India Water Soluble Polymers Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Water Soluble Polymers Market Overview:

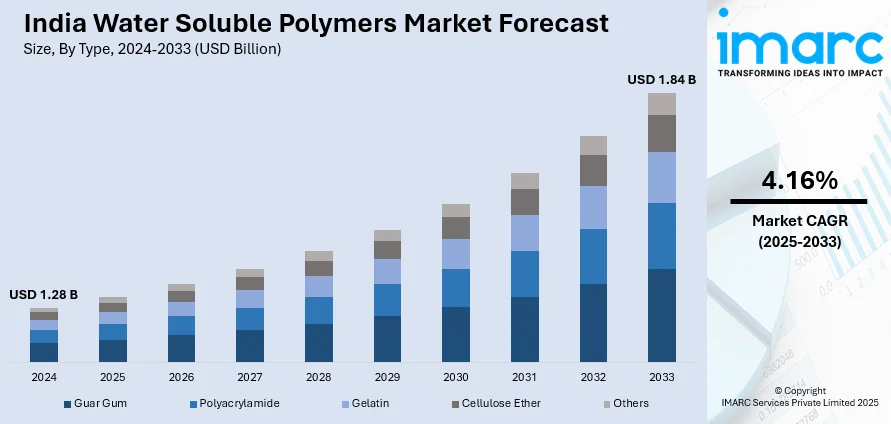

The India water soluble polymers market size reached USD 1.28 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.84 Billion by 2033, exhibiting a growth rate (CAGR) of 4.16% during 2025-2033. The rising demand for wastewater treatment, expanding applications in pharmaceuticals and food processing, increasing product utilization in enhanced oil recovery, favorable government initiatives for water conservation, growing adoption of bio-based polymers, and ongoing advancements in polymer technology for improved efficiency are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.28 Billion |

| Market Forecast in 2033 | USD 1.84 Billion |

| Market Growth Rate 2025-2033 | 4.16% |

India Water Soluble Polymers Market Trends:

Increasing Emphasis on Water Treatment Solutions

India's swift industrial growth and urban expansion have exacerbated water scarcity and pollution concerns, boosting the need for advanced water treatment solutions in which water-soluble polymers are essential. With the country's population projected to cross 1.5 billion by 2030, urban areas face mounting pressure to maintain a clean water supply and manage wastewater effectively. Water-soluble polymers, such as polyacrylamide, are integral to coagulation and flocculation processes, aiding in contaminant removal and improving water quality. Government-led initiatives such as the Jal Jeevan Mission (JJM), Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), and Jal Shakti Abhiyan, are further reinforcing sustainable water management through infrastructure development, water conservation, and community engagement. The Jal Jeevan Mission, for instance, aims to provide safe, reliable piped water to every rural household by 2024, with a 2022 assessment showing that 86% of households had functional tap connections. These initiatives have accelerated the adoption of advanced water treatment technologies, boosting the demand for water-soluble polymers across municipal and industrial sectors. As a result, India’s water treatment segment is set for significant expansion, driven by the urgent need for sustainable water management solutions.

To get more information of this market, Request Sample

Adoption of Sustainable Packaging Solutions

The growing environmental concerns and the implementation of stringent regulatory policies are accelerating the shift toward sustainable packaging solutions, with water-soluble polymers, particularly polyvinyl alcohol (PVA), emerging as a key alternative due to their biodegradable and non-toxic properties. India’s commitment to achieving net-zero emissions by 2070, announced at the 26th Conference of the Parties (COP 26) in 2021, has further strengthened the push for eco-friendly materials. The regulatory drive towards sustainability is encouraging industries to reduce plastic waste, aligning with government policies promoting green packaging. Notably, 91% of Indian businesses reportedly increased their sustainability investments over 2024, prioritizing eco-friendly innovations while ensuring economic growth. Additionally, shifting consumer preferences toward environmentally responsible products are influencing companies to adopt biodegradable packaging, with water-soluble polymers providing an effective solution. This trend is particularly evident in the pharmaceutical sector, where these polymers enhance drug solubility and bioavailability, contributing to their growing demand.

India Water Soluble Polymers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Guar Gum

- Polyacrylamide

- Gelatin

- Cellulose Ether

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes guar gum, polyacrylamide, gelatin, cellulose ether, and others.

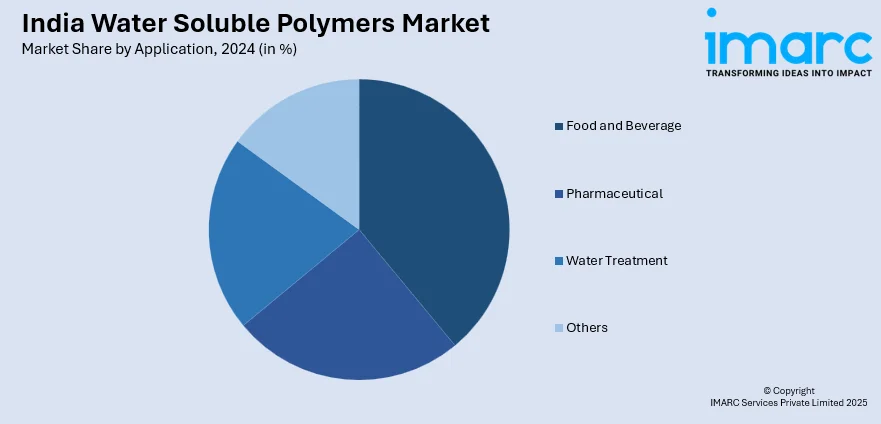

Application Insights:

- Food and Beverage

- Pharmaceutical

- Water Treatment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverage, pharmaceutical, water treatment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Water Soluble Polymers Market News:

- October 2024: Arrow Greentech's flagship brand, Watersol™, showcased cutting-edge water-soluble film technology to meet worldwide demand for sustainable and safe packaging requirements. The water soluble film technology is intended to dissolve in water in seconds, offering an environmentally friendly alternative to traditional plastic packaging. This method enables the safe handling of agrochemicals, considerably lowering the danger of human exposure to hazardous compounds.

- March 2024: Toppan Inc. and India-based Toppan Speciality Films Private Limited (TSF) have developed GL-SP, a new barrier film utilizing biaxially oriented polypropylene (BOPP) as its base. Production and sales are set to commence in April 2024, targeting markets in the Americas, Europe, India, and the ASEAN region. GL-SP is part of Toppan's GL BARRIER series of transparent vapor-deposited barrier films.

India Water Soluble Polymers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Guar Gum, Polyacrylamide, Gelatin, Cellulose Ether, Others |

| Applications Covered | Food and Beverage, Pharmaceutical, Water Treatment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India water soluble polymers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India water soluble polymers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India water soluble polymers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The water soluble polymers market in India was valued at USD 1.28 Billion in 2024.

The India water soluble polymers market is projected to exhibit a CAGR of 4.16% during 2025-2033, reaching a value of USD 1.84 Billion by 2033.

Increasing urbanization and industrial activities are creating the need for effective wastewater treatment, where polymers are used for flocculation and sludge treatment. In agriculture, water soluble polymers are employed to enhance soil moisture retention and fertilizer efficiency. The pharmaceutical industry’s demand for these polymers in drug delivery and formulation is also contributing to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)