India Water Conservation Solutions Market Size, Share, Trends and Forecast by Solution Type, Application, Distribution Channel, End User, and Region, 2026-2034

India Water Conservation Solutions Market Overview:

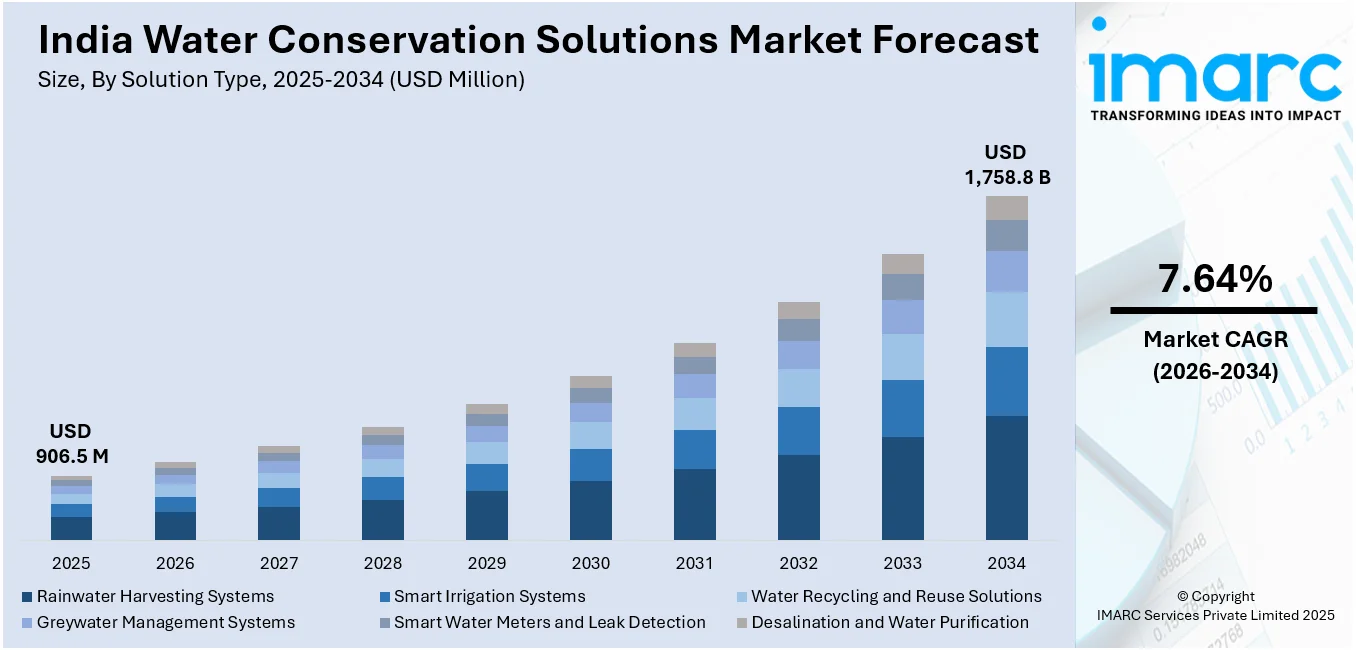

The India water conservation solutions market size reached USD 906.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,758.8 Million by 2034, exhibiting a growth rate (CAGR) of 7.64% during 2026-2034. The market is witnessing growth driven by government initiatives, technological advancements, and community participation. Programs promoting rainwater harvesting, groundwater recharge, and water-saving technologies are increasing demand for sustainable solutions, encouraging investments, and fostering innovation in efficient water management systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 906.5 Million |

| Market Forecast in 2034 | USD 1,758.8 Million |

| Market Growth Rate (2026-2034) | 7.64% |

India Water Conservation Solutions Market Trends:

Community-Led Initiatives Driving Water Conservation

India's market has also witnessed rapid expansion with community-oriented schemes and official intervention. Raising awareness with the help of people through mass public campaigns led by the government is encouraging regional-level participation in water conservation drives. With mounting water scarcity, novel conservation solutions are becoming more popular. In March 2025, Madhya Pradesh launched the "Jal Ganga Samvardhan Abhiyan," a 90-day campaign emphasizing public participation in constructing and maintaining water structures. This development aimed to enhance rainwater harvesting, groundwater recharge, and sustainable water usage. By encouraging active community involvement, the state increased demand for water management technologies, boosting investments in water storage and recycling solutions. The growing market response to such large-scale initiatives highlights the rising interest in sustainable water solutions. Companies offering water conservation products and services are witnessing increased adoption, particularly in rural and semi-urban regions. This shift has also accelerated partnerships between governments and private sector players, promoting innovation in water-saving technologies. As states continue implementing similar programs, the market is expected to expand further, driving technological advancements and supporting India's water conservation goals.

To get more information on this market Request Sample

Technological Advancements Promoting Efficient Water Use

Technological innovations are playing a critical role in the Indian water conservation solutions market. With rising concerns over water scarcity, companies are introducing advanced products to optimize water consumption and promote sustainability. Affordable and effective solutions are particularly gaining traction among households, businesses, and institutions. In April 2024, Hindware launched its "Aqua Pro Water Saving Solutions" range, featuring three advanced nozzles capable of reducing water usage by up to 98%. Partnering with Swedish innovation company Altered, Hindware leveraged patented technology to create these water-efficient nozzles. Manufactured locally, these products were introduced at an affordable price of INR 399, ensuring broader accessibility. This development increased demand for water-saving fixtures and boosted the market for sustainable water management solutions. The availability of such technologies encouraged residential and commercial users to adopt water-saving practices. Additionally, partnerships between domestic and international companies brought advanced technologies to the Indian market, fostering further innovation. As water conservation gains prominence in both urban and rural areas, the market is expected to experience sustained growth, with companies investing in product innovation and expanding their reach to meet increasing consumer demand.

India Water Conservation Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on solution type, application, distribution channel, and end user.

Solution Type Insights:

- Rainwater Harvesting Systems

- Smart Irrigation Systems

- Water Recycling and Reuse Solutions

- Greywater Management Systems

- Smart Water Meters and Leak Detection

- Desalination and Water Purification

The report has provided a detailed breakup and analysis of the market based on the solution type. This includes rainwater harvesting systems, smart irrigation systems, water recycling and reuse solutions, greywater management systems, smart water meters and leak detection, and desalination and water purification.

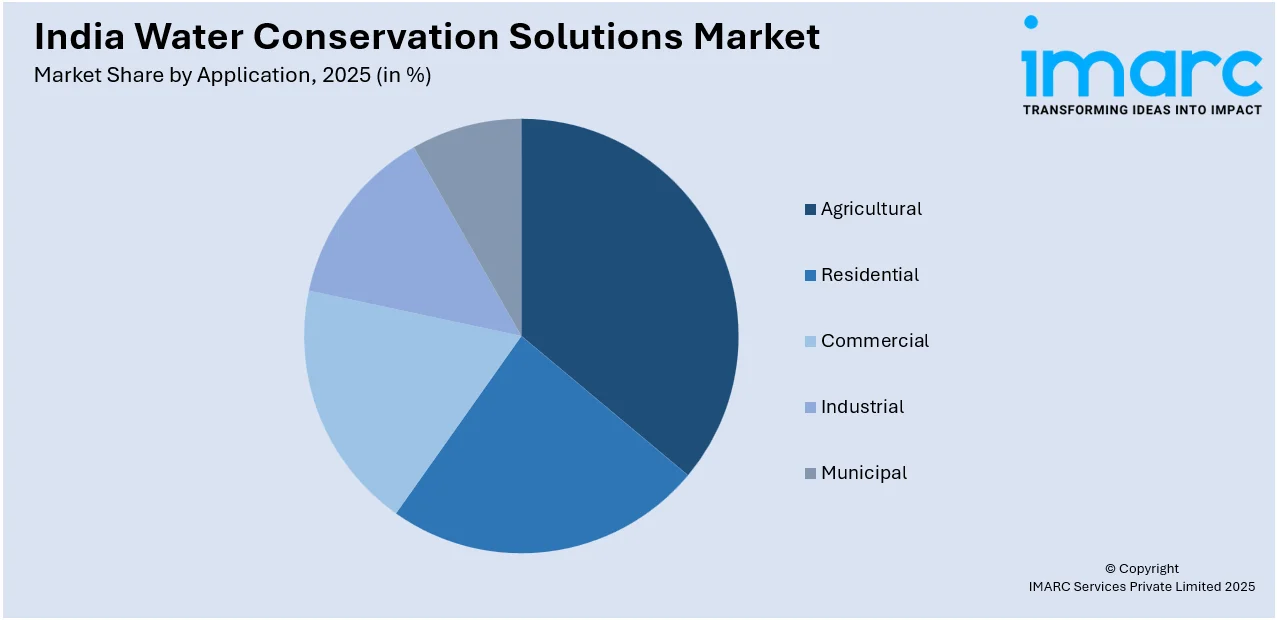

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Agricultural

- Residential

- Commercial

- Industrial

- Municipal

The report has provided a detailed breakup and analysis of the market based on the application. This includes agricultural, residential, commercial, industrial, and municipal.

Distribution Channel Insights:

- Direct Sales

- Online Sales

- Retail Stores

- Distributors/Wholesalers

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, online sales, retail stores, and distributors/wholesalers.

End User Insights:

- Farmers

- Homeowners

- Businesses

- Government Agencies

- NGOs

The report has provided a detailed breakup and analysis of the market based on the end user. This includes farmers, homeowners, businesses, government agencies, and NGOs.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Conservation Solutions Market News:

- March 2025: Amazon expanded its water conservation efforts in India, aiming to return more water to communities than it used by 2027. Projects like restoring Bengaluru’s Yamare Lake and Hyderabad’s Sai Reddy Lake boosted demand for water management solutions, positively impacting the water conservation solutions industry.

- March 2025: The Ministry of Jal Shakti launched the ‘Jal Shakti Abhiyan: Catch the Rain - 2025,’ promoting water conservation solutions across 148 districts. Emphasizing rainwater harvesting, groundwater recharge, and community participation, it boosted demand for sustainable water management technologies.

India Water Conservation Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Rainwater Harvesting Systems, Smart Irrigation Systems, Water Recycling and Reuse Solutions, Greywater Management Systems, Smart Water Meters and Leak Detection, Desalination and Water Purification |

| Applications Covered | Agricultural, Residential, Commercial, Industrial, Municipal |

| Distribution Channels Covered | Direct Sales, Online Sales, Retail Stores, Distributors/Wholesalers |

| End Users Covered | Farmers, Homeowners, Businesses, Government Agencies, NGOs |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India water conservation solutions market performed so far and how will it perform in the coming years?

- what is the breakup of the India water conservation solutions market on the basis of solution type?

- what is the breakup of the India water conservation solutions market on the basis of application?

- what is the breakup of the India water conservation solutions market on the basis of distribution channel?

- what is the breakup of the India water conservation solutions market on the basis of end user?

- What are the various stages in the value chain of the India water conservation solutions market?

- What are the key driving factors and challenges in the India water conservation solutions market?

- What is the structure of the India water conservation solutions market and who are the key players?

- What is the degree of competition in the India water conservation solutions market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water conservation solutions market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water conservation solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water conservation solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)