India Welding Consumables Market Size, Share, Trends and Forecast by Product, Welding Technique, End Use Industries, and Region, 2025-2033

Market Overview:

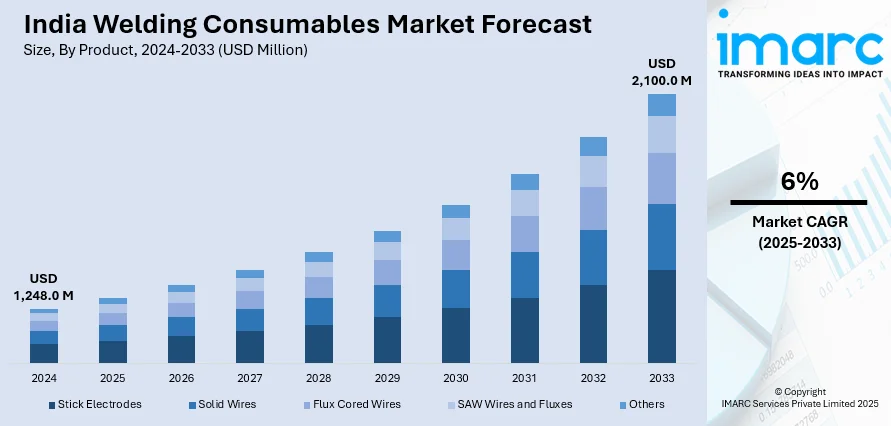

The India welding consumables market size reached USD 1,248.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,100.0 Million by 2033, exhibiting a growth rate (CAGR) of 6% during 2025-2033. The expansion of renewable energy projects, such as wind farms and solar power installations, the expanding oil and gas sector, the introduction of advanced welding technologies and materials are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,248.0 Million |

|

Market Forecast in 2033

|

USD 2,100.0 Million |

| Market Growth Rate (2025-2033) | 6% |

Welding consumables are essential materials utilized in the welding process to produce a strong joint between two metals. These consumables include electrodes, filler metals, fluxes, and gases, which help in achieving a successful weld and ensuring its durability. Electrodes are coated metal sticks used in electric arc welding. The coating, when burned, produces a shielding gas that protects the weld from contamination. Filler metals, on the other hand, are added to the weld to ensure it fills completely and has the desired mechanical properties. Fluxes are often used in processes such as submerged arc welding. They produce a slag that shields the weld from impurities and atmospheric contamination. Gases such as argon, carbon dioxide, and helium are also used in welding, especially in gas metal arc and gas tungsten arc welding, to protect the molten weld pool from atmospheric elements that can weaken the weld.

To get more information on this market, Request Sample

The expansion of renewable energy projects, such as wind farms and solar power installations, is driving the market in India. As India increases its focus on clean energy, welding consumables for these applications see increased demand. Moreover, the expanding oil and gas sector is further supporting the market as it relies on these consumables for the construction and maintenance of pipelines, storage tanks, and offshore platforms. As India seeks to enhance its energy infrastructure, this industry continues to be a significant driver. Besides, India's rural development initiatives, such as electrification and rural infrastructure projects, require welding for building essential facilities. This drives demand in rural areas for welding consumables. Also, India's defense and aerospace industries require precision welding for the fabrication of aircraft, vehicles, and defense equipment. The augmenting demand for advanced product variants to meet stringent quality and safety standards in these sectors is on the rise. Also, the introduction of advanced welding technologies and materials in India, such as laser welding and high-performance alloys, augments the need for specialized welding consumables and keeps the market evolving.

India Welding Consumables Market Trends/Drivers:

Infrastructure development and urbanization

As nations strive to modernize, there's an accelerated push towards the construction of bridges, highways, buildings, pipelines, and other essential infrastructure. This development directly translates to an increased demand for welding and, by extension, welding consumables. The process of urbanization, characterized by the migration of populations from rural to urban areas, necessitates the creation of new housing and public utilities. These constructions rely heavily on metal frameworks, all of which require welding at various stages. Moreover, with the advent of smart cities and the push for more sustainable living spaces, the demand for precision welding, which mandates high-quality consumables, has seen a significant uptick. Moreover, infrastructure projects, such as railways, airports, and dams, have long life cycles and continuous maintenance requirements. The durability of these projects is often directly linked to the quality of welding. This has led contractors and governments to invest in high-grade welding consumables to ensure longevity and safety.

Advancements in the automotive and shipbuilding industries

Both the industries are metal-intensive and hinge critically on welding processes for production and repair work. The automotive industry, in particular, is witnessing a paradigm shift with the rise of electric vehicles (EVs). This transition necessitates a redesign of many vehicle components, and as a result, new welding techniques and consumables are required to meet these evolving specifications. Lightweight and strong metals are now in demand for vehicle frames to improve fuel efficiency, and these materials often require specialized welding consumables. Additionally, with the expansion of global trade and the push for more energy-efficient and environmentally friendly vessels, there is an increasing need for advanced ships. These ships, built from specialized alloys to withstand harsh maritime conditions, rely on high-quality welding consumables to ensure the integrity and durability of the vessel.

Continual technological advancements in welding techniques

As these new techniques emerge, they often bring with them a need for specific welding consumables tailored to ensure the best possible outcomes. The rise of laser welding, friction stir welding, and robotic welding has necessitated the development of consumables that can withstand higher temperatures and pressures. Additionally, with industries moving towards automation, there's a growing demand for welding consumables compatible with automated welding setups. Moreover, research and development in the welding domain also focuses on producing environmentally friendly consumables that reduce waste and harmful emissions. Such consumables are becoming increasingly important given the global emphasis on sustainability and reducing the environmental footprint. Furthermore, as industries such as aerospace and defense seek precision and strength in their components, they turn to advanced welding techniques. These sectors require consumables that can ensure a weld's integrity even under extreme conditions.

India Welding Consumables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India welding consumables market report, along with forecasts at the country level from 2025-2033. Our report has categorized the market based on product, welding technique, and end use industries.

Breakup by Product:

- Stick Electrodes

- Solid Wires

- Flux Cored Wires

- SAW Wires and Fluxes

- Others

Stick electrodes accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes stick electrodes, solid wires, flux cored wires, SAW wires and fluxes, and others. According to the report, stick electrodes represented the largest segment.

Stick electrodes possess a core wire rod coated in a protective flux. This design is both simple and ingenious. As the electrode is consumed in the welding process, the flux coating decomposes to produce gases that act as a shield, preventing contamination from atmospheric gases, such as oxygen and nitrogen. This ensures that the weld is not only strong but also free from potential weaknesses, including porosity or inclusions. Also, they don't require external shielding gases or complex setups. This makes them ideal for fieldwork or in situations were bringing in large equipment or gas cylinders is not feasible. In environments like these, the simplicity of stick electrodes proves invaluable. Additionally, manufacturers continually refine and improve stick electrodes, introducing variants that cater to specific applications or metals. These innovations ensure that stick electrodes remain relevant, even as the demands of the industry evolve.

Breakup by Welding Technique:

- Arc Welding

- Resistance Welding

- Oxyfuel Welding

- Ultrasonic Welding

- Others

Arc welding holds the largest share in the industry

A detailed breakup and analysis of the market based on the welding technique has also been provided in the report. This includes arc welding, resistance welding, oxyfuel welding, ultrasonic welding, and others. According to the report, arc welding accounted for the largest market share.

Arc welding encompasses various subtypes, each tailored to specific applications and materials. Diversity allows arc welding to be employed across a broad spectrum of industries, from construction and manufacturing to aerospace and automotive, making it a go-to choose for many welding needs. Moreover, the simplicity and adaptability of arc welding further cement its dominance. Arc welding can be performed indoors or outdoors, adding to its versatility. This flexibility ensures that it remains the preferred choice in diverse working environments, from construction sites to fabrication shops. Additionally, arc welding techniques are known for their robustness and reliability. They can produce strong, high-quality welds in various positions, including vertical and overhead. This reliability is crucial in industries where the structural integrity and safety of welded components are paramount, such as in the construction of buildings, bridges, and critical infrastructure.

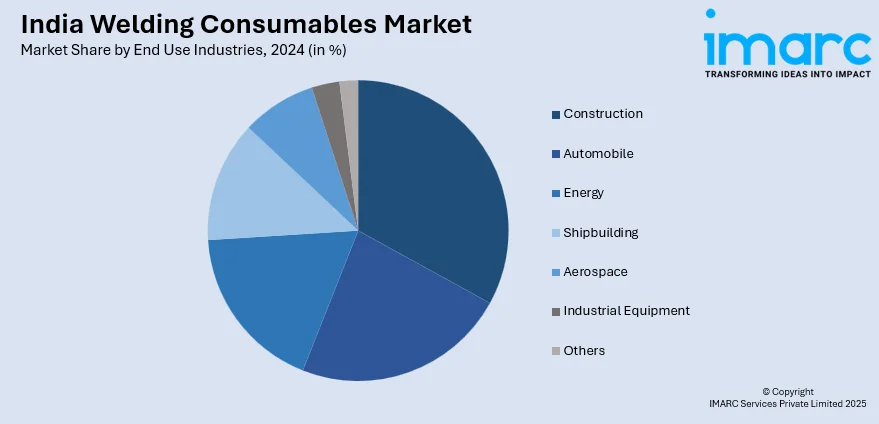

Breakup by End Use Industries:

- Construction

- Automobile

- Energy

- Shipbuilding

- Aerospace

- Industrial Equipment

- Others

Construction represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use industries. This includes construction, automobile, energy, shipbuilding, aerospace, industrial equipment, and others. According to the report, construction represented the largest segment.

Construction projects are inherently diverse, ranging from the erection of towering skyscrapers to the development of essential infrastructure, such as bridges, roads, and tunnels. In all these endeavors, welding plays a pivotal role in joining and fabricating the structural components that form the backbone of these structures. The durability and integrity of these welded connections are paramount for ensuring the long-term safety and stability of the constructed edifices. Welding finds extensive application in constructing steel and concrete structures. In steel structures, including high-rise buildings and industrial facilities, welding is used to create rigid connections between beams, columns, and other load-bearing elements. This enables structures to withstand the forces of gravity, wind, and seismic activity. Furthermore, Moreover, the construction sector's adaptability and responsiveness to evolving demands further contribute to its status as the largest end-use industry segment for welding consumables.

Breakup by Region:

- North India

- West and Central India

- South India

- East India

West and Central India leads the market, accounting for the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India. According to the report, West and Central India was the largest market for welding consumables in the country.

West and Central India boast a well-developed transportation and logistics infrastructure. This facilitates the efficient movement of raw materials, finished products, and welding consumables, streamlining supply chains, and reducing operational costs. As a result, businesses in this region can access welding consumables readily, which further bolsters their dominance in the market. Furthermore, the presence of numerous educational and research institutions specializing in engineering and metallurgy in West and Central India fosters a skilled workforce with expertise in welding technologies. This skilled labor pool is essential for ensuring the proper application of welding consumables, contributing to the region's market dominance by maintaining high-quality welding standards. The region's strategic location on the western coast of India also facilitates international trade, allowing for the import and export of welding consumables and related equipment. This international connectivity further enhances the availability and variety of consumables, making West and Central India a preferred destination for various industries.

Competitive Landscape:

Companies are improving the quality and performance of their products, developing new welding consumables for specialized applications, and enhance the environmental sustainability of their offerings. Moreover, the major players are expanding their product portfolios to cater to a wide range of welding needs. Furthermore, they are implementing stringent quality control processes to ensure their welding consumables meet industry standards and specifications. Moreover, the leading players are developing environmentally friendly consumables with reduced emissions and waste. This aligns with global sustainability goals and appeals to environmentally conscious customers. Welding consumables manufacturers are also providing comprehensive customer support and training programs.

The competitive landscape of the market has been studied in the report with the detailed profiles of the key players operating in the market.

India Welding Consumables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Stick Electrodes, Solid Wires, Flux Cored Wires, SAW Wires and Fluxes, Others |

| Welding Techniques Covered | Arc Welding, Resistance Welding, Oxyfuel Welding, Ultrasonic Welding, Others |

| End use Industries Covered | Construction, Automobile, Energy, Shipbuilding, Aerospace, Industrial Equipment, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India welding consumables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India welding consumables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India welding consumables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India welding consumables market was valued at USD 1,248.0 Million in 2024.

We expect the India welding consumables market to exhibit a CAGR of 6% during 2025-2033.

The advent of automated and laser-based welding technologies, used for manufacturing of automobiles with enhanced safety and fuel efficiency, is primarily catalyzing the India welding consumables market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation resulting in the temporary closure of numerous end-use industries, thereby limiting the demand for welding consumables.

Based on the product, the India welding consumables market can be segmented into stick electrodes, solid wires, flux cored wires, SAW wires and fluxes, and others. Currently, stick electrodes hold the majority of the total market share.

Based on the welding technique, the India welding consumables market has been divided into arc welding, resistance welding, oxyfuel welding, ultrasonic welding, and others. Among these, arc welding currently exhibits a clear dominance in the market.

Based on the end use industries, the India welding consumables market can be categorized into construction, automobile, energy, shipbuilding, aerospace, industrial equipment, and others. Currently, the construction industry accounts for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)