India Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2026-2034

India Watch Market Size and Share:

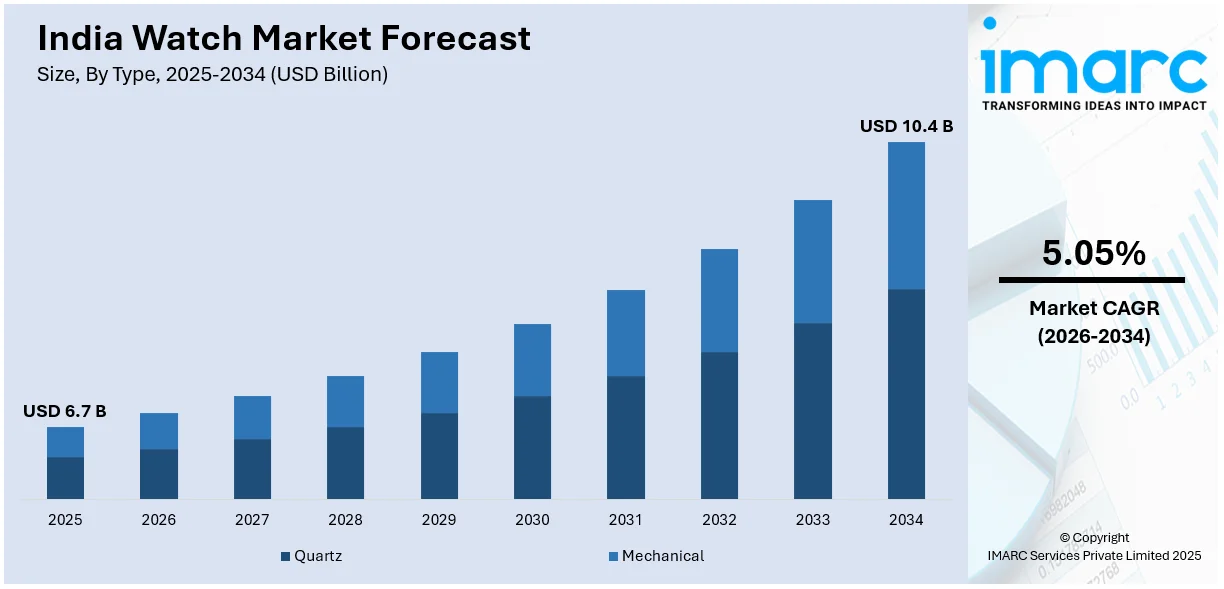

The India watch market size reached USD 6.7 Billion in 2025. The market is expected to reach USD 10.4 Billion by 2034, exhibiting a growth rate (CAGR) of 5.05% during 2026-2034. The market growth is attributed to increasing investment in advertising and promotional activities by watch manufacturers to build their brand image and attract customers. Moreover, continual innovations and the launch of personalized and customized watches are supporting the market growth. Apart from this, the proliferation of e-commerce platforms is allowing easier access to a wide range of watch brands and styles, further facilitating market development.

Market Insights:

- On the basis of region, the market has been divided into South India, North India, Central and West India, and East India.

- On the basis of type, the market has been divided into quartz and mechanical.

- On the basis of price range, the market has been divided into low-range, mid-range, and luxury.

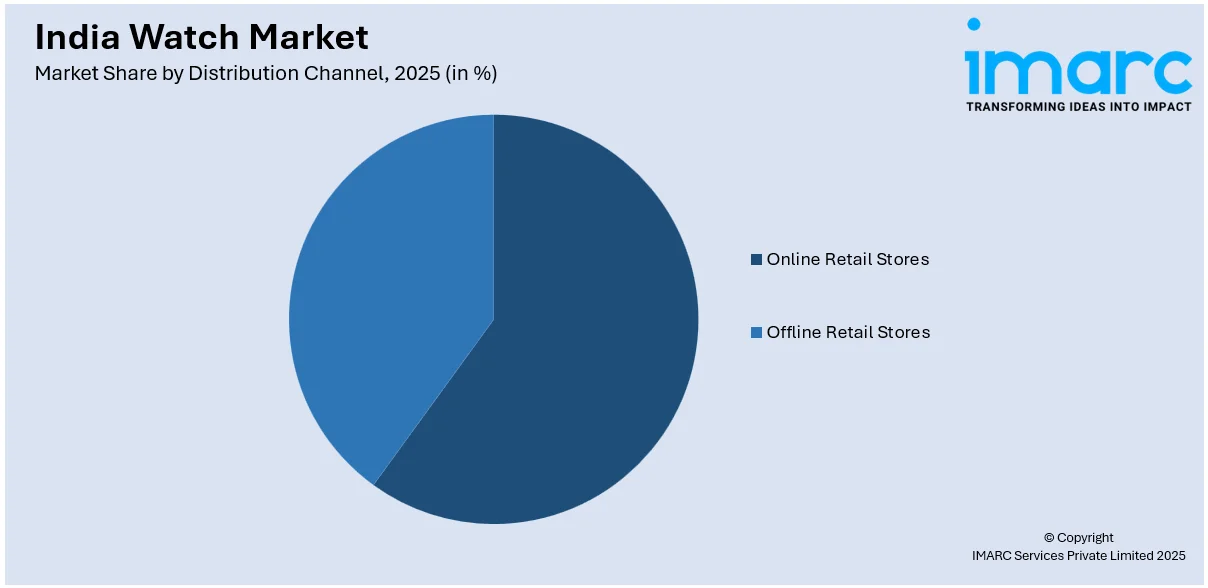

- On the basis of distribution channel, the market has been divided into online retail stores and offline retail stores.

- On the basis of end user, the market has been divided into men, women, and unisex.

Market Size and Forecast:

- 2025 Market Size: USD 6.7 Billion

- 2034 Projected Market Size: USD 10.4 Billion

- CAGR (2026-2034): 5.05%

A watch is a portable timepiece designed to be worn or carried by a person. It is a small clock, typically worn on one's wrist, secured with a strap or bracelet. Watches have evolved from mechanical devices to electronic gadgets over centuries. Initially, they operated using mechanical movements powered by winding a mainspring. However, with advances in technology, most modern watches now use quartz movements or are digitally powered. The primary function of a watch is to keep accurate time. However, beyond this basic function, watches often come with additional features, such as a date display, alarm, stopwatch, timer, and even moon phase display. In recent times, smartwatches are emerging and are capable of fitness tracking, syncing with smartphones for notifications, and many other functions. Moreover, watches are also evolving as fashion accessories and status symbols. Luxury watches, meticulously crafted, often with precious metals and gemstones, represent craftsmanship, elegance, and exclusivity. Watches hold cultural, historical, and personal significance, reflecting personal style, accomplishment, or a rite of passage.

To get more information on this market Request Sample

The proliferation of e-commerce platforms is allowing easier access to a wide range of watch brands and styles, including international luxury brands, which represents one of the key factors driving the growth of the watch market in India. Online shopping also provides convenience, competitive pricing, and easy return policies, which are attracting more customers to buy watches online, thus boosting the growth of the market. In line with this, watches are evolving from being mere timekeeping devices to fashion accessories and status symbols. The increasing consciousness regarding fashion among people, along with the rising interest in premium lifestyle products is driving the demand for stylish and luxury watches, which is contributor to the watch industry in India. The market is also driven by the increasing demand for smartwatches, along with the rise of wearable technology in India. These devices not only tell time but also track fitness, provide notifications, and offer various other features which are making them popular, particularly among the younger population, thus fueling the growth of the market. Apart from this, the rising demand for women's watches due to the increasing number of working women in the country is facilitating the growth of the market. Moreover, increasing disposable income, rapid urbanization, innovations and customizations, and significant investments in advertising and promotional activities by manufacturers to build their brand image and attract customers, are some of the other factors creating a positive outlook for the market across the country.

India Watch Market Trends:

Digital Integration and Smart Technology Adoption

The market is undergoing a remarkable shift fueled by integration with digital technology and smart capabilities. Conventional watches are transforming to integrate cutting-edge functionalities like health tracking, GPS capabilities, and connectivity to smartphones. This trend is largely evident among consumers who are technology-oriented and look for instruments that perform multi-functions beyond mere timekeeping. The increasing popularity of wearable technology in India has spurred the adoption of smartwatches, which provide capabilities such as heart rate monitoring, sleep tracking, and fitness analysis. This, in turn, is supporting the expansion of watch market size in India. Manufacturers are addressing the demand by creating hybrid watches, which merge traditional looks with contemporary technological abilities. The use of artificial intelligence and machine learning algorithms is facilitating customized user experiences, boosting the popularity of these devices among a wider consumer group. This digital transformation is revolutionizing consumer expectations and innovation throughout the entire watch industry ecosystem.

Sustainable and Eco-Friendly Manufacturing Processes

Green awareness is becoming a powerful driver in augmenting the watch market share in India, with consumers becoming more and more focused on sustainable and responsibly made watches. Manufacturers are embracing environmental-friendly materials like recycled metal, sustainable leather replacement materials, and biodegradable elements in their manufacturing processes. This is a wider trend towards environmentally conscious consumption habits among increasingly eco-conscious Indian consumers. Watch brands are embracing circular economy thinking by providing repair facilities, trade-in schemes, and refurbishment to prolong product lifetimes. Solar-powered movements and energy-efficient tech are increasingly popular as brands aim to minimize their carbon footprint. In addition, transparent supply chain management and responsible material sourcing are increasingly becoming differentiators in the marketplace. This green trend not only appeals to environmentally sensitive consumers but also presents new market opportunities for companies that commit to going green in their manufacturing processes. This, in turn, is facilitating the expansion of the market size of watch industry in India.

Some of the other trends in the market include,

- Ethical Production: In the market, companies are increasingly using eco-friendly materials and ethical production processes to resonate with environmentally aware consumers. The utilization of recycled metal, vegan leather straps, and eco-friendly packaging is slowly influencing consumer tastes, especially among young buyers.

- AR/VR Try-Ons and AI Personalization: Indian watch retailers are testing AR/VR technology to give virtual try-on experiences, enabling consumers to make purchasing decisions wisely in both online and offline environments. Moreover, AI personalization is going beyond simple smart capabilities, providing tailored suggestions catering to personal style and usage behavior. This is augmenting the market share of watch industry in India.

- Localization and Adjustment to World Disturbances: Localization is still key in the watch market of India, where companies customize pricing, design, and marketing campaigns according to local tastes and cultural sensibilities. In addition, the industry has adjusted rapidly to world disturbances like supply chain restrictions with diversification of sourcing and the reinforcement of local assembly facilities.

- Health and Fitness Integration in Smartwatches: Increasing health and fitness feature demand has driven the Indian smartwatch market, with heart rate monitoring, SpO₂ monitoring, and sleep tracking becoming mandatory features. This follows heightened health consciousness and the adoption of active lifestyles among urban customers.

- Increased Demand from Women: Women's increasing participation in the workforce and changing lifestyle choices are driving greater demand for watches among India's female consumer base. Brands are addressing this with refined yet practical designs, balancing looks with functionality, including activity tracking and ruggedness.

- Supply Chain, Regulatory, and Cultural Drivers: The India watch market share is also driven by supply chain efficacies, import policies, and changing cultural values that drive design and positioning. Watches are not just viewed as utility items but also as status symbols and gifts, further impacting buying behavior.

Growth, Opportunities, and Challenges in the India Watch Market:

- Growth Drivers: The rapid digitization and increasing smartphone penetration in India are driving significant demand for smartwatches and connected wearable devices. Rising disposable income levels, particularly among the growing middle class and urban population, are enabling consumers to invest in premium and luxury timepieces as fashion statements and status symbols. The expanding e-commerce infrastructure and increasing internet connectivity are making a wide variety of watch brands and models easily accessible to consumers across different geographical regions.

- Market Opportunities: The untapped rural and semi-urban markets present significant growth opportunities for watch manufacturers, particularly for affordable and feature-rich smartwatches tailored to local needs and preferences. The growing health and fitness consciousness among Indian consumers creates substantial opportunities for watches with advanced health monitoring features, including blood oxygen monitoring, ECG, and stress tracking capabilities. This is providing a boost to India watch market growth. The increasing participation of women in the workforce and their rising purchasing power represents a lucrative opportunity for brands to develop and market women-specific watch collections with fashionable designs and functional features.

- Market Challenges: Intense price competition from low-cost imports and counterfeit products continues to pressure profit margins and brand positioning for legitimate watch manufacturers in the Indian market. The rapid pace of technological change in smartwatch features requires continuous innovation and significant investment in research and development to remain competitive. Supply chain disruptions, fluctuating raw material costs, and complex regulatory requirements pose operational challenges for both domestic and international watch brands operating in India.

India Watch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India watch market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, price range, distribution channel, and end user.

Type Insights:

- Quartz

- Mechanical

The report has provided a detailed breakup and analysis of the market based on the type. This includes quartz and mechanical. According to the report, quartz represented the largest segment.

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

A detailed breakup and analysis of the market based on the price range has also been provided in the report. This includes low-range, mid-range, and luxury. According to the report, low-range accounted for the largest market share.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Retail Stores

- Offline Retail Stores

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes online and offline retail stores. According to the report, offline retail stores accounted for the largest market share.

End User Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes men, women, and unisex. According to the report, men accounted for the largest market share.

Regional Insights:

- South India

- North India

- Central and West India

- East India

A detailed breakup and analysis of the market based on the region has also been provided in the report. This includes South India, North India, Central and West India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India watch market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report.

Latest News and Developments:

- In September 2025, Samsung launched the Galaxy Watch 8 and Galaxy Watch 8 Classic in India, introducing enhanced health, fitness, and wellness features alongside a refined design. The Galaxy Watch 8 is offered in 40 mm and 44 mm sizes, focusing on lightweight comfort and premium display quality, while the Watch 8 Classic comes in a larger 46 mm variant with a signature rotating mechanical bezel. Pricing begins at INR 32,999 for the Galaxy Watch 8 and INR 46,999 for the Classic edition, with sales commencing shortly after the launch.

- In August 2025, Casio India launched its first automatic watch collection, the Edifice EFK-100 series, marking its entry into mechanical timepieces. The motorsport-inspired line includes five models, starting at INR 25,995, all combining traditional automatic watchmaking with Casio’s precision engineering. The top model, EFK-100XPB-1A, features forged carbon in both the dial and case, while other variants use forged-carbon texture or electroforming to achieve premium aesthetics.

- In April 2025, Xiaomi introduced the Redmi Watch Move, its first smartwatch to be locally manufactured in India. The device is priced at INR 1,999 and offers features including a 1.85-inch AMOLED display, over 140 workout modes, health tracking (heart rate, SpO₂, sleep, stress), IP68 water and dust resistance, and support for Hindi language. It runs on Xiaomi’s HyperOS and is available in four color variants.

India Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-range, Mid-range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India watch market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India watch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The watch market in India was valued at USD 6.7 Billion in 2025.

The India watch market is projected to exhibit a CAGR of 5.05% during 2026-2034, reaching a value of USD 10.4 Billion by 2034.

The India watch market is booming due to rising disposable incomes, growing fashion consciousness, and the surge in smartwatch adoption. Increased health awareness drives demand for smartwatches with fitness features, while e-commerce expansion provides wider accessibility and choice for consumers seeking both traditional and luxury timepieces.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)