India White Cement Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Market Overview:

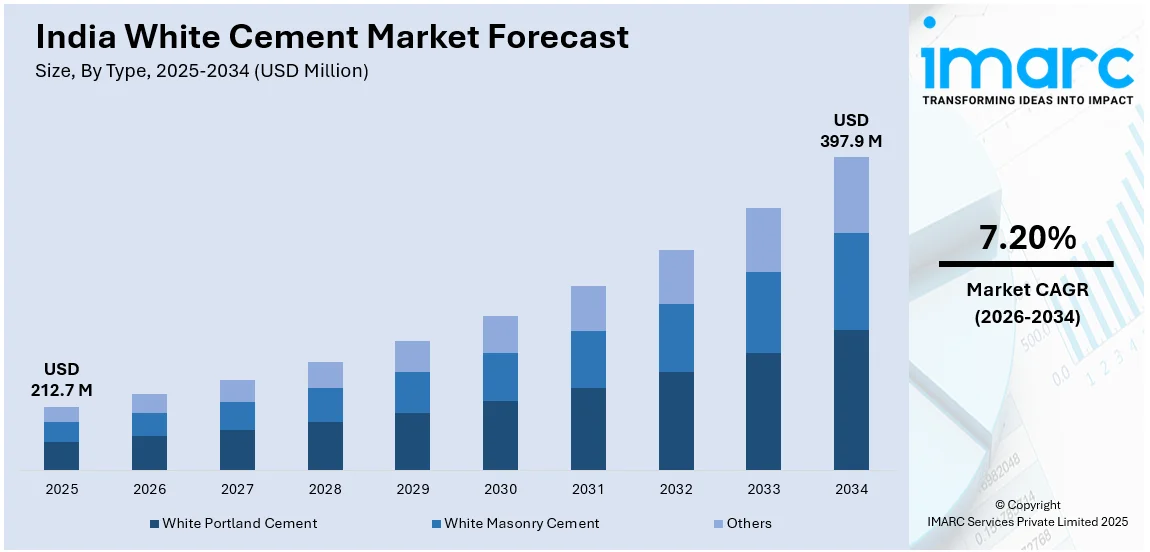

India white cement market size reached USD 212.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 397.9 Million by 2034, exhibiting a growth rate (CAGR) of 7.20% during 2026-2034. The rising popularity of green buildings and the implementation of supportive government policies are primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 212.7 Million |

| Market Forecast in 2034 | USD 397.9 Million |

| Market Growth Rate (2026-2034) | 7.20% |

White cement is a refined form of ordinary Portland cement distinguished by its unique white color, achieved by excluding iron and magnesium in the manufacturing process. Its composition includes several elements like limestone, kaolin, and gypsum. Utilized extensively in various applications such as decorative designs, precast structural units, architectural concrete, and wall putty, white cement also finds its place in grouts, ceramic tile adhesives, mosaic tiles, terrazzo, exterior facades, swimming pools, and aesthetic concrete repairs. It not only enhances visual appeal but also contributes to improved reflectivity, providing a superior finish and texture. Beyond aesthetics, white cement facilitates a more precise visual assessment of concrete cracks, diminishes the heat-island effect in urban areas, and offers an extensive range of color options. The versatility and aesthetic benefits of white cement make it a sought-after choice in a diverse range of construction and design applications.

To get more information on this market Request Sample

India White Cement Market Trends:

The white cement market in India is undergoing transformative changes, with a confluence of drivers and trends reshaping its dynamics. Primarily, the surge in construction activities is a pivotal driver, propelling the demand for white cement. As India witnesses increased infrastructural development, the use of white cement in architectural concrete, exterior facades, and decorative designs is on the rise. Moreover, the growing focus on aesthetics and design in the construction industry is fueling the demand for white cement. Besides this, architects and builders are increasingly incorporating white cement in projects to achieve a superior finish, enhance visual appeal, and provide a distinctive aesthetic touch. Additionally, the rise of the real estate and housing sector is another significant driver. As the demand for residential and commercial spaces escalates, the use of white cement in precast structural units and aesthetic concrete repairs is gaining prominence. Additionally, the emphasis on sustainability and eco-friendly construction practices is impacting the white cement market. Apart from this, the rising focus on aesthetic design, real estate expansion, and the increasing inclination towards sustainable building practices are anticipated to fuel the market growth over the forecasted period.

India White Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- White Portland Cement

- White Masonry Cement

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes white portland cement, white masonry cement, and others.

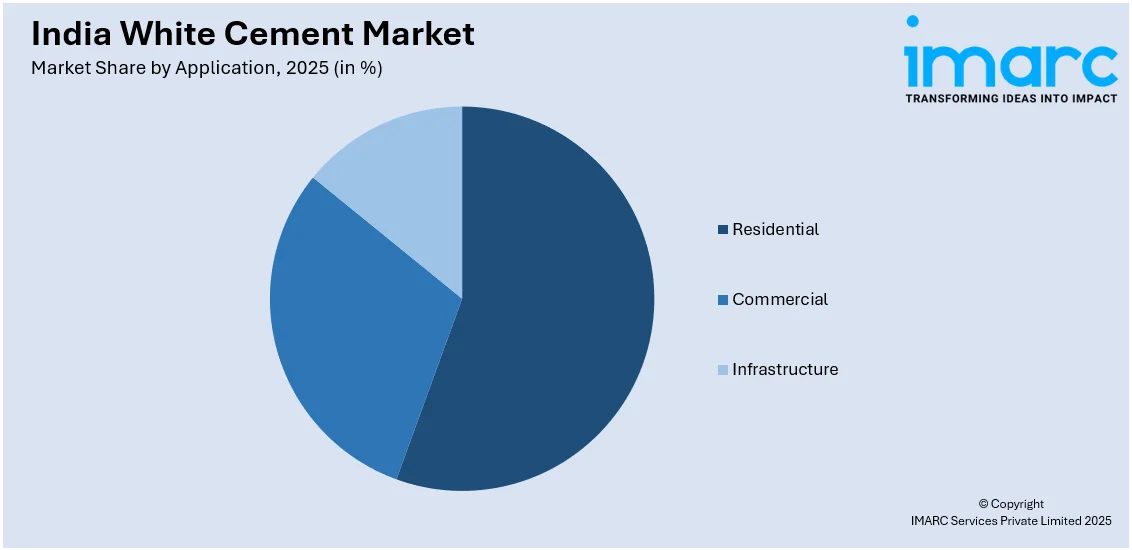

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India White Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | White Portland Cement, White Masonry Cement, Others |

| Applications Covered | Residential, Commercial, Infrastructure |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India white cement market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India white cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India white cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The white cement market in India was valued at USD 212.7 Million in 2025.

The white cement market in India is projected to exhibit a CAGR of 7.20% during 2026-2034, reaching a value of USD 397.9 Million by 2034.

The market is primarily driven by increasing construction and infrastructure activities, rising emphasis on aesthetics and architectural finishes, and growing adoption of eco-friendly building materials. The expanding real estate sector and growing demand for premium construction materials further support the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)