India Weapons and Ammunition Manufacturing Market Size, Share, Trends and Forecast by Product, Caliber, Lethality, Application, and Region, 2025-2033

India Weapons and Ammunition Manufacturing Market Overview:

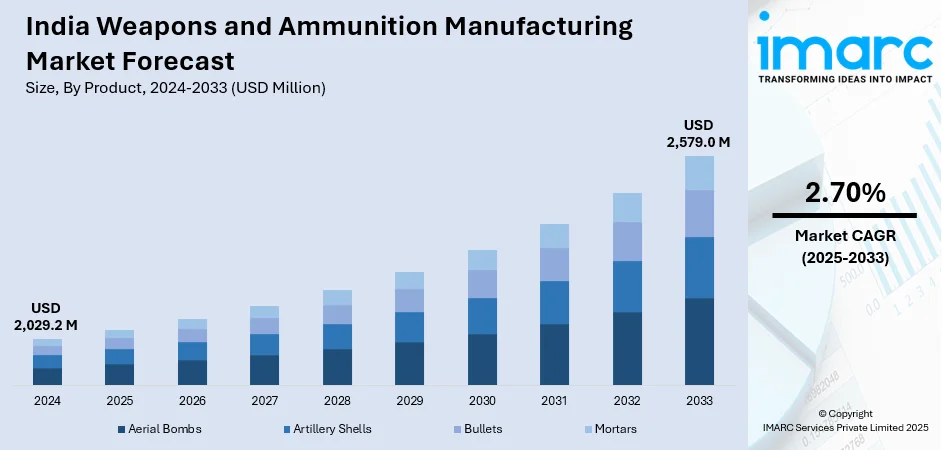

The India weapons and ammunition manufacturing market size reached USD 2,029.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,579.0 Million by 2033, exhibiting a growth rate (CAGR) of 2.70% during 2025-2033. The market is experiencing steady growth due to the defense modernization, indigenization policies, and private sector involvement. Export potential, technological advancements, and strategic collaborations are also strengthening production capabilities. Government initiatives are creating a supportive ecosystem for sustained growth, which is positively influencing the India weapons and ammunition manufacturing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,029.2 Million |

|

Market Forecast in 2033

|

USD 2,579.0 Million |

| Market Growth Rate 2025-2033 | 2.70% |

India Weapons and Ammunition Manufacturing Market Trends:

Government Policy and Indigenization Initiatives

One of the key drivers of India’s weapons and ammunition manufacturing market is the government's strong push for indigenization under the “Atmanirbhar Bharat” (self-reliant India) initiative. Policies like the Defence Acquisition Procedure (DAP) and the introduction of positive indigenization lists restrict imports of specific defense items and encourage domestic production. Additionally, initiatives such as the Strategic Partnership Model, corporatization of the Ordnance Factory Board (OFB), and increased FDI limits in defense manufacturing promote local capabilities. These policies are aimed at reducing dependency on imports, enhancing domestic production efficiency, and creating a defense ecosystem that supports long-term national security and economic development. For instance, in February 2025, Bharat Electronics Limited (BEL) and Safran Electronics & Defense from France entered into a memorandum of understanding to create a joint venture for the manufacturing, customization, and upkeep of the HAMMER precision-guided air-to-ground missile in India. This collaboration seeks to enhance India's defense manufacturing abilities and decrease reliance on imports, in line with the Atmanirbhar Bharat program.

To get more information on this market, Request Sample

Private Sector Participation and Foreign Investment

The opening of India’s defense sector to private companies and increased foreign direct investment (FDI) are significant growth enablers. Private firms now collaborate with the Defense Public Sector Undertakings (DPSUs) and global defense companies to manufacture advanced weapons and ammunition locally. The liberalized FDI policy, permitting up to 74% under the automatic route, has attracted strategic collaborations, technology transfers, and joint ventures. This has enhanced production capacity, innovation, and competitive pricing, which is further driving the India weapons and ammunition manufacturing market growth. The entry of private players fosters a more dynamic and efficient manufacturing ecosystem, accelerating indigenous capability development and aligning India with global defense supply chains. For instance, in February 2025, Apollo Micro Systems Ltd (AMSL) signed a deal with the state-owned Munitions India to collaboratively create cutting-edge defense systems for both domestic and global markets. According to a regulatory filing, AMSL announced that both organizations will work together on the design, development, and implementation of advanced defense technologies under the Memorandum of Understanding (MoU).

India Weapons and Ammunition Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, caliber, lethality, and application.

Product Insights:

- Aerial Bombs

- Artillery Shells

- Bullets

- Mortars

The report has provided a detailed breakup and analysis of the market based on the product. This includes aerial bombs, artillery shells, bullets, and mortars.

Caliber Insights:

- Large

- Medium

- Small

A detailed breakup and analysis of the market based on the caliber have also been provided in the report. This includes large, medium, and small.

Lethality Insights:

- Less Lethal

- Lethal

A detailed breakup and analysis of the market based on the lethality have also been provided in the report. This includes less lethal and lethal.

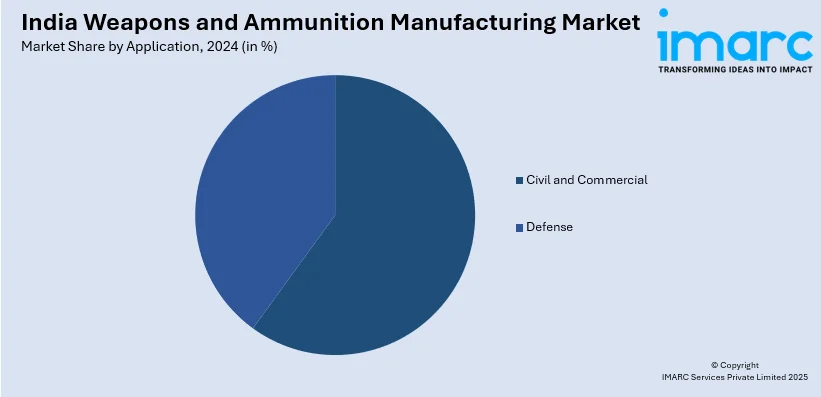

Application Insights:

- Civil and Commercial

- Defense

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes civil and commercial and defense.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Weapons and Ammunition Manufacturing Market News:

- In February 2024, India's first domestically designed 155 Smart Ammunition was created by the Indian Institute of Technology Madras (IIT Madras) in collaboration with Munitions India Limited, a Defense Public Sector Enterprise. This project will contribute to the indigenization of a vital defense industry.

- In January 2025, the Cabinet Committee on Security approved the purchase of ammunition valued at nearly ₹10,000 crore for the army’s homegrown Pinaka multi-launcher rocket system, marking a further advancement in self-sufficiency within the defense manufacturing industry.

India Weapons and Ammunition Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Aerial Bombs, Artillery Shells, Bullets, Mortars |

| Calibers Covered | Large, Medium, Small |

| Lethalities Covered | Less Lethal, Lethal |

| Applications Covered | Civil and Commercial, Defense |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India weapons and ammunition manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India weapons and ammunition manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India weapons and ammunition manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The weapons and ammunition manufacturing market in India was valued at USD 2,029.2 Million in 2024.

The India weapons and ammunition manufacturing market is projected to exhibit a CAGR of (CAGR) of 2.70% during 2025-2033, reaching a value of USD 2,579.0 Million by 2033.

Increased growth in India's weapons and ammunition manufacturing is fueled by effective policy measures enacting self-reliance, defense modernization initiatives, and greater procurement from local companies. Favorable measures foster public-private partnerships, while liberalization of foreign investment rules and heightened geopolitical tensions further enhance demand. Local innovation and export opportunities are also increasing manufacturing capabilities and capacities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)