest share in the India waste to energy market, supported by higher urbanization, stronger policy implementation, and more active private sector participation in large-scale waste treatment projects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)