India Water Filters Market Size, Share, Trends and Forecast by Media Type, Applications, Distribution Channel, End User, and Region, 2025-2033

India Water Filters Market Overview:

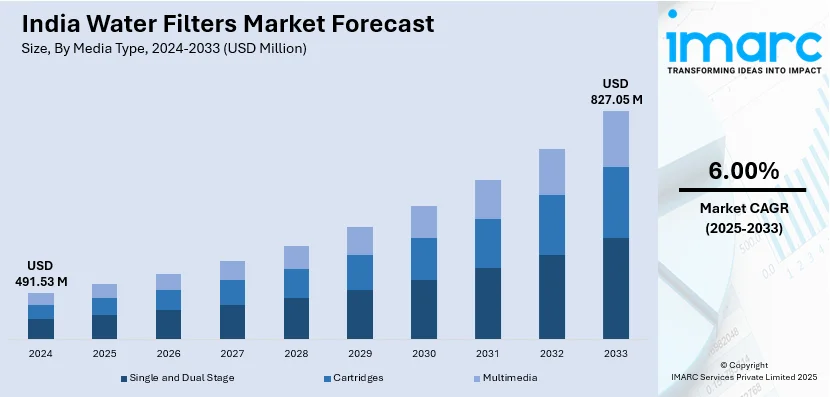

The India water filters market size reached USD 491.53 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 827.05 Million by 2033, exhibiting a growth rate (CAGR) of 6.00% during 2025-2033. The India water filters market is propelled by rapid urbanization, increased disposable incomes, rising concerns toward groundwater pollution, improvements in filtration technology, government programs for clean water, industrial growth impacting water quality, and innovations such as DIY filter replacement that improve convenience and affordability for the consumer.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 491.53 Million |

| Market Forecast in 2033 | USD 827.05 Million |

| Market Growth Rate (2025-2033) | 6.00% |

India Water Filters Market Trends:

Urbanization and Rising Disposable Incomes

India has witnessed tremendous urbanization in the past few years, which has brought a considerable change in the population movement from rural to urban parts of the country. Urban migration has triggered higher demand for urban amenities, such as access to pure and safe drinking water. With growing cities, the pressure on current water infrastructure increases, frequently compelling the residents to adopt alternative measures like water filters to maintain the purity of their drinking water. As per the Annual Survey of Industries (ASI) 2021-22, India's industrial output expanded by over 35% compared to the last year, reflecting strong economic activity and urbanization. Industrial growth tends to go hand in hand with urban growth, which can affect local water resources because of greater industrial effluent discharge and upsurge in water usage. As a result, urban consumers are becoming more aware of water quality, leading to the use of water filtration systems. Additionally, the ASI mentioned a 7% rise in employment in the industrial sector for 2021-22 compared to the corresponding period of last year. Greater employment leads to higher disposable incomes in urban dwellers, allowing for more consumers to invest in water purification systems at homes. There is now greater consumer knowledge about the possible impurities in municipal water supplies and active search for effective filtration systems to protect their health. This is supplemented by government efforts to enhance water quality monitoring and infrastructure, prompting residents to embrace water purification practices.

To get more information of this market, Request Sample

Agricultural Practices and Groundwater Utilization

Agriculture is a central component of India's economy, and it uses a large percentage of water. India uses about 89% of its water resources for agriculture, with 65% of that coming from groundwater. The heavy use of groundwater for irrigation has water quality implications, as over-extraction can cause contamination by natural and anthropogenic sources. The intensive reliance on groundwater has caused issues like aquifer depletion and elevated mineral and pollutant concentration in water sources. This situation highlights the need for efficient water filtration technologies to provide clean drinking water, particularly in areas where groundwater forms the main source. To address these challenges, there has been a united effort to advance the use of water in optimal ways in industrial applications, including the creation of technologies for managing and treating wastewater. These efforts are intended to harmonize the demand and consumption of water such that industrial activities do not taint the water available for residential use. The interaction between farming activities and groundwater use directly affects the quality of water that is available to communities. As the awareness of these problems continues to rise, there is an escalating demand for domestic water filters that are effective in eliminating certain contaminants found in groundwater supplies. This is an indication of proactive action by consumers to protect themselves from possible health hazards, thus stimulating the market for water filtration products in India.

India Water Filters Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on media type, applications, distribution channel, and end-user.

Media Type Insights:

- Single and Dual Stage

- Cartridges

- Multimedia

The report has provided a detailed breakup and analysis of the market based on the media type. This includes single and dual stage, cartridges, and multimedia.

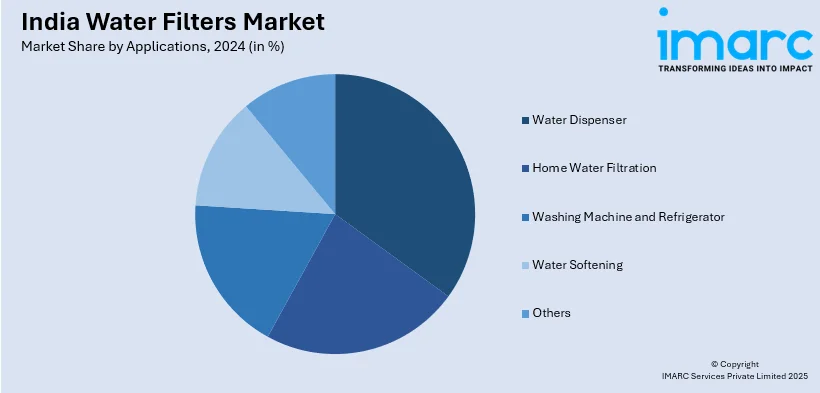

Applications Insights:

- Water Dispenser

- Home Water Filtration

- Washing Machine and Refrigerator

- Water Softening

- Others

A detailed breakup and analysis of the market based on the applications have also been provided in the report. This includes water dispenser, home water filtration, washing machine and refrigerator, water softening, and others.

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Filters Market News:

- November 2024: A. O. Smith Corporation acquired Pureit, Hindustan Unilever Limited's water purification business, for around INR 601 crore. This acquisition strengthens A. O. Smith's product portfolio and distribution network in India and positions the company firmly in the water purifier market. The addition of Pureit's well-established brand is likely to address the propelling demand for water purification solutions in the country.

- July 2024: Acer launched the Acerpure Amrit line of water purifiers in India, with user-replaceable filters that do away with service fees and ease maintenance. This technology gives consumers the ability to change filters themselves, offering convenience and lowering recurring expenses. Such technology is expected to drive the usage of water purifiers in the Indian market, as it overcomes typical maintenance issues and provides easy access to clean drinking water.

India Water Filters Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Media Types Covered | Single and Dual Stage, Cartridges, Multimedia |

| Applications Covered | Water Dispenser, Home Water Filtration, Washing Machine and Refrigerator, Water Softening, Others |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India water filters market performed so far and how will it perform in the coming years?

- What is the breakup of the India water filters market on the basis of media type?

- What is the breakup of the India water filters market on the basis of applications?

- What is the breakup of the India water filters market on the basis of distribution channel?

- What is the breakup of the India water filters market on the basis of end user?

- What are the various stages in the value chain of the India water filters market?

- What are the key driving factors and challenges in the India water filters market?

- What is the structure of the India water filters market and who are the key players?

- What is the degree of competition in the India water filters market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water filters market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water filters market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water filters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)