India Watches and Clocks Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, and Region, 2025-2033

India Watches and Clocks Market Overview:

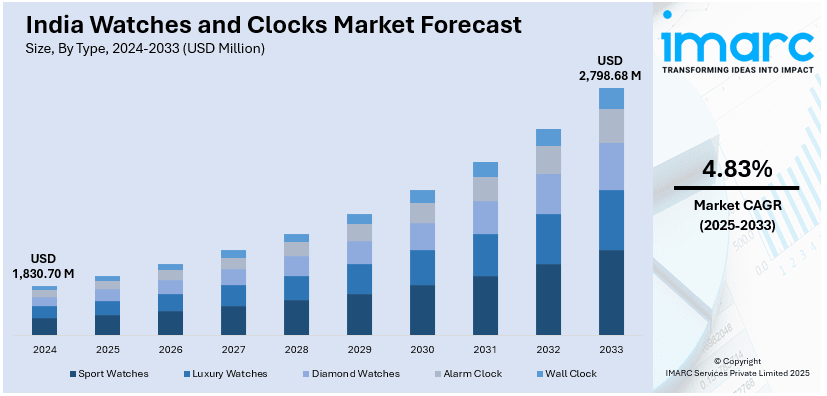

The India watches and clocks market size reached USD 1,830.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,798.68 Million by 2033, exhibiting a growth rate (CAGR) of 4.83% during 2025-2033. India market is growing with a broad portfolio of products ranging from sports luxury and diamond-encrusted watches to smart clocks serving both functional and beauty needs through offline and online channels representing changing consumer trends and technological development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,830.70 Million |

| Market Forecast in 2033 | USD 2,798.68 Million |

| Market Growth Rate 2025-2033 | 4.83% |

India Watches and Clocks Market Trends:

Growing Demand for Smart and Hybrid Watches

The India market for watches is experiencing a remarkable increase in the demand for smart and hybrid watches. The consumer is demanding timepieces that can provide them with more than time, with functionality like fitness tracking, heart rate monitoring, sleep analysis, and GPS. For example, in January 2024, Noise introduced the NoiseFit Vortex Plus smartwatch in India with a 1.46-inch AMOLED screen, Bluetooth calling, 100+ watch faces, heart rate and SpO2 tracking, sleep monitoring, sports modes, and a 7-day battery life with a metal, leather, and silicone strap. Moreover, heightening health and wellness awareness and improved wearable technology have turned smartwatches into the first choice among consumers, particularly among young adults. Hybrid watches that combine traditional analog looks with intelligent features are also picking up steam among buyers seeking a fashionable but technologically enabled option. The inclusion of AI-based features like voice assistance and contactless transactions is also furthering user convenience. As more internet penetration happens and cheap smartwatches enter the fray, the space will continue to grow. The presence of smartwatches in various price segments, coupled with growing e-commerce platforms, is fueling accessibility and penetration in urban as well as semi-urban areas.

To get more information of this market, Request Sample

Rising Popularity of Luxury and Limited-Edition Watches

High-end and limited-edition watches are gaining traction in India, with increasing disposable incomes and an enhancing passion for exclusivity and craftsmanship. Watch aficionados and high-net-worth individuals are heavily investing in top-of-the-range timepieces as status symbols and collectibles. Demand for mechanical watches, intricately handcrafted designs, and limited production run models is highly sought after among consumers who care about heritage and fine detailing. Also, watch collectors are attracted to custom products, such as engravings and special collaborations. Premiumization is also evident in the accelerating demand for automatic and Swiss-made watches, which are associated with elegance and higher quality craftsmanship. For instance, in October 2024, Indian group KDDL's Favre Leuba brand, which it bought for SFr1.49M, introduced 22 watches at Geneva Watch Days, such as Deep Blue (SFr2,200), Sea Sky (SFr3,950), and Chief Chronograph (SFr4,375). Moreover, offline store expansion, luxury stores, and experiential marketing are also reinforcing this segment. Social media and celebrity endorsements are also taking a prominent part in influencing consumer choice, rendering luxury watches aspirational buys for the contemporary Indian consumer.

Expansion of E-Commerce and Omni-Channel Retailing

The fast growth in e-commerce and omni-channel retailing is revolutionizing India's watch and clock industry. Customers are using online channels increasingly for a convenient shopping experience with access to multiple products, value for money, and ease. Digital-first offerings such as virtual try-ons, artificial intelligence (AI) driven suggestions, and augmented reality (AR) shopping are maximizing customer interaction. Further, the presence of digital payment systems, return ease, and online-only offerings is propelling greater adoption. Brands and retailers are also targeting an omni-channel strategy with the blending of physical and digital platforms to create individualized experiences. The direct-to-consumer (DTC) models and social commerce are further reshaping conventional retail architectures. With boosting internet penetration and smartphone adoption, the online watch market is likely to expand exponentially, addressing both mass-market and luxury segments. With digital transformation picking up pace, brands are using technology to boost customer interaction and achieve greater sales.

India Watches and Clocks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, distribution channel and application.

Type Insights:

- Sport Watches

- Fitness Trackers

- Diving Watches

- Running Watches

- Multi-sport Watches

- Luxury Watches

- Mechanical Watches

- Quartz Watches

- Limited Edition Watches

- Smart Luxury Watches

- Diamond Watches

- Diamond-Studded Watches

- Diamond-Encrusted Watches

- Custom Diamond Watches

- Alarm Clock

- Digital Alarm Clocks

- Analog Alarm Clocks

- Smart Alarm Clocks

- Wall Clock

- Decorative Wall Clocks

- Contemporary Wall Clocks

- Classic Wall Clocks

- Smart Wall Clocks

The report has provided a detailed breakup and analysis of the market based on the type. This includes sport watches (fitness trackers, diving watches, running watches, and multi-sport watches), luxury watches (mechanical watches, quartz watches, limited edition watches, and smart luxury watches), diamond watches (diamond-studded watches, diamond-encrusted watches, and custom diamond watches), alarm clocks (digital alarm clocks, analog alarm clocks, and smart alarm clocks), and wall clocks (decorative wall clocks, contemporary wall clocks, classic wall clocks, and smart wall clocks).

Distribution Channel Insights:

- Offline

- Online

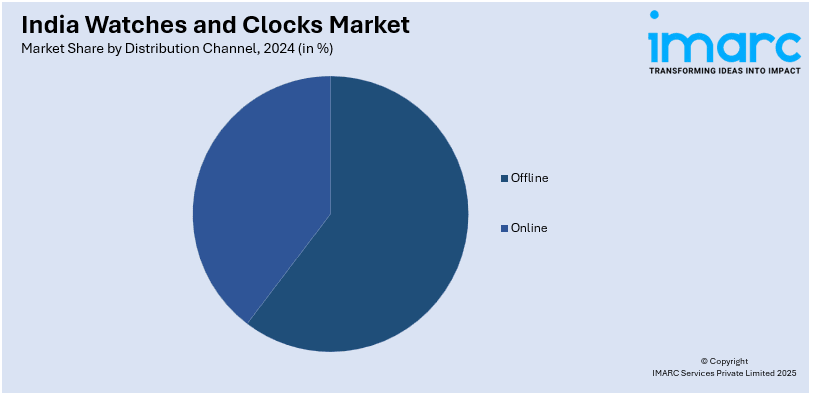

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

Application Insights:

- Display Time

- Adornment

- Collection

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes display time, adornment, collection, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Watches and Clocks Market News:

- In March 2024, Itel introduced the Icon 2 smartwatch, boasting a 1.83-inch screen with 550 nits brightness. The devices are available in Black, Blue, and Rose Gold and offer heart rate monitoring, sleep tracking, SpO2 reading, and Bluetooth calling, addressing India's increasing requirement for feature-packed, low-cost smartwatches.

- In September 2023, Casio has decided to produce watches in India, with a local company for quality testing. The decision comes after robust sales growth in FY23. Casio's G-Shock G-Squad GBD-H1000 sports five sensors, solar and USB charging, Bluetooth connectivity, and GPS, depicting the brand's innovation drive.

India Watches and Clocks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Display Time, Adornment, Collection, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India watches and clocks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India watches and clocks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India watches and clocks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India watches and clocks market was valued at USD 1,830.70 Million in 2024.

The India watches and clocks market is projected to exhibit a CAGR of 4.83% during 2025-2033, reaching a value of USD 2,798.68 Million by 2033.

The India watches and clocks market is driven by rising disposable incomes, fashion awareness, and increasing demand for smartwatches. Urbanization, brand-conscious consumers, and gifting trends also support growth. E-commerce expansion, innovative designs, and youth-oriented marketing further boost demand across both premium and affordable segments in urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)