India Water Purifier Market Size, Share, Trends and Forecast by Technology Type, Distribution Channel, End User, and Region, 2026-2034

India Water Purifier Market Summary:

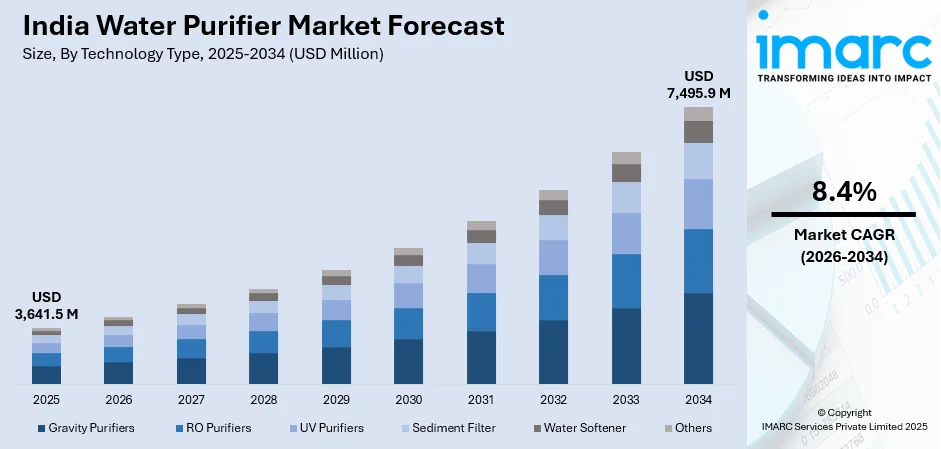

The India water purifier market size was valued at USD 3,641.5 Million in 2025 and is projected to reach USD 7,495.9 Million by 2034, growing at a compound annual growth rate of 8.4% from 2026-2034.

The India water purifier market is seeing strong growth due to increasing health awareness among people and lack of satisfactory quality in groundwater everywhere, in both urban and rural areas. Rapid urbanization, rising disposable incomes, and growing awareness about waterborne diseases are driving demand for advanced systems with better purification. The market also gets a boost from various government initiatives to encourage safe drinking water, technological development in filtration mechanisms, and a widening retail and online distribution that extends even in areas wherein access was poor earlier.

Key Takeaways and Insights:

- By Technology Type: RO purifiers dominate the market with a share of 36% in 2025, fueled by their exceptional ability to eliminate dissolved salts, heavy metals, and microbial contaminants from water sources with high levels of total dissolved solids commonly found across India.

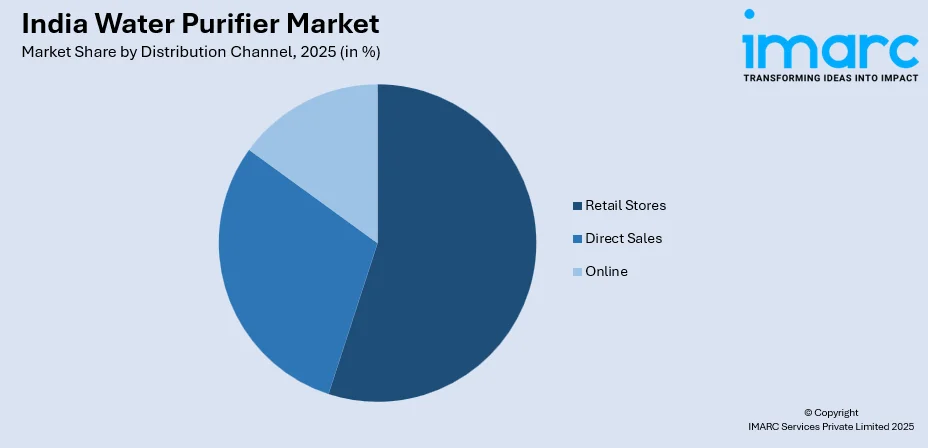

- By Distribution Channel: Retail stores lead the market with a share of 40% in 2025, owing to consumer preference for physical demonstration, immediate product availability, and trusted after-sales service networks established by major brands.

- By End User: Household represents the largest segment with a market share of 44% in 2025, fueled by increasing health awareness, nuclear family proliferation, and growing adoption of water purifiers as essential home appliances.

- By Region: North India dominates the market with a share of 30% in 2025, driven by high groundwater contamination levels, significant urban population concentration in Delhi NCR, and well-established distribution infrastructure.

- Key Players: The India water purifier market exhibits a competitive landscape with established domestic and international players competing across technology segments. Major players leverage extensive service networks, brand recognition, and continuous product innovation to maintain market positions.

To get more information on this market Request Sample

The India water purifier market is undergoing significant transformation driven by growing health consciousness and shifting consumer expectations toward advanced purification solutions. Increasing prevalence of waterborne ailments has amplified public awareness about the critical importance of access to safe and clean drinking water. For example, smart purifier provider DrinkPrime recently announced that it has doubled its user base to over 250,000 households and reached 1 million users across India, underscoring rising demand for tech‑enabled water safety solutions, with more than 100,000 of these in Bangalore alone. Government programs focused on universal clean water access are accelerating adoption in rural regions, while urban households increasingly seek technologically sophisticated purifiers equipped with intelligent monitoring features. Industry participants are introducing innovative products incorporating mineral enrichment capabilities, water-efficient mechanisms, and environmentally sustainable designs. The proliferation of organized retail networks, rising e-commerce adoption, and emergence of flexible ownership models including rentals and subscriptions are broadening market accessibility across diverse consumer segments throughout the country.

India Water Purifier Market Trends:

Growing Adoption of Smart Water Purification Systems

The integration of Internet of Things technology and smart features in water purifiers represents a significant market trend reshaping consumer expectations. Modern purifiers increasingly incorporate real-time water quality monitoring, automated filter replacement alerts, and smartphone connectivity enabling remote operation and maintenance scheduling. For instance, smart purifier provider DrinkPrime’s IoT‑enabled technology allows users to monitor water consumption, quality, and purifier performance in real time through its mobile app, enhancing transparency and user convenience, a capability the company highlighted as it marked its 9th anniversary with expansion across multiple Indian cities in March 2025. These technological enhancements resonate with urban consumers seeking convenience and data-driven insights into their water consumption patterns, driving premiumization across the product portfolio.

Rising Demand for Eco-Friendly and Sustainable Solutions

Environmental consciousness is increasingly influencing consumer purchase decisions, driving demand for water purifiers with reduced wastewater generation and energy-efficient operation. Manufacturers are developing systems that minimize reject water ratios, incorporate recyclable components, and feature sustainable filtration media. For example, V‑Guard recently updated its Rejive RO water purifier series in January 2026 to deliver about 40% water savings even under high TDS conditions, highlighting industry efforts to reduce waste and improve sustainability in purification technology. This trend aligns with broader sustainability goals while addressing consumer concerns about water conservation in regions facing scarcity challenges.

Expansion of Subscription-Based and Rental Models

Innovative business models including subscription services and equipment rentals are gaining traction, particularly among price-sensitive consumer segments. These models lower entry barriers by reducing upfront costs while ensuring regular maintenance and filter replacements. For example, water purifier maker Livpure is aggressively expanding its “water‑as‑a‑service” subscription model, targeting over 1 million subscriptions in India over the next four years as part of its strategy to make purified water more affordable and accessible through flexible payment plans and bundled services. The approach is expanding market penetration in semi-urban and rural areas where affordability concerns previously limited adoption of advanced purification technologies.

Market Outlook 2026-2034:

The outlook for the India water purifier market remains good, with continued growth expected throughout the forecast period. Specifically, urbanization trajectory, infrastructure development under government initiatives, and rising middle-class spending power will keep driving market growth. Product evolution will be characterized by technological convergence combining multiple purification stages, mineral enhancement, and smart connectivity. Additionally, rural market penetration has huge potential with electrification and access to piped water expanding across the country. The market generated a revenue of USD 3,641.5 Million in 2025 and is projected to reach a revenue of USD 7,495.9 Million by 2034, growing at a compound annual growth rate of 8.4% from 2026-2034.

India Water Purifier Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology Type | RO Purifiers | 36% |

| Distribution Channel | Retail Stores | 40% |

| End User | Household | 44% |

| Region | North India | 30% |

Technology Type Insights:

- Gravity Purifiers

- RO Purifiers

- UV Purifiers

- Sediment Filter

- Water Softener

- Others

The RO purifiers dominates with a market share of 36% of the total India water purifier market in 2025.

The reverse osmosis water purifiers continue to hold the leading market position due to its overall purification capacity, which is capable of removing all types and levels of impurities found in Indian water. The membranes work well to remove dissolved salts, heavy metals like arsenic and lead, pesticides, and bacteria. The TDS level in the groundwater is usually very high, and hence, RO is required to obtain pure drinking water. This is mainly found in the northern and western parts of India.

Consumer confidence in the usage of RO purifiers owes to the success and penetration of these units in domestic and commercial sectors. Improvement in these units is also being seen with the incorporation of mineral retainer cartridges, less water waste, and advanced monitoring systems in the purifiers. The combination of the UV and UF process with the RO process forms a complete purification solution with mineral retention.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Retail Stores

- Direct Sales

- Online

The retail stores leads with a share of 40% of the total India water purifier market in 2025.

Retail stores maintain distribution dominance through their ability to provide hands-on product demonstrations, immediate availability, and established trust relationships with consumers. Physical retail presence enables customers to evaluate multiple brands and technologies before purchase decisions, particularly important for high-consideration appliances. For example, Eureka Forbes announced plans to expand the number of retail outlets selling its products from about 20,000 to 25,000 in India as part of its strategy to strengthen offline distribution and boost sales across both urban and smaller town markets. Major electronics retailers and specialized appliance stores offer comprehensive product ranges alongside installation and maintenance services.

The retail channel benefits from manufacturer investments in exclusive brand stores and shop-in-shop formats within multi-brand outlets. Service network accessibility through retail partnerships addresses consumer concerns regarding after-sales support and filter replacement convenience. However, online channels are experiencing accelerated growth as e-commerce platforms offer competitive pricing, doorstep delivery, and increasingly comprehensive installation services.

End User Insights:

- Industrial

- Commercial

- Household

The household dominates with a market share of 44% of the total India water purifier market in 2025.

Household adoption drives market growth as residential consumers increasingly recognize water purifiers as essential home appliances rather than discretionary purchases. Rising health awareness, particularly regarding waterborne diseases affecting children and elderly family members, motivates investment in reliable purification solutions. Nuclear family proliferation and dual-income households with limited time for alternative water sourcing methods further accelerate residential adoption.

Urban residential penetration continues expanding while semi-urban and rural households represent significant growth potential. Government initiatives improving electricity access and piped water supply create enabling infrastructure for electric purifier adoption in previously underserved areas. Manufacturers are developing entry-level products and flexible payment options targeting price-sensitive household segments while premiumization trends drive demand for advanced features among affluent urban consumers.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 30% share of the total India water purifier market in 2025.

North India maintains its leading position in the water purifier market owing to significant groundwater contamination challenges prevalent across the region. The concentration of urban population in major metropolitan areas including Delhi NCR, Chandigarh, Jaipur, and Lucknow drives substantial demand for reliable purification solutions. High total dissolved solids levels and industrial pollutants in water sources necessitate advanced filtration technologies, particularly reverse osmosis systems, making water purifiers essential household appliances throughout the region.

The region benefits from well-established distribution infrastructure and extensive service networks ensuring convenient product accessibility and after-sales support. Rising disposable incomes among the expanding middle-class population enable investment in premium purification technologies. Growing health awareness regarding waterborne diseases and deteriorating tap water quality further propels adoption rates. Government initiatives promoting safe drinking water access complement private sector efforts, collectively strengthening market penetration across urban centers and increasingly reaching semi-urban and rural households.

Market Dynamics:

Growth Drivers:

Why is the India Water Purifier Market Growing?

Rising Awareness of Waterborne Diseases and Health Consciousness

Escalating awareness regarding waterborne diseases constitutes a primary growth catalyst for the India water purifier market. Increasing incidence of typhoid, cholera, diarrhea, and jaundice attributed to contaminated water sources has heightened consumer consciousness about water quality requirements. For example, in January, a typhoid outbreak in Gandhinagar linked to sewage‑contaminated drinking water led authorities to open a dedicated 30‑bed ward at the city’s Civil Hospital to treat affected patients, underscoring the very real impacts of waterborne illness on public health and the urgency of clean water solutions. Media coverage of water contamination incidents and health impacts has educated consumers about the necessity of point-of-use purification. Healthcare practitioners increasingly recommend water purification as preventive healthcare, particularly for households with children, elderly members, or immunocompromised individuals. This health-driven demand transcends income segments as consumers prioritize family wellbeing over cost considerations.

Government Initiatives Promoting Safe Drinking Water Access

Government programs including the Jal Jeevan Mission aim to provide piped water supply to every rural household, creating enabling infrastructure for water purifier adoption. As of July 2025, over 80 % of rural Indian households have received piped drinking water connections through the Jal Jeevan Mission’s “Har Ghar Jal” initiative, significantly improving access to potable water at the household level and reducing reliance on untreated sources. The WASH initiative by UNICEF, in collaboration with government agencies, supports water, sanitation, and hygiene awareness while assisting flagship programmes like the Jal Jeevan Mission and broader behaviour change efforts to promote safe water practices. These programs generate consumer awareness while infrastructure development improves electricity access and water supply consistency required for electric purifier operation. Policy support for clean drinking water standards and public health campaigns reinforces the importance of water purification at household level. Public-private partnerships facilitate affordable access through subsidized systems for economically weaker sections.

Rapid Urbanization and Rising Disposable Incomes

India's rapid urban growth is playing a pivotal role in driving water purifier market expansion across the country. Metropolitan centers are witnessing substantial population influx, fundamentally reshaping household water consumption behaviors and creating heightened demand for efficient purification systems. A 2025 survey found that only about 6% of urban households in India receive drinking‑water of safe quality directly from municipal sources, while around 62% rely on modern filtration methods like water purifiers and RO systems to make tap water drinkable, highlighting how urban water quality challenges are driving appliance adoption. Increasing purchasing power among the growing middle-class segment enables consumers to invest in advanced purification technologies that were previously beyond their financial reach. Modern urban households characterized by nuclear family setups and dual-income earners increasingly prioritize convenience and dependability, establishing water purifiers as indispensable home appliances. Evolving lifestyle preferences coupled with heightened health awareness among city dwellers are fueling demand for premium products and accelerating adoption of feature-rich purification systems with smart capabilities.

Market Restraints:

What Challenges the India Water Purifier Market is Facing?

High Initial Investment and Maintenance Costs

Significant upfront investment required for advanced purification systems remains a barrier for price-sensitive consumer segments, particularly in rural and semi-urban areas. RO systems commanding higher price points limit accessibility despite superior purification capabilities. Recurring maintenance costs including filter replacements and servicing add to total cost of ownership, deterring adoption among lower-income households.

Inadequate Infrastructure in Rural Areas

Insufficient electricity availability and unreliable piped water connections across rural areas significantly hinder the adoption of electric water purifiers. After-sales service networks remain predominantly focused in urban locations, posing maintenance difficulties for consumers in remote regions. These infrastructure limitations continue to restrict market expansion in rural territories despite increasing consumer awareness and the introduction of more affordable entry-level purification products.

Water Wastage Concerns with RO Technology

Growing environmental apprehension surrounding wastewater discharge from reverse osmosis systems is deterring eco-conscious buyers from adopting such technologies. Water scarcity conditions prevailing across multiple Indian states further intensify concerns regarding purification-related water loss. While manufacturers are implementing enhanced water recovery mechanisms and providing guidance on reject water reuse, negative perceptions about wastage continue to influence purchase decisions among environmentally aware consumer segments.

Competitive Landscape:

The competitive structure of the India water purifier market is moderately fragmented, with well-established domestic players competing with international players. Key players are drawing on wide service networks, strong brand recognition, and continuous product innovation in order to garner leading positions in the market. Companies seek differentiation through technological integration, subscription-based business models, and geographical expansion into under-served markets. Strategic partnerships, celebrity endorsements, and digital marketing are typical competitive methods. The research and development investments being made by manufacturers cater towards sustainable technologies that address water wastage and energy consumption concerns while improving effectiveness in purification.

Recent Developments:

- In December 2025, Livpure has launched a new range of water purifiers equipped with 2X Power Filters that last up to 2 years, reducing the need for frequent replacements. The purifiers can handle high TDS levels up to 1500 ppm and are available via e‑commerce and retail outlets.

India Water Purifier Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Types Covered | Gravity Purifiers, RO Purifiers, UV Purifiers, Sediment Filter, Water Softener, Others |

| Distribution Channels Covered | Retail Stores, Direct Stores, Online |

| End Users Covered | Industrial, Commercial, Household |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India water purifier market size was valued at USD 3,641.5 Million in 2025.

The India water purifier market is expected to grow at a compound annual growth rate of 8.4% from 2026-2034 to reach USD 7,495.9 Million by 2034.

RO purifiers dominated the market with a 36% share, driven by their proven effectiveness in removing dissolved salts, heavy metals, and microbial contaminants from water sources with high TDS levels prevalent across Indian regions.

Key factors driving the India water purifier market include rising awareness of waterborne diseases, increasing water contamination levels, rapid urbanization, growing disposable incomes, supportive government initiatives, and technological advancements in purification systems.

Major challenges include high initial investment costs limiting accessibility for price-sensitive segments, inadequate infrastructure in rural areas constraining electric purifier adoption, recurring maintenance expenses, and environmental concerns regarding water wastage from RO systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)