India Water Management Systems Market Size, Share, Trends and Forecast by Offering, Application, End User, and Region, 2025-2033

India Water Management Systems Market Overview:

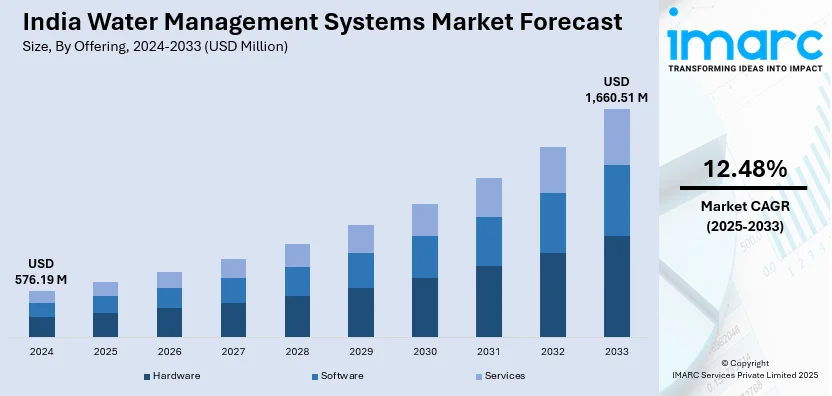

The India water management systems market size reached USD 576.19 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,660.51 Million by 2033, exhibiting a growth rate (CAGR) of 12.48% during 2025-2033. The market is experiencing steady growth due to the increasing water scarcity, industrial expansion and government initiatives promoting efficient water use. Advancements in IoT-based monitoring, wastewater treatment and smart irrigation systems are also increasing their adoption across residential, industrial and commercial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 576.19 Million |

| Market Forecast in 2033 | USD 1,660.51 Million |

| Market Growth Rate (2025-2033) | 12.48% |

India Water Management Systems Market Trends:

Rising Demand for Smart Water Management Solutions

The India water management systems market is witnessing significant expansion driven by increasing urbanization, industrial demand and government initiatives. The India water management systems market growth is fueled by the rising adoption of smart technologies such as IoT-enabled water meters, AI-driven analytics and automated monitoring systems. These innovations enhance operational efficiency by providing real-time insights into water consumption, leak detection and infrastructure performance. AI-powered analytics further enable predictive maintenance and demand forecasting optimizing resource allocation. Automated monitoring systems integrated with cloud platforms facilitate swift decision-making by offering live data on water quality, pressure and supply networks. Government programs like the Jal Jeevan Mission and Smart Cities Mission are accelerating digital water solutions across urban and rural areas. In line with this trend companies are introducing advanced technologies to enhance water quality monitoring and contamination control. For instance, in November 2024, Clavrit Digital Solutions announced the launch of smart water tech to combat water contamination from industrial and sewage sources. Featuring IoT-enabled real-time analytics, this solution empowers stakeholders to monitor and manage water quality effectively. Industries and residential sectors are adopting these technologies to reduce costs and meet regulations contributing to the India water management systems market share expansion.

To get more information of this market, Request Sample

Expansion of Wastewater Treatment and Recycling

The expansion of wastewater treatment and recycling is a key driver in the India water management systems market driven by stricter environmental regulations and increasing water scarcity. Industries and municipalities are investing in advanced treatment technologies such as membrane filtration, reverse osmosis and desalination to ensure sustainable water reuse. These solutions help in reducing industrial discharge, improving water recovery rates and complying with environmental norms set by regulatory authorities. With rising industrialization and urbanization, the demand for efficient wastewater management is growing leading to the adoption of smart treatment plants equipped with IoT and AI-based monitoring systems. Government initiatives like the Namami Gange program and Smart Cities Mission are further accelerating investments in wastewater recycling infrastructure. Additionally, industries across sectors such as pharmaceuticals, textiles and food processing are prioritizing water recycling contributing to the India water management systems market share expansion.

Growing Industrial and Agricultural Water Consumption

India's rapid industrialization and agricultural expansion are significantly driving the demand for efficient water treatment, recycling and conservation systems. Industries such as manufacturing, textiles, pharmaceuticals and power generation require large volumes of water increasing the need for advanced wastewater treatment and reuse technologies. Similarly, agriculture which accounts for the highest water consumption is witnessing a shift toward efficient irrigation methods such as drip and sprinkler systems to enhance water conservation. Government initiatives promoting sustainable water use such as the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) are further boosting demand for smart water management solutions. As groundwater depletion and water scarcity become pressing concerns, both industrial and agricultural sectors are adopting innovative solutions, ensuring long-term sustainability and reducing operational costs while maintaining productivity.

India Water Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on offering, application, and end user.

Offering Insights:

- Hardware

- Sensors and Meters

- Pumps and Valves

- Controllers and Actuators

- Water Treatment Equipment

- Software

- Water Quality Monitoring Software

- Leak Detection Software

- SCADA (Supervisory Control and Data Acquisition) Systems

- Data Analytics and Reporting Software

- Services

- Consulting Services

- Installation and Maintenance Services

- Managed Services

- System Integration Services

The report has provided a detailed breakup and analysis of the market based on the offering. This includes hardware (sensors and meters, pumps and valves, controllers and actuators and water treatment equipment), software [water quality monitoring software, leak detection software, SCADA (Supervisory Control and Data Acquisition) systems and data analytics and reporting software] and services (consulting services, installation and maintenance services, managed services and system integration services).

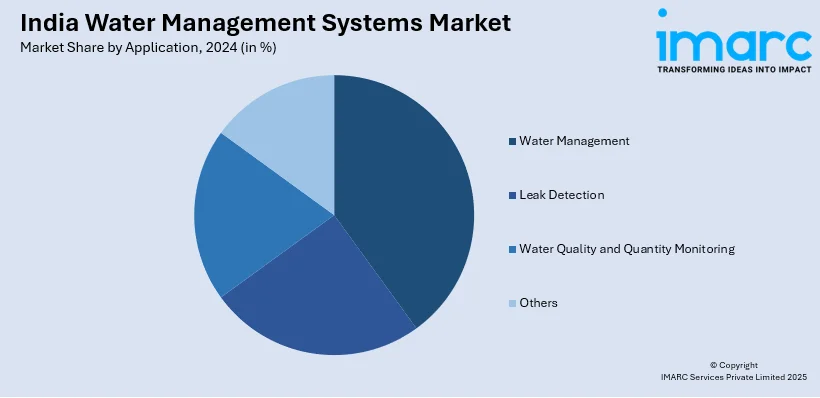

Application Insights:

- Water Management

- Leak Detection

- Water Quality and Quantity Monitoring

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes water management, leak detection, water quality and quantity monitoring and others.

End User Insights:

- Residential

- Industrial

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, industrial and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Management Systems Market News:

- In February 2025, Lucknow Municipal Corporation announced plans to implement a SCADA system for smart water management under the AMRUT mission. The Rs 193 crore project aims for real-time monitoring, automated chlorine dosing, and efficient water usage tracking.

- In March 2024, Lindström India launched initiatives for sustainable water management including its Aquaest water recycling project which reduced freshwater use by 56% in Chennai. The company aims to expand this system across Asia, potentially saving 330 million liters annually.

India Water Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Applications Covered | Water Management, Leak Detection, Water Quality and Quantity Monitoring, Others |

| End Users Covered | Residential, Industrial, Commercial. |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water management systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The water management systems market in India was valued at USD 576.19 Million in 2024.

The water management systems market in India is projected to exhibit a CAGR of 12.48% during 2025-2033, reaching a value of USD 1,660.51 Million by 2033.

The India water management systems market is driven by rising concerns over water scarcity, increasing urbanization, and the need for efficient resource utilization. Government-led initiatives promoting smart infrastructure, coupled with technological advancements in monitoring and control systems, are accelerating adoption. Industrial growth, demand for wastewater treatment, and heightened awareness around sustainable water practices are also fueling market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)