India Water Heater Market Size, Share, Trends and Forecast by Product Type, Application and Region, 2025-2033

India Water Heater Market Overview:

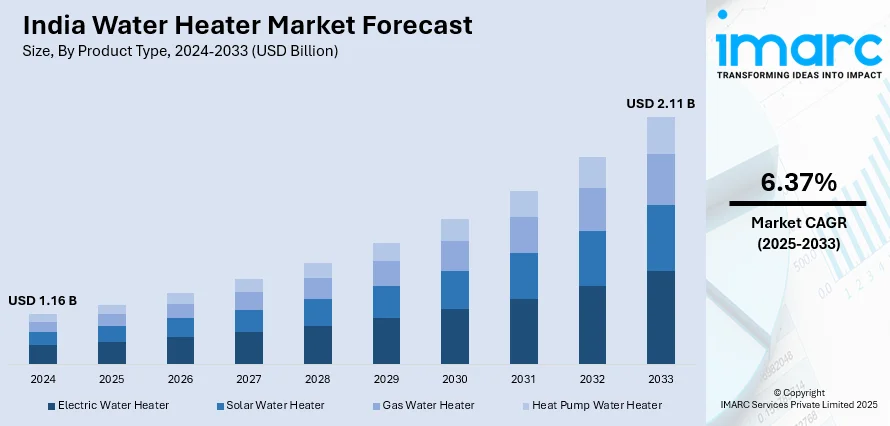

The India water heater market size reached USD 1.16 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.11 Billion by 2033, exhibiting a growth rate (CAGR) of 6.37% during 2025-2033. The market is growing as a result of increased urbanization, rising disposable income, and expanding demand for energy-efficient solutions. Solar water heaters are being promoted with government incentives, improvements in heat pump technology, and intelligent IoT-enabled models are propelling adoption in residential and commercial spaces.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.16 Billion |

| Market Forecast in 2033 | USD 2.11 Billion |

| Market Growth Rate (2025-2033) | 6.37% |

India Water Heater Market Trends:

Rising Demand for Energy-Efficient Water Heaters

The demand for energy-efficient water heaters and cost savings is being fueled by the drive for energy conservation in India. Customers are moving towards heat pump water heaters and solar water heaters because of reduced electricity usage and government incentives for the use of renewable energy. Bureau of Energy Efficiency (BEE) star-rated electric water heaters are becoming popular as they save long-term operating costs. With increasing electricity costs, residential and commercial users are increasingly turning to high-end insulation and smart control capabilities that maximize efficiency. The demand is also boosted by real estate projects incorporating energy-efficient appliances. For instance, in January 2024, Havells India introduced India's first made-in-India energy-efficient heat pump water heater, providing 75% energy saving and with the facility of eco-mode operation at 55°C for maximum efficiency. Moreover, improvements in heat pump technology enable high performance even in colder climates, making them a suitable substitute for conventional electric and gas models. The market is also witnessing innovation like IoT-powered monitoring, where users can streamline usage patterns and reduce energy waste, driving further adoption in both residential and commercial segments.

To get more information on this market, Request Sample

Growth in Solar Water Heater Adoption

India's emphasis on sustainability and renewable energy is pushing solar water heaters, particularly in areas that receive high solar radiation. The Solar Water Heating Systems (SWHS) program under the Ministry of New and Renewable Energy (MNRE) offers subsidies and incentives to promote adoption. Residential complexes and commercial buildings, such as hotels, hospitals, and schools, are incorporating solar water heating systems to minimize electricity and gas dependence. Improvements in evacuated tube collector (ETC) technology and flat plate collectors (FPC) are improving efficiency, and these systems are becoming more applicable for different climates. Declining solar panel prices and better storage systems are also driving market growth. Rural and semi-urban locations, where electricity from the grid is not reliable or very costly, are becoming major markets for solar water heaters, cementing their demand throughout the country even more.

Smart and Connected Water Heater Market Expansion

Rising penetration of intelligent home technology is driving adoption for Internet of Things (IoT) integrated water heaters in India. End-users are adopting connected products and appliances with growing preference for smart devices enabling remote control, scheduling, and time-of-day consumption monitoring using apps. For example, in March 2024, Panasonic Life Solutions India introduced the IoT-enabled Duro Smart and Prime water heater series. With turbo heating, voice control, and smart features, the series provides increased convenience and efficiency, addressing India's increasing need for smart home appliances. Furthermore, manufacturers are incorporating artificial intelligence (AI) infused functionalities, such as learning-driven adaptive heating that adapts the temperature control in accordance with customer behavior and energy usage patterns to maximize efficiency. The need for smart water heaters is especially pronounced in urban areas, where the desire for convenience and automation shapes buying behavior. Commercial businesses like hotels and offices are also moving to connected water heating systems in order to optimize operational efficiency and lower costs. The growth of voice-activated assistants such as Amazon Alexa and Google Assistant is also fueling adoption, with users looking to integrate seamlessly into their current smart home environments. With rising internet penetration and a growing population that is tech-savvy, the smart water heater market is expected to witness high growth over the next few years.

India Water Heater Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Electric Water Heater

- Solar Water Heater

- Gas Water Heater

- Heat Pump Water Heater

The report has provided a detailed breakup and analysis of the market based on the product type. This includes electric water heater, solar water heater, gas water heater, and heat pump water heater.

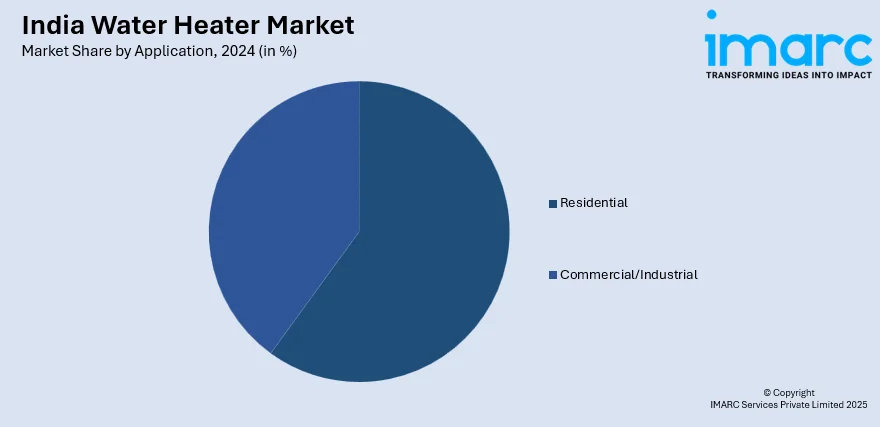

Application Insights:

- Residential

- Commercial/Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, and commercial/industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Heater Market News:

- In September 2024, Racold launched the Omnis Slim Electric Storage Water Heater and Aures Pro 13 kW Tankless Water Heater with Italian design fused with cutting-edge energy efficiency. Both models include Titanium Plus Technology, smart connectivity, and instant heating, bringing better performance for contemporary Indian households and businesses.

- In April 2024, GM Modular has launched its first storage water heater, R1X, adding to its home appliance range. It is designed for Indian homes with 99.5% heating efficiency, energy-saving mode, rust-proof body, and hydrodynamic technology for effective heating. The company is looking to expand further in the appliance segment.

India Water Heater Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Electric Water Heater, Solar Water Heater, Gas Water Heater, Heat Pump Water Heater |

| Applications Covered | Residential, Commercial/Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water heater market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water heater market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water heater industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India water heater market was valued at USD 1.16 Billion in 2024.

The India water heater market is projected to exhibit a CAGR of 6.37% during 2025-2033, reaching a value of USD 2.11 Billion by 2033.

The India water heater market is driven by rapid urbanization, rising disposable incomes, and government incentives for energy-efficient appliances. Consumers increasingly prioritize hygiene and comfort, boosting demand for hot water solutions. Technological advancements, including smart and solar water heaters, further propel market growth, aligning with sustainability goals.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)